Significant Amazon Gains: The Case For Long-Term Holding

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Significant Amazon Gains: The Case for Long-Term Holding

Amazon. The name conjures images of instant gratification, next-day delivery, and a seemingly unstoppable tech behemoth. But for investors, Amazon represents something more: a potentially lucrative long-term holding. Recent market fluctuations may have some questioning its future, but a deeper dive reveals compelling reasons why maintaining a long-term position in AMZN stock remains a smart strategy.

Amazon's Unwavering Dominance:

Amazon's success isn't built on a single product or service. Its multifaceted business model is the key to its resilience. From its e-commerce dominance (still growing, despite increased competition) to its rapidly expanding cloud computing arm (AWS), Amazon continuously innovates and diversifies. This diversification mitigates risk and ensures sustained growth across various economic cycles.

- E-commerce Giant: While competitors like Walmart and Shopify are vying for market share, Amazon’s established infrastructure, Prime membership loyalty, and robust logistics network provide a significant competitive advantage. The company continues to expand into new markets and product categories, ensuring continued growth in its core business.

- AWS: The Cloud Leader: Amazon Web Services (AWS) is not only a significant revenue generator but also a crucial driver of future innovation. As cloud computing continues its explosive growth, AWS is well-positioned to capitalize on this trend, contributing significantly to Amazon's overall profitability.

- Beyond the Basics: Amazon's reach extends far beyond online retail and cloud computing. Its foray into advertising, streaming (Prime Video), and even healthcare demonstrates a commitment to long-term growth and exploration of new, high-potential markets.

Addressing Investor Concerns:

While Amazon’s future looks bright, it's crucial to acknowledge potential challenges. Recent economic downturns and increased competition have impacted investor sentiment. However, these are short-term concerns that don't negate the company's long-term potential.

- Inflationary Pressures: Rising inflation has impacted Amazon's costs, but the company has demonstrated its ability to adapt and implement pricing strategies to mitigate these challenges.

- Increased Competition: The competitive landscape is indeed intensifying, but Amazon's scale, brand recognition, and innovative capacity give it a significant edge.

- Market Volatility: Short-term market fluctuations are normal. Focusing on Amazon's long-term fundamentals is crucial for weathering these storms.

Why Hold for the Long Term?

Investing in Amazon is a bet on its continued innovation and expansion. Its proven track record of adapting to changing market conditions, coupled with its diverse revenue streams, makes it a compelling long-term investment. Holding onto AMZN stock allows you to benefit from:

- Compounding Growth: Amazon's consistent growth allows for significant compounding returns over time. Holding for the long term maximizes the potential for substantial gains.

- Reduced Transaction Costs: Frequent buying and selling incurs transaction fees and capital gains taxes. A long-term hold strategy minimizes these costs.

- Riding the Innovation Wave: Amazon is constantly pushing boundaries. Holding its stock allows you to participate in the potential rewards of its future innovations.

Conclusion:

While short-term market volatility is inevitable, Amazon's long-term prospects remain strong. Its diversified business model, innovative spirit, and dominant market position make a compelling case for long-term holding. However, remember that all investments carry risk, and conducting thorough research before making any investment decisions is always recommended. Consider consulting with a qualified financial advisor to determine if Amazon aligns with your individual investment goals and risk tolerance. Learn more about strategies to make informed decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Significant Amazon Gains: The Case For Long-Term Holding. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Georgia Residents Targeted New Dmv Scam Spreading Across The State

