Should You Invest In SiriusXM Holdings? Analyzing The Risks And Rewards

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Invest in SiriusXM Holdings? Analyzing the Risks and Rewards

SiriusXM Holdings (SIRI) has carved a niche for itself in the satellite radio market, boasting millions of subscribers. But is this established player a sound investment for your portfolio? This in-depth analysis explores the potential rewards and inherent risks associated with investing in SiriusXM Holdings, helping you make an informed decision.

The Allure of SiriusXM: Understanding the Potential Rewards

SiriusXM's dominance in satellite radio provides a strong foundation for potential growth. Their subscriber base, characterized by high customer loyalty and relatively low churn, generates consistent revenue streams. This predictable revenue stream is a key attraction for investors seeking stability. Furthermore, SiriusXM's strategic expansion into various audio entertainment avenues, including podcasts and Pandora, diversifies its revenue streams and lessens reliance on its core satellite radio service. This diversification strategy aims to attract a broader audience and cater to evolving consumer preferences in the audio entertainment landscape.

- Strong Subscriber Base: A substantial and loyal subscriber base forms the bedrock of SiriusXM's financial strength. This translates to predictable cash flow, appealing to investors seeking stability.

- Content Diversification: The company's strategic moves into podcasts and online streaming through Pandora offer avenues for growth beyond traditional satellite radio.

- Potential for Growth in Emerging Markets: While currently dominant in North America, SiriusXM has the potential to expand into new international markets, opening up further growth opportunities.

Navigating the Risks: Potential Downsides to Consider

Despite its strengths, investing in SiriusXM comes with inherent risks. The competitive landscape is ever-evolving, with streaming services like Spotify and Apple Music offering strong alternatives. Furthermore, technological advancements and changing consumer preferences pose ongoing challenges.

- Intense Competition: The audio entertainment market is fiercely competitive. Streaming giants like Spotify and Apple Music represent significant challenges to SiriusXM's market share.

- Technological Disruption: The shift towards streaming services and the increasing popularity of podcasts pose a potential threat to the traditional satellite radio model.

- Economic Sensitivity: As a discretionary spending item, SiriusXM subscriptions can be susceptible to economic downturns, potentially affecting subscriber numbers and revenue.

Financial Performance: A Look at the Numbers

Analyzing SiriusXM's recent financial reports is crucial for evaluating its investment potential. Investors should examine key performance indicators like revenue growth, subscriber acquisition costs, and profitability margins. Comparing these figures to industry benchmarks and competitor performance provides valuable context. Access to reliable financial data through reputable sources like the company's investor relations website and financial news outlets is essential for informed decision-making. Understanding the company's debt levels and its ability to manage its finances is also critical.

Making the Investment Decision: Weighing the Pros and Cons

The decision of whether to invest in SiriusXM Holdings ultimately depends on your individual risk tolerance, investment goals, and overall portfolio diversification strategy. If you are seeking a relatively stable investment with potential for moderate growth and are comfortable with the inherent risks associated with the audio entertainment industry, SiriusXM might be worth considering. However, if you prefer investments with higher growth potential or are risk-averse, you might want to explore alternative options.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves inherent risks, and you should conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Call to Action: Want to stay updated on the latest developments in the audio entertainment industry and investment market? Subscribe to our newsletter for regular insights and analysis. [Link to Newsletter Signup]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Invest In SiriusXM Holdings? Analyzing The Risks And Rewards. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Heightened Tensions In Jerusalem Israeli March Sparks Clashes

