Should Investors Ditch SiriusXM Holdings? Analyzing The Recent Performance.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should Investors Ditch SiriusXM Holdings? Analyzing the Recent Performance

SiriusXM Holdings (SIRI), the satellite radio giant, has seen its stock performance fluctuate recently, leaving many investors questioning its future. Is it time to ditch the stock, or are there reasons to remain optimistic about this entertainment powerhouse? This in-depth analysis examines SiriusXM's recent performance, exploring both the headwinds and tailwinds impacting its future prospects.

Recent Performance: A Mixed Bag

SiriusXM's recent financial reports present a mixed picture. While the company continues to boast a substantial subscriber base, growth has slowed, raising concerns among analysts. The company's Q[Insert most recent quarter] earnings [Insert key figures, e.g., showed a slight increase in revenue but a decrease in earnings per share]. This underperformance, coupled with broader market volatility, has contributed to the stock's price decline. Key factors contributing to this include:

-

Increased Competition: Streaming services like Spotify and Apple Music pose a significant threat, offering diverse music libraries and podcast content at competitive prices. This intensified competition is impacting SiriusXM's ability to attract and retain subscribers, especially among younger demographics.

-

Economic Headwinds: Inflation and rising interest rates have impacted consumer spending, potentially affecting SiriusXM's ability to maintain its subscription rates and attract new subscribers. The discretionary nature of entertainment spending makes it particularly vulnerable during economic downturns.

-

Content Acquisition Costs: Securing exclusive content and maintaining licensing agreements can be expensive. Rising costs in this area could impact SiriusXM's profitability if not effectively managed.

Reasons for Optimism:

Despite the challenges, several factors suggest SiriusXM might not be ready for the scrap heap just yet:

-

Strong Subscriber Base: SiriusXM still boasts a considerable and loyal subscriber base, particularly within the automotive sector. Its partnerships with major automakers provide a crucial revenue stream and a built-in audience.

-

Diversification Efforts: SiriusXM is actively diversifying its offerings beyond satellite radio, expanding into podcasting and other audio entertainment formats. This strategic move aims to broaden its appeal and reach new audience segments. [Link to relevant SiriusXM news about diversification efforts].

-

Potential for Growth in Emerging Markets: International expansion remains a potential avenue for growth, although this will require significant investment and overcoming regulatory hurdles.

What Should Investors Do?

The decision of whether to hold or sell SiriusXM stock depends on individual investment strategies and risk tolerance. For long-term investors with a high-risk tolerance, holding the stock might be a viable option, given the company's substantial subscriber base and diversification efforts. However, investors seeking stability and immediate returns might consider divesting. A thorough review of your portfolio diversification and a consideration of the overall market conditions are crucial.

Conclusion:

SiriusXM faces significant challenges in a rapidly evolving entertainment landscape. While recent performance has been underwhelming, its substantial subscriber base and diversification strategies offer potential for future growth. Investors should carefully weigh the risks and rewards before making any decisions regarding their SiriusXM holdings. Consult with a financial advisor for personalized guidance based on your individual circumstances. Remember, this analysis is for informational purposes only and not financial advice.

Keywords: SiriusXM, SIRI, SiriusXM stock, satellite radio, stock market, investment, financial analysis, streaming services, competition, economic headwinds, subscriber growth, diversification, podcasting, automotive industry.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should Investors Ditch SiriusXM Holdings? Analyzing The Recent Performance.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Uncertainty Remains Will The Two Child Benefit Cap Be Lifted

May 27, 2025

Uncertainty Remains Will The Two Child Benefit Cap Be Lifted

May 27, 2025 -

Two Sigma Invests 236 55 Million In Bank Of America A Significant Stake

May 27, 2025

Two Sigma Invests 236 55 Million In Bank Of America A Significant Stake

May 27, 2025 -

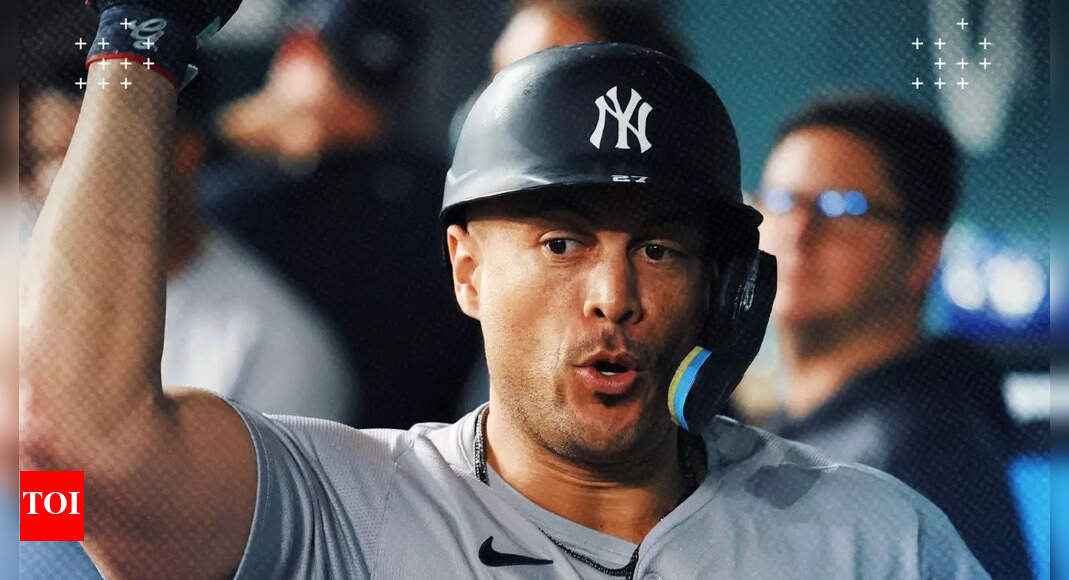

Stantons Yankees Exit Mariners Next Chapter Begins

May 27, 2025

Stantons Yankees Exit Mariners Next Chapter Begins

May 27, 2025 -

2 2 Million Medical Bill Dads Extraordinary Rowing Fundraising Effort

May 27, 2025

2 2 Million Medical Bill Dads Extraordinary Rowing Fundraising Effort

May 27, 2025 -

The Mysterious Death Of Andriy Portnov Investigating Ukraines Latest Tragedy

May 27, 2025

The Mysterious Death Of Andriy Portnov Investigating Ukraines Latest Tragedy

May 27, 2025

Latest Posts

-

Could Reversed Climate Policies Under Trump Increase The Threat Of Livestock Pests

May 28, 2025

Could Reversed Climate Policies Under Trump Increase The Threat Of Livestock Pests

May 28, 2025 -

No Sewage New Homes Historic Village Faces Development Dispute

May 28, 2025

No Sewage New Homes Historic Village Faces Development Dispute

May 28, 2025 -

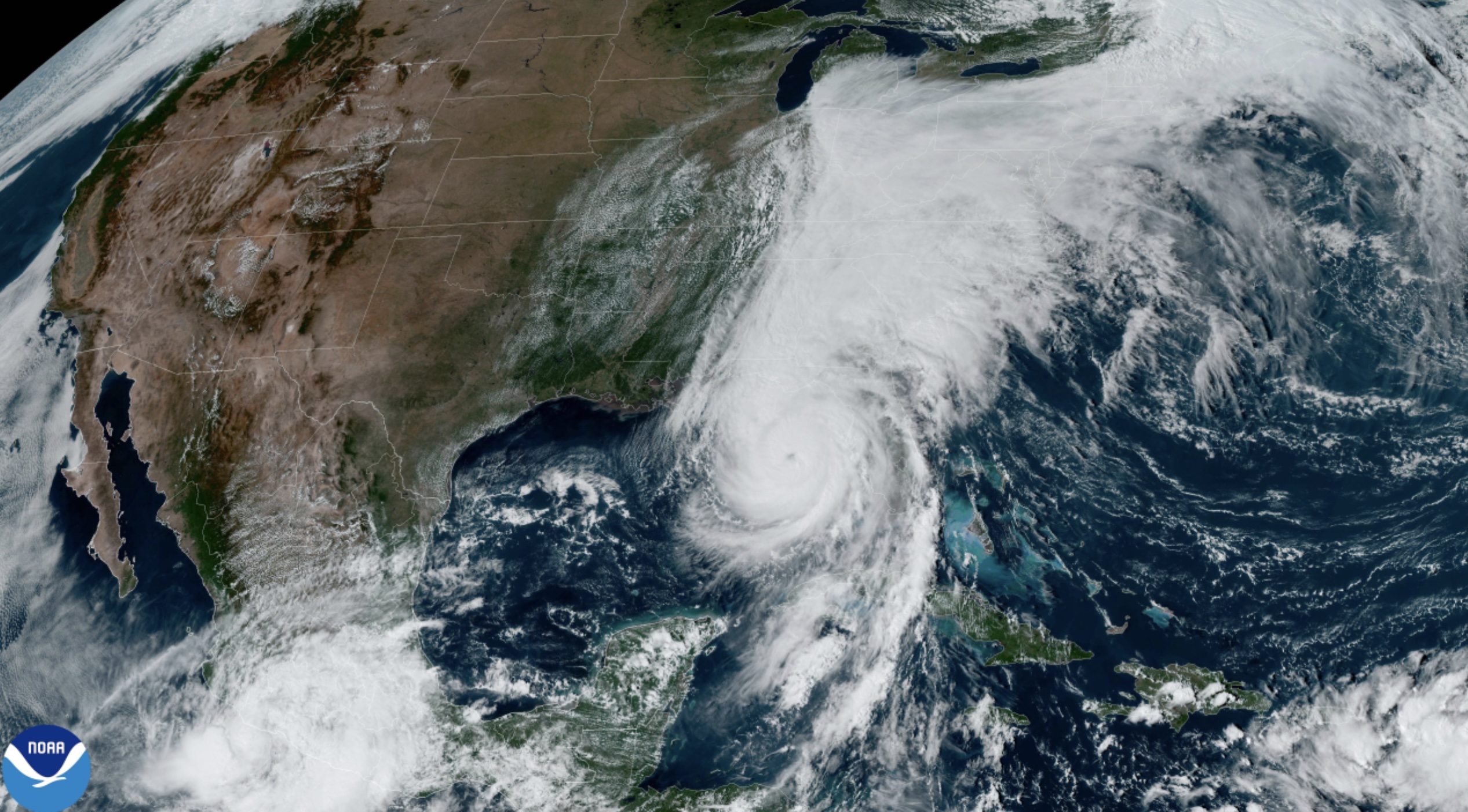

Summer Hurricane Outlook Above Normal Conditions Could Mean 10 Us Hurricanes

May 28, 2025

Summer Hurricane Outlook Above Normal Conditions Could Mean 10 Us Hurricanes

May 28, 2025 -

Israeli Ultra Nationalist March Fuels Jerusalem Tensions Cnn Report

May 28, 2025

Israeli Ultra Nationalist March Fuels Jerusalem Tensions Cnn Report

May 28, 2025 -

The Trump Harvard Conflict Is Elitism The Real Issue

May 28, 2025

The Trump Harvard Conflict Is Elitism The Real Issue

May 28, 2025