SiriusXM Holdings: A Millionaire-Maker Stock? Examining The Returns

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SiriusXM Holdings: A Millionaire-Maker Stock? Examining the Returns

SiriusXM Holdings Inc. (SIRI), the satellite radio giant, has seen its share price fluctuate significantly over the years. While some investors have raked in impressive returns, others have questioned its long-term potential. So, is SiriusXM a millionaire-maker stock? Let's delve into the data and examine the reality behind the potential.

A History of Volatility and Growth:

SiriusXM's journey hasn't been a smooth upward trajectory. The company, formed from the merger of Sirius and XM Satellite Radio in 2008, faced early challenges integrating operations and navigating a changing media landscape. However, it has since demonstrated a remarkable ability to adapt, expanding its subscriber base and diversifying its revenue streams. This has led to periods of significant growth, punctuated by periods of market correction reflecting broader economic trends and investor sentiment.

Analyzing the Returns:

To understand SiriusXM's potential as a millionaire-maker stock, we need to look beyond headline figures. While past performance doesn't guarantee future results, analyzing historical returns provides valuable context. For long-term investors who bought and held, the returns have been substantial for certain periods, especially considering reinvesting dividends. However, timing the market remains crucial. Those who bought at market peaks experienced losses. Short-term trading in SIRI shares has proven to be considerably more volatile, with significant potential for both gains and losses.

Factors Influencing Returns:

Several key factors influence SiriusXM's stock performance:

-

Subscriber Growth: Consistent subscriber additions are crucial for revenue growth and ultimately, stock price appreciation. The company's success in attracting and retaining subscribers, particularly in the face of competition from streaming services, directly impacts its financial health.

-

Content Strategy: SiriusXM's ability to offer compelling and exclusive content remains paramount. Securing high-profile personalities and offering diverse programming across various genres is essential to maintaining subscriber loyalty and attracting new users.

-

Technological Advancements: The integration of technology, such as improved streaming capabilities and smart car integrations, influences SiriusXM's reach and appeal to a broader audience. This constant adaptation to the evolving media landscape is crucial for long-term success.

-

Economic Conditions: Broader economic conditions, interest rates, and investor sentiment significantly impact the stock market, including SiriusXM's performance. Recessions or periods of economic uncertainty can lead to decreased investor confidence and lower stock prices.

Is it a Millionaire-Maker? A Cautious Perspective:

While SiriusXM has the potential to generate significant returns for long-term investors, labeling it a "millionaire-maker" stock is an oversimplification. The reality is far more nuanced. Successful investing in SiriusXM, or any stock, requires careful consideration of various factors, including:

-

Risk Tolerance: Investing in the stock market inherently involves risk. SiriusXM's stock price can be volatile, and investors need to have a comfortable risk tolerance.

-

Long-Term Investment Horizon: Consistent long-term growth is more likely than short-term gains. Short-term trading in SIRI carries considerable risk.

-

Diversification: Diversifying your investment portfolio is crucial to mitigate risk. Don't put all your eggs in one basket.

Conclusion:

SiriusXM Holdings presents an interesting case study in the complexities of stock market investing. While past performance suggests the potential for substantial returns, it's crucial to approach any investment decision with careful research, a long-term perspective, and a realistic understanding of the inherent risks. It's not a guaranteed path to becoming a millionaire, but with a strategic approach and a well-diversified portfolio, it could certainly contribute to building wealth over time. Always consult with a financial advisor before making any investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SiriusXM Holdings: A Millionaire-Maker Stock? Examining The Returns. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Gary Linekers Bbc Exit End Of An Era For Match Of The Day

May 28, 2025

Gary Linekers Bbc Exit End Of An Era For Match Of The Day

May 28, 2025 -

Concerns Raised Over Hs 2 Staff Provision In West Midlands Investigation Underway

May 28, 2025

Concerns Raised Over Hs 2 Staff Provision In West Midlands Investigation Underway

