SiriusXM Holdings: A Millionaire-Making Stock? Pros, Cons, And Investment Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SiriusXM Holdings: A Millionaire-Making Stock? Pros, Cons, and Investment Analysis

SiriusXM Holdings (SIRI) has captivated investors for years, sparking the question: could this satellite radio giant be the key to building a millionaire-making portfolio? While no investment guarantees riches, understanding the pros and cons of SiriusXM, coupled with a thorough investment analysis, is crucial for any potential investor. This article delves into the intricacies of SiriusXM's performance, exploring its potential for growth and the risks involved.

The Allure of SiriusXM: Why Investors Are Intrigued

SiriusXM's unique business model, offering ad-free music and premium content, provides a compelling value proposition. This has led to a loyal subscriber base, forming a solid foundation for revenue generation. Several factors contribute to its appeal as a potential millionaire-maker:

- Recurring Revenue Streams: The subscription-based nature of the business ensures consistent cash flow, a crucial element for long-term growth and stability. This predictable revenue is attractive to investors seeking lower risk.

- Market Dominance: SiriusXM enjoys a dominant position in the satellite radio market, minimizing direct competition and maximizing its pricing power.

- Content Diversification: The company continually expands its content offerings, including sports, talk radio, and exclusive artist channels, attracting a broader audience and boosting subscriber acquisition.

- Potential for Expansion: Opportunities for growth exist through technological advancements, such as integrating with smart cars and expanding into new geographical markets.

Navigating the Challenges: Potential Downsides of Investing in SiriusXM

Despite its strengths, investing in SiriusXM isn't without risks. Potential investors must carefully consider:

- Competition from Streaming Services: The rise of streaming services like Spotify and Apple Music poses a significant challenge, attracting listeners with vast music libraries and on-demand capabilities.

- Dependence on the Automotive Industry: A significant portion of SiriusXM's subscriber base comes from car manufacturers. Slowdowns in the auto industry could directly impact subscriber growth.

- Debt Levels: SiriusXM carries a substantial amount of debt, which can impact profitability and potentially limit its ability to pursue growth opportunities.

- Content Costs: Maintaining a diverse and high-quality content library requires significant investment, affecting profitability margins.

Investment Analysis: A Deeper Dive into SIRI Stock

To determine if SiriusXM is right for your portfolio, consider these key aspects:

- Financial Performance: Analyze SiriusXM's revenue growth, profit margins, and cash flow trends over time. Pay attention to key financial metrics like Earnings Per Share (EPS) and Return on Equity (ROE). Reliable financial data can be found on websites like and .

- Valuation: Compare SiriusXM's current market capitalization to its fundamental value. Consider metrics like the Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio, comparing them to industry averages and historical data to gauge whether the stock is overvalued or undervalued.

- Growth Prospects: Analyze the company's future growth potential, considering factors like subscriber acquisition rates, technological advancements, and competitive pressures.

- Risk Tolerance: Assess your own risk tolerance. Investing in SiriusXM involves inherent risks; it's not a risk-free investment.

Conclusion: Is SiriusXM a Millionaire-Making Stock?

Whether SiriusXM can propel you to millionaire status depends on various factors, including your investment timeframe, risk tolerance, and overall portfolio strategy. While the company exhibits strong fundamentals, the competitive landscape and inherent risks necessitate careful consideration. Conduct thorough due diligence, diversify your investments, and consult with a financial advisor before making any investment decisions. SiriusXM's future success, and its impact on your portfolio, hinges on its ability to navigate the evolving media landscape and maintain its subscriber base. Remember, consistent, long-term investment strategies often yield the best results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SiriusXM Holdings: A Millionaire-Making Stock? Pros, Cons, And Investment Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

