Should You Invest In SiriusXM Holdings? A Detailed Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Invest in SiriusXM Holdings? A Detailed Analysis

SiriusXM Holdings (SIRI) is a major player in the satellite radio industry, offering a diverse range of subscription-based audio entertainment. But is it a wise investment for your portfolio? This in-depth analysis explores the pros and cons, considering current market trends and future projections to help you make an informed decision.

SiriusXM's Strengths: A Dominant Market Position

SiriusXM boasts a significant advantage: its near-monopoly in the satellite radio market. This provides a substantial moat against competitors, ensuring a consistent stream of revenue from its loyal subscriber base. This dominance translates into predictable cash flows, a key attraction for many investors. Their vast content library, including ad-free music, sports, news, and talk radio, further strengthens their position. The company's ongoing efforts in expanding its content offerings and technological advancements also contribute to its market leadership.

Growth Potential: Beyond Satellite Radio

While satellite radio forms the core of SiriusXM's business, the company is actively diversifying. Their investments in podcasting, streaming services, and connected car technology represent significant growth opportunities. This strategic diversification mitigates reliance on a single revenue stream and positions them for success in the evolving media landscape. The increasing integration of SiriusXM into new vehicles also presents a substantial avenue for subscriber growth.

Financial Performance: A Mixed Bag

While SiriusXM generally demonstrates consistent revenue growth, profitability can fluctuate. Understanding the company's financial statements, including revenue streams, operating expenses, and debt levels, is crucial before making any investment decisions. Analyzing key financial ratios such as the debt-to-equity ratio and return on equity can provide valuable insights into the company’s financial health and stability. Referencing reputable financial news sources and SEC filings is essential for this analysis.

Challenges and Risks: Competition and Industry Trends

Despite its market dominance, SiriusXM faces challenges. The rise of streaming music services like Spotify and Apple Music presents stiff competition. These platforms offer a vast library of on-demand music at a comparatively lower cost. Furthermore, changes in consumer listening habits and technological advancements could impact SiriusXM’s future growth. The company's dependence on subscription revenue also makes it vulnerable to subscriber churn.

Analyzing the Stock: Factors to Consider

Before investing in SiriusXM Holdings, consider several crucial factors:

- Current Market Valuation: Compare SIRI's current stock price to its historical performance and industry peers. Is it overvalued or undervalued?

- Analyst Ratings: Research recommendations from reputable financial analysts to gauge market sentiment.

- Long-Term Growth Prospects: Assess the company's potential for sustained growth, considering its diversification efforts and competitive landscape.

- Risk Tolerance: Understand the inherent risks associated with investing in the media and entertainment sector.

Conclusion: Is SiriusXM a Buy, Sell, or Hold?

Investing in SiriusXM Holdings involves a careful assessment of its strengths and weaknesses. While its dominant market position and diversification efforts are promising, the competitive landscape and reliance on subscriptions present considerable risks. Ultimately, the decision to invest depends on your individual risk tolerance, investment goals, and thorough due diligence. Conducting your own research and seeking advice from a qualified financial advisor is strongly recommended. This analysis provides a framework for your decision-making process, but it should not be considered financial advice.

Disclaimer: This article is for informational purposes only and should not be construed as financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Invest In SiriusXM Holdings? A Detailed Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Closure After 79 Years Wwii Bomber Crash Victims Identified Four Coming Home

