Significant 401(k) Changes On The Horizon: Are You Prepared?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Significant 401(k) Changes on the Horizon: Are You Prepared?

Retirement planning just got more complex. The landscape of 401(k) plans is shifting, bringing both challenges and opportunities for millions of Americans. Proposed changes and evolving regulations mean it's more crucial than ever to understand how these shifts will impact your retirement savings. Are you ready?

The current 401(k) system, while offering tax advantages and employer matching contributions, isn't without its flaws. High fees, limited investment options, and a lack of financial literacy among participants have led to calls for significant reform. These upcoming changes aim to address some of these long-standing issues, but understanding their implications is vital for securing your financial future.

H2: Key Changes to Watch Out For:

Several significant changes are bubbling to the surface, impacting how you contribute, invest, and ultimately withdraw from your 401(k). Here are some key areas to focus on:

-

Increased Transparency and Fee Disclosure: Expect stricter regulations regarding the disclosure of fees associated with your 401(k) plan. This means clearer explanations of all costs, making it easier to compare plans and choose the most cost-effective option. This increased transparency is a positive step towards empowering participants to make informed decisions.

-

Potential for Default Investments: There's growing discussion around automatic enrollment in target-date funds (TDFs) or other low-cost, diversified investment options. While this simplifies the decision-making process for new participants, understanding the underlying investment strategy of your default fund is critical. Consult with a financial advisor if you have any doubts.

-

Improved Access to Financial Advice: More employers may offer access to financial advisors or online resources to help employees navigate their 401(k) investments. This could lead to better investment strategies and improved retirement outcomes. However, it's crucial to carefully evaluate the qualifications and potential conflicts of interest of any advisor your employer recommends.

-

Changes to Withdrawal Rules: While unlikely to be drastically altered, minor tweaks to withdrawal rules are possible. Staying informed about any changes concerning early withdrawals and penalties is crucial.

H2: How to Prepare for the Upcoming Changes:

The evolving 401(k) landscape requires proactive engagement. Here are some steps you can take to prepare:

-

Review your current 401(k) plan: Understand your investment choices, fees, and contribution limits. Look for hidden fees and compare your plan's performance to similar plans.

-

Diversify your portfolio: Don't put all your eggs in one basket. A well-diversified portfolio minimizes risk and maximizes potential returns. Consider consulting a financial advisor for personalized advice. [Link to a reputable financial planning resource].

-

Increase your contributions: Even small increases in your contributions can significantly impact your retirement savings over time. Take advantage of employer matching contributions whenever possible.

-

Stay informed: Keep abreast of legislative changes and updates to your 401(k) plan. Regularly review your account statements and seek professional advice when needed.

H3: Don't Get Caught Off Guard:

The upcoming changes to 401(k) plans represent both opportunities and challenges. By staying informed, taking proactive steps, and seeking professional advice when needed, you can navigate these changes successfully and secure a comfortable retirement. Don't wait until it's too late – start planning your financial future today.

Call to Action: Share this article with your friends and family to help them prepare for the upcoming changes to 401(k) plans. Let's work together to ensure a secure retirement for everyone.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Significant 401(k) Changes On The Horizon: Are You Prepared?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Chat Gpts Advancements A Significant Leap Forward In Artificial Intelligence

