Significant Drop: Average Mortgage Rate Reaches Early April Low

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Significant Drop: Average Mortgage Rate Reaches Early April Low

Homebuyers rejoice! Average mortgage rates have plummeted to levels not seen since early April, offering a significant boost to the struggling housing market. This unexpected dip presents a golden opportunity for prospective homebuyers and those looking to refinance. But how long will these low rates last? Let's dive into the details.

The Current Market Landscape:

The average 30-year fixed-rate mortgage has fallen to [Insert Current Rate Here]%, a substantial decrease from [Insert Previous Rate Here]% just [Number] weeks ago. This dramatic drop is largely attributed to [Explain the reason for the drop - e.g., concerns about banking sector stability, lower-than-expected inflation figures, or shifts in investor sentiment]. This shift has injected a much-needed dose of optimism into the market, which has been grappling with high rates and reduced affordability for much of the year.

<br>

Who Benefits Most?

This sudden decrease in mortgage rates is good news for several groups:

- First-time homebuyers: With affordability a major hurdle for many, lower rates significantly reduce the monthly mortgage payment, making homeownership more attainable.

- Refinancing homeowners: Those with existing mortgages can potentially save thousands of dollars annually by refinancing at the lower rate. This can free up cash flow for other financial goals.

- Home sellers: While inventory remains tight in many areas, lower rates could stimulate buyer demand, potentially leading to a more balanced market.

Understanding the Implications:

While the lower rates are undeniably positive, it's crucial to understand the broader context. This drop doesn't necessarily signal a long-term trend. Several factors could influence future rate changes, including:

- Inflation: The Federal Reserve's actions on interest rates are heavily influenced by inflation data. If inflation remains stubbornly high, rates could rise again.

- Economic growth: Economic uncertainty can impact investor confidence, affecting mortgage rates.

- Government policy: Government regulations and interventions can also play a role.

<br>

What Should You Do Now?

If you're considering buying a home or refinancing your existing mortgage, this is a favorable time to act. However, it's vital to:

- Shop around: Compare rates from multiple lenders to ensure you secure the best possible deal. [Link to a reputable mortgage rate comparison website] can help with this.

- Get pre-approved: A pre-approval letter demonstrates your financial readiness to lenders and can strengthen your offer in a competitive market.

- Consult a financial advisor: Discuss your individual financial situation and long-term goals to determine the best course of action.

<br>

Looking Ahead:

The future direction of mortgage rates remains uncertain. While this recent drop provides a welcome reprieve for many, it’s crucial to stay informed about market trends and consult with financial professionals to make informed decisions. Keep an eye on economic indicators and news related to the Federal Reserve's monetary policy to anticipate potential future shifts. This unexpected dip offers a window of opportunity – don't miss it!

Keywords: Mortgage rates, average mortgage rate, mortgage rate drop, low mortgage rates, home buying, refinancing, housing market, interest rates, Federal Reserve, inflation, economic growth, homeownership, first-time homebuyers.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Significant Drop: Average Mortgage Rate Reaches Early April Low. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ed Sheerans Shape Of You Topping Apple Musics Decade Streaming Chart