May 28, 2025

Georgia Residents Targeted New Dmv Scam Spreading Across The State

May 28, 2025 -

11 Dead In Wwii Bomber Crash Four Airmens Remains To Be Returned To Families

May 28, 2025

11 Dead In Wwii Bomber Crash Four Airmens Remains To Be Returned To Families

May 28, 2025 -

Seaside Towns Memorial Day Weekend Marred By 73 Arrests Violence

May 28, 2025

Seaside Towns Memorial Day Weekend Marred By 73 Arrests Violence

May 28, 2025 -

7 000 Job Boost Kfcs Growth Plan For Uk And Ireland

May 28, 2025

7 000 Job Boost Kfcs Growth Plan For Uk And Ireland

May 28, 2025 -

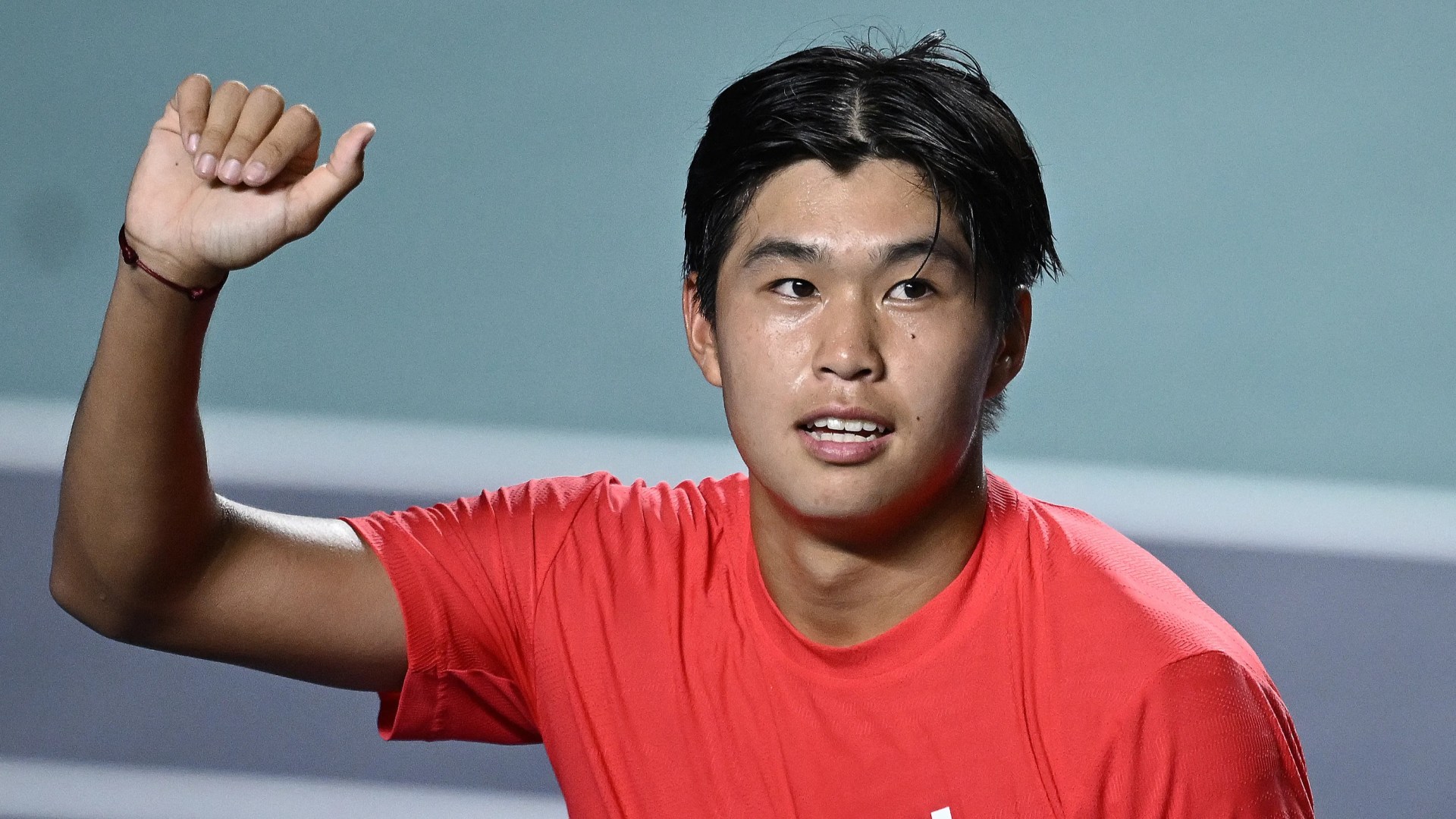

Inspired By Moms Career Us Tennis Rising Star Takes On World No 3

May 28, 2025

Inspired By Moms Career Us Tennis Rising Star Takes On World No 3

May 28, 2025

Latest Posts

-

E L F Beauty Acquires Hailey Biebers Rhode Skin For 1 Billion A Skincare Industry Power Play