May 28, 2025 -

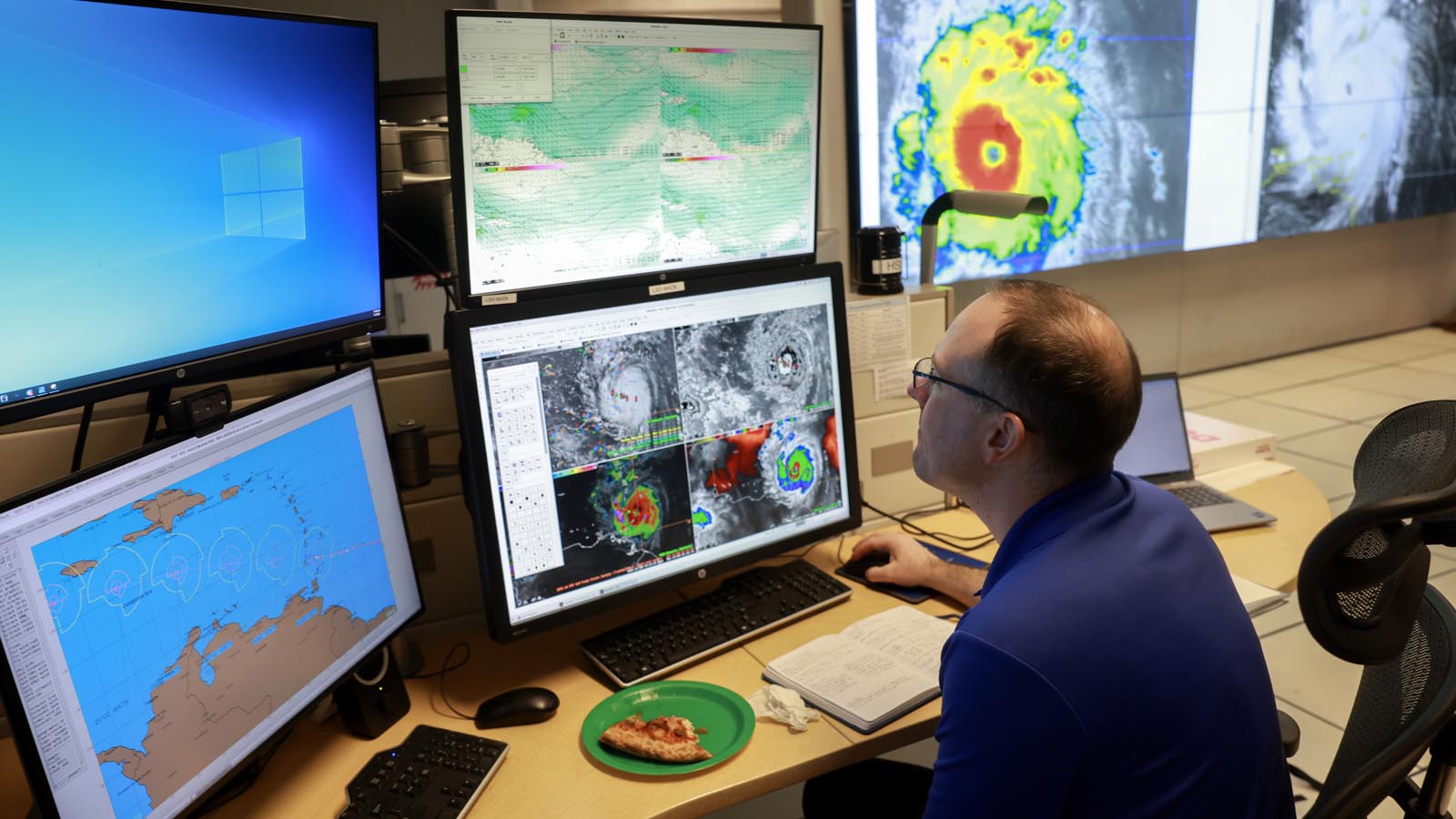

Evaluating Hurricane Forecast Models Your 2025 Guide

May 28, 2025

Evaluating Hurricane Forecast Models Your 2025 Guide

May 28, 2025 -

Is Doc Rivers The Answer Milwaukee Bucks Risky Strategy To Retain Giannis

May 28, 2025

Is Doc Rivers The Answer Milwaukee Bucks Risky Strategy To Retain Giannis

May 28, 2025 -

Milwaukee Bucks Uncertain Future Is Doc Rivers The Answer To Retaining Giannis

May 28, 2025

Milwaukee Bucks Uncertain Future Is Doc Rivers The Answer To Retaining Giannis

May 28, 2025

Latest Posts

-

Witness The Anguish Un Envoy Breaks Down In Tears Over Gaza Child Casualties

May 30, 2025

Witness The Anguish Un Envoy Breaks Down In Tears Over Gaza Child Casualties

