Significant Amazon Gains (560%): My Rationale For Not Selling

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Significant Amazon Gains (560%): My Rationale for Not Selling

Amazon. The name alone conjures images of booming success, rapid growth, and untold riches. For many investors, a 560% return on their Amazon stock would be an undeniable siren song, a clear signal to cash out and celebrate. But for me, despite this significant gain, selling isn't even a consideration. This article will delve into my reasoning, exploring the long-term potential of Amazon and the factors influencing my decision to hold.

The Tempting 560%:

Let's be clear: a 560% return is extraordinary. It’s a testament to Amazon's consistent growth and innovative spirit. Many would argue that securing such profits warrants immediate action – sell high, buy low, and secure your gains. This strategy is sound in many situations, but Amazon presents a unique case.

Why I'm Holding onto My Amazon Stock:

My decision to hold stems from a confluence of factors, all pointing towards a bright future for the company:

-

Unmatched Market Dominance: Amazon isn't just an online retailer; it's a behemoth controlling significant portions of the e-commerce, cloud computing (AWS), and digital advertising markets. This diversified portfolio significantly mitigates risk. [Link to article on Amazon's market share].

-

Continued Innovation: Amazon consistently pushes the boundaries of technology and consumer experience. From its groundbreaking drone delivery program to its advancements in artificial intelligence and machine learning, the company shows no signs of slowing down. This constant evolution fuels future growth. [Link to Amazon's innovation news page].

-

Long-Term Growth Potential: Despite its current size, Amazon still has significant untapped potential. Expanding into new markets, developing new technologies, and further penetrating existing markets offer immense opportunities for continued growth. This long-term perspective justifies my holding strategy.

-

Strategic Acquisitions: Amazon's history of strategic acquisitions, such as Whole Foods Market and PillPack, demonstrates its ability to expand into new sectors and integrate them seamlessly into its existing ecosystem. This capacity for expansion suggests ongoing growth potential. [Link to article on Amazon's acquisition strategy].

-

Resilience in Economic Downturns: While the overall economy fluctuates, Amazon has proven remarkably resilient during economic downturns. Its essential services and diversified business model provide a buffer against economic headwinds.

Addressing Potential Concerns:

Of course, no investment is without risk. Concerns surrounding increased competition, regulatory scrutiny, and potential economic slowdowns are valid. However, Amazon's size, diversification, and innovation capacity suggest a strong ability to navigate these challenges.

Beyond the Numbers:

My decision to hold isn't solely based on financial projections. It's about believing in Amazon's vision, its commitment to innovation, and its long-term potential to shape the future of commerce and technology.

Conclusion:

While a 560% return is undeniably significant, my rationale for not selling my Amazon stock centers on the company's long-term potential, its diversified business model, and its consistent track record of innovation. The temptation to cash out is real, but my belief in Amazon’s continued growth outweighs the immediate gratification of selling. This isn't financial advice, but a personal reflection on my investment strategy. Always conduct thorough research and consult with a financial advisor before making any investment decisions.

Call to Action: What are your thoughts on Amazon's future? Share your perspective in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Significant Amazon Gains (560%): My Rationale For Not Selling. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Livestock At Risk How Trumps Climate Stance Might Resurrect A Deadly Pest

May 28, 2025

Livestock At Risk How Trumps Climate Stance Might Resurrect A Deadly Pest

May 28, 2025 -

Trading California For Germany A Reluctant Expat Shares Her Story

May 28, 2025

Trading California For Germany A Reluctant Expat Shares Her Story

May 28, 2025 -

Birmingham Capital Management Co Inc Al Disposes Of 20 850 Bank Of America Bac Shares

May 28, 2025

Birmingham Capital Management Co Inc Al Disposes Of 20 850 Bank Of America Bac Shares

May 28, 2025 -

Investment Giant Two Sigma Takes Large Position In Bank Of America Stock Bac

May 28, 2025

Investment Giant Two Sigma Takes Large Position In Bank Of America Stock Bac

May 28, 2025 -

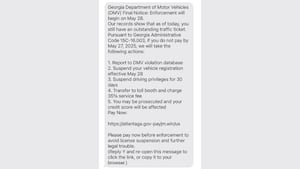

Georgia Dds Scam Warning Protect Yourself From Text Message Fraud

May 28, 2025

Georgia Dds Scam Warning Protect Yourself From Text Message Fraud

May 28, 2025

Latest Posts

-

Rhode Skin Hailey Biebers Brand Sold To E L F Cosmetics For 1 Billion

May 30, 2025

Rhode Skin Hailey Biebers Brand Sold To E L F Cosmetics For 1 Billion

May 30, 2025 -

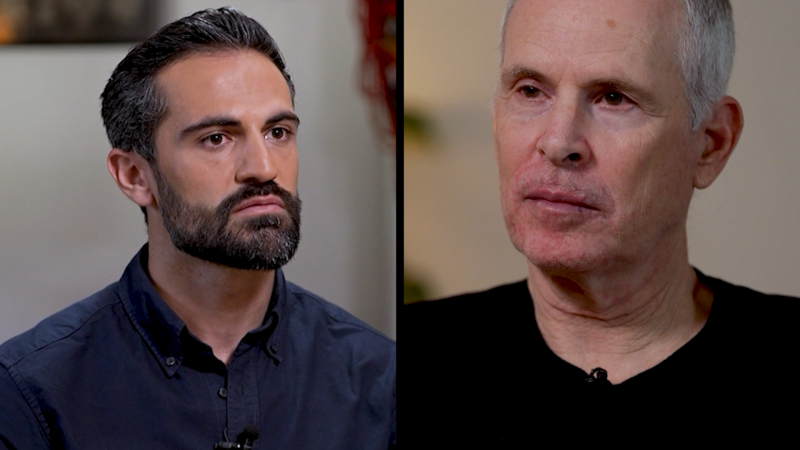

Witness To Terror Israeli Hostages Account Of Hamas Torture On Cnn

May 30, 2025

Witness To Terror Israeli Hostages Account Of Hamas Torture On Cnn

May 30, 2025 -

Holger Runes Third Round Berth At French Open A Comprehensive Match Report

May 30, 2025

Holger Runes Third Round Berth At French Open A Comprehensive Match Report

May 30, 2025 -

Sheinelle Jones And Family Mourn Loss Of Husband Uche Ojeh Today Confirms

May 30, 2025

Sheinelle Jones And Family Mourn Loss Of Husband Uche Ojeh Today Confirms

May 30, 2025 -

Rune Advances To French Open Third Round After Straight Sets Victory

May 30, 2025

Rune Advances To French Open Third Round After Straight Sets Victory

May 30, 2025