Should You Invest In SiriusXM Holdings? A Comprehensive Stock Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Invest in SiriusXM Holdings? A Comprehensive Stock Analysis

SiriusXM Holdings (SIRI) has been a topic of much discussion among investors lately. This satellite radio giant boasts millions of subscribers, but is it a smart investment for your portfolio? This comprehensive analysis delves into the company's strengths, weaknesses, opportunities, and threats (SWOT analysis) to help you make an informed decision.

SiriusXM's Strengths: A Dominant Player in Satellite Radio

SiriusXM's primary strength lies in its dominance within the satellite radio market. With a substantial subscriber base and a strong brand recognition, the company enjoys significant market share and pricing power. This established position provides a solid foundation for future growth, particularly as it expands into new areas. Their diverse programming, including ad-free music channels, sports talk, and comedy, caters to a wide range of listeners, further solidifying their market position.

Opportunities for Growth: Beyond the Satellite

While satellite radio remains a core component of SiriusXM's business, the company is actively exploring growth opportunities beyond this traditional model. The expansion into connected vehicles presents a significant avenue for growth, offering access to a much larger potential customer base. [Link to relevant article about SiriusXM's expansion into connected cars]. Moreover, their foray into podcasting and other audio entertainment platforms demonstrates a strategic effort to diversify revenue streams and adapt to changing consumer preferences. This diversification mitigates risk and positions SiriusXM for long-term success in a dynamic media landscape.

Weaknesses: Competition and Dependence on Subscriptions

Despite its market dominance, SiriusXM faces several challenges. The rise of streaming services presents significant competition for listener attention and advertising dollars. Services like Spotify and Apple Music offer vast music libraries and personalized recommendations, posing a threat to SiriusXM's subscriber base. Furthermore, SiriusXM's business model relies heavily on subscription revenue, making it vulnerable to subscriber churn and economic downturns. A drop in subscriptions could significantly impact the company's financial performance.

Threats: Technological Disruption and Economic Factors

The ever-evolving technological landscape presents a constant threat to SiriusXM. New audio technologies and evolving consumer preferences could disrupt the satellite radio market. Furthermore, macroeconomic factors such as inflation and recessionary pressures can affect consumer spending habits, potentially impacting subscription renewals and overall revenue. These economic uncertainties are important considerations when evaluating SiriusXM as an investment.

Financial Performance: A Look at the Numbers

Analyzing SiriusXM's financial statements, including revenue growth, profitability, and debt levels, is crucial for any prospective investor. [Link to SiriusXM's investor relations page]. Investors should carefully examine key financial metrics like the price-to-earnings (P/E) ratio, return on equity (ROE), and debt-to-equity ratio to assess the company's financial health and potential for future growth. A thorough understanding of these metrics is vital for making an informed investment decision.

Should You Invest? The Verdict

Whether or not to invest in SiriusXM Holdings ultimately depends on your individual investment goals and risk tolerance. While the company enjoys a strong market position and is actively pursuing growth opportunities, it also faces significant challenges from competition and economic factors. Careful consideration of the SWOT analysis outlined above, coupled with a thorough review of the company's financial performance, is essential before making an investment decision. Remember to consult with a qualified financial advisor before making any investment choices.

Disclaimer: This article provides general information and should not be considered financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Invest In SiriusXM Holdings? A Comprehensive Stock Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Hs 2 West Midlands Staffing Firms Under Investigation

May 27, 2025

Hs 2 West Midlands Staffing Firms Under Investigation

May 27, 2025 -

Lacrosse Championship Maryland And Cornell Ready For Final Face Off

May 27, 2025

Lacrosse Championship Maryland And Cornell Ready For Final Face Off

May 27, 2025 -

Macron Et Brigitte Au Vietnam Un Simple Differend Dement L Entourage Presidentiel

May 27, 2025

Macron Et Brigitte Au Vietnam Un Simple Differend Dement L Entourage Presidentiel

