Should You Invest In Coca-Cola (KO)? A Comprehensive Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Invest in Coca-Cola (KO)? A Comprehensive Analysis

Coca-Cola (KO). The name conjures images of classic refreshment, iconic branding, and seemingly unwavering global popularity. But is this iconic beverage giant a sound investment in today's volatile market? This comprehensive analysis delves into the strengths and weaknesses of Coca-Cola stock, helping you determine if it's the right addition to your portfolio.

Coca-Cola's Strengths: A Legacy of Success

Coca-Cola boasts a compelling history of success, built on a foundation of strong brand recognition and global reach. This translates into several key strengths for potential investors:

-

Unwavering Brand Loyalty: Few brands enjoy the global recognition and unwavering loyalty that Coca-Cola possesses. This brand power provides a significant competitive advantage, ensuring consistent demand even amidst shifting consumer preferences.

-

Diversified Portfolio: While Coca-Cola Classic remains a flagship product, the company has strategically diversified its portfolio to include a wide range of beverages, from sparkling drinks and juices to teas and waters. This diversification mitigates risk associated with relying on a single product. Think brands like Sprite, Fanta, Minute Maid, and Dasani – all contributing to a robust revenue stream.

-

Global Reach and Distribution Network: Coca-Cola's global distribution network is unparalleled. Its products are available in virtually every corner of the world, providing a significant advantage in accessing diverse markets and maximizing revenue potential.

-

Consistent Dividend Payments: Coca-Cola has a long history of paying consistent dividends, making it attractive to income-seeking investors. This dividend payout offers a degree of stability and predictable returns. [Link to a reputable source on KO's dividend history]

Coca-Cola's Challenges: Navigating the Modern Landscape

Despite its strengths, Coca-Cola faces significant challenges in the ever-evolving beverage market:

-

Shifting Consumer Preferences: Growing health consciousness has led to a decline in the consumption of sugary drinks, impacting the demand for some of Coca-Cola's flagship products. The company is actively responding to this by investing in healthier alternatives, but this transition presents challenges.

-

Intense Competition: The beverage industry is fiercely competitive. Coca-Cola faces pressure from both established competitors and emerging brands offering healthier and more innovative options.

-

Pricing Pressures: Fluctuating commodity prices and increasing input costs can impact Coca-Cola's profitability and margins. Managing these pressures effectively is crucial for maintaining its competitive edge.

-

Economic Volatility: Global economic uncertainty can affect consumer spending, impacting the demand for Coca-Cola's products, particularly in emerging markets.

Analyzing the Financial Performance:

A thorough assessment of Coca-Cola's financial performance is crucial. Investors should review key metrics like revenue growth, profit margins, debt levels, and cash flow. Analyzing these factors alongside industry benchmarks provides valuable insight into the company's financial health and future potential. [Link to Coca-Cola's investor relations website]

Should You Invest? The Verdict

Whether or not Coca-Cola is a suitable investment for you depends on your individual investment goals and risk tolerance. While the company faces challenges in adapting to changing consumer preferences, its strong brand recognition, diversified portfolio, and consistent dividend payments offer a degree of stability.

Before making any investment decisions, conduct thorough due diligence, consult with a qualified financial advisor, and carefully consider your own personal circumstances.

Keywords: Coca-Cola, KO, stock, investment, dividend, beverage, market analysis, financial performance, brand loyalty, global reach, competitive advantage, consumer preferences, diversification, risk, opportunity.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Invest In Coca-Cola (KO)? A Comprehensive Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

