Shared Ownership Problems: What You Need To Know Before You Buy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Shared Ownership Problems: What You Need to Know Before You Buy

Dreaming of homeownership but daunted by soaring property prices? Shared ownership schemes might seem like the perfect solution, offering a pathway onto the property ladder with a smaller initial investment. However, before you sign on the dotted line, it's crucial to understand the potential pitfalls. This article delves into the common problems associated with shared ownership, equipping you with the knowledge to make an informed decision.

What is Shared Ownership?

Shared ownership involves buying a share of a property, typically between 25% and 75%, from a housing association or similar provider. You pay a mortgage on your share and pay rent on the remaining portion. As your financial situation improves, you can buy further shares (staircasing) until you own the property outright. While seemingly attractive, several challenges can arise.

Potential Problems with Shared Ownership:

-

Limited Staircasing Opportunities: One of the biggest frustrations for shared owners is the difficulty in staircasing. Housing associations often have waiting lists or restrictive rules, making it challenging to buy additional shares when you're ready. This can leave you feeling trapped in a system that doesn't allow for the flexibility you initially anticipated. Thoroughly investigate the staircasing process before committing to a shared ownership scheme.

-

Service Charges: Be prepared for potentially high service charges. These cover the upkeep of communal areas, building insurance, and other essential services. These costs can fluctuate and may increase unexpectedly, adding significant financial pressure. Always request detailed information on current and projected service charges.

-

Restrictions and Regulations: Shared ownership often comes with more restrictions than outright homeownership. You may face limitations on renovations, subletting, and even decorating. Review the lease agreement meticulously to understand the permitted and prohibited actions.

-

Leasehold Issues: Many shared ownership properties are leasehold, meaning you don't own the freehold. This can create complications down the line, especially when the lease nears its end. You'll need to understand the lease terms and the potential costs associated with lease extensions. .

-

Mortgage Difficulties: Securing a mortgage for a shared ownership property can sometimes be more challenging than for a traditional home purchase. Lenders may have specific criteria, and the process might involve additional paperwork. Shop around and compare mortgage offers from various lenders.

-

Hidden Costs: Be aware of potential hidden costs, such as administration fees, ground rent, and legal fees associated with the purchase and staircasing process. Factor these expenses into your budget to avoid any unpleasant surprises.

H2: Making an Informed Decision:

Before investing in shared ownership, consider the following:

-

Affordability: Carefully assess your financial situation and ensure you can comfortably afford the mortgage payments, rent, and service charges. Don't underestimate the long-term financial commitment.

-

Research: Thoroughly research different housing associations and shared ownership schemes. Compare the costs, restrictions, and staircasing policies to find the best option for your needs.

-

Legal Advice: Seek independent legal advice before signing any contracts. A solicitor can review the lease agreement and highlight any potential issues.

-

Future Plans: Think about your long-term plans. Will shared ownership support your future goals, or might it hinder them?

Conclusion:

Shared ownership can be a viable stepping stone to homeownership, but it's crucial to be fully aware of the potential drawbacks. By carefully considering the points raised in this article and conducting thorough research, you can make an informed decision and avoid potential problems. Remember, seeking professional advice is essential to ensure a smooth and stress-free journey towards homeownership.

Call to Action: Share your experiences with shared ownership in the comments below – your insights can help others!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Shared Ownership Problems: What You Need To Know Before You Buy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Basketball Legend Stunned By Caitlin Clarks 3 Point Barrage

Jun 18, 2025

Basketball Legend Stunned By Caitlin Clarks 3 Point Barrage

Jun 18, 2025 -

Mets Conquer Atlanta A Franchise Altering Victory And The Path Forward

Jun 18, 2025

Mets Conquer Atlanta A Franchise Altering Victory And The Path Forward

Jun 18, 2025 -

Wnba Betting Predictions 5 Smart Plays For June 17 2025

Jun 18, 2025

Wnba Betting Predictions 5 Smart Plays For June 17 2025

Jun 18, 2025 -

Speechless Basketball Great On Caitlin Clarks Impressive 3 Point Display

Jun 18, 2025

Speechless Basketball Great On Caitlin Clarks Impressive 3 Point Display

Jun 18, 2025 -

How To Watch Connecticut Sun Vs Indiana Fever Live Stream Info Tv Listings And Caitlin Clark

Jun 18, 2025

How To Watch Connecticut Sun Vs Indiana Fever Live Stream Info Tv Listings And Caitlin Clark