May 30, 2025 -

Tesco Installs Var Style Cameras At Self Checkouts The Public Responds

May 30, 2025

Tesco Installs Var Style Cameras At Self Checkouts The Public Responds

May 30, 2025 -

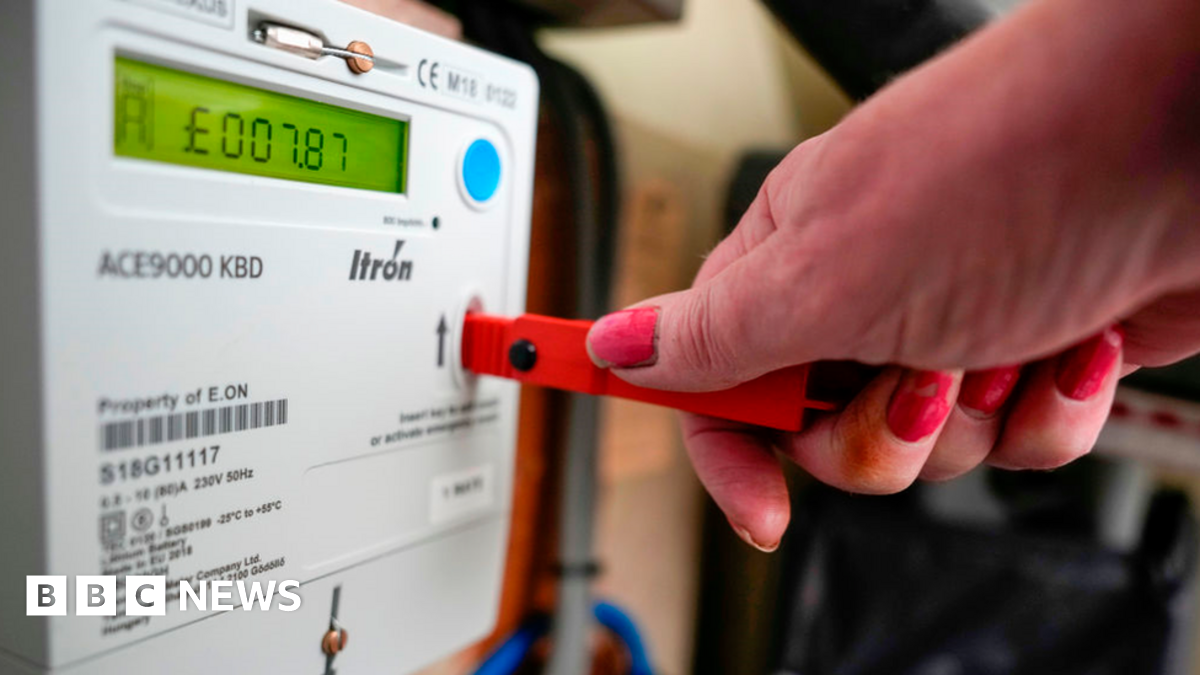

Public Outrage Thousands In Line For Compensation After Meter Fitting Scandal

May 30, 2025

Public Outrage Thousands In Line For Compensation After Meter Fitting Scandal

May 30, 2025 -

Sex Party Scandal Escorts Apology To Cassie After Diddy Party

May 30, 2025

Sex Party Scandal Escorts Apology To Cassie After Diddy Party

May 30, 2025 -

73 Year Old George Strait Overcome With Grief During Heartbreaking Eulogy

May 30, 2025

73 Year Old George Strait Overcome With Grief During Heartbreaking Eulogy

May 30, 2025