Should Investors Reconsider SiriusXM Holdings?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should Investors Reconsider SiriusXM Holdings? A Deep Dive into the Satellite Radio Giant

SiriusXM Holdings (SIRI) has been a staple in many investment portfolios for years, offering a seemingly stable stream of revenue from its satellite radio service. But with the rise of streaming services and evolving listening habits, should investors reconsider their position in this media giant? This in-depth analysis explores the current state of SiriusXM, examining its strengths, weaknesses, and future prospects.

The Allure of SiriusXM: A Look at the Positives

SiriusXM boasts a substantial subscriber base, a key strength that continues to drive revenue. The company's ad-free listening experience and diverse programming, ranging from music to sports talk and comedy, remain attractive to many consumers. This loyal subscriber base provides a predictable revenue stream, a significant factor for investors seeking stability. Furthermore, SiriusXM's strategic acquisitions and partnerships, such as its involvement in Pandora, demonstrate a proactive approach to adapting to the changing media landscape. This diversification mitigates risk and potentially opens new avenues for growth.

Navigating the Challenges: Weaknesses and Concerns

Despite its strengths, SiriusXM faces significant headwinds. The increasing popularity of streaming music services like Spotify and Apple Music presents a considerable challenge. These platforms offer on-demand listening, a feature absent in SiriusXM's traditional satellite radio model. Competition in the podcasting space is also intensifying, requiring SiriusXM to innovate and invest heavily to maintain its competitiveness. Furthermore, the high cost of satellite infrastructure represents a long-term concern, limiting potential profit margins. Finally, the potential for cord-cutting to impact satellite radio subscriptions warrants careful consideration.

The Future of SiriusXM: Growth Potential and Risks

The future success of SiriusXM hinges on its ability to adapt and innovate. Its investment in digital platforms like Pandora is crucial for capturing a younger demographic. However, the profitability of these ventures remains a key question. The company's success will also depend on its ability to offer compelling content that differentiates it from the multitude of streaming options available to consumers. Effective marketing strategies targeting new subscribers will also be essential.

Analyzing the Stock: Is it a Buy, Sell, or Hold?

Whether or not to invest in SiriusXM is a complex decision depending on individual risk tolerance and investment goals. While the predictable revenue stream and loyal subscriber base offer stability, the competitive landscape and the need for significant investment in digital platforms represent considerable risks. Investors should carefully consider the following before making a decision:

- Market trends: How are listening habits evolving? Are more people shifting away from traditional radio?

- Competitive landscape: How effectively is SiriusXM competing with streaming services and podcasts?

- Financial performance: What are the company's key financial indicators, including revenue growth and profitability?

- Long-term strategy: Does the company's long-term strategy address the challenges it faces?

Conclusion:

SiriusXM's future is not guaranteed. While the company's loyal subscriber base and stable revenue streams provide a foundation, the rise of streaming services presents a significant challenge. Investors should conduct thorough due diligence, including analyzing financial statements and industry trends, before making an investment decision. Consulting with a financial advisor is highly recommended. The decision to buy, sell, or hold SiriusXM stock ultimately rests on a careful assessment of its strengths, weaknesses, and the evolving media landscape. Only after a comprehensive analysis can a well-informed investment strategy be formulated.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should Investors Reconsider SiriusXM Holdings?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

