Should You Invest In SiriusXM Holdings? A Thorough Examination

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Invest in SiriusXM Holdings? A Thorough Examination

SiriusXM Holdings Inc. (SIRI) has carved a significant niche in the satellite radio market, but is it a worthwhile investment for your portfolio? This in-depth analysis explores the company's strengths, weaknesses, opportunities, and threats (SWOT analysis) to help you decide. The stock market is volatile, and understanding the nuances of SiriusXM is crucial before committing your capital.

SiriusXM's Strengths: A Dominant Market Position

SiriusXM boasts a dominant position in the satellite radio market, enjoying a near-monopoly in the US. This provides a stable revenue stream and considerable pricing power. Their extensive content library, including exclusive sports programming, Howard Stern's show, and a wide range of music channels, attracts a loyal subscriber base. This strong brand recognition and customer loyalty are key factors contributing to their consistent performance.

Weaknesses: Dependence on the Automotive Sector and Subscription Model

A significant weakness for SiriusXM is its heavy reliance on the automotive industry. Vehicle sales directly impact new subscriber acquisitions. Furthermore, their subscription-based model makes them vulnerable to churn – subscribers canceling their service. Competition from streaming services offering similar content also presents a challenge. The company needs to diversify its revenue streams to mitigate these risks.

Opportunities: Expanding into New Markets and Technologies

SiriusXM has several opportunities for growth. Expanding into international markets and exploring partnerships with emerging technologies like connected cars and autonomous driving systems could significantly boost revenue. Developing innovative content and features to retain existing subscribers and attract new ones is also crucial for long-term success. The potential for integrating podcasts and other digital audio content into their platform is a significant area of opportunity.

Threats: Increasing Competition from Streaming Services and Technological Advancements

The rise of streaming services like Spotify and Apple Music poses a considerable threat. These platforms offer vast music libraries and podcasts at competitive prices, potentially drawing subscribers away from satellite radio. Technological advancements, such as better in-car entertainment systems offering diverse streaming options, also present a long-term challenge.

Financial Performance and Valuation:

Analyzing SiriusXM's recent financial statements is crucial. Look for trends in revenue growth, subscriber numbers, and profitability. Compare the company's valuation metrics, such as Price-to-Earnings (P/E) ratio, to its competitors and industry averages. Remember to consult financial news websites like and for up-to-date data.

Should You Invest? A Balanced Perspective

Investing in SiriusXM involves weighing the potential rewards against the risks. While the company enjoys a strong market position and loyal subscribers, its reliance on the automotive industry and the competitive landscape present challenges. Conduct thorough due diligence, including a comprehensive SWOT analysis, before making any investment decisions.

Before investing, consider:

- Your risk tolerance: SiriusXM's stock price can fluctuate significantly.

- Your investment timeline: Long-term investors may be better positioned to weather market volatility.

- Diversification: Don't put all your eggs in one basket. Diversify your investments across various asset classes.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making any investment decisions. Market conditions change rapidly, and this information may not be current.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Invest In SiriusXM Holdings? A Thorough Examination. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