Jul 07, 2025

Ed Sheerans Shape Of You Topping Apple Musics Decade Streaming Chart

Jul 07, 2025 -

The Music Habits Ed Sheeran Wants You To Ditch

Jul 07, 2025

The Music Habits Ed Sheeran Wants You To Ditch

Jul 07, 2025 -

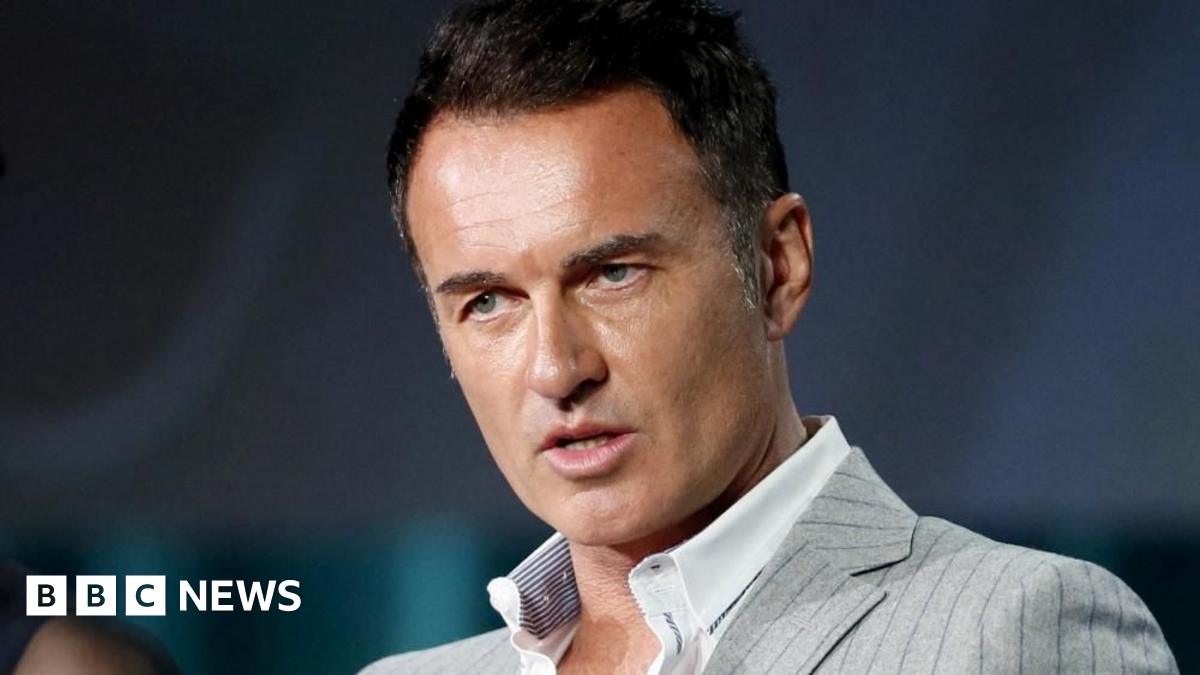

Hollywood Mourns Julian Mc Mahon Star Of Charmed And Nip Tuck Dies At 56

Jul 07, 2025

Hollywood Mourns Julian Mc Mahon Star Of Charmed And Nip Tuck Dies At 56

Jul 07, 2025 -

Apple Musics Most Streamed Songs 2010 2019 Ed Sheerans Triumph

Jul 07, 2025

Apple Musics Most Streamed Songs 2010 2019 Ed Sheerans Triumph

Jul 07, 2025 -

Global Launch Supercell Releases Mobile Game Mo Co

Jul 07, 2025

Global Launch Supercell Releases Mobile Game Mo Co

Jul 07, 2025

Latest Posts

-

Newspaper Headline Analysis Exploring The Effectiveness Of You Ll Never Walk Alone And Swept Away

Jul 07, 2025

Newspaper Headline Analysis Exploring The Effectiveness Of You Ll Never Walk Alone And Swept Away

Jul 07, 2025 -

The Superman Lex Luthor Relationship A Deep Dive Into Their Complicated Bond

Jul 07, 2025

The Superman Lex Luthor Relationship A Deep Dive Into Their Complicated Bond

Jul 07, 2025 -

Dogecoins Future Examining The Factors Behind Potential Price Increases

Jul 07, 2025

Dogecoins Future Examining The Factors Behind Potential Price Increases

Jul 07, 2025 -

Yemen Ports Hit In Israeli Military Operation Galaxy Leader Ship Involved

Jul 07, 2025

Yemen Ports Hit In Israeli Military Operation Galaxy Leader Ship Involved

Jul 07, 2025 -

Tragedy Strikes Poynton Police Discover Bodies Of Two Teenagers

Jul 07, 2025

Tragedy Strikes Poynton Police Discover Bodies Of Two Teenagers

Jul 07, 2025