Significant Amazon Gains (560%): My Long-Term Investment Strategy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Significant Amazon Gains (560%): My Long-Term Investment Strategy

Amazon's meteoric rise: For long-term investors, witnessing a 560% return on an investment is a dream. But for many who held Amazon (AMZN) stock over the years, it's a reality. This article details the strategies behind such significant gains and explores the principles of successful long-term investing. It's not about getting rich quick, but about strategic planning and patience.

The Power of Long-Term Investing: The 560% growth in Amazon stock highlights the immense potential of long-term investing. This isn't just about picking the "next big thing"; it's about identifying companies with strong fundamentals, a clear vision, and the potential for sustained growth. While short-term trading can be lucrative, it’s significantly riskier. Long-term investing allows you to weather market fluctuations and benefit from the compounding effect of returns over time.

My Amazon Investment Strategy: My personal journey with Amazon shares wasn't based on a gut feeling or a hot tip. It was a calculated decision informed by several key factors:

-

Fundamental Analysis: I thoroughly researched Amazon's financial statements, assessing its revenue growth, profitability, and market position. The company's expansion into various sectors, from e-commerce to cloud computing (AWS), indicated a robust and diversified business model. Understanding key financial metrics like the price-to-earnings ratio (P/E ratio) and revenue growth is crucial.

-

Competitive Advantage: Amazon's powerful network effect, its vast logistics network, and its relentless focus on customer experience solidified its dominance in the e-commerce landscape. Identifying companies with a significant competitive advantage is key to successful long-term investing.

-

Long-Term Vision: I recognized Amazon's ambitious long-term vision and its ability to adapt to changing market conditions. This adaptability, combined with consistent innovation, is a hallmark of successful companies. Look for companies with a clear roadmap for future growth.

-

Diversification: While Amazon formed a significant part of my portfolio, I didn't put all my eggs in one basket. Diversification across different asset classes and sectors helps mitigate risk. Learn more about .

-

Emotional Discipline: The key to riding out market volatility is emotional discipline. Resisting the urge to panic-sell during market downturns is crucial for long-term success. Investing is a marathon, not a sprint.

Beyond Amazon: Applying the Strategy: The principles applied to my Amazon investment can be adapted to other promising companies. Look for companies with:

- Strong leadership: A visionary CEO and a capable management team are vital for a company's long-term success.

- Innovative products or services: Companies that consistently innovate and adapt to changing market demands are more likely to thrive.

- Scalable business models: Companies with business models that can scale efficiently have a greater potential for growth.

Conclusion: My 560% gain from Amazon is a testament to the power of long-term investing. It's not about luck; it's about careful research, strategic planning, and emotional discipline. Remember to always conduct thorough due diligence before making any investment decisions and consider consulting a financial advisor. This article provides insights into a successful long-term investment strategy, but individual results may vary. Start building your own wealth today by focusing on long-term growth and sustainable investments. What are your thoughts on long-term investing? Share your experiences in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Significant Amazon Gains (560%): My Long-Term Investment Strategy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

