Significant Amazon Gains (560%): My Rationale For Continued Investment

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Significant Amazon Gains (560%): My Rationale for Continued Investment

Amazon. The name conjures images of lightning-fast deliveries, a seemingly endless selection of products, and a technological juggernaut reshaping retail and beyond. For many investors, it's also synonymous with significant returns. My personal portfolio has seen a staggering 560% gain from my initial Amazon investment, and I believe the growth story is far from over. This article outlines my rationale for continued investment in this tech titan.

Why 560%? A Deep Dive into Amazon's Success

My substantial returns aren't solely due to luck. Amazon's consistent growth across multiple sectors has fueled this impressive increase. This isn't just about online retail; it's about a diversified portfolio that includes:

-

E-commerce Dominance: Amazon remains the undisputed king of online retail, consistently expanding its market share globally. Their logistics network, unparalleled customer service, and Prime membership program are key differentiators.

-

AWS: The Cloud Computing Colossus: Amazon Web Services (AWS) is a powerhouse, powering countless businesses and applications worldwide. Its consistent revenue growth and market leadership position AWS as a significant driver of Amazon's overall profitability. Learn more about AWS's market share .

-

Advertising Powerhouse: Amazon's advertising platform is rapidly becoming a major competitor to Google and Facebook, leveraging its massive user base and detailed consumer data to deliver highly targeted ads.

-

Expanding into New Markets: From grocery (Whole Foods Market) to healthcare (Amazon Pharmacy), Amazon continues to aggressively expand into new and lucrative markets, demonstrating its ambition and adaptability.

-

Technological Innovation: Constant innovation is baked into Amazon's DNA. From drone delivery initiatives to advancements in artificial intelligence, Amazon is consistently pushing the boundaries of what's possible.

Addressing Potential Risks: A Balanced Perspective

While the outlook is positive, it's crucial to acknowledge potential risks. Increased competition, regulatory scrutiny, and economic downturns could all impact Amazon's performance. However, I believe that Amazon's diversification, strong brand recognition, and consistent innovation mitigate these risks significantly.

My Investment Strategy: Long-Term Vision

My continued investment in Amazon is rooted in a long-term perspective. I'm not focused on short-term market fluctuations; rather, I'm betting on Amazon's continued growth and dominance across multiple sectors. This strategy involves:

-

Dollar-Cost Averaging (DCA): This approach involves investing a fixed amount of money at regular intervals, mitigating the risk associated with market volatility.

-

Diversification: While a significant portion of my portfolio is allocated to Amazon, I maintain a diversified portfolio across various asset classes to minimize risk.

-

Regular Portfolio Review: I consistently review my investment strategy and make adjustments as needed based on market conditions and Amazon's performance.

Conclusion: A Strong Buy for the Long Term?

Based on Amazon's consistent growth, diversification, and innovative spirit, I believe it remains a compelling investment for the long term. While no investment is without risk, the potential for substantial returns, fueled by its expanding business model, makes Amazon a strong contender in my portfolio. However, remember to conduct thorough research and consider your individual risk tolerance before making any investment decisions. This article reflects my personal opinion and should not be considered financial advice. Consult a qualified financial advisor for personalized guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Significant Amazon Gains (560%): My Rationale For Continued Investment. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Health Update Bruneis Sultan Undergoes Treatment For Fatigue In Kl

May 27, 2025

Health Update Bruneis Sultan Undergoes Treatment For Fatigue In Kl

May 27, 2025 -

Amazon Investment 560 Profit And My Decision To Hold

May 27, 2025

Amazon Investment 560 Profit And My Decision To Hold

May 27, 2025 -

Jeanine Pirros Statement On Israeli Embassy Murders

May 27, 2025

Jeanine Pirros Statement On Israeli Embassy Murders

May 27, 2025 -

Sirius Xm Holdings Stock A Millionaire Maker Analyzing The Risks And Rewards

May 27, 2025

Sirius Xm Holdings Stock A Millionaire Maker Analyzing The Risks And Rewards

May 27, 2025 -

Brunei Sultan Hospitalized In Kuala Lumpur Fatigue Cited As Reason

May 27, 2025

Brunei Sultan Hospitalized In Kuala Lumpur Fatigue Cited As Reason

May 27, 2025

Latest Posts

-

Understanding Billy Joels Neurological Disorder Expert Insights From Dr Sanjay Gupta

May 31, 2025

Understanding Billy Joels Neurological Disorder Expert Insights From Dr Sanjay Gupta

May 31, 2025 -

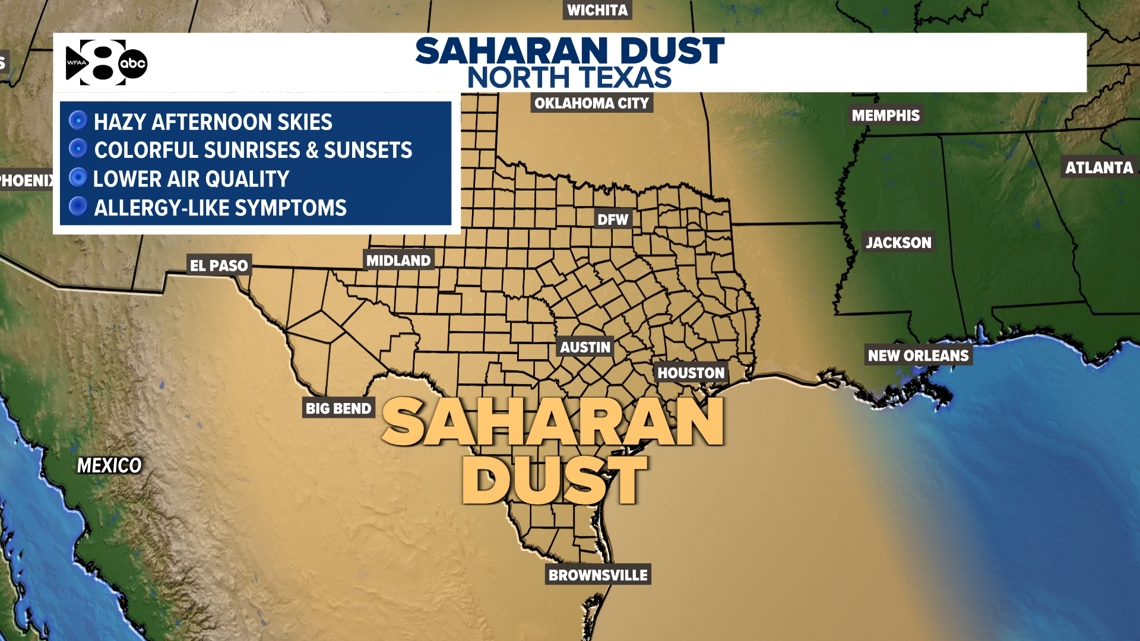

5 000 Mile Dust Storm Impact On North Texas Air Quality

May 31, 2025

5 000 Mile Dust Storm Impact On North Texas Air Quality

May 31, 2025 -

Missing Teen Case Reward Offered For Information Leading To Location

May 31, 2025

Missing Teen Case Reward Offered For Information Leading To Location

May 31, 2025 -

Badenochs Leadership Under Fire Tory Sources Reveal Total Disaster

May 31, 2025

Badenochs Leadership Under Fire Tory Sources Reveal Total Disaster

May 31, 2025 -

New York Knicks Ending The Doldrums Pursuing Championship Glory

May 31, 2025

New York Knicks Ending The Doldrums Pursuing Championship Glory

May 31, 2025