Should You Invest In SiriusXM Holdings? Examining Its Track Record Of Wealth Creation

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Invest in SiriusXM Holdings? Examining its Track Record of Wealth Creation

SiriusXM Holdings Inc. (SIRI) has carved a niche for itself in the entertainment industry, offering satellite radio and streaming services. But is it a worthwhile investment for your portfolio? This in-depth analysis examines SiriusXM's track record, exploring its strengths, weaknesses, and future prospects to help you decide if it's the right stock for you.

A Look Back: SiriusXM's Journey and Historical Performance

SiriusXM's history is a rollercoaster. Born from the merger of Sirius and XM Satellite Radio in 2008, the company initially struggled with debt and competition. However, it strategically navigated the shift towards digital streaming, broadening its reach beyond traditional satellite radio. This adaptation has been a crucial factor in its recent success, although past performance is not indicative of future results. Investors should always conduct thorough due diligence.

Analyzing historical stock performance reveals periods of significant growth punctuated by dips. Understanding these fluctuations requires considering external factors like economic downturns and changes in consumer preferences. For example, the rise of podcasting and other audio streaming services presents both a challenge and an opportunity for SiriusXM to adapt and innovate. Examining historical charts and financial reports – readily available through resources like Yahoo Finance and Google Finance – is crucial for informed decision-making.

Strengths of Investing in SiriusXM:

- Dominant Market Share: SiriusXM holds a significant market share in the satellite radio sector, providing a substantial revenue base. This market dominance offers a degree of stability compared to newer, less established players.

- Subscription-Based Model: The subscription-based revenue model provides predictable income streams, reducing reliance on volatile advertising revenue. This predictable income flow is attractive to many investors seeking stability.

- Content Diversification: Beyond its core satellite radio offering, SiriusXM continues to diversify its content portfolio, expanding into podcasts and other digital audio formats. This diversification strategy mitigates risk and taps into growing market segments.

- Strategic Partnerships: Strategic alliances and acquisitions enhance SiriusXM's content library and reach, reinforcing its market position and driving future growth.

Weaknesses and Potential Risks:

- Competition: The rise of streaming services like Spotify and Apple Music, coupled with the increasing popularity of podcasts, presents stiff competition. SiriusXM must continuously innovate to maintain its competitive edge.

- Debt Burden: While SiriusXM has reduced its debt, it still carries a significant debt load, which could impact profitability and financial flexibility.

- Economic Sensitivity: Consumer discretionary spending, which includes entertainment subscriptions, is often affected by economic fluctuations. Recessions or economic downturns could impact subscription rates.

- Regulatory Landscape: The regulatory environment for broadcasting and telecommunications can be complex and subject to change, presenting potential challenges for SiriusXM.

Is SiriusXM a Good Investment for You?

The decision of whether or not to invest in SiriusXM Holdings is a personal one, heavily dependent on your individual risk tolerance, investment goals, and overall portfolio strategy. While SiriusXM's market dominance and subscription model offer a degree of stability, the competitive landscape and debt burden present significant challenges.

Before investing, consider:

- Your risk tolerance: Are you comfortable with the potential volatility of the stock market?

- Your investment timeline: How long do you plan to hold the investment? Long-term investors might be better positioned to weather market fluctuations.

- Diversification: Remember to diversify your investments to mitigate risk. Don't put all your eggs in one basket.

Conduct thorough research, consult with a financial advisor, and carefully consider the information presented above before making any investment decisions. Remember that past performance is not indicative of future results. Investing in the stock market always carries inherent risk.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Invest In SiriusXM Holdings? Examining Its Track Record Of Wealth Creation. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Analysis Jeanine Pirros Statement On Israeli Embassy Deaths