Aug 09, 2025

Chat Gpts Advancements A Significant Leap Forward In Artificial Intelligence

Aug 09, 2025 -

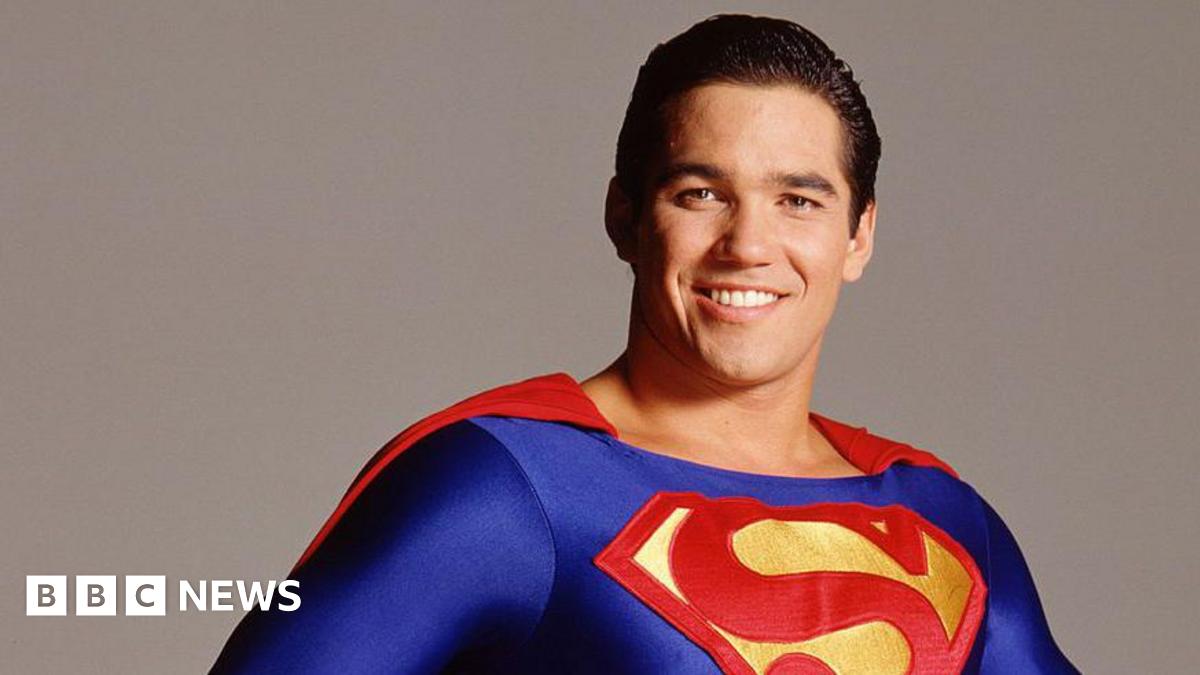

Former Superman Actor Dean Cain Embraces Law Enforcement Career With Ice

Aug 09, 2025

Former Superman Actor Dean Cain Embraces Law Enforcement Career With Ice

Aug 09, 2025 -

Britains Cross Fit Champion Nick Balls Training And Lifestyle

Aug 09, 2025

Britains Cross Fit Champion Nick Balls Training And Lifestyle

Aug 09, 2025 -

Predicting The 2025 Nfl Preseason Trade Market One Key Player Per Team

Aug 09, 2025

Predicting The 2025 Nfl Preseason Trade Market One Key Player Per Team

Aug 09, 2025 -

Tennessee Familys Murder Prosecutors Eye Death Penalty For Killers

Aug 09, 2025

Tennessee Familys Murder Prosecutors Eye Death Penalty For Killers

Aug 09, 2025

Latest Posts

-

Cnns Journey Into Ecuadorian Gang Territory An Interview With A Key Figure

Aug 09, 2025

Cnns Journey Into Ecuadorian Gang Territory An Interview With A Key Figure

Aug 09, 2025 -

Trendyol Sueper Lig De Heyecan Yeniden Basliyor Sezonun Ilk Maci

Aug 09, 2025

Trendyol Sueper Lig De Heyecan Yeniden Basliyor Sezonun Ilk Maci

Aug 09, 2025 -

Two Arrested Following Antisemitic Attack On Orthodox Jews

Aug 09, 2025

Two Arrested Following Antisemitic Attack On Orthodox Jews

Aug 09, 2025 -

Ennis Rakestraw Speaks Out Against Online Harassment Following Abusive Dms

Aug 09, 2025

Ennis Rakestraw Speaks Out Against Online Harassment Following Abusive Dms

Aug 09, 2025 -

2025 Nfl Preseason One Trade Candidate For Every Team

Aug 09, 2025

2025 Nfl Preseason One Trade Candidate For Every Team

Aug 09, 2025