From Concept To Catastrophe A Look At High Tech Project Failures

Jun 05, 2025

From Concept To Catastrophe A Look At High Tech Project Failures

Jun 05, 2025 -

Landmark Supreme Court Decision Impacts Reverse Discrimination Claims

Jun 05, 2025

Landmark Supreme Court Decision Impacts Reverse Discrimination Claims

Jun 05, 2025 -

Norrie Vs Djokovic Draper Vs Bublik French Open Day 2 Recap

Jun 05, 2025

Norrie Vs Djokovic Draper Vs Bublik French Open Day 2 Recap

Jun 05, 2025 -

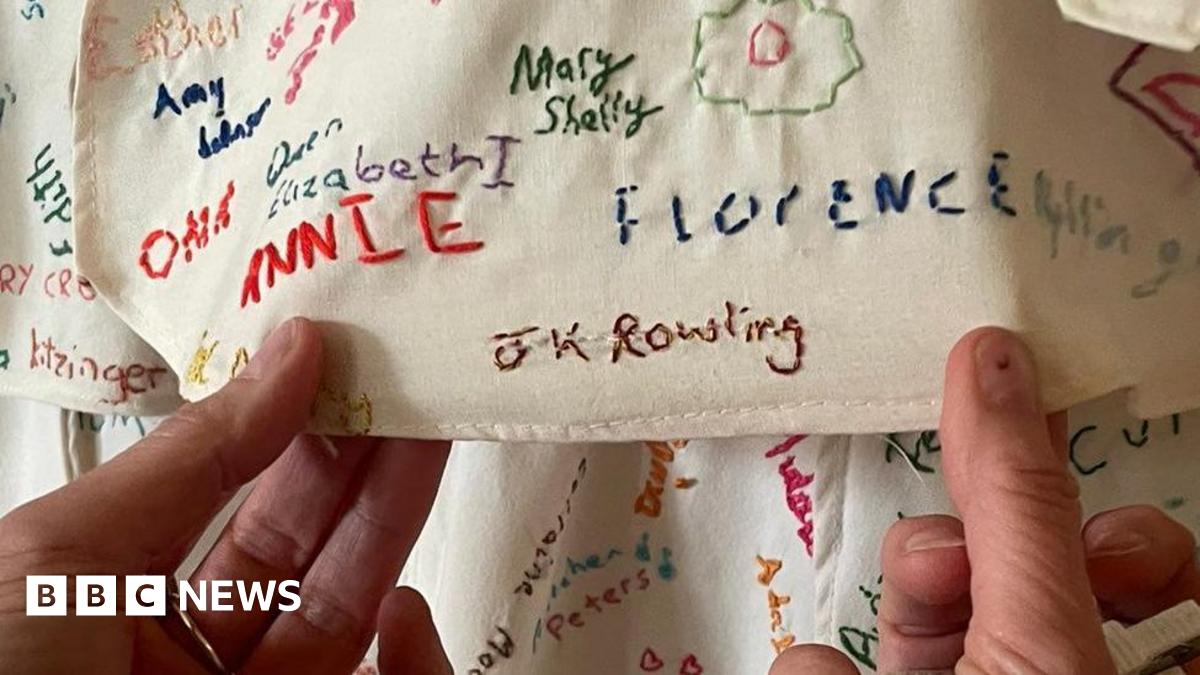

Derbyshire National Trust Site Hides Vandalized J K Rowling Artwork

Jun 05, 2025

Derbyshire National Trust Site Hides Vandalized J K Rowling Artwork

Jun 05, 2025 -

Wilders Departure Shakes Dutch Politics Coalition Government Collapses

Jun 05, 2025

Wilders Departure Shakes Dutch Politics Coalition Government Collapses

Jun 05, 2025

Latest Posts

-

The Ukrainian Peoples Struggle For Peace And Sovereignty

Aug 17, 2025

The Ukrainian Peoples Struggle For Peace And Sovereignty

Aug 17, 2025 -

Can Topshop Reclaim Its Place As A High Street Fashion Icon

Aug 17, 2025

Can Topshop Reclaim Its Place As A High Street Fashion Icon

Aug 17, 2025 -

Battlefield 6 Beta Review A Deep Dive Into Multiplayer Gameplay

Aug 17, 2025

Battlefield 6 Beta Review A Deep Dive Into Multiplayer Gameplay

Aug 17, 2025 -

Understanding The Trump Putin Alaska Summit Five Crucial Points

Aug 17, 2025

Understanding The Trump Putin Alaska Summit Five Crucial Points

Aug 17, 2025 -

Tristan Rogers Dead At 79 Remembering Robert Scorpio Of General Hospital

Aug 17, 2025

Tristan Rogers Dead At 79 Remembering Robert Scorpio Of General Hospital

Aug 17, 2025