Should You Buy Robinhood Stock? Weighing The Risks And Rewards

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Buy Robinhood Stock? Weighing the Risks and Rewards

Robinhood, the once-darling of the millennial investing world, has experienced a rollercoaster ride since its IPO. Its disruptive commission-free trading platform revolutionized the industry, but recent challenges have left many investors questioning whether now is the right time to buy RH stock. This article delves into the current state of Robinhood, analyzing the potential rewards and risks to help you make an informed investment decision.

Robinhood's Rise and Fall (and Potential Rise Again?)

Robinhood's initial success was undeniable. Its user-friendly app and zero-commission trading attracted millions of new investors, particularly younger demographics. This explosive growth fueled its highly anticipated IPO in 2021. However, the subsequent stock performance has been far from stellar. Several factors contributed to this decline, including:

- Increased Competition: The commission-free trading model is now commonplace, leading to intense competition from established players like Fidelity and Charles Schwab.

- Regulatory Scrutiny: Robinhood has faced significant regulatory challenges and investigations, impacting its reputation and financial stability.

- Market Volatility: The broader market downturn significantly impacted Robinhood's performance, as investors became more risk-averse.

- Loss of Users and Revenue: The company saw a decrease in active users and trading volume which led to a drop in revenue and impacting profitability.

The Case for Investing in Robinhood:

Despite the challenges, several arguments suggest a potential for future growth:

- Long-Term Growth Potential: The long-term potential for growth in the online brokerage industry remains strong, especially as more people embrace digital investing.

- Innovation and Expansion: Robinhood continues to innovate, expanding its product offerings beyond simple stock trading to include options, cryptocurrencies, and more. This diversification can potentially drive future revenue streams.

- Undervalued Stock?: Some analysts believe the current Robinhood stock price may undervalue the company's long-term potential. This presents a possible buying opportunity for long-term investors with a higher risk tolerance.

- Growing Customer Base: Although the company experienced a dip, its platform remains attractive to many, providing potential for future customer acquisition.

The Risks of Investing in Robinhood:

Before considering investing, it's crucial to acknowledge the significant risks:

- Financial Instability: Robinhood's financial performance remains volatile, and further losses are possible.

- Regulatory Uncertainty: Ongoing regulatory investigations and potential fines could negatively impact the company's financial health and stock price.

- Intense Competition: The competitive landscape remains fiercely competitive, making it challenging for Robinhood to maintain its market share and profitability.

- Market Sentiment: Investor sentiment towards Robinhood remains mixed, and any negative news could trigger further stock price declines.

Who Should Consider Investing in Robinhood Stock?

Investing in Robinhood is not suitable for all investors. It's a high-risk investment best suited for:

- Long-term investors: Those with a long-term investment horizon and a higher risk tolerance.

- Growth-oriented investors: Investors seeking significant growth potential, even with the associated risks.

- Experienced investors: Those who understand the intricacies of the stock market and can assess the risks involved.

Conclusion: A Risky Bet with Potential Rewards

Investing in Robinhood stock presents a high-risk, high-reward scenario. While the company faces significant challenges, its long-term growth potential remains a compelling factor for some investors. Before investing, conduct thorough due diligence, carefully consider your risk tolerance, and diversify your portfolio to mitigate potential losses. Remember to consult with a financial advisor before making any investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves inherent risks, and you could lose money.

Keywords: Robinhood stock, RH stock, buy Robinhood stock, Robinhood investment, Robinhood risks, Robinhood rewards, online brokerage, stock market investment, investing in Robinhood, Robinhood IPO, high-risk investment, long-term investment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Buy Robinhood Stock? Weighing The Risks And Rewards. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Blake Livelys Lawsuit Against Justin Baldoni Dismissed

Jun 05, 2025

Blake Livelys Lawsuit Against Justin Baldoni Dismissed

Jun 05, 2025 -

Far Right Leaders Exit Will The Dutch Government Survive The Geert Wilders Crisis

Jun 05, 2025

Far Right Leaders Exit Will The Dutch Government Survive The Geert Wilders Crisis

Jun 05, 2025 -

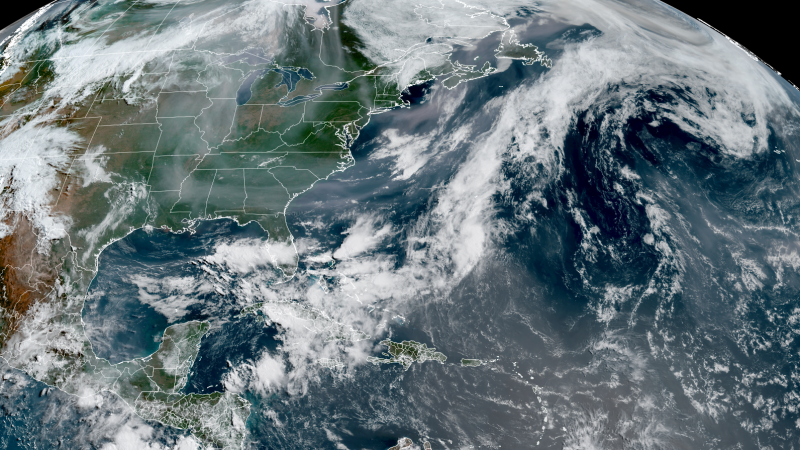

Weather Forecast Imminent Collision Of Canadian Smoke And African Dust Over Southern Regions

Jun 05, 2025

Weather Forecast Imminent Collision Of Canadian Smoke And African Dust Over Southern Regions

Jun 05, 2025 -

Coca Cola Ko Stock Is It A Smart Investment Now

Jun 05, 2025

Coca Cola Ko Stock Is It A Smart Investment Now

Jun 05, 2025 -

Forensic Video Experts Testimony Could Decide Sean Diddy Combs Fate

Jun 05, 2025

Forensic Video Experts Testimony Could Decide Sean Diddy Combs Fate

Jun 05, 2025

Latest Posts

-

Keita Nakagawas Game Tying Home Run Fuels Orix Comeback

Aug 17, 2025

Keita Nakagawas Game Tying Home Run Fuels Orix Comeback

Aug 17, 2025 -

Newly Found Documents Shed Light On Trump Putin Meeting In Alaska

Aug 17, 2025

Newly Found Documents Shed Light On Trump Putin Meeting In Alaska

Aug 17, 2025 -

Actor Tristan Rogers Iconic General Hospital Star Passes Away At 79

Aug 17, 2025

Actor Tristan Rogers Iconic General Hospital Star Passes Away At 79

Aug 17, 2025 -

Premier League Racism Antoine Semenyo Details Abuse During Liverpool Game

Aug 17, 2025

Premier League Racism Antoine Semenyo Details Abuse During Liverpool Game

Aug 17, 2025 -

The Untold Story Of A Wwii Veteran A Vj Day Memory That Moved Queen Camilla

Aug 17, 2025

The Untold Story Of A Wwii Veteran A Vj Day Memory That Moved Queen Camilla

Aug 17, 2025