Should Investors Abandon SiriusXM Holdings Stock? A Closer Look.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should Investors Abandon SiriusXM Holdings Stock? A Closer Look

SiriusXM Holdings Inc. (SIRI) has been a source of both excitement and apprehension for investors. While the satellite radio giant boasts a loyal subscriber base and a seemingly recession-resistant business model, recent performance and market trends have some questioning its long-term viability. Should investors abandon ship, or is there still potential for growth? Let's delve into a closer look.

The Allure of SiriusXM: A Dominant Player in Satellite Radio

SiriusXM's dominance in the satellite radio market is undeniable. With millions of subscribers, the company enjoys a significant competitive advantage. This established market position provides a degree of stability, making it relatively insulated from the volatility affecting other tech stocks. This inherent stability has historically attracted investors seeking lower-risk, dividend-paying opportunities. The company's diverse content offerings, including music, sports, talk radio, and exclusive programming, further contribute to its appeal.

Headwinds Facing SiriusXM: Challenges in a Changing Media Landscape

Despite its strengths, SiriusXM faces significant headwinds. The rise of streaming services like Spotify and Apple Music presents a formidable challenge. These platforms offer vast music libraries, on-demand content, and often come bundled with other services, making them increasingly attractive alternatives. Furthermore, the increasing popularity of podcasts and other audio-on-demand content further fragments the media landscape, impacting SiriusXM's traditional appeal.

Financial Performance and Future Outlook: A Mixed Bag

Recent financial reports paint a mixed picture. While SiriusXM consistently generates revenue and maintains a subscriber base, growth has slowed. Investors are scrutinizing the company's ability to adapt to the changing media consumption habits and compete effectively against streaming giants. Analyzing key financial metrics such as revenue growth, subscriber churn, and operating margins is crucial for any investor considering a position in SIRI. A thorough review of the company's quarterly earnings calls and SEC filings is highly recommended.

What Should Investors Do? A Balanced Perspective

The decision to buy, sell, or hold SiriusXM stock is a highly individual one, depending on your risk tolerance and investment strategy. There's no simple yes or no answer.

Arguments for Holding/Buying:

- Loyal Subscriber Base: SiriusXM retains a large, loyal subscriber base, providing a solid revenue stream.

- Recession-Resistance: The subscription-based model is generally considered relatively recession-resistant.

- Potential for Expansion: SiriusXM continues to explore new avenues for growth, including expanding into new markets and exploring partnerships.

- Dividend Potential: The company's history of paying dividends may be attractive to income-oriented investors.

Arguments for Selling:

- Competition from Streaming Services: The increasing popularity of streaming services poses a significant threat.

- Slowing Growth: Recent growth has been slower than in previous years.

- Dependence on Traditional Media: SiriusXM's reliance on a traditional model in a rapidly evolving digital landscape is a concern.

Before making any investment decisions, consider:

- Diversification: Never put all your eggs in one basket. Diversify your portfolio across various asset classes.

- Professional Advice: Consult with a qualified financial advisor before making any significant investment decisions. They can help assess your risk tolerance and investment goals.

- Thorough Research: Conduct thorough due diligence on SiriusXM and the broader market before investing.

Conclusion: A Calculated Risk

SiriusXM Holdings stock presents a calculated risk. While the company holds a strong market position, the challenges it faces in a rapidly evolving media landscape cannot be ignored. Investors should carefully weigh the potential rewards against the inherent risks before making any investment decisions. Remember to conduct thorough research and consider seeking professional financial advice.

(Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing involves risk, and you could lose money.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should Investors Abandon SiriusXM Holdings Stock? A Closer Look.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Top Hurricane Models To Watch In 2025 Accuracy And Limitations

