Significant Amazon Gains (560%): Why I'm Not Selling Yet

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Significant Amazon Gains (560%): Why I'm Not Selling Yet

Headline: Amazon Stock Soars 560%: Holding On Despite Market Volatility

Introduction: Amazon's recent stock surge has left many investors reeling, with a staggering 560% increase sparking intense debate about selling versus holding. While the temptation to cash in on such significant gains is undeniable, my strategy remains focused on long-term growth. This article delves into the reasons behind Amazon's impressive performance and explains why I believe now is not the time to sell, despite the enticing profits.

Amazon's Meteoric Rise: A Breakdown of the 560% Gain

The 560% increase in Amazon's stock price isn't simply the result of one factor; it's a confluence of positive trends that paint a compelling picture for future growth. Let's break down the key drivers:

-

E-commerce Dominance: Amazon remains the undisputed king of e-commerce, consistently expanding its market share and innovating to stay ahead of the competition. This dominance translates directly into consistent revenue growth.

-

AWS Cloud Computing Powerhouse: Amazon Web Services (AWS) continues its reign as the leading cloud computing platform, powering businesses globally. The demand for cloud services shows no signs of slowing, ensuring consistent revenue streams for Amazon.

-

Expansion into New Markets: Amazon's relentless expansion into new markets, including advertising, grocery delivery (with Whole Foods Market), and subscription services like Amazon Prime, diversifies its revenue streams and mitigates risk.

-

Strategic Acquisitions: Amazon's strategic acquisitions, often flying under the radar, continuously enhance its capabilities and expand its reach into new technological frontiers. This proactive approach ensures Amazon stays at the forefront of innovation.

Why I'm Holding: A Long-Term Perspective

Despite the significant gains, selling my Amazon stock now feels premature. My investment strategy focuses on long-term growth, and several factors reinforce this decision:

-

Undervalued Potential: Despite the impressive growth, many analysts believe Amazon still holds significant undervalued potential. Further expansion into emerging markets and technological advancements promise even greater returns in the years to come.

-

Market Volatility: While the current market shows strength, short-term volatility is inevitable. Selling now could mean missing out on substantial future gains as the market stabilizes and Amazon continues its growth trajectory. Timing the market is notoriously difficult, and attempting to do so often proves detrimental.

-

Dividend Potential: While not currently a dividend-paying stock, Amazon's future profitability strongly suggests the possibility of future dividend payouts. This represents another potential avenue for long-term gains.

Risks and Mitigation Strategies

It's crucial to acknowledge the risks involved in any investment. Potential threats to Amazon's continued growth include increased competition, regulatory hurdles, and economic downturns. To mitigate these risks, I employ a diversified investment portfolio and regularly review my holdings to ensure they align with my overall financial goals. This diversified strategy reduces the overall risk associated with any single stock, including Amazon.

Conclusion: A Long-Term Hold

The 560% gain in Amazon stock is undeniably impressive. However, my decision to hold stems from a belief in Amazon's long-term potential, a diversified investment strategy, and a recognition of the inherent challenges in trying to time the market perfectly. While taking profits is always an option, in this case, I believe the potential for future growth significantly outweighs the temptation of immediate gratification. What's your strategy? Share your thoughts in the comments below!

(Optional CTA): Want to learn more about long-term investment strategies? Check out our [link to relevant resource/article].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Significant Amazon Gains (560%): Why I'm Not Selling Yet. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