May 31, 2025

E L F Beauty Acquires Hailey Biebers Rhode Skin For 1 Billion A Skincare Industry Power Play

May 31, 2025 -

2025 Us Open Unveils Althea Gibson Theme

May 31, 2025

2025 Us Open Unveils Althea Gibson Theme

May 31, 2025 -

Securing The Future Governments Urgent Reservoir Project

May 31, 2025

Securing The Future Governments Urgent Reservoir Project

May 31, 2025 -

Us Court Decision Limits Presidential Power On Trade Tariffs

May 31, 2025

Us Court Decision Limits Presidential Power On Trade Tariffs

May 31, 2025 -

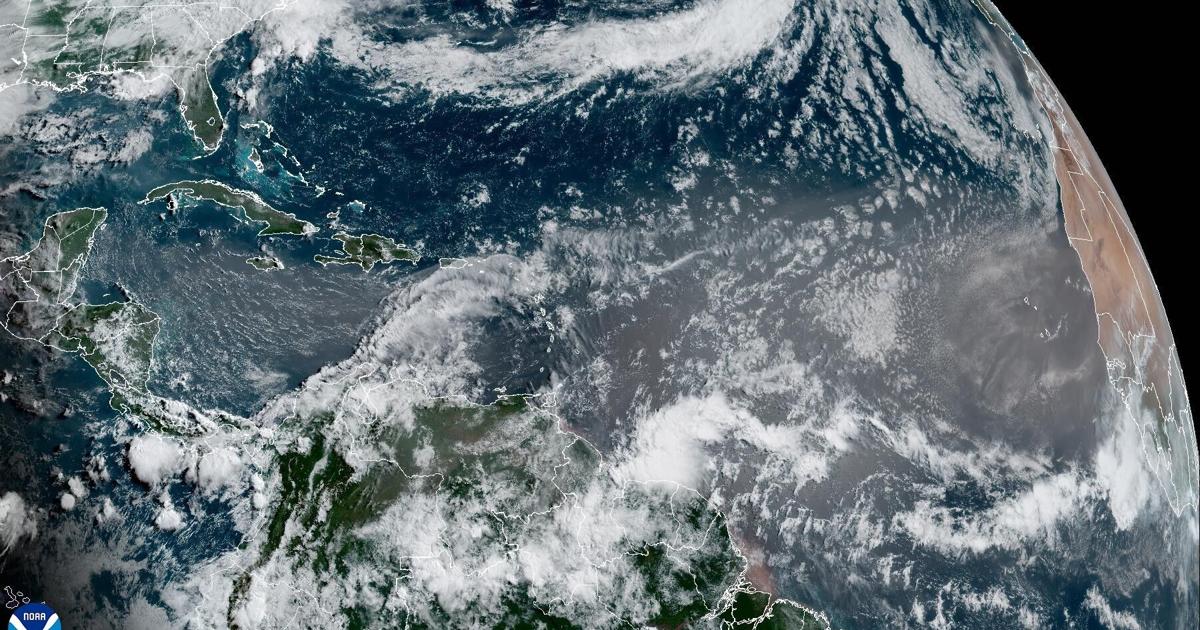

Saharan Dust Cloud Impacts Louisiana Sunset Forecast And Timeline

May 31, 2025

Saharan Dust Cloud Impacts Louisiana Sunset Forecast And Timeline

May 31, 2025