Jun 18, 2025

Latest Posts

-

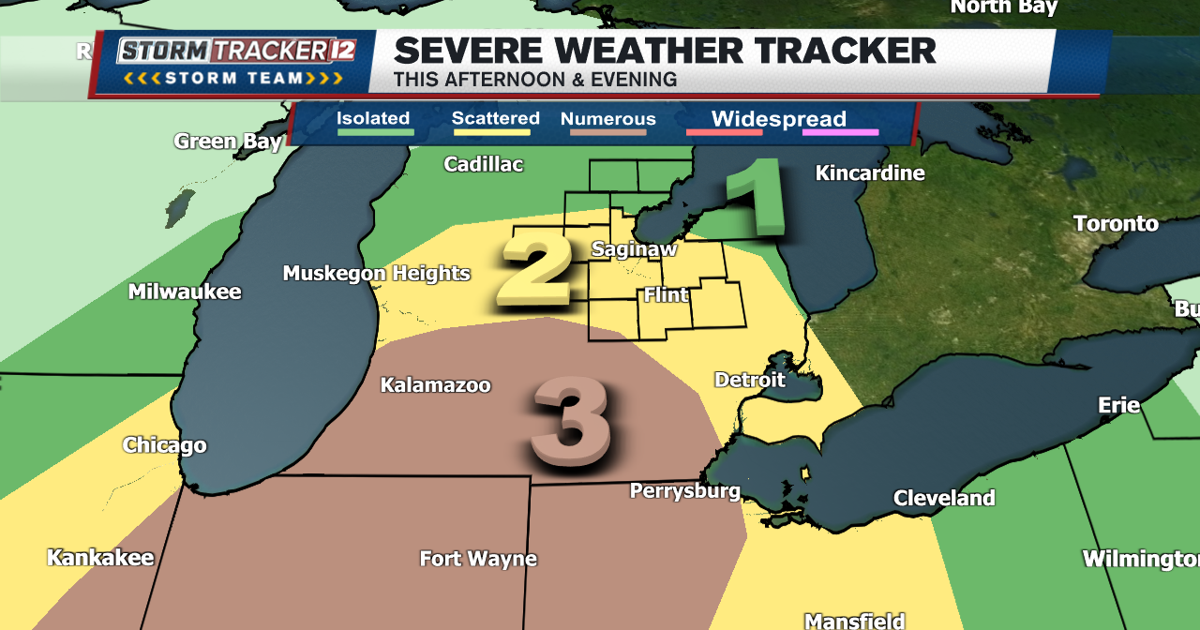

Mid Michigan Heat Wave Thunderstorms Kick Off 2025s First Scorcher

Jun 19, 2025

Mid Michigan Heat Wave Thunderstorms Kick Off 2025s First Scorcher

Jun 19, 2025 -

Cubs Vs Brewers Expert Picks Starting Pitchers And Betting Trends June 18

Jun 19, 2025

Cubs Vs Brewers Expert Picks Starting Pitchers And Betting Trends June 18

Jun 19, 2025 -

Adam Mazur Expected To Start This Week

Jun 19, 2025

Adam Mazur Expected To Start This Week

Jun 19, 2025 -

Free Live Stream Costa Rica Vs Dominican Republic Gold Cup Match

Jun 19, 2025

Free Live Stream Costa Rica Vs Dominican Republic Gold Cup Match

Jun 19, 2025 -

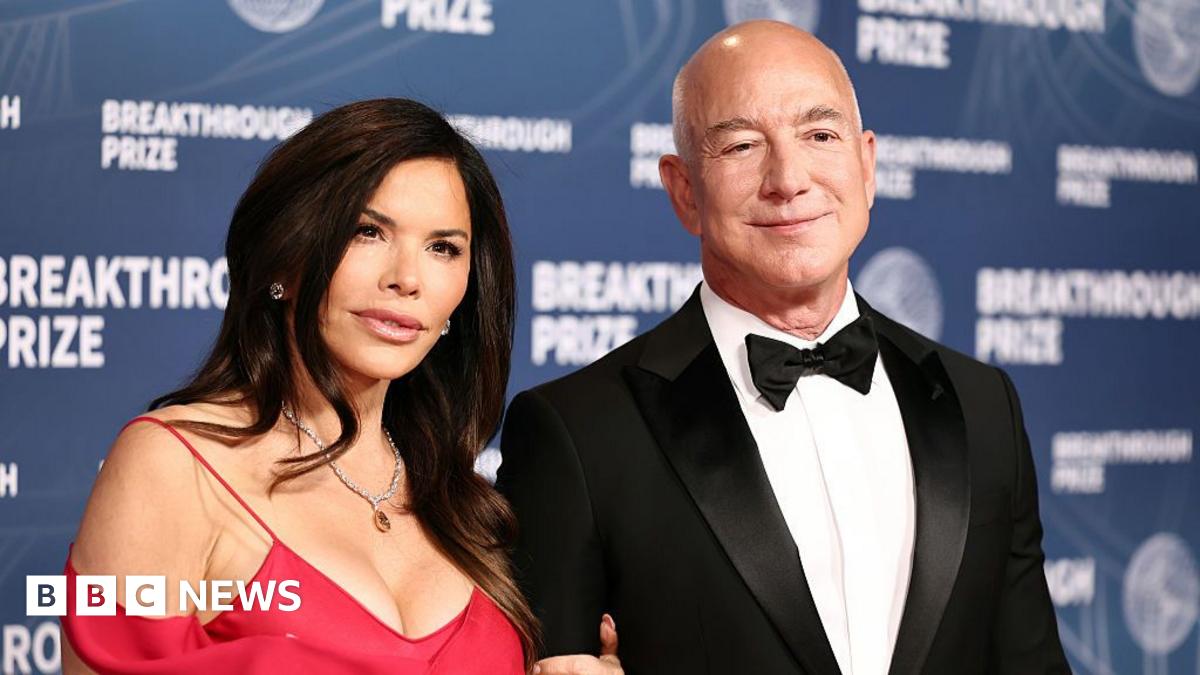

Venice Wedding Disruption Activists Plans Against Bezos

Jun 19, 2025

Venice Wedding Disruption Activists Plans Against Bezos

Jun 19, 2025