Single Rate Cut Projected In 2025: Impact On U.S. Treasury Yields

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Single Rate Cut Projected in 2025: Impact on U.S. Treasury Yields

The Federal Reserve's aggressive interest rate hikes throughout 2022 and early 2023 are finally showing signs of slowing. While inflation remains a concern, projections now point towards a single interest rate cut in 2025. This anticipated shift in monetary policy has significant implications for U.S. Treasury yields, impacting everything from borrowing costs for businesses to the returns on fixed-income investments. Understanding these implications is crucial for investors and economic analysts alike.

The Projected Rate Cut: A Sign of Economic Slowdown?

The consensus among many leading economists and financial institutions is that the Fed will lower interest rates by 25 basis points sometime in 2025. This forecast is based on several factors: a projected slowdown in economic growth, a gradual decrease in inflation, and the potential for increased unemployment. While a single cut seems modest, it represents a significant change in direction after a period of consistent increases. This move signals a belief that the Fed's aggressive tightening measures have begun to sufficiently cool the economy and that further rate hikes are unnecessary.

However, it's crucial to remember that these projections are subject to change based on evolving economic data. Unforeseen events, such as a resurgence in inflation or a sharper-than-expected economic downturn, could drastically alter the Fed's plans.

Impact on U.S. Treasury Yields

The projected rate cut is expected to have a noticeable impact on U.S. Treasury yields. Generally, lower interest rates lead to lower Treasury yields. This is because investors demand lower returns when interest rates are low, as they have fewer attractive alternatives for their investments. This inverse relationship between interest rates and bond yields is a fundamental principle of finance.

This potential decline in yields could have several consequences:

- Increased Demand for Treasuries: Lower yields could attract investors seeking a safe haven asset in an uncertain economic climate, driving up demand for Treasury bonds.

- Lower Borrowing Costs: Lower yields make it cheaper for the government and corporations to borrow money, potentially stimulating economic activity.

- Impact on Investment Strategies: Investors with fixed-income portfolios may need to adjust their strategies to account for lower yields, potentially shifting towards higher-risk investments to achieve their desired returns.

Uncertainty Remains: Navigating the Market

Despite the projections, significant uncertainty remains. The timing of the rate cut, the extent of the reduction, and the overall economic outlook are all subject to revision. Moreover, other global economic factors, such as geopolitical instability and shifts in energy prices, could also significantly influence the trajectory of Treasury yields.

Staying Informed: Staying abreast of economic indicators and Fed pronouncements is vital for investors and businesses. Regularly reviewing financial news sources and consulting with financial advisors can help navigate the complexities of the current market environment.

Disclaimer: This article provides general information and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions. The information provided is based on current projections and is subject to change.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Single Rate Cut Projected In 2025: Impact On U.S. Treasury Yields. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Railroad Bridge Tragedy Two Adults Dead One Child Missing Another Injured

May 20, 2025

Railroad Bridge Tragedy Two Adults Dead One Child Missing Another Injured

May 20, 2025 -

Eu Brexit Talks Last Minute Deal Or Betrayal

May 20, 2025

Eu Brexit Talks Last Minute Deal Or Betrayal

May 20, 2025 -

Eurovision Shock Go Jo Eliminated Copyright Battle Brewing For Aussie Horror Film

May 20, 2025

Eurovision Shock Go Jo Eliminated Copyright Battle Brewing For Aussie Horror Film

