Significant Amazon Returns (560%): My Long-Term Investment Strategy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Significant Amazon Returns (560%): My Long-Term Investment Strategy

Headline: Amazon Stock Soared 560%: My Long-Term Investment Strategy and Why I'm Still Holding

Introduction:

The tech giant Amazon has consistently defied expectations, delivering staggering returns for long-term investors. My personal journey with Amazon stock showcases a 560% return over a significant period, a testament to the power of strategic investing and patience. This article details my long-term investment strategy, the factors contributing to Amazon's success, and why I believe it remains a strong investment for the future. Are you ready to learn how to potentially ride the wave of growth with a tech giant like Amazon?

H2: The Power of Long-Term Investing: A Case Study

Many investors chase quick wins, jumping from one hot stock to another. However, my experience with Amazon demonstrates the undeniable power of a long-term investment strategy. Investing in a fundamentally strong company and holding onto it through market fluctuations can yield extraordinary results. My initial investment, made several years ago, reflects a belief in Amazon's vision and its potential to disrupt various industries. This isn't just about short-term gains; it’s about building wealth steadily over time.

H2: Amazon's Diversification: A Key to Sustained Growth

Amazon's success isn't solely reliant on its e-commerce dominance. Its diversification into cloud computing (Amazon Web Services or AWS), streaming (Amazon Prime Video), and advertising, among other ventures, has proven crucial to its resilience and growth. This diversification mitigates risk and provides multiple avenues for revenue generation. AWS, in particular, has become a powerhouse, consistently driving significant profits and demonstrating the company's adaptability.

H3: Analyzing Key Performance Indicators (KPIs)

Understanding key performance indicators is vital for any investor. For Amazon, I consistently monitor metrics like:

- Revenue Growth: Sustained revenue growth indicates a healthy and expanding market share.

- AWS Revenue: The performance of AWS is a crucial indicator of future profitability.

- Operating Income: This reflects the company's profitability after deducting operating expenses.

- Free Cash Flow: This demonstrates Amazon's ability to generate cash after covering capital expenditures.

Regularly reviewing these KPIs helped me stay informed and confident in my investment.

H2: Navigating Market Volatility: Patience and Perspective

The stock market is inherently volatile. There were periods during my investment in Amazon where the stock price fluctuated significantly. However, my long-term strategy helped me weather these storms. Sticking to my investment plan, based on fundamental analysis and a belief in Amazon's long-term potential, was paramount. Remember, patience is a virtue in the world of long-term investing.

H2: Risks and Considerations

While my experience has been positive, it's crucial to acknowledge potential risks associated with investing in any single company, including Amazon:

- Competition: Increased competition in various sectors could impact Amazon's market share.

- Regulatory Scrutiny: Government regulations and antitrust concerns could affect Amazon's operations.

- Economic Downturns: A broader economic downturn could negatively impact consumer spending and Amazon's revenue.

Diversification across your investment portfolio is always recommended to mitigate these risks.

H2: Conclusion: The Future of Amazon and Long-Term Investing

My 560% return on Amazon stock is a testament to the rewards of long-term investing in a fundamentally strong company. While past performance doesn't guarantee future returns, I remain optimistic about Amazon's prospects. Its continuous innovation, diversification, and strong market position suggest it will continue to be a significant player in the global economy. This case study underlines the importance of conducting thorough research, understanding your risk tolerance, and having a long-term perspective before investing. Remember to consult with a financial advisor before making any investment decisions.

Call to Action: What are your thoughts on long-term investing in tech giants like Amazon? Share your experiences and strategies in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Significant Amazon Returns (560%): My Long-Term Investment Strategy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

2 2 Million Medical Bill A Fathers Extraordinary Rowing Feat

May 27, 2025

2 2 Million Medical Bill A Fathers Extraordinary Rowing Feat

May 27, 2025 -

Future Of Two Child Benefit Cap Uncertain Rayners Response

May 27, 2025

Future Of Two Child Benefit Cap Uncertain Rayners Response

May 27, 2025 -

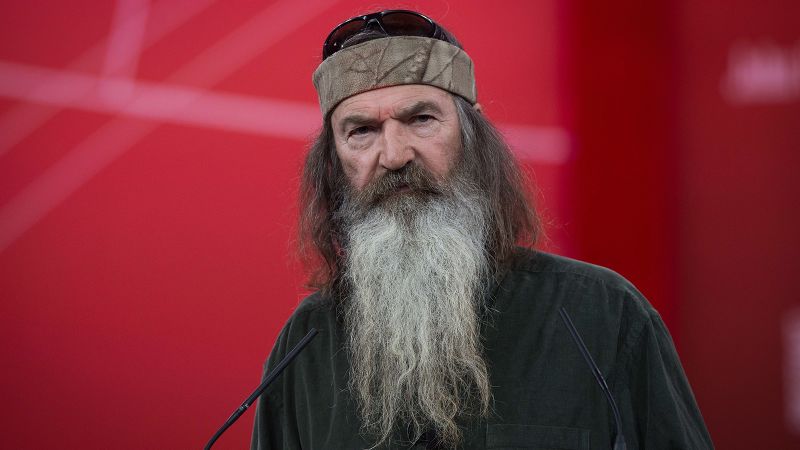

Phil Robertson Dies At 79 Remembering The Duck Dynasty Star

May 27, 2025

Phil Robertson Dies At 79 Remembering The Duck Dynasty Star

May 27, 2025 -

Chris Hughes Airport Gesture New Fuel For Jo Jo Siwa Romance Rumors

May 27, 2025

Chris Hughes Airport Gesture New Fuel For Jo Jo Siwa Romance Rumors

May 27, 2025 -

Giancarlo Stanton To Seattle Mariners Reportedly Eyeing Slugger

May 27, 2025

Giancarlo Stanton To Seattle Mariners Reportedly Eyeing Slugger

May 27, 2025

Latest Posts

-

Doc Rivers Impact Will His Presence Sway Giannis Antetokounmpos Future In Milwaukee

May 28, 2025

Doc Rivers Impact Will His Presence Sway Giannis Antetokounmpos Future In Milwaukee

May 28, 2025 -

Stellantis Ceo Antonio Filosa Background And Leadership Style

May 28, 2025

Stellantis Ceo Antonio Filosa Background And Leadership Style

May 28, 2025 -

French President Macron Responds To Video Of Incident With Wife

May 28, 2025

French President Macron Responds To Video Of Incident With Wife

May 28, 2025 -

Dazzling Display Alexandra Daddario Stuns In A Sheer Gown At Dior Cruise

May 28, 2025

Dazzling Display Alexandra Daddario Stuns In A Sheer Gown At Dior Cruise

May 28, 2025 -

Man Eating Screwworms Public Health Concerns And Control Efforts

May 28, 2025

Man Eating Screwworms Public Health Concerns And Control Efforts

May 28, 2025