May 27, 2025

Closure After 79 Years Wwii Bomber Crash Victims Identified Four Coming Home

May 27, 2025 -

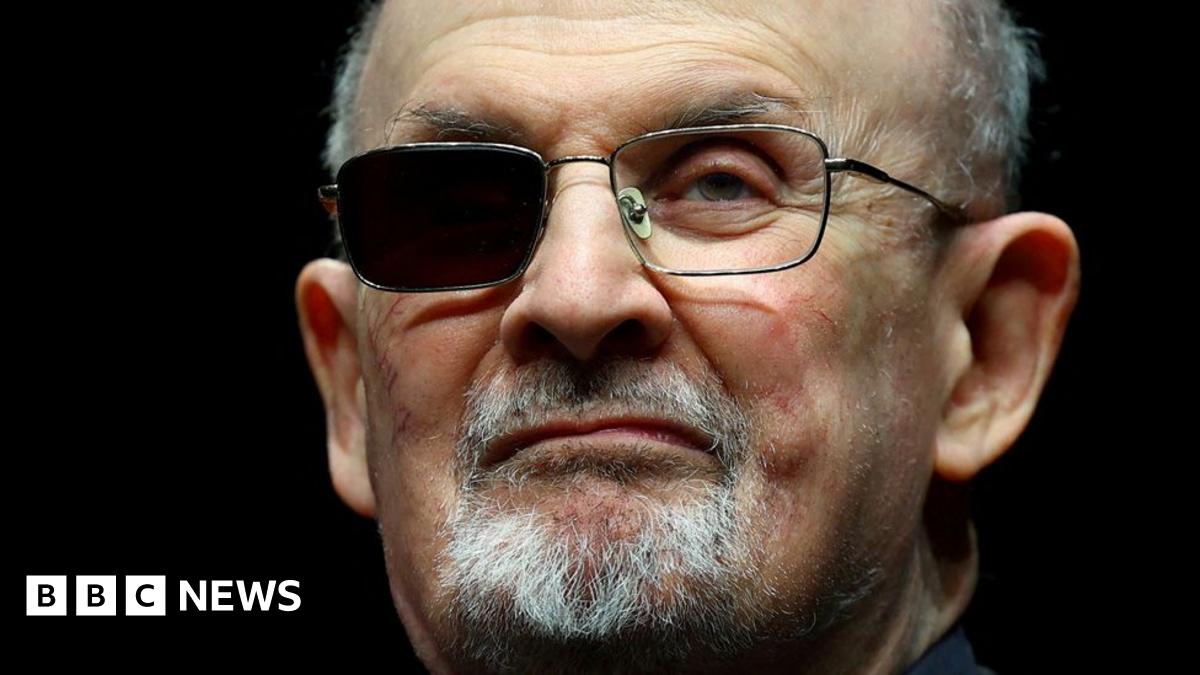

Rushdie Pleased With Maximum Sentence For His Attacker

May 27, 2025

Rushdie Pleased With Maximum Sentence For His Attacker

May 27, 2025 -

Sirius Xm Holdings Stock Should You Invest Or Walk Away

May 27, 2025

Sirius Xm Holdings Stock Should You Invest Or Walk Away

May 27, 2025 -

Social Security Benefit Increase Maximum Payments Of 5 108 Issued

May 27, 2025

Social Security Benefit Increase Maximum Payments Of 5 108 Issued

May 27, 2025 -

Top 5 I Os 18 5 Features And 3 Bonus Discoveries

May 27, 2025

Top 5 I Os 18 5 Features And 3 Bonus Discoveries

May 27, 2025

Latest Posts

-

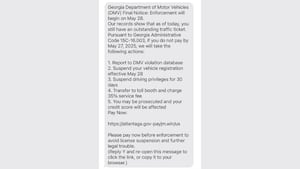

Beware Georgia Dmv Text Scam Targeting Drivers

May 28, 2025

Beware Georgia Dmv Text Scam Targeting Drivers

May 28, 2025 -

Major Blast Rocks Chinese Chemical Plant Authorities Battle To Contain Aftermath

May 28, 2025

Major Blast Rocks Chinese Chemical Plant Authorities Battle To Contain Aftermath

May 28, 2025 -

Chinese Chemical Plant Explosion Rescue Operation Underway After Major Blast

May 28, 2025

Chinese Chemical Plant Explosion Rescue Operation Underway After Major Blast

May 28, 2025 -

Protect Yourself How To Spot And Avoid The Georgia Dmv Imposter Scam

May 28, 2025

Protect Yourself How To Spot And Avoid The Georgia Dmv Imposter Scam

May 28, 2025 -

Us Backed Gaza Aid Group Begins Distribution A New Chapter In Relief Efforts

May 28, 2025

Us Backed Gaza Aid Group Begins Distribution A New Chapter In Relief Efforts

May 28, 2025