May 20, 2025 -

Bbc Faces Backlash After Gary Linekers Expected Match Of The Day Exit

May 20, 2025

Bbc Faces Backlash After Gary Linekers Expected Match Of The Day Exit

May 20, 2025 -

Severe Weather Alert Dallas Tornado Watch Ends In North Texas

May 20, 2025

Severe Weather Alert Dallas Tornado Watch Ends In North Texas

May 20, 2025

Latest Posts

-

New Peaky Blinders Series Officially Confirmed Expect The Unexpected

May 21, 2025

New Peaky Blinders Series Officially Confirmed Expect The Unexpected

May 21, 2025 -

2027 The Year For Driverless Cars In The Uk Ubers Perspective

May 21, 2025

2027 The Year For Driverless Cars In The Uk Ubers Perspective

May 21, 2025 -

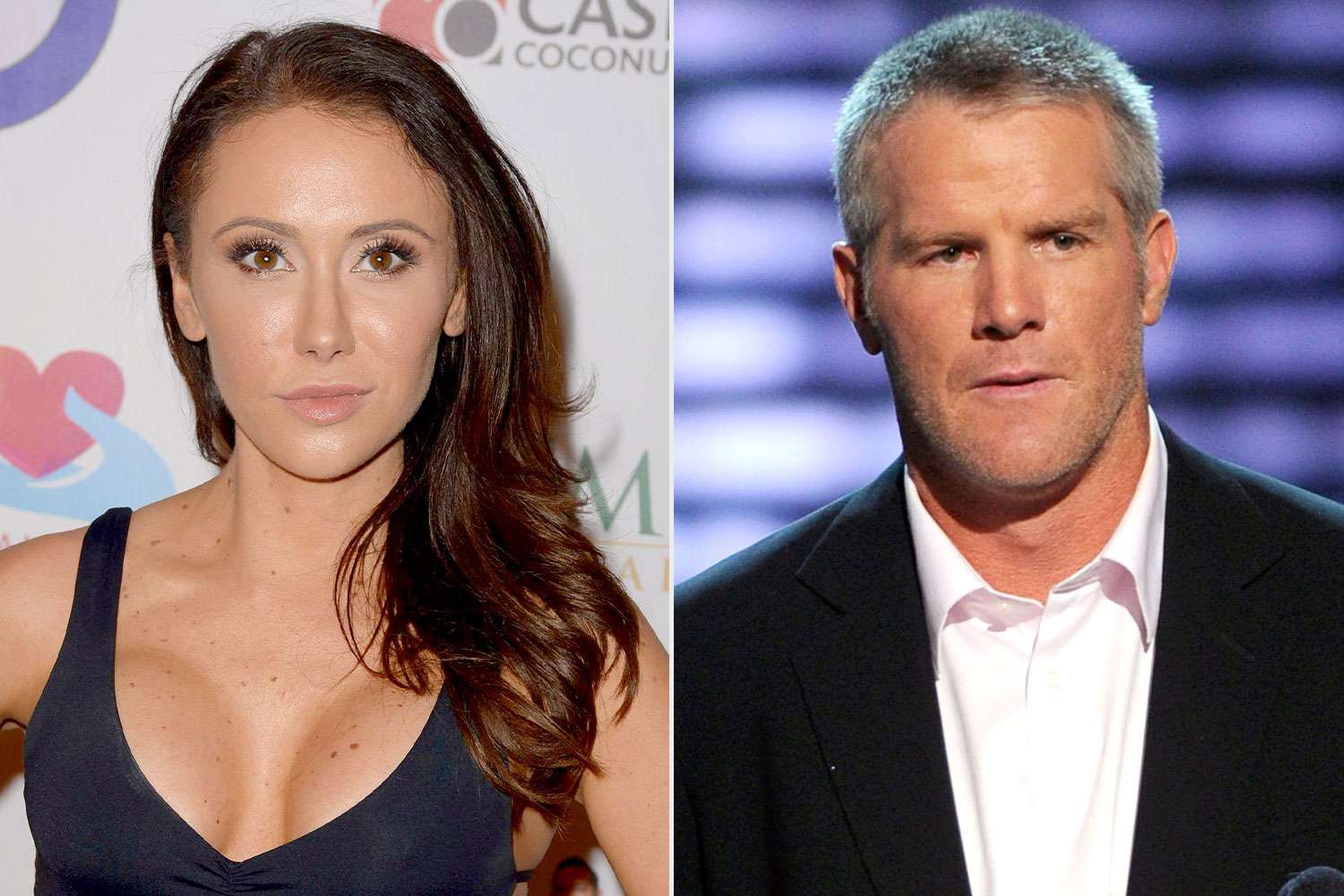

Brett Favre Sexting Scandal Jenn Sterger Speaks Out On The Aftermath

May 21, 2025

Brett Favre Sexting Scandal Jenn Sterger Speaks Out On The Aftermath

May 21, 2025 -

Femicide In The Spotlight Recent Deaths Of A Colombian Model And Mexican Influencer Ignite Public Anger

May 21, 2025

Femicide In The Spotlight Recent Deaths Of A Colombian Model And Mexican Influencer Ignite Public Anger

May 21, 2025 -

Putin Demonstrates Unnecessary Reliance On Trump

May 21, 2025

Putin Demonstrates Unnecessary Reliance On Trump

May 21, 2025