California To Germany My Story Of Unexpected Regret

May 27, 2025

California To Germany My Story Of Unexpected Regret

May 27, 2025 -

Coffee Grounds Gardening 3 Simple Techniques For Healthy Plants

May 27, 2025

Coffee Grounds Gardening 3 Simple Techniques For Healthy Plants

May 27, 2025 -

Driving Instructors And Learners Clash Over Rising Test Fees

May 27, 2025

Driving Instructors And Learners Clash Over Rising Test Fees

May 27, 2025 -

Social Security Benefit Increase Expect Payments Up To 5 108 This Week

May 27, 2025

Social Security Benefit Increase Expect Payments Up To 5 108 This Week

May 27, 2025 -

Increased Risk Of Invasive Fungal Infections Linked To Climate Change

May 27, 2025

Increased Risk Of Invasive Fungal Infections Linked To Climate Change

May 27, 2025

Latest Posts

-

French Broadcasters Remove Macrons Political Advertisement

May 30, 2025

French Broadcasters Remove Macrons Political Advertisement

May 30, 2025 -

French Open Live Follow Sinner Draper Djokovic And Gauff On Day 5

May 30, 2025

French Open Live Follow Sinner Draper Djokovic And Gauff On Day 5

May 30, 2025 -

High Profile Jailbreaks Why America Remains Captivated By Manhunts

May 30, 2025

High Profile Jailbreaks Why America Remains Captivated By Manhunts

May 30, 2025 -

Henrique Rocha Estoria De Sucesso Na Estreia Em Roland Garros

May 30, 2025

Henrique Rocha Estoria De Sucesso Na Estreia Em Roland Garros

May 30, 2025 -

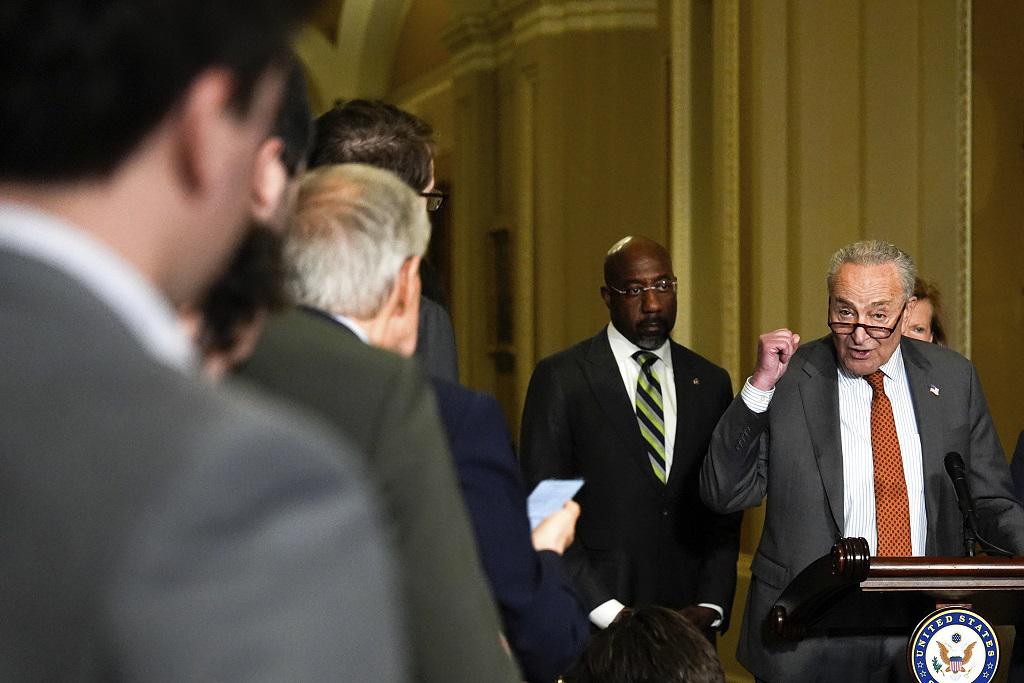

Democrats Gain Leverage Blocking The Big Beautiful Bill

May 30, 2025

Democrats Gain Leverage Blocking The Big Beautiful Bill

May 30, 2025