Should Investors Ditch SiriusXM Holdings Stock Now?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should Investors Ditch SiriusXM Holdings Stock Now? A Deep Dive into the Satellite Radio Giant

SiriusXM Holdings Inc. (SIRI) has been a source of both excitement and apprehension for investors. While the company boasts a loyal subscriber base and a seemingly dominant position in satellite radio, recent market performance and industry shifts have left some wondering: is it time to ditch SiriusXM stock? This in-depth analysis explores the current state of SiriusXM, examining the factors that might lead investors to sell, as well as arguments for holding onto or even buying more shares.

The Case for Selling:

Several factors contribute to the argument for divesting from SiriusXM stock:

- Competition: The rise of streaming services like Spotify and Apple Music presents a significant challenge. These platforms offer vast music libraries at competitive prices, potentially attracting subscribers away from satellite radio. The increasing popularity of podcasts further fragments the audio entertainment market.

- Growth Concerns: While SiriusXM continues to add subscribers, the rate of growth has slowed in recent years. Sustaining significant growth in a saturated market poses a substantial hurdle. Analysts are closely watching subscriber acquisition costs and churn rates.

- Economic Headwinds: Inflation and a potential recession could impact consumer spending, potentially leading to subscriber cancellations as individuals seek to cut discretionary expenses. The impact on advertising revenue should also be considered.

- Debt Levels: SiriusXM carries a considerable amount of debt. While manageable currently, high interest rates could increase the company's financial burden, impacting profitability and potentially investor confidence.

The Case for Holding or Buying:

Despite the challenges, there are compelling reasons to remain invested in or even acquire SiriusXM stock:

- Loyal Subscriber Base: SiriusXM boasts a highly loyal subscriber base, demonstrating the enduring appeal of its ad-free listening experience and curated content. This provides a solid foundation for future revenue streams.

- Content Diversification: The company is actively diversifying its content offerings beyond music, including talk radio, sports, and news programming. This strategy aims to attract a wider audience and reduce reliance on music subscriptions alone. Their expansion into podcasts is also a key element of this strategy.

- Strategic Partnerships: SiriusXM has forged strategic partnerships with various companies, expanding its reach and creating new revenue opportunities. These collaborations often unlock access to new audiences and technologies.

- Potential for Consolidation: The consolidation of the media landscape might present opportunities for SiriusXM to acquire smaller competitors or expand into new markets, further strengthening its position.

Analyzing the Future:

Ultimately, the decision of whether to ditch SiriusXM stock depends on individual investor risk tolerance and long-term outlook. Investors should carefully consider the factors outlined above, conducting thorough due diligence and potentially consulting with a financial advisor before making any investment decisions. Analyzing future earnings reports and tracking industry trends will be crucial in making informed choices.

What to Watch For:

- Subscriber growth trends: Keep an eye on quarterly reports for updates on subscriber additions and churn.

- Content strategy updates: Monitor announcements regarding new programming, partnerships, and technological advancements.

- Financial performance: Pay close attention to debt levels, profitability, and cash flow.

Conclusion:

The future of SiriusXM Holdings remains uncertain. While the challenges are real, the company's loyal subscriber base and diversification efforts offer a degree of resilience. Investors should carefully weigh the risks and rewards before deciding whether to hold, buy, or sell SiriusXM stock. This is not financial advice; always conduct thorough research before making investment decisions. For more information on investing in the media sector, consider exploring resources like [link to a reputable financial news source].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should Investors Ditch SiriusXM Holdings Stock Now?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Following The Israeli Embassy Murders Jeanine Pirros Statement