French Open 2024 Remembering Nadals Heartfelt Goodbye

May 27, 2025

French Open 2024 Remembering Nadals Heartfelt Goodbye

May 27, 2025 -

Why Analysts See Strong Momentum Ahead For Amazon Amzn Stock

May 27, 2025

Why Analysts See Strong Momentum Ahead For Amazon Amzn Stock

May 27, 2025 -

Sirius Xm Holdings Stock Performance A Detailed Analysis

May 27, 2025

Sirius Xm Holdings Stock Performance A Detailed Analysis

May 27, 2025 -

Twelve Injured In Mexico Hot Air Balloon Disaster Cnn Reports

May 27, 2025

Twelve Injured In Mexico Hot Air Balloon Disaster Cnn Reports

May 27, 2025 -

Ukraine Grapples With Andriy Portnovs Killing A Lack Of Public Sympathy

May 27, 2025

Ukraine Grapples With Andriy Portnovs Killing A Lack Of Public Sympathy

May 27, 2025

Latest Posts

-

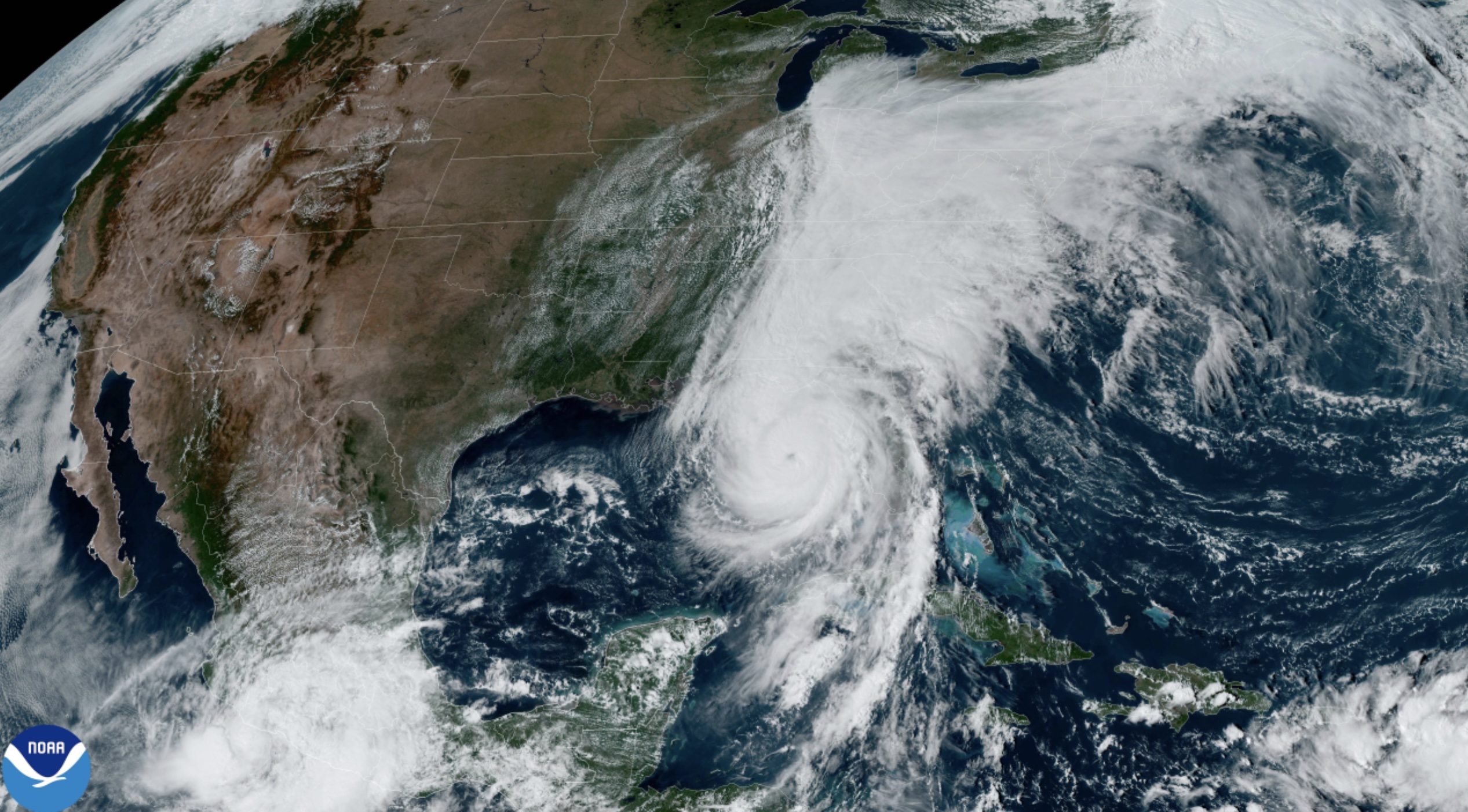

Summer Hurricane Outlook Above Normal Conditions Could Mean 10 Us Hurricanes

May 28, 2025

Summer Hurricane Outlook Above Normal Conditions Could Mean 10 Us Hurricanes

May 28, 2025 -

Israeli Ultra Nationalist March Fuels Jerusalem Tensions Cnn Report

May 28, 2025

Israeli Ultra Nationalist March Fuels Jerusalem Tensions Cnn Report

May 28, 2025 -

The Trump Harvard Conflict Is Elitism The Real Issue

May 28, 2025

The Trump Harvard Conflict Is Elitism The Real Issue

May 28, 2025 -

Food Inflation Hits One Year Peak The Role Of Beef

May 28, 2025

Food Inflation Hits One Year Peak The Role Of Beef

May 28, 2025 -

The Truth Behind Trumps Anger At Harvard A Maga Financial Scandal

May 28, 2025

The Truth Behind Trumps Anger At Harvard A Maga Financial Scandal

May 28, 2025