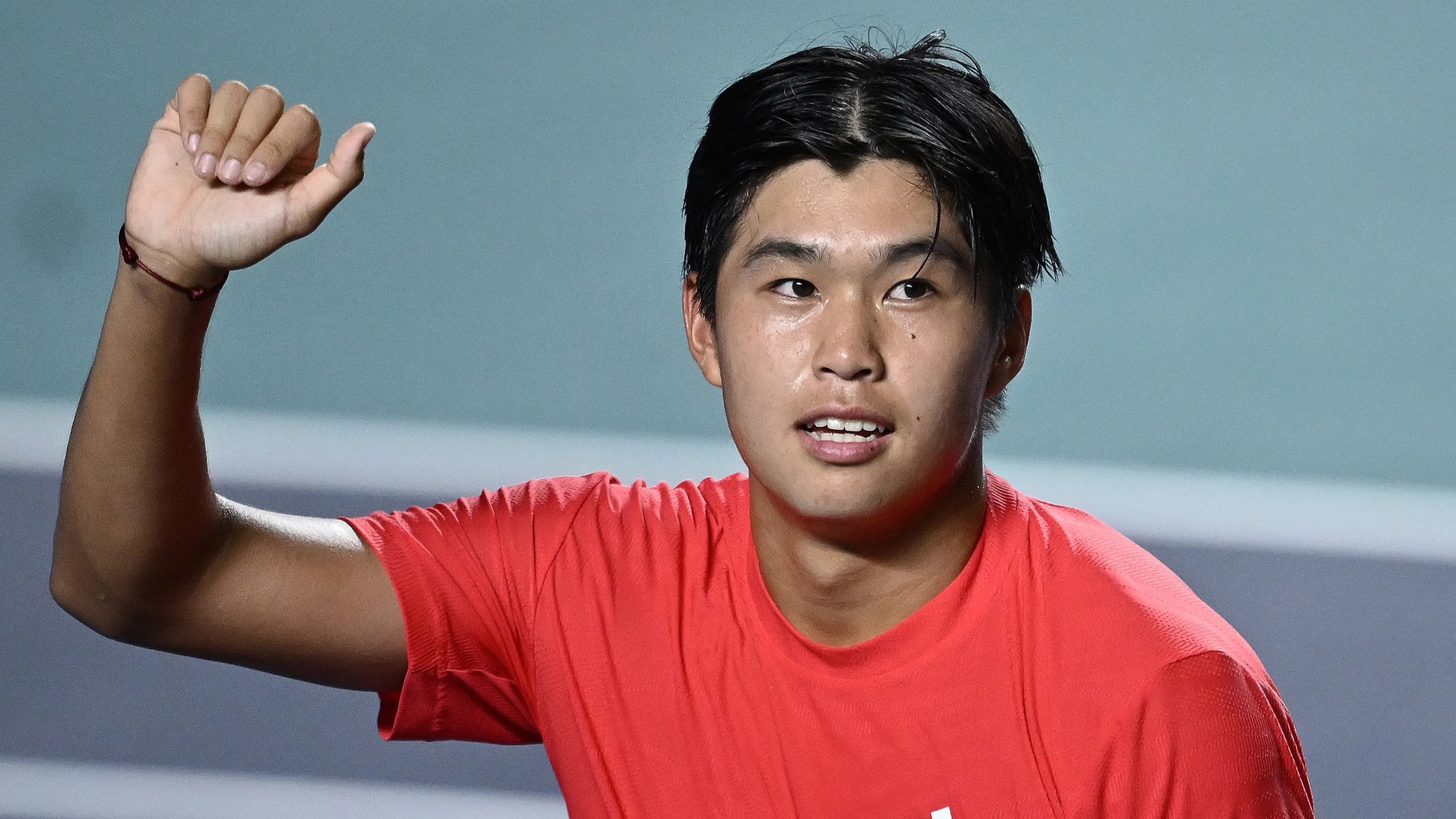

Unique Name Unstoppable Drive Us Tennis Player Takes On World No 3

May 28, 2025

Unique Name Unstoppable Drive Us Tennis Player Takes On World No 3

May 28, 2025 -

Police Doubts Revealed Leaked Recording Exposes Concerns In Abortion Arrest Case

May 28, 2025

Police Doubts Revealed Leaked Recording Exposes Concerns In Abortion Arrest Case

May 28, 2025 -

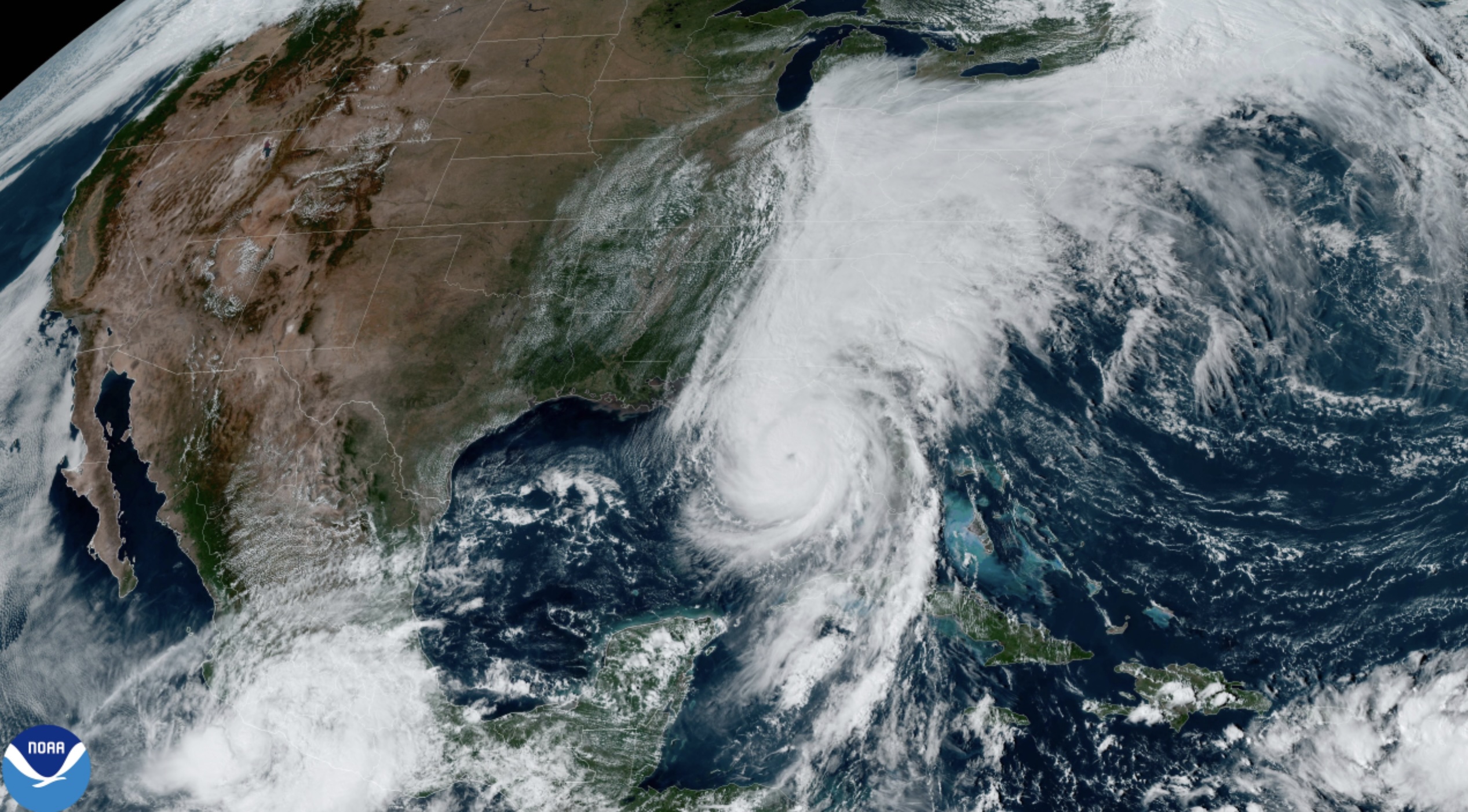

Increased Hurricane Risk Above Normal Conditions Forecast For Us

May 28, 2025

Increased Hurricane Risk Above Normal Conditions Forecast For Us

May 28, 2025 -

The Truth Behind Trumps Angry Harvard Tirade A Maga Scandal

May 28, 2025

The Truth Behind Trumps Angry Harvard Tirade A Maga Scandal

May 28, 2025 -

Brunei Sultans Fatigue Hospital Stay In Kl Confirmed By Malaysian Officials

May 28, 2025

Brunei Sultans Fatigue Hospital Stay In Kl Confirmed By Malaysian Officials

May 28, 2025

Latest Posts

-

Social Media Vetting Intensifies Us Freezes New Student Visa Appointments

May 29, 2025

Social Media Vetting Intensifies Us Freezes New Student Visa Appointments

May 29, 2025 -

Roland Garros 2025 Sinner Pegula Djokovic Day 5 Action Live Updates

May 29, 2025

Roland Garros 2025 Sinner Pegula Djokovic Day 5 Action Live Updates

May 29, 2025 -

Former Arkansas Police Chief Found Guilty The Crucial Evidence And A Questionable Warrant

May 29, 2025

Former Arkansas Police Chief Found Guilty The Crucial Evidence And A Questionable Warrant

May 29, 2025 -

Grand Slam A Incrivel Jornada De Henrique Rocha Em Paris

May 29, 2025

Grand Slam A Incrivel Jornada De Henrique Rocha Em Paris

May 29, 2025 -

First Odi Live England Takes On West Indies In Crucial Cricket Match

May 29, 2025

First Odi Live England Takes On West Indies In Crucial Cricket Match

May 29, 2025