Should Investors Ditch SiriusXM Holdings? A Deeper Look At The Stock's Performance.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should Investors Ditch SiriusXM Holdings? A Deeper Look at the Stock's Performance

SiriusXM Holdings (SIRI), the satellite radio giant, has seen its stock price fluctuate significantly in recent years. This has left many investors questioning whether it's time to cut their losses and move on, or if this is simply a temporary dip in a long-term growth story. Let's delve into the current state of SiriusXM and analyze whether it's time to ditch the stock.

SiriusXM's Strengths: A Solid Foundation?

Despite recent market volatility, SiriusXM boasts several key strengths that continue to attract investors:

- Dominant Market Share: SiriusXM holds a near-monopoly in the satellite radio market, providing a significant moat against competitors. This established position ensures a stable subscriber base and predictable revenue streams.

- Growing Subscriber Base: While growth may not be explosive, SiriusXM consistently adds new subscribers, demonstrating the enduring appeal of its ad-free audio entertainment. This consistent growth, albeit at a slower pace recently, points to a sustainable business model.

- Content Diversification: Beyond its core satellite radio offerings, SiriusXM is expanding into podcasts and other audio entertainment formats. This diversification strategy aims to broaden its appeal and attract a wider audience, mitigating reliance on a single revenue source. Their foray into Pandora, for example, represents a significant step in this direction.

- Strategic Partnerships: Collaborations with major automakers continue to be crucial for SiriusXM's growth, ensuring pre-installed radios in new vehicles. These partnerships guarantee a steady stream of new subscribers.

Challenges Facing SiriusXM: Headwinds to Consider

However, several challenges threaten SiriusXM's long-term prospects and are causing investor concern:

- Competition from Streaming Services: The rise of streaming services like Spotify and Apple Music poses a significant threat. These platforms offer a vast library of music and podcasts at competitive price points, directly challenging SiriusXM's market dominance.

- Subscription Price Increases: While necessary for profitability, frequent subscription price hikes can lead to subscriber churn and negatively impact customer satisfaction. Finding a balance between revenue growth and maintaining affordability is crucial.

- Economic Slowdowns: As an entertainment service, SiriusXM's performance is often sensitive to economic downturns. During periods of economic uncertainty, consumers may cut back on discretionary spending, potentially impacting subscription rates.

- Technological Advancements: The evolving landscape of audio entertainment requires SiriusXM to constantly innovate and adapt. Failure to keep pace with technological advancements could lead to a decline in market share.

Analyzing the Stock's Performance: A Mixed Bag

SiriusXM's stock performance has been erratic. While the company has shown resilience, the stock hasn't delivered the explosive returns some investors were hoping for. Factors influencing the stock price include broader market trends, investor sentiment, and the company's own financial performance. Analyzing historical data and comparing it to industry benchmarks is essential for any informed investment decision. Checking resources like or will provide up-to-date information on the stock's performance.

Should You Ditch SiriusXM? The Verdict

The decision of whether to hold or sell SiriusXM stock ultimately depends on your individual investment strategy and risk tolerance. While the company faces challenges, its established market position and ongoing diversification efforts provide a degree of stability. However, the competitive landscape and economic uncertainties warrant careful consideration.

Before making any investment decisions, thoroughly research the company's financials, future prospects, and compare its performance to similar companies in the entertainment sector. Consider consulting with a qualified financial advisor to gain personalized advice tailored to your specific circumstances. Remember, investing always carries inherent risk.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Conduct your own research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should Investors Ditch SiriusXM Holdings? A Deeper Look At The Stock's Performance.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Coal Miners Black Lung Protection Weakened By Budget Cuts

