Significant Drop In Average Mortgage Rates: April's Low Undercut

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Significant Drop in Average Mortgage Rates: April's Low Undercut

Record-low mortgage rates are back in the headlines, with April's already impressive figures being significantly undercut in recent weeks. Homebuyers are rejoicing as the average mortgage rates have plummeted, presenting a potentially golden opportunity for those looking to enter the housing market or refinance their existing loans. But what's driving this unexpected drop, and how long will these low rates last? Let's dive in.

The Stunning Numbers: How Low Have Rates Gone?

The latest data reveals a dramatic shift in the mortgage landscape. While April saw average rates that were already considered exceptionally low, May and early June have seen further decreases, with some lenders offering rates significantly below what was previously considered the norm. This translates to substantial savings for borrowers, both on their monthly payments and the overall cost of their mortgage. For example, a drop of even half a percentage point can save thousands of dollars over the life of a 30-year loan. Specific numbers vary depending on the lender, loan type (e.g., 30-year fixed, 15-year fixed, adjustable-rate mortgage - ARM), and individual credit score, but the trend is undeniable: rates are down.

What's Fueling This Rate Drop?

Several factors are contributing to this surprising decline in mortgage rates:

- Easing Inflation Concerns: While inflation remains a concern, recent economic data suggests a potential cooling-off period, leading investors to adjust their expectations. This, in turn, impacts interest rates.

- Banking Sector Stability: Following recent banking sector volatility, the Federal Reserve has acted to shore up confidence, indirectly impacting borrowing costs.

- Increased Supply of Mortgages: Competition among lenders is also contributing to the lower rates, as they strive to attract new borrowers.

Is This a Temporary Dip or a Lasting Trend?

While these low rates are certainly welcome news for prospective homebuyers, predicting their longevity is challenging. Several experts caution against assuming this trend will continue indefinitely. Factors like future inflation reports and the Federal Reserve's monetary policy decisions will significantly influence future mortgage rate movements.

What Should Homebuyers Do?

The current climate presents a potentially advantageous time for homebuyers. However, it's crucial to act strategically:

- Shop Around: Comparing offers from multiple lenders is vital to secure the best possible rate.

- Improve Your Credit Score: A higher credit score translates to more favorable loan terms and lower interest rates.

- Get Pre-Approved: Pre-approval demonstrates your financial readiness to lenders and strengthens your negotiating position.

- Understand Your Budget: Don't get caught up in the excitement of low rates; ensure you can comfortably afford the monthly payments and associated homeownership costs.

Looking Ahead: Navigating the Mortgage Market

The mortgage market is dynamic and ever-changing. Staying informed about current rates, economic indicators, and your personal financial situation is crucial. Utilizing online mortgage calculators and consulting with a qualified financial advisor can help you navigate this complex landscape.

Disclaimer: This article provides general information and should not be considered financial advice. Consult with a financial professional before making any financial decisions.

Keywords: Mortgage rates, average mortgage rate, low mortgage rates, interest rates, home buying, refinance, mortgage calculator, Federal Reserve, inflation, banking sector, home loan, financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Significant Drop In Average Mortgage Rates: April's Low Undercut. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

