SiriusXM Holdings: Analyzing The Stock's Recent Success And Future Potential.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SiriusXM Holdings: Riding High or Headed for a Fall? Analyzing the Stock's Recent Success and Future Potential

SiriusXM Holdings (SIRI) has seen a surge in its stock price recently, leaving many investors wondering: is this sustainable growth, or is it a temporary bump in the road? This in-depth analysis explores the factors contributing to SiriusXM's recent success and assesses its future potential, offering insights for investors considering adding this stock to their portfolio.

The Drivers of SiriusXM's Recent Success:

Several key factors have contributed to SiriusXM's positive momentum. Firstly, the company's robust subscriber growth continues to be a major driver. Despite the rise of streaming services, SiriusXM's unique offering of ad-free music, sports, and talk radio continues to resonate with a broad audience. Their strategic expansion into various niches, including podcasting and exclusive content, has also broadened their appeal and attracted new subscribers.

Secondly, SiriusXM's successful cost-cutting measures and improved operational efficiency have boosted profitability. This allows the company to reinvest in its platform, enhancing the user experience and further attracting new subscribers. Improved margins signify a healthier financial standing, a crucial factor influencing investor confidence.

Finally, strategic partnerships and acquisitions have expanded SiriusXM's reach and diversified its revenue streams. These moves, carefully planned and executed, have significantly contributed to the company's overall growth trajectory. For example, their foray into connected car services opens up substantial new revenue opportunities.

H2: Challenges and Risks Facing SiriusXM:

Despite the positive trends, SiriusXM faces significant challenges. The increasing competition from streaming services offering similar audio content remains a considerable threat. Maintaining subscriber growth in a highly competitive landscape requires continuous innovation and investment. Further, economic downturns could impact consumer spending, potentially affecting subscriber acquisition and retention.

Another key concern is churn rate. While subscriber growth remains positive, maintaining low churn is crucial for sustained growth. Any significant increase in churn could negatively impact the company's financial performance. Furthermore, the evolving media landscape necessitates constant adaptation and investment in new technologies.

H2: Future Potential: A Look Ahead

SiriusXM's future potential hinges on several key factors:

- Maintaining subscriber growth: Continuing to attract new subscribers and retain existing ones will be paramount.

- Innovation and technological advancements: Investing in new technologies and expanding its content offerings to stay competitive is crucial.

- Strategic partnerships: Leveraging successful collaborations and exploring new strategic alliances will be key.

- Expansion into new markets: Exploring international expansion opportunities could unlock significant growth potential.

H3: What Investors Should Consider:

Investors should carefully weigh the risks and rewards before investing in SiriusXM. The company's recent success is encouraging, but the challenges remain significant. Thorough due diligence, including a review of financial statements and future growth projections, is essential. Diversifying your investment portfolio is always recommended to mitigate risk.

H2: Conclusion: A Cautiously Optimistic Outlook

SiriusXM Holdings exhibits a compelling blend of strengths and challenges. While the recent success is encouraging, maintaining this momentum requires continuous innovation and adaptation. Investors should adopt a cautiously optimistic outlook, acknowledging both the potential for continued growth and the inherent risks associated with the competitive media landscape. Further research and careful consideration of your personal investment strategy are crucial before making any decisions. Consult with a financial advisor for personalized guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SiriusXM Holdings: Analyzing The Stock's Recent Success And Future Potential.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

King Charles In Canada A Successful Visit Amidst Political Tensions With Trump

May 28, 2025

King Charles In Canada A Successful Visit Amidst Political Tensions With Trump

May 28, 2025 -

Royal Intervention King Rallies Behind Canada Amidst Us Trade Dispute

May 28, 2025

Royal Intervention King Rallies Behind Canada Amidst Us Trade Dispute

May 28, 2025 -

Emotional Tribute Fans Mourn Nadals French Open Departure

May 28, 2025

Emotional Tribute Fans Mourn Nadals French Open Departure

May 28, 2025 -

Residents Fight Back New Housing Approved In Historic Village Lacking Sewage Infrastructure

May 28, 2025

Residents Fight Back New Housing Approved In Historic Village Lacking Sewage Infrastructure