New Initiative Us Funded Aid Reaching Gaza Residents

May 28, 2025

New Initiative Us Funded Aid Reaching Gaza Residents

May 28, 2025 -

Trumps Increasingly Unhinged Attacks On Harvard Reveal A Financial Scheme

May 28, 2025

Trumps Increasingly Unhinged Attacks On Harvard Reveal A Financial Scheme

May 28, 2025 -

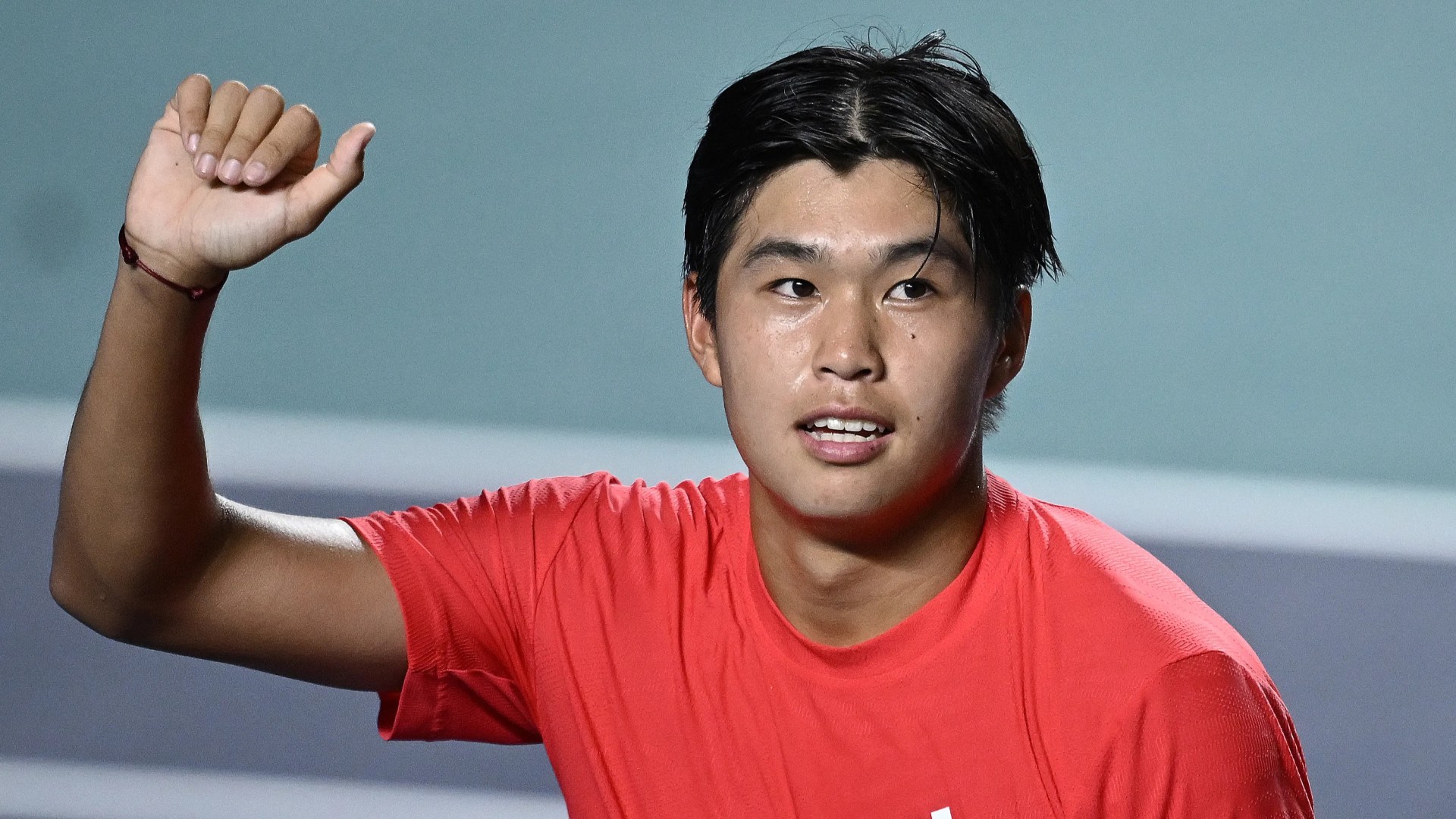

Unique Name Unstoppable Drive Us Tennis Sensation Takes On World No 3

May 28, 2025

Unique Name Unstoppable Drive Us Tennis Sensation Takes On World No 3

May 28, 2025 -

Sultan Of Brunei Undergoes Treatment In Kuala Lumpur Hospital

May 28, 2025

Sultan Of Brunei Undergoes Treatment In Kuala Lumpur Hospital

May 28, 2025 -

Invasive Screwworm Flies Understanding The Risk And Prevention

May 28, 2025

Invasive Screwworm Flies Understanding The Risk And Prevention

May 28, 2025

Latest Posts

-

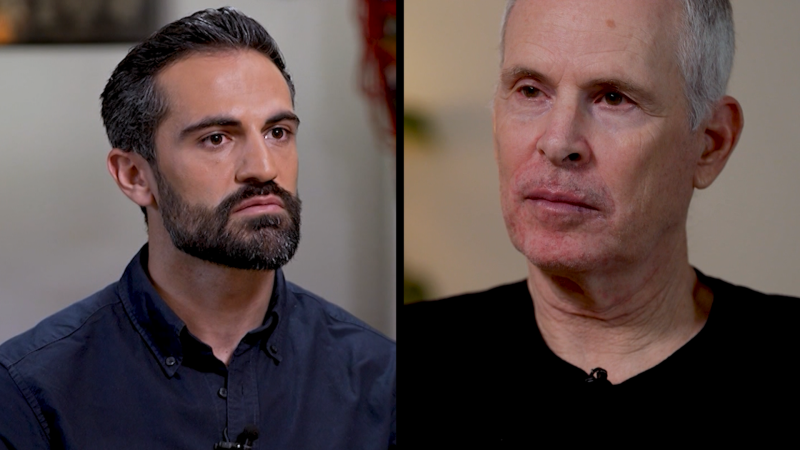