May 28, 2025

Coal Miners Black Lung Protection Weakened By Budget Cuts

May 28, 2025 -

Confirmation Of Remains Michael Gaine County Kerry Farmer Found Deceased

May 28, 2025

Confirmation Of Remains Michael Gaine County Kerry Farmer Found Deceased

May 28, 2025 -

Antonio Filosa Appointed Stellantis Ceo Key Facts And Future Implications

May 28, 2025

Antonio Filosa Appointed Stellantis Ceo Key Facts And Future Implications

May 28, 2025 -

The Harvard Trump Conflict A Battle Over Elitism

May 28, 2025

The Harvard Trump Conflict A Battle Over Elitism

May 28, 2025 -

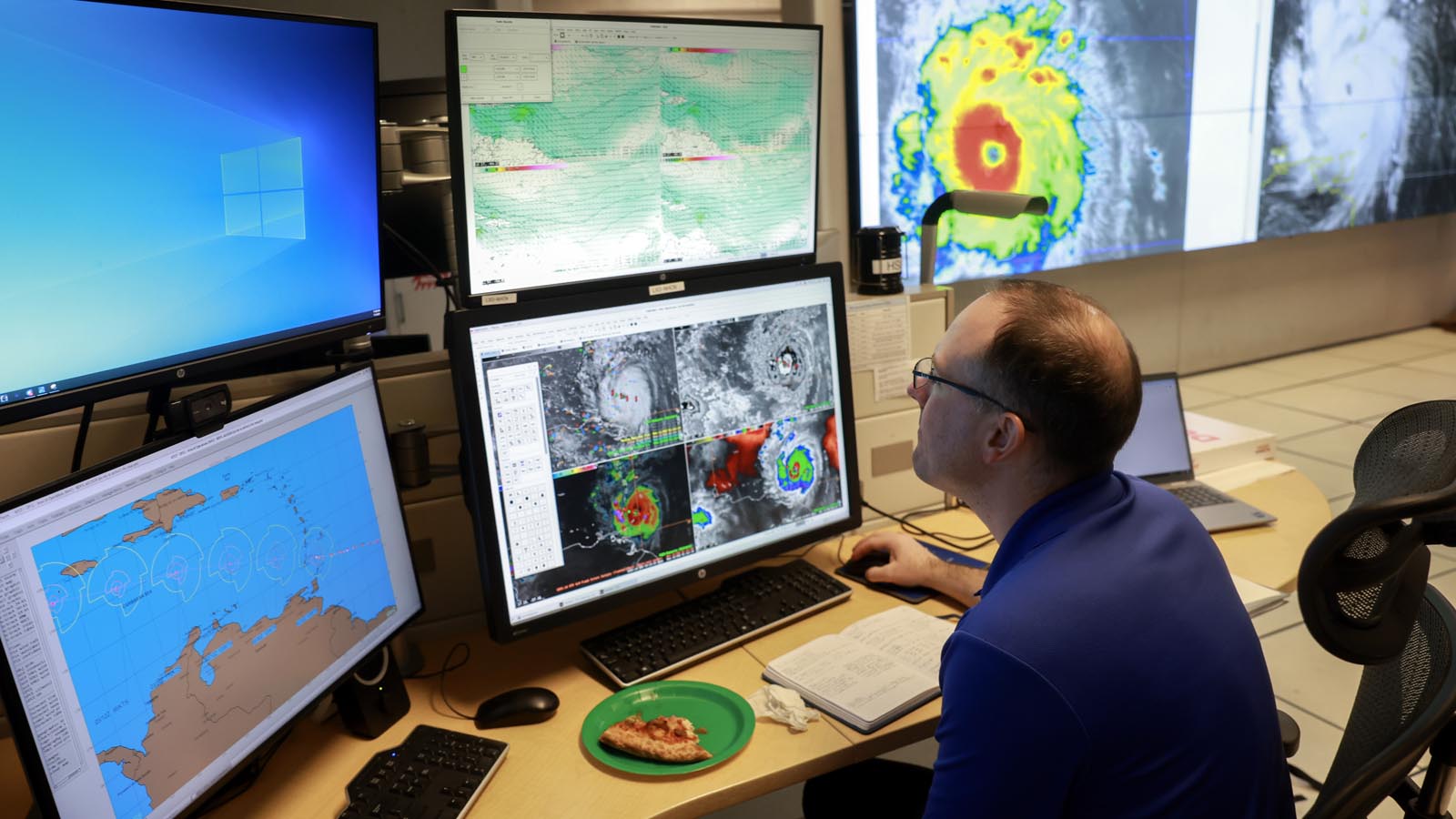

Understanding Hurricane Model Accuracy A 2025 Perspective

May 28, 2025

Understanding Hurricane Model Accuracy A 2025 Perspective

May 28, 2025

Latest Posts

-

Nih Director Faces Staff Uprising Over Research Cuts And Ideology

May 29, 2025

Nih Director Faces Staff Uprising Over Research Cuts And Ideology

May 29, 2025 -

Driver Charged After Thames Valley Police Officer Sustains Injuries In Car Crash

May 29, 2025

Driver Charged After Thames Valley Police Officer Sustains Injuries In Car Crash

May 29, 2025 -

Daring Fashion Alexandra Daddario Stuns In A Sheer Gown At Dior

May 29, 2025

Daring Fashion Alexandra Daddario Stuns In A Sheer Gown At Dior

May 29, 2025 -

Abortion Case Police Internal Concerns Revealed In Confidential Recording Leak

May 29, 2025

Abortion Case Police Internal Concerns Revealed In Confidential Recording Leak

May 29, 2025 -

How A Humble Lumber Yard Launched Shepmates To Social Media Success

May 29, 2025

How A Humble Lumber Yard Launched Shepmates To Social Media Success

May 29, 2025