How To Stay Safe Understanding The Severity Of This Years Tick Season

Jul 07, 2025

How To Stay Safe Understanding The Severity Of This Years Tick Season

Jul 07, 2025 -

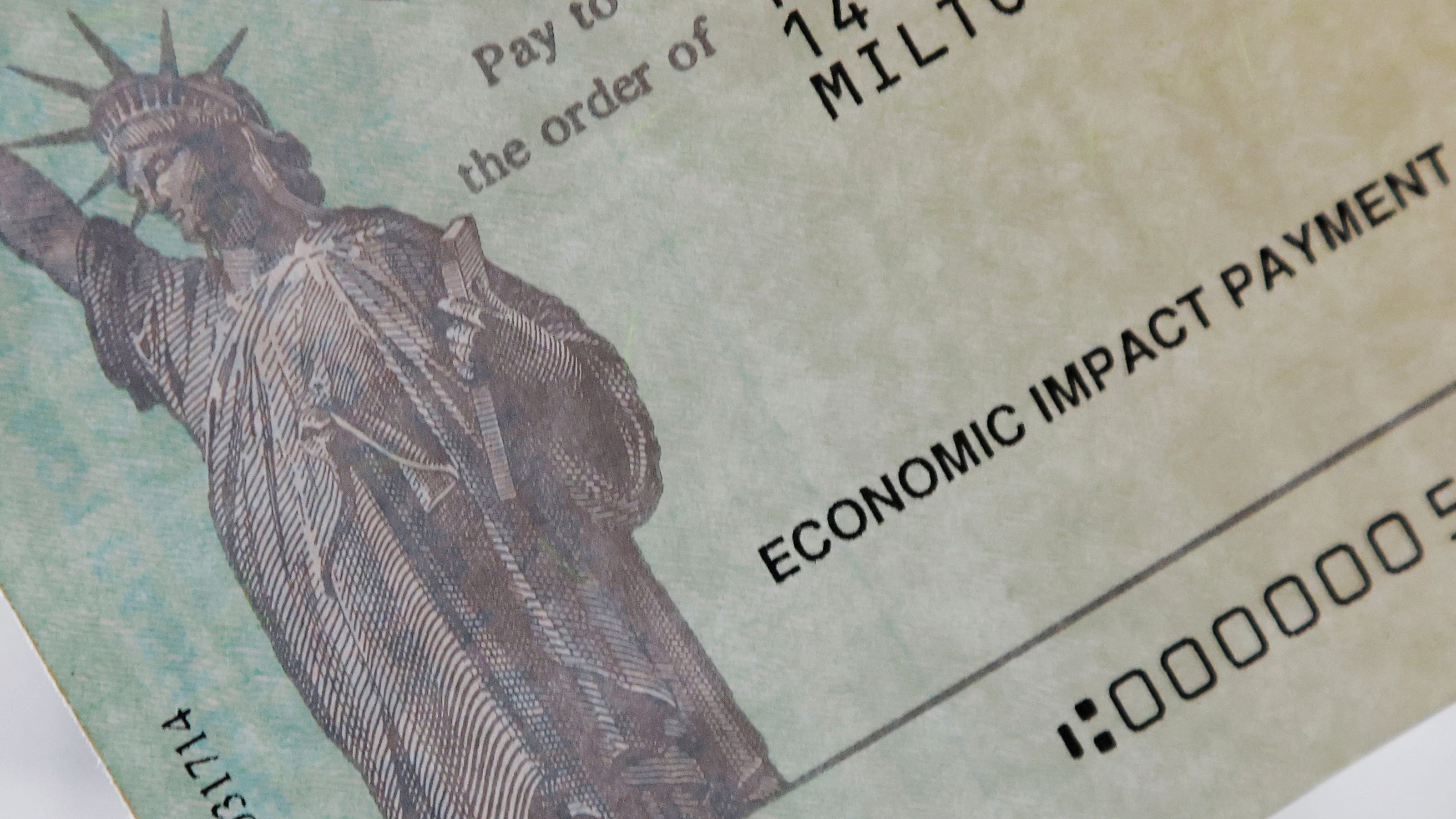

Is Another Stimulus Check Coming Decoding The Latest Spending Bill

Jul 07, 2025

Is Another Stimulus Check Coming Decoding The Latest Spending Bill

Jul 07, 2025 -

Parisians Return To Seine Swimming After Century Long Ban

Jul 07, 2025

Parisians Return To Seine Swimming After Century Long Ban

Jul 07, 2025 -

How Funding Cuts Threaten London Prides Continued Success

Jul 07, 2025

How Funding Cuts Threaten London Prides Continued Success

Jul 07, 2025 -

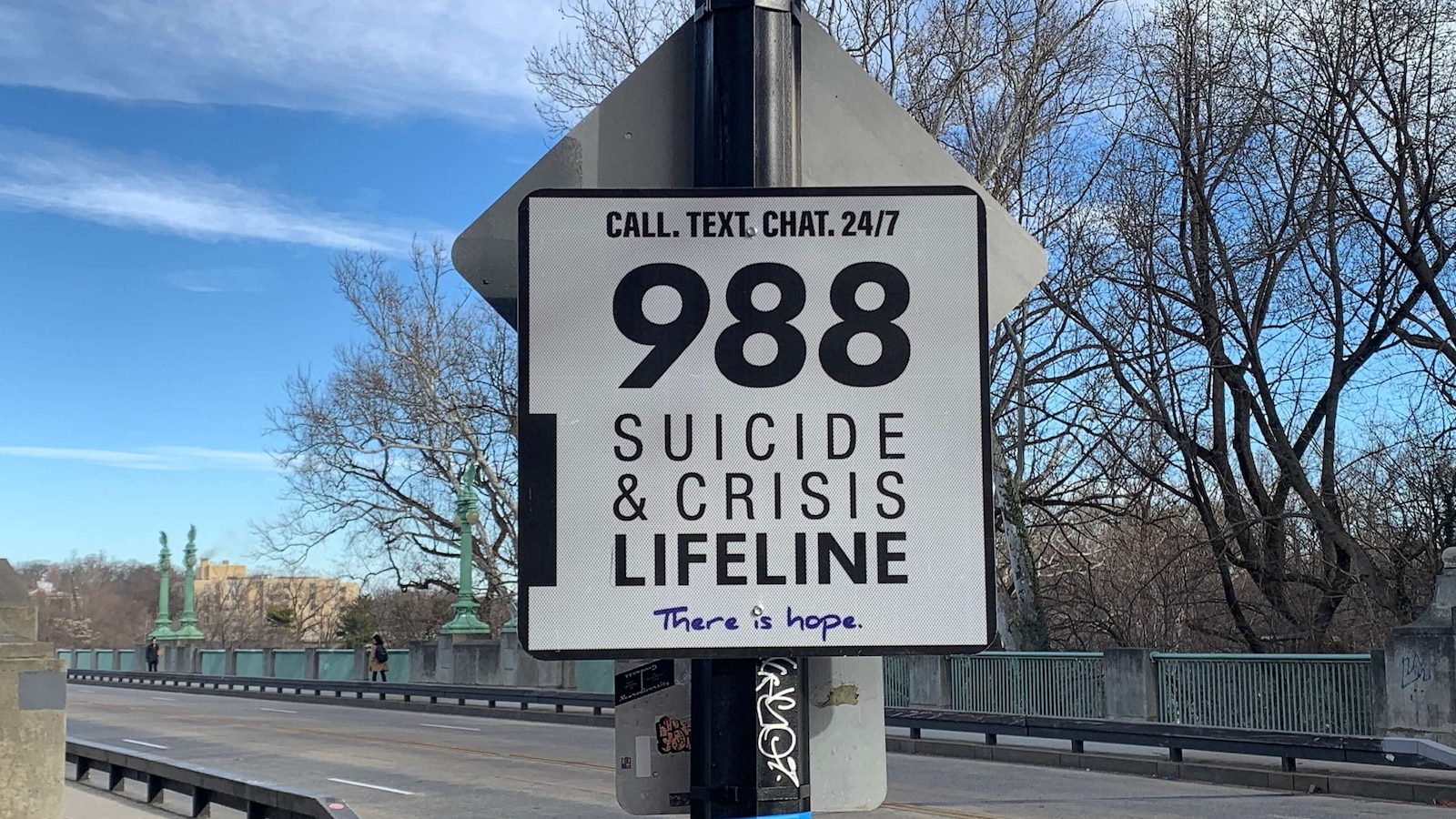

Analysis The 988 Lifelines Growth And The Discontinued Lgbtq Youth Option

Jul 07, 2025

Analysis The 988 Lifelines Growth And The Discontinued Lgbtq Youth Option

Jul 07, 2025

Latest Posts

-

The Superman Lex Luthor Relationship A Deep Dive Into Their Complicated Bond

Jul 07, 2025

The Superman Lex Luthor Relationship A Deep Dive Into Their Complicated Bond

Jul 07, 2025 -

Dogecoins Future Examining The Factors Behind Potential Price Increases

Jul 07, 2025

Dogecoins Future Examining The Factors Behind Potential Price Increases

Jul 07, 2025 -

Yemen Ports Hit In Israeli Military Operation Galaxy Leader Ship Involved

Jul 07, 2025

Yemen Ports Hit In Israeli Military Operation Galaxy Leader Ship Involved

Jul 07, 2025 -

Tragedy Strikes Poynton Police Discover Bodies Of Two Teenagers

Jul 07, 2025

Tragedy Strikes Poynton Police Discover Bodies Of Two Teenagers

Jul 07, 2025 -

Severe Tick Season Increased Risk And Essential Prevention Strategies

Jul 07, 2025

Severe Tick Season Increased Risk And Essential Prevention Strategies

Jul 07, 2025