Witness To Horror Israeli Hostage Describes Hamas Torture On Cnn

May 30, 2025

Witness To Horror Israeli Hostage Describes Hamas Torture On Cnn

May 30, 2025 -

Remembering Althea Gibson The Us Opens 2025 Tribute

May 30, 2025

Remembering Althea Gibson The Us Opens 2025 Tribute

May 30, 2025 -

Joshlin Smith Kidnapping Case Mother Kelly Smith Receives Jail Sentence

May 30, 2025

Joshlin Smith Kidnapping Case Mother Kelly Smith Receives Jail Sentence

May 30, 2025 -

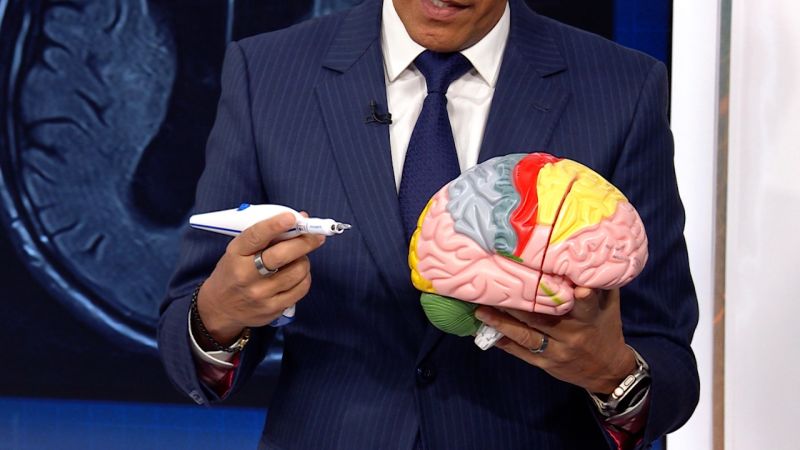

Cnn Dr Sanjay Gupta On The Potential Treatments For Billy Joels Neurological Issue

May 30, 2025

Cnn Dr Sanjay Gupta On The Potential Treatments For Billy Joels Neurological Issue

May 30, 2025 -

Ohio Electric Bills Rising Duke Energys June 1 Rate Increase Details

May 30, 2025

Ohio Electric Bills Rising Duke Energys June 1 Rate Increase Details

May 30, 2025