May 27, 2025 -

Fewer Inspectors Laxer Rules The Feds Weakening Of Black Lung Prevention

May 27, 2025

Fewer Inspectors Laxer Rules The Feds Weakening Of Black Lung Prevention

May 27, 2025 -

Stantons Yankees Exit New Beginning With Seattle Mariners

May 27, 2025

Stantons Yankees Exit New Beginning With Seattle Mariners

May 27, 2025

Latest Posts

-

Israeli Ultra Nationalists March In Jerusalem Heightened Tensions And Clashes

May 28, 2025

Israeli Ultra Nationalists March In Jerusalem Heightened Tensions And Clashes

May 28, 2025 -

From Lumber To Likes Shepmates Journey To Social Media Domination

May 28, 2025

From Lumber To Likes Shepmates Journey To Social Media Domination

May 28, 2025 -

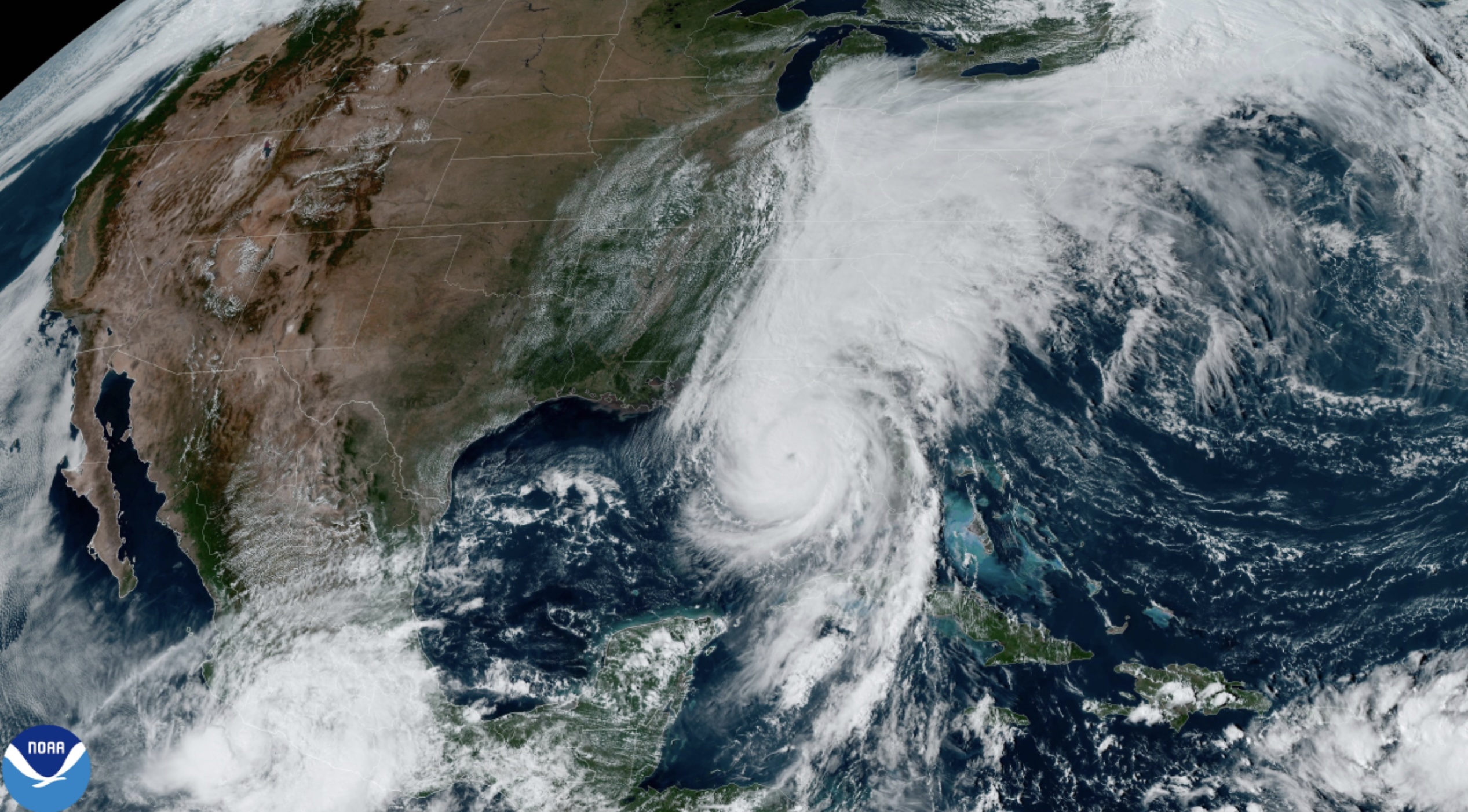

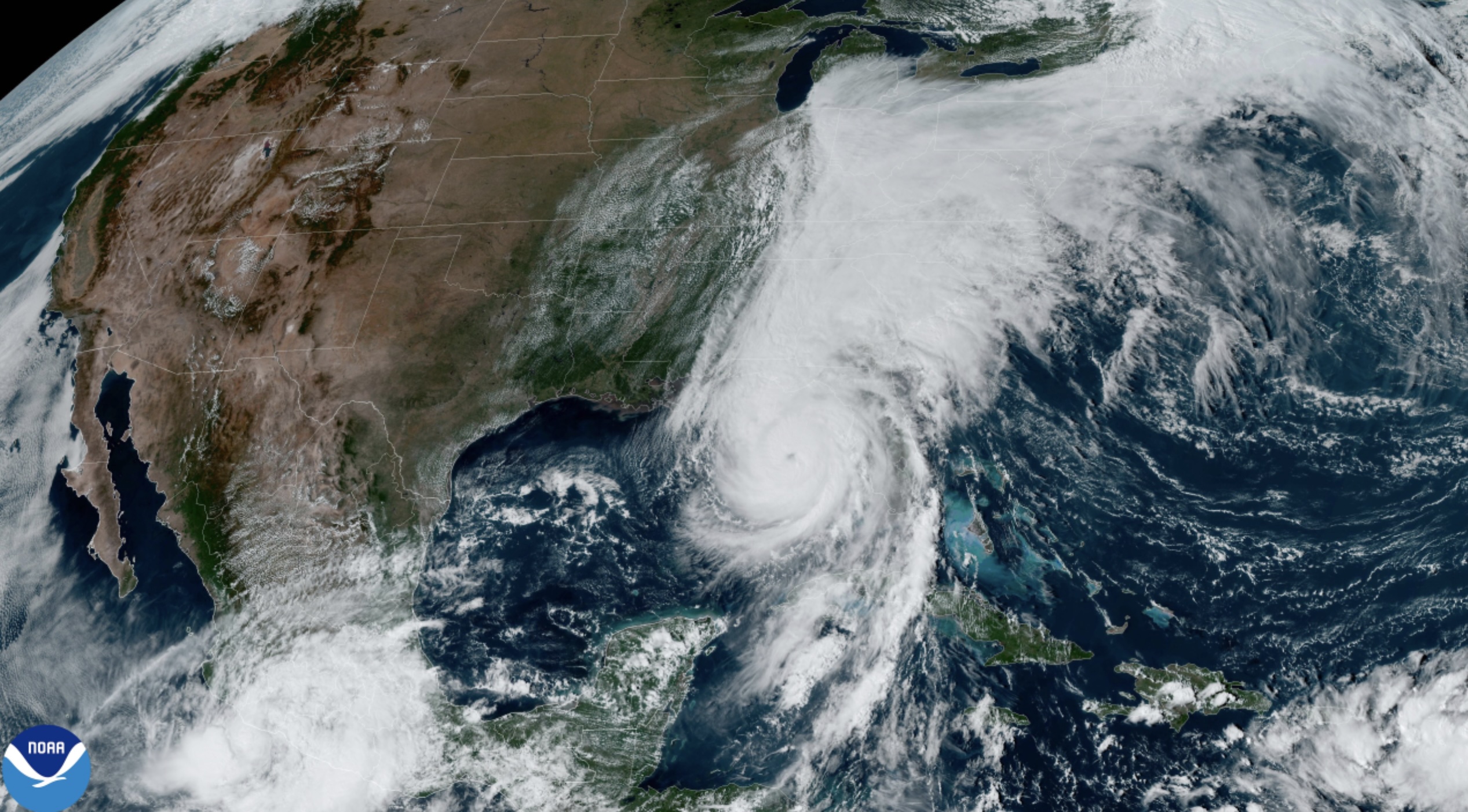

Increased Hurricane Threat Above Normal Conditions Could Mean 10 Us Hurricanes This Summer

May 28, 2025

Increased Hurricane Threat Above Normal Conditions Could Mean 10 Us Hurricanes This Summer

May 28, 2025 -

Above Normal Hurricane Season Forecast 10 Storms Possible For The Us

May 28, 2025

Above Normal Hurricane Season Forecast 10 Storms Possible For The Us

May 28, 2025 -

Royal Visit And Political Controversy King Charles In Canada As Trump Eyes 51st State

May 28, 2025

Royal Visit And Political Controversy King Charles In Canada As Trump Eyes 51st State

May 28, 2025