May 28, 2025 -

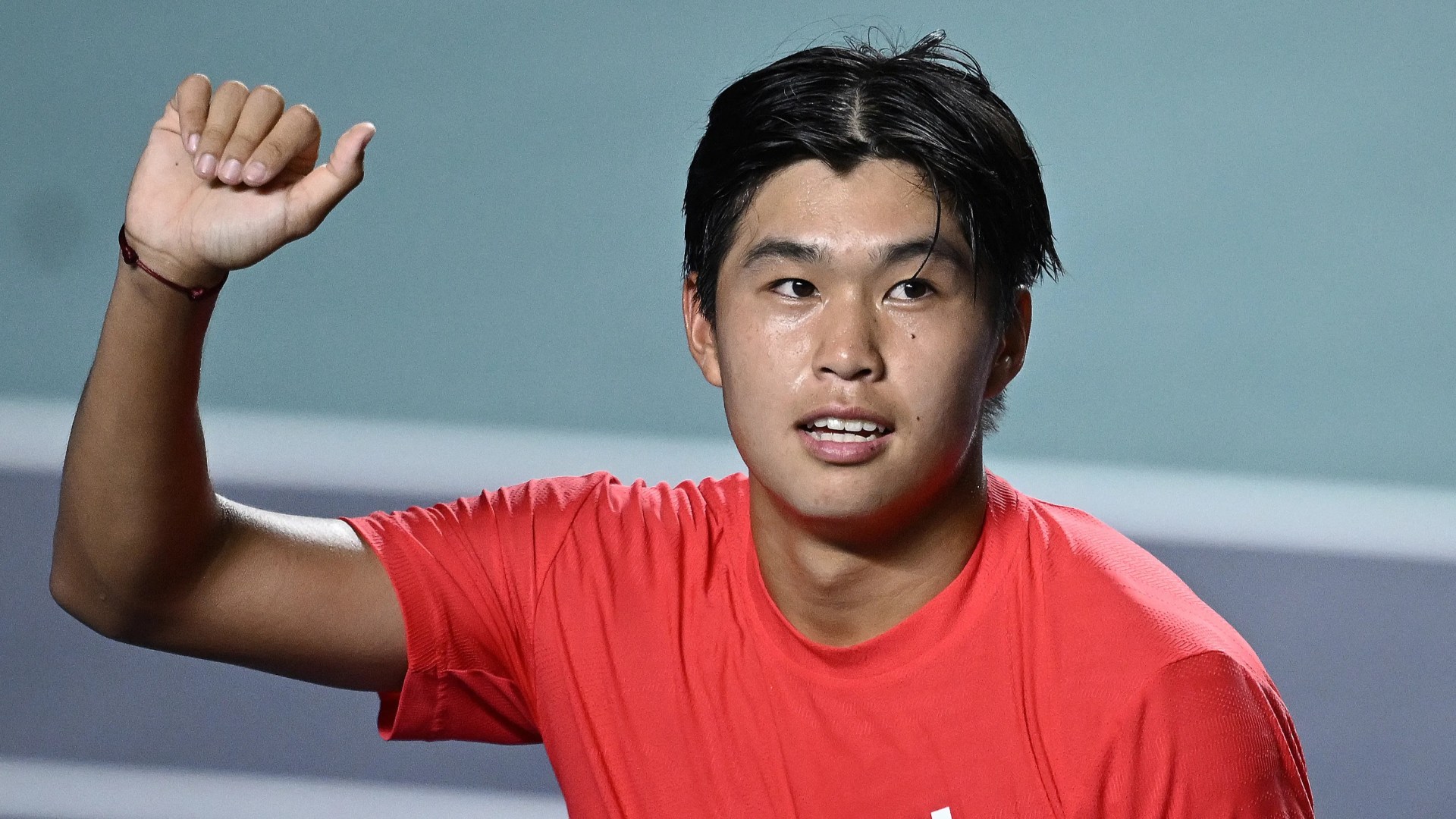

A Mothers Legacy Us Tennis Sensation Eyes Victory Against World No 3

May 28, 2025

A Mothers Legacy Us Tennis Sensation Eyes Victory Against World No 3

May 28, 2025

Latest Posts

-

Harvards Elitism Fueling Trumps Political Attacks

May 29, 2025

Harvards Elitism Fueling Trumps Political Attacks

May 29, 2025 -

Cnn Investigation Into Truck Explosion After Possible Propane Leak

May 29, 2025

Cnn Investigation Into Truck Explosion After Possible Propane Leak

May 29, 2025 -