May 28, 2025

Top Hurricane Models To Watch In 2025 Accuracy And Limitations

May 28, 2025 -

American Life Vs German Life Why One Expat Returned Home Disappointed

May 28, 2025

American Life Vs German Life Why One Expat Returned Home Disappointed

May 28, 2025 -

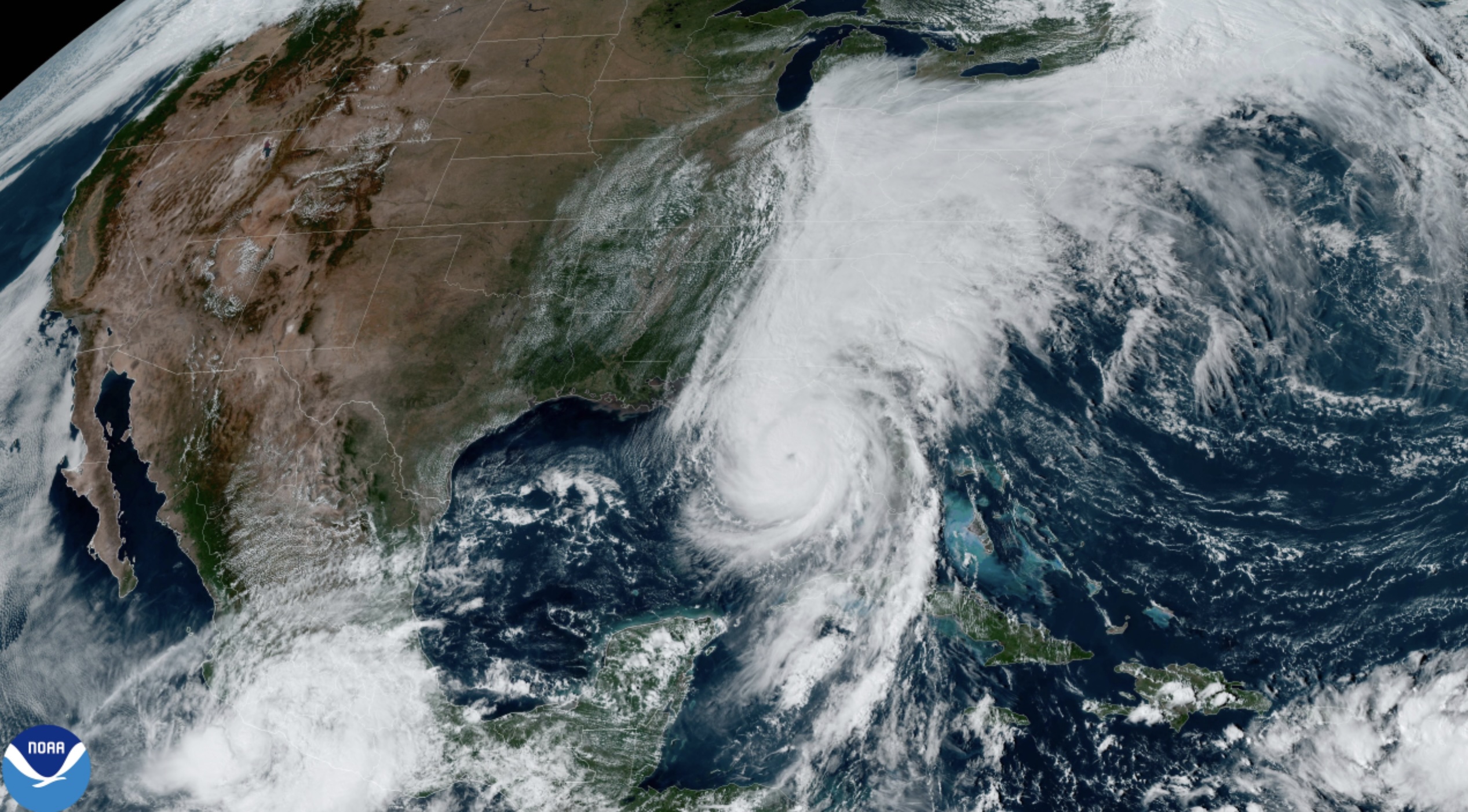

Above Normal Hurricane Season Experts Predict Active Summer For Us

May 28, 2025

Above Normal Hurricane Season Experts Predict Active Summer For Us

May 28, 2025 -

Surprise Nba Trade Examining Teams That Might Target Giannis

May 28, 2025

Surprise Nba Trade Examining Teams That Might Target Giannis

May 28, 2025 -

Alexandra Daddarios Daring Lace Dress Fashion Forward Or Too Much

May 28, 2025

Alexandra Daddarios Daring Lace Dress Fashion Forward Or Too Much

May 28, 2025

Latest Posts

-

Kemi Badenoch Faces Intense Backlash From Within Conservative Party

May 31, 2025

Kemi Badenoch Faces Intense Backlash From Within Conservative Party

May 31, 2025 -

Newark Flights Grounded The Impact Of Proposed Atc Changes

May 31, 2025

Newark Flights Grounded The Impact Of Proposed Atc Changes

May 31, 2025 -

Indigenous Communities Seek Repatriation Of Sacred Items Held By The Vatican For A Century

May 31, 2025

Indigenous Communities Seek Repatriation Of Sacred Items Held By The Vatican For A Century

May 31, 2025 -

Lexington Teen Missing Police Investigation And Community Search Underway

May 31, 2025

Lexington Teen Missing Police Investigation And Community Search Underway

May 31, 2025 -

Understanding The Saharan Dust Plumes Effects On Florida

May 31, 2025

Understanding The Saharan Dust Plumes Effects On Florida

May 31, 2025