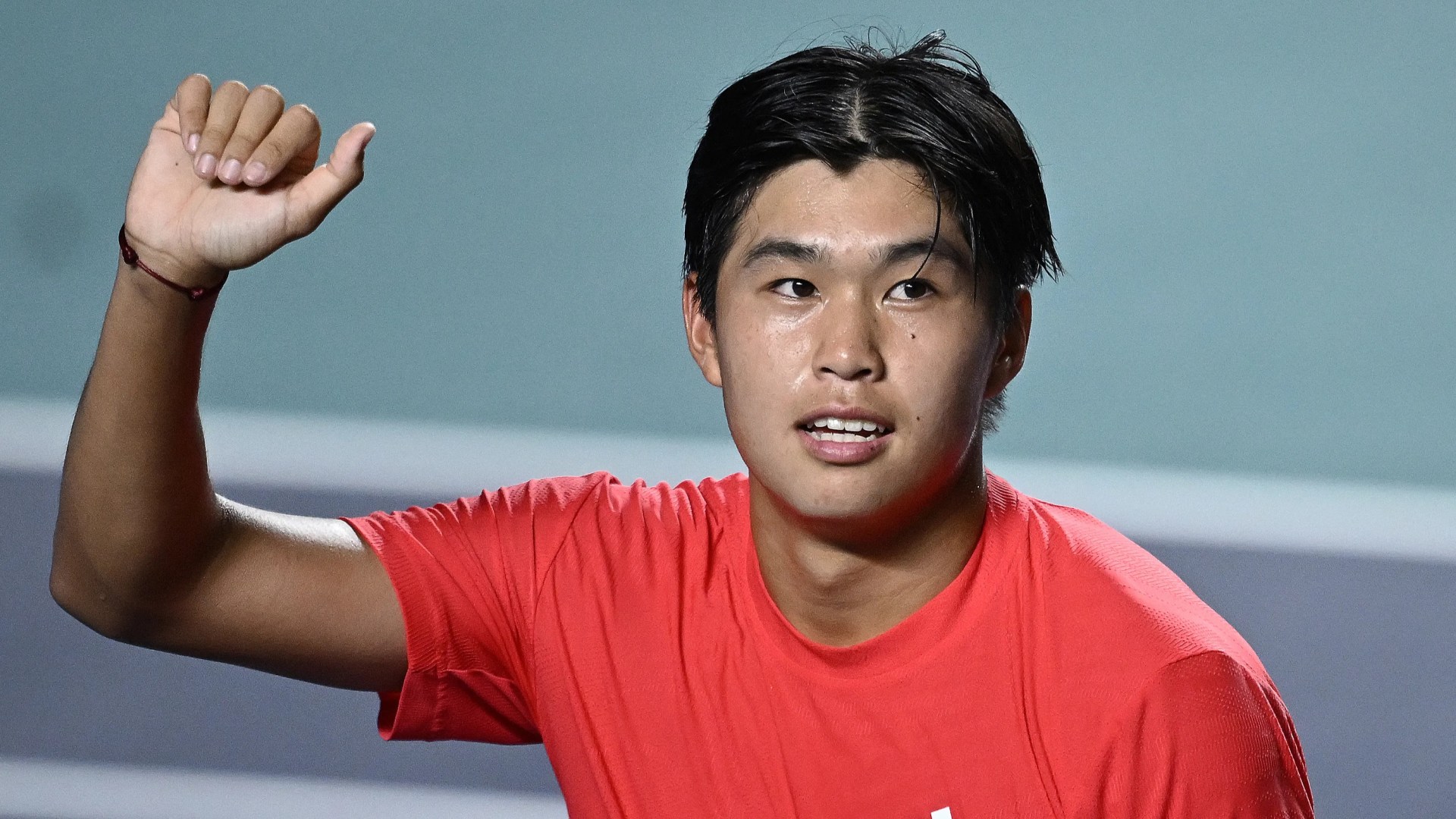

Us Tennis Prodigy Named For Moms Occupation Challenges Top 3 Player

May 28, 2025

Us Tennis Prodigy Named For Moms Occupation Challenges Top 3 Player

May 28, 2025 -

Liverpool Fc Parade Key Facts And Ongoing Investigations

May 28, 2025

Liverpool Fc Parade Key Facts And Ongoing Investigations

May 28, 2025 -

Liverpool Fc Celebrations Understanding The Parade Incident

May 28, 2025

Liverpool Fc Celebrations Understanding The Parade Incident

May 28, 2025 -

Coal Miners At Risk Federal Cuts Hamper Black Lung Prevention Program

May 28, 2025

Coal Miners At Risk Federal Cuts Hamper Black Lung Prevention Program

May 28, 2025 -

Marine Mammal Death Minke Whale Found On Portstewart Strand

May 28, 2025

Marine Mammal Death Minke Whale Found On Portstewart Strand

May 28, 2025

Latest Posts

-

Urgent Appeal Following Severe Dog Attack In Greater Manchester Baby Among Victims

Jun 01, 2025

Urgent Appeal Following Severe Dog Attack In Greater Manchester Baby Among Victims

Jun 01, 2025 -

The Harassment Of A Transgender Athlete A Reflection On Sports And Humanity

Jun 01, 2025

The Harassment Of A Transgender Athlete A Reflection On Sports And Humanity

Jun 01, 2025 -

St Johns County Residents React To Possible Tornado Caught On Traffic Camera

Jun 01, 2025

St Johns County Residents React To Possible Tornado Caught On Traffic Camera

Jun 01, 2025 -

How The Landscape Of Northern Arkansas Aids In Evasion

Jun 01, 2025

How The Landscape Of Northern Arkansas Aids In Evasion

Jun 01, 2025 -

Court Appearance For Liverpool Car Crash Suspect City Reeling

Jun 01, 2025

Court Appearance For Liverpool Car Crash Suspect City Reeling

Jun 01, 2025