May 27, 2025

Analysis Jeanine Pirros Statement On Israeli Embassy Deaths

May 27, 2025 -

Rising Temperatures Rising Risk The Danger Of Invasive Fungal Infections

May 27, 2025

Rising Temperatures Rising Risk The Danger Of Invasive Fungal Infections

May 27, 2025 -

Official June 2025 Social Security Payment Calendar For The U S

May 27, 2025

Official June 2025 Social Security Payment Calendar For The U S

May 27, 2025 -

Nadals Last Roland Garros A Heartfelt Farewell At The French Open

May 27, 2025

Nadals Last Roland Garros A Heartfelt Farewell At The French Open

May 27, 2025 -

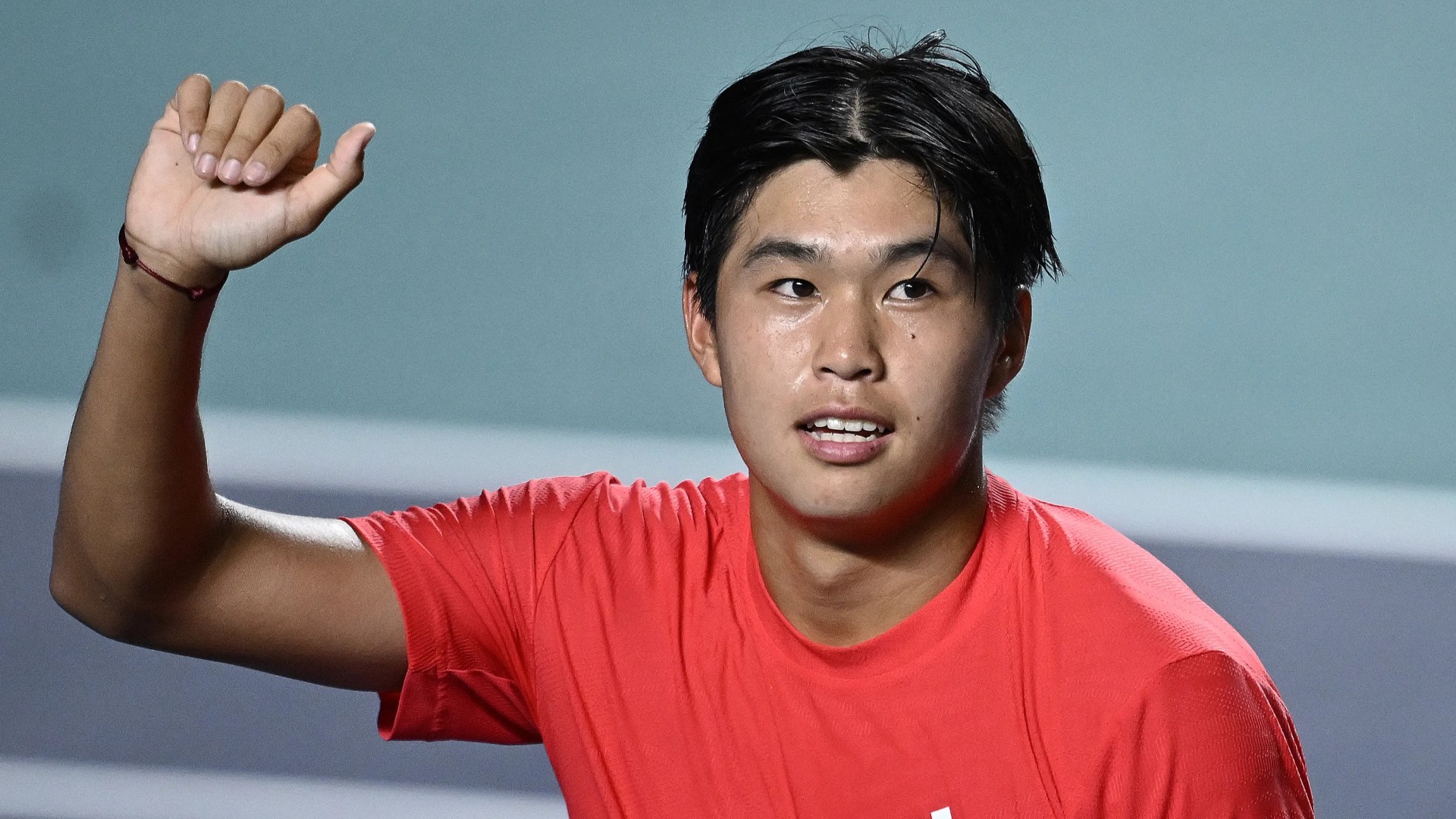

Facing The World No 3 The Story Of A Us Tennis Prodigy Named After Moms Career

May 27, 2025

Facing The World No 3 The Story Of A Us Tennis Prodigy Named After Moms Career

May 27, 2025

Latest Posts

-

French Media Censorship Macrons Marital Ad Disappears

May 30, 2025

French Media Censorship Macrons Marital Ad Disappears

May 30, 2025 -

Musician Rick Derringer Dead At 77 His Collaborations And Impact

May 30, 2025

Musician Rick Derringer Dead At 77 His Collaborations And Impact

May 30, 2025 -

High Profile Jailbreaks Fuel Renewed Debate On Us Prison Security

May 30, 2025

High Profile Jailbreaks Fuel Renewed Debate On Us Prison Security

May 30, 2025 -

Tesco Shoppers Mock Self Checkout Surveillance

May 30, 2025

Tesco Shoppers Mock Self Checkout Surveillance

May 30, 2025 -

In Memoriam George Strait Remembers His Hero Victim Of North Texas House Fire

May 30, 2025

In Memoriam George Strait Remembers His Hero Victim Of North Texas House Fire

May 30, 2025