May 28, 2025

Heightened Tensions In Jerusalem Israeli March Sparks Clashes

May 28, 2025 -

Sirius Xm A Millionaire Maker Stock Examining The Investment

May 28, 2025

Sirius Xm A Millionaire Maker Stock Examining The Investment

May 28, 2025 -

Harvards Shortcomings And The Choice Between It And Trumps Presidency

May 28, 2025

Harvards Shortcomings And The Choice Between It And Trumps Presidency

May 28, 2025 -

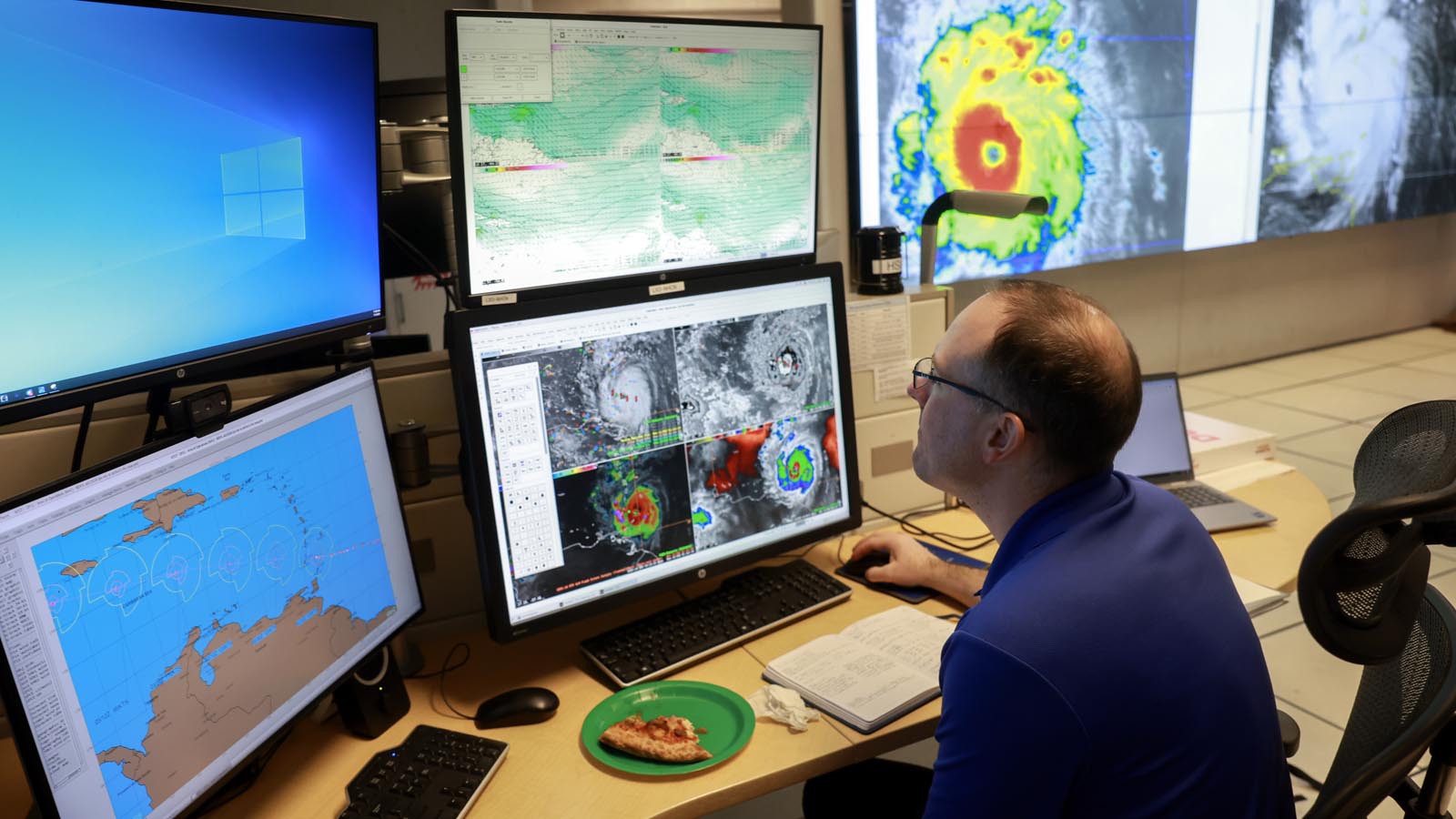

Understanding Hurricane Model Accuracy Your 2025 Forecasting Resource

May 28, 2025

Understanding Hurricane Model Accuracy Your 2025 Forecasting Resource

May 28, 2025 -

Pdd Holdings To Report Q1 2025 Financial Results What Investors Should Watch For

May 28, 2025

Pdd Holdings To Report Q1 2025 Financial Results What Investors Should Watch For

May 28, 2025

Latest Posts

-

Community Rallies To Find Missing Teen Reward Increased

May 30, 2025

Community Rallies To Find Missing Teen Reward Increased

May 30, 2025 -

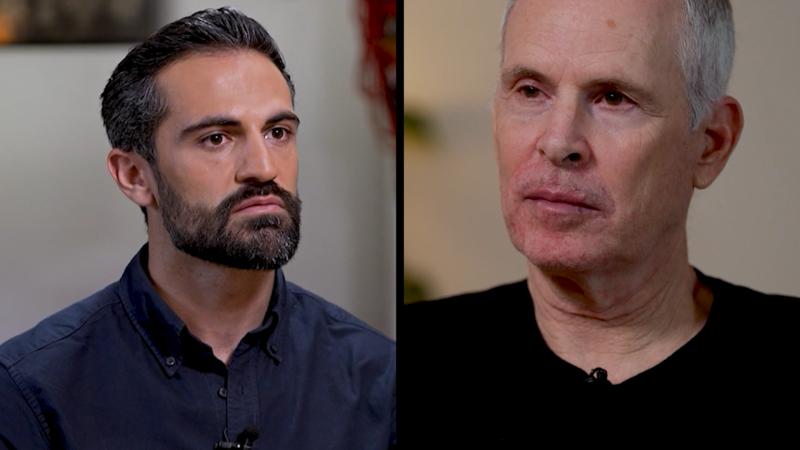

Israeli Hostage Details Gruesome Hamas Torture Cnn Interview

May 30, 2025

Israeli Hostage Details Gruesome Hamas Torture Cnn Interview

May 30, 2025 -

2025 Cif State Track And Field Championships A Key Statement

May 30, 2025

2025 Cif State Track And Field Championships A Key Statement

May 30, 2025 -

Real Estate Report Surge In Home Sellers Creates 12 Year Imbalance

May 30, 2025

Real Estate Report Surge In Home Sellers Creates 12 Year Imbalance

May 30, 2025 -

Israels West Bank Settlement Expansion Implications And Reactions

May 30, 2025

Israels West Bank Settlement Expansion Implications And Reactions

May 30, 2025