Shared Ownership: Was It A Dream Or A Deception?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Shared Ownership: Was it a Dream or a Deception?

The allure of homeownership, once a cornerstone of the British dream, has become increasingly elusive for many. Shared ownership schemes, designed to bridge the affordability gap, promised a pathway to property ownership for those struggling to afford a deposit. But years on, are these schemes delivering on their promises, or have they proven to be a deceptive mirage? This article delves into the realities of shared ownership, examining both its successes and its significant drawbacks.

What is Shared Ownership?

Shared ownership is a government-backed scheme enabling buyers to purchase a share of a property, typically between 25% and 75%, while renting the remaining share from a housing association. This reduces the initial deposit required, making homeownership more accessible. Buyers pay a mortgage on the share they own and rent on the remaining portion. As their financial situation improves, they can purchase further shares (staircasing) until they own the property outright.

The Appealing Facade:

On the surface, shared ownership offers undeniable advantages:

- Lower initial deposit: Significantly reduces the financial barrier to entry, opening up homeownership to a wider range of buyers.

- Affordable monthly payments: Initially, monthly payments are lower than a full mortgage, making it manageable for those with limited incomes.

- Pathway to full ownership: The opportunity to staircase provides a clear route to owning the property outright.

The Harsh Realities:

However, the reality for many shared ownership homeowners is far from idyllic. Several significant drawbacks often overshadow the initial appeal:

- High service charges: These charges, paid to the housing association for maintenance and upkeep, can be substantial and unpredictable, adding significantly to the monthly costs. These can increase unexpectedly, impacting household budgets.

- Staircasing difficulties: Purchasing additional shares can prove difficult. The valuation process can be lengthy and expensive, and securing further financing might be challenging, particularly during economic downturns.

- Limited choice: The selection of properties available through shared ownership schemes is often limited, potentially restricting buyers' location and property preferences. Furthermore, resale can be complex.

- Rent is still a significant cost: While the mortgage is reduced, the rental element remains, effectively making the long-term cost higher than many anticipate. This 'hidden' cost often isn't fully considered when assessing affordability.

Is it worth it? A nuanced perspective.

Whether shared ownership is a dream or a deception depends heavily on individual circumstances and expectations. For some, it acts as a crucial stepping stone towards full homeownership, offering a route they might not otherwise have. For others, the hidden costs and complexities outweigh the benefits, leaving them feeling trapped in a system that offers less freedom and flexibility than anticipated.

Alternatives to Shared Ownership:

Before committing to shared ownership, it's crucial to explore alternative options, such as:

- Help to Buy ISA: This government scheme offers a bonus towards a first-time buyer's deposit.

- Help to Buy Equity Loan: This scheme provides an equity loan, reducing the amount you need to borrow.

- Rent-to-Buy schemes: These schemes give tenants the option to buy the property they are renting after a set period.

Conclusion:

Shared ownership presents a complex picture. While it can be a valuable pathway to homeownership for some, thorough research and a realistic understanding of the associated costs and limitations are crucial. Weighing the pros and cons carefully, and considering alternative options, is essential to make an informed decision that aligns with your long-term financial goals. Remember to seek independent financial advice before committing to any shared ownership scheme. The dream of owning a home is a powerful one, but it shouldn't come at the cost of long-term financial instability.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Shared Ownership: Was It A Dream Or A Deception?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Mets Atlanta Victory Building Momentum For The Playoffs

Jun 18, 2025

Mets Atlanta Victory Building Momentum For The Playoffs

Jun 18, 2025 -

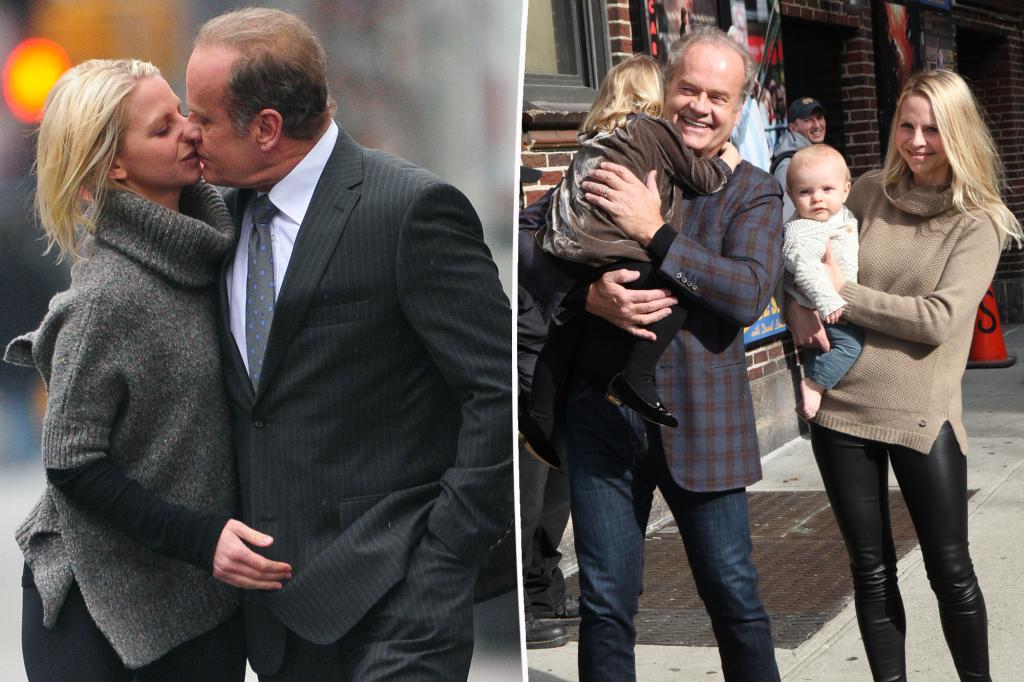

Kelsey Grammers Wife Kayte Walsh Pregnant Report

Jun 18, 2025

Kelsey Grammers Wife Kayte Walsh Pregnant Report

Jun 18, 2025 -

Jacob Morrisons Gem Coastal Carolinas Historic Cws Win

Jun 18, 2025

Jacob Morrisons Gem Coastal Carolinas Historic Cws Win

Jun 18, 2025 -

Frasier Star Kelsey Grammer Expecting 8th Child With Wife 46

Jun 18, 2025

Frasier Star Kelsey Grammer Expecting 8th Child With Wife 46

Jun 18, 2025 -

Cincinnatis Twin Appeal Top Spots For Twins And Double The Fun

Jun 18, 2025

Cincinnatis Twin Appeal Top Spots For Twins And Double The Fun

Jun 18, 2025

Latest Posts

-

Grief And Neglect Air India Crash Families Speak Out

Jun 18, 2025

Grief And Neglect Air India Crash Families Speak Out

Jun 18, 2025 -

Kelsey Grammer To Become Father Of Eight At 70

Jun 18, 2025

Kelsey Grammer To Become Father Of Eight At 70

Jun 18, 2025 -

Wnba Betting 5 Smart Bets For Tuesday June 17 2025 Games

Jun 18, 2025

Wnba Betting 5 Smart Bets For Tuesday June 17 2025 Games

Jun 18, 2025 -

Increased Ice Activity In Democratic Cities Following Trump Order

Jun 18, 2025

Increased Ice Activity In Democratic Cities Following Trump Order

Jun 18, 2025 -

Clarks Impressive Performance Secures Win Against Liberty

Jun 18, 2025

Clarks Impressive Performance Secures Win Against Liberty

Jun 18, 2025