Significant Drop In Average Mortgage Rates: Early April Levels Reached

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Significant Drop in Average Mortgage Rates: Early April Levels Reached

Homebuyers rejoice! Average mortgage rates have plummeted, reaching levels last seen in early April. This significant drop offers a much-needed boost to the housing market, potentially reigniting buyer interest and easing some of the pressure on affordability. But what's driving this sudden shift, and what does it mean for you?

The recent decline in mortgage rates is primarily attributed to several factors. Firstly, concerns about the stability of several regional banks have prompted investors to flock to safer assets, like government bonds. This increased demand for these bonds has driven down their yields, subsequently influencing mortgage rates, which are closely tied to the 10-year Treasury yield. Secondly, weaker-than-expected economic data has led some to believe the Federal Reserve might pause or even slow down its interest rate hikes, further contributing to the drop in mortgage rates.

Breaking Down the Numbers

While the exact figures vary depending on the lender and loan type, several major mortgage rate trackers show a substantial decrease. For example, [insert name of reputable mortgage rate tracking website here], a leading source for mortgage rate information, reported a drop of [insert percentage]% in the average 30-year fixed-rate mortgage. This brings the average rate down to [insert current average rate]%, a level not seen since early April.

This decrease is particularly significant because it follows a period of relatively high rates, making homeownership more expensive for many. The drop offers a glimmer of hope for potential homebuyers who have been sidelined by rising costs.

What This Means for Homebuyers

This sudden drop in mortgage rates translates to significant savings for prospective homebuyers. For example, a buyer purchasing a $300,000 home with a 20% down payment will see a substantial reduction in their monthly mortgage payment compared to just a few weeks ago. This could open doors for many who were previously priced out of the market.

- Lower Monthly Payments: The lower interest rate directly translates to lower monthly mortgage payments, making homeownership more affordable.

- Increased Purchasing Power: With lower rates, buyers can afford a more expensive home or potentially secure a larger loan amount.

- Revived Market Activity: This drop could lead to increased competition among buyers, potentially stimulating the housing market.

What This Means for Refinance Options

Existing homeowners with higher interest rates on their mortgages may also find this a beneficial time to consider refinancing. A lower interest rate can result in significant long-term savings, making refinancing a worthwhile financial decision for many. However, it is crucial to carefully weigh the costs and benefits of refinancing before making a decision. Consider factors like closing costs and the length of your current mortgage. Consult with a financial advisor or mortgage professional to determine if refinancing is right for you.

Looking Ahead: Will Rates Continue to Fall?

While this drop in mortgage rates is welcome news, predicting future trends remains challenging. Several economic factors could influence future rate movements, including inflation, the Federal Reserve's monetary policy, and overall economic growth. It's crucial to stay informed about the latest market developments and consult with financial experts to make informed decisions.

Call to Action: Stay tuned for further updates on mortgage rate trends and consider consulting a mortgage professional to explore your options. Understanding the current market conditions is vital whether you're looking to buy, sell, or refinance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Significant Drop In Average Mortgage Rates: Early April Levels Reached. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Administrative Leave For Apd Officer After Reported Off Duty Incident

Jul 06, 2025

Administrative Leave For Apd Officer After Reported Off Duty Incident

Jul 06, 2025 -

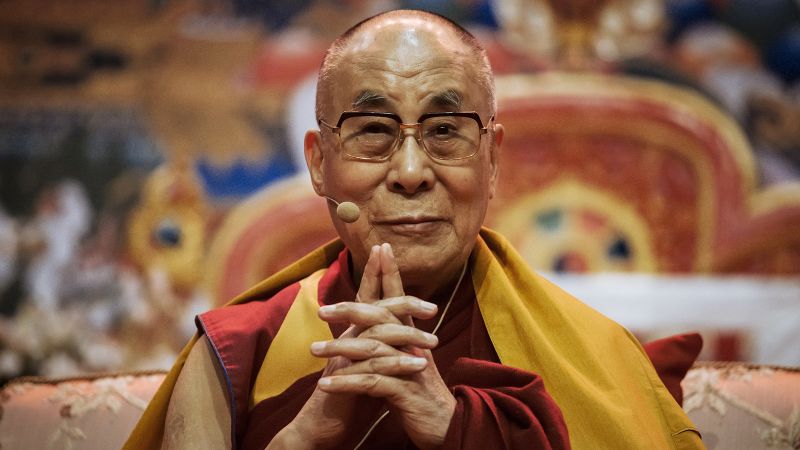

At 90 The Dalai Lama Faces His Final Test The Battle Over His Reincarnation

Jul 06, 2025

At 90 The Dalai Lama Faces His Final Test The Battle Over His Reincarnation

Jul 06, 2025 -

Tim Burtons Next Film A Sneak Peek From The Batman Director

Jul 06, 2025

Tim Burtons Next Film A Sneak Peek From The Batman Director

Jul 06, 2025 -

London Pride Returns But Financial Difficulties Cast Shadow

Jul 06, 2025

London Pride Returns But Financial Difficulties Cast Shadow

Jul 06, 2025 -

Panama Vs Australia Womens International Football Friendly Live Coverage

Jul 06, 2025

Panama Vs Australia Womens International Football Friendly Live Coverage

Jul 06, 2025

Latest Posts

-

Apple Musics Decade Defining Hits Shape Of You Leads The Pack

Jul 06, 2025

Apple Musics Decade Defining Hits Shape Of You Leads The Pack

Jul 06, 2025 -

Ed Sheerans Shape Of You Dominates Apple Musics Decade Streaming List

Jul 06, 2025

Ed Sheerans Shape Of You Dominates Apple Musics Decade Streaming List

Jul 06, 2025 -

Top Rated Iowa Hawkeyes In Ea Sports College Football 2026 Player Ratings Breakdown

Jul 06, 2025

Top Rated Iowa Hawkeyes In Ea Sports College Football 2026 Player Ratings Breakdown

Jul 06, 2025 -

Search For Missing Girls Continues After Texas Floods Claim 24 Lives

Jul 06, 2025

Search For Missing Girls Continues After Texas Floods Claim 24 Lives

Jul 06, 2025 -

Ed Sheerans Shape Of You Topping Apple Musics Decade Streaming Chart

Jul 06, 2025

Ed Sheerans Shape Of You Topping Apple Musics Decade Streaming Chart

Jul 06, 2025