May 27, 2025

Following The Israeli Embassy Murders Jeanine Pirros Statement

May 27, 2025 -

Their Dc Love Story A Journey From Afar Cut Short

May 27, 2025

Their Dc Love Story A Journey From Afar Cut Short

May 27, 2025 -

Black Lung Disease Feds Slash Enforcement Leaving Miners Vulnerable

May 27, 2025

Black Lung Disease Feds Slash Enforcement Leaving Miners Vulnerable

May 27, 2025 -

Mexican Authorities Respond To Hot Air Balloon Crash Multiple Injuries Reported

May 27, 2025

Mexican Authorities Respond To Hot Air Balloon Crash Multiple Injuries Reported

May 27, 2025 -

Bruneis Sultan Undergoes Medical Assessment In Kuala Lumpur For Fatigue

May 27, 2025

Bruneis Sultan Undergoes Medical Assessment In Kuala Lumpur For Fatigue

May 27, 2025

Latest Posts

-

Canadian Us Relations Boycotts Effect On Tourism

May 29, 2025

Canadian Us Relations Boycotts Effect On Tourism

May 29, 2025 -

King Charles Canadian Visit A Royal Tour Amidst Trumps Statehood Bid

May 29, 2025

King Charles Canadian Visit A Royal Tour Amidst Trumps Statehood Bid

May 29, 2025 -

Serious Police Concerns Surface In Leaked Recording About Abortion Arrest

May 29, 2025

Serious Police Concerns Surface In Leaked Recording About Abortion Arrest

May 29, 2025 -

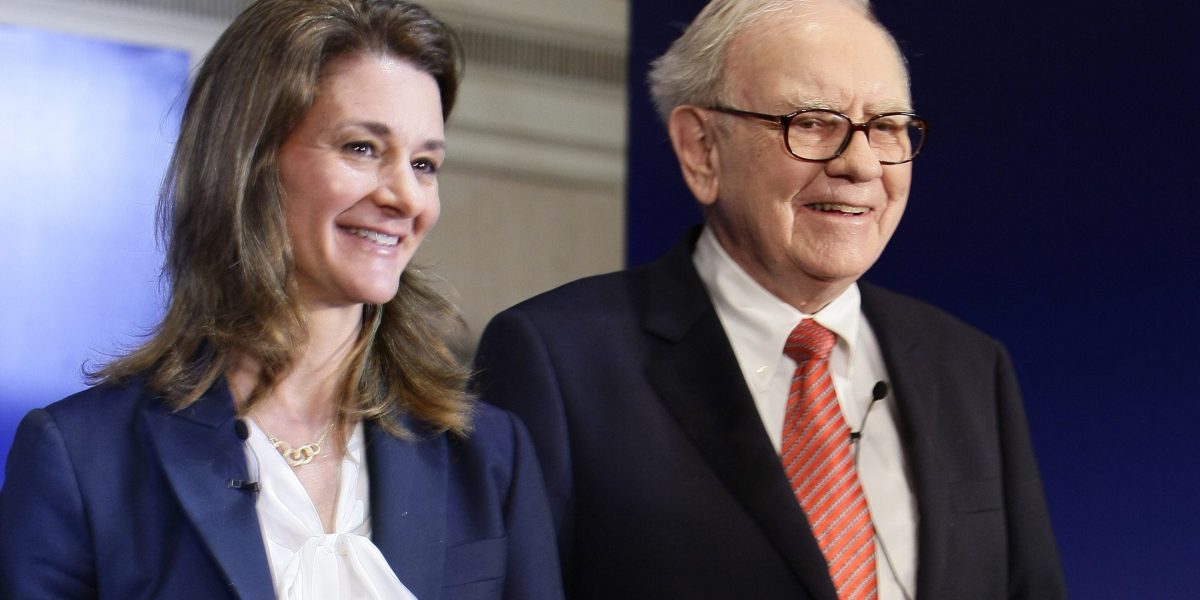

The Future Of Billionaire Giving Analyzing The 600 Billion Pledge

May 29, 2025

The Future Of Billionaire Giving Analyzing The 600 Billion Pledge

May 29, 2025 -

Alexandra Daddarios Nearly Naked Lace Dress At Recent Event

May 29, 2025

Alexandra Daddarios Nearly Naked Lace Dress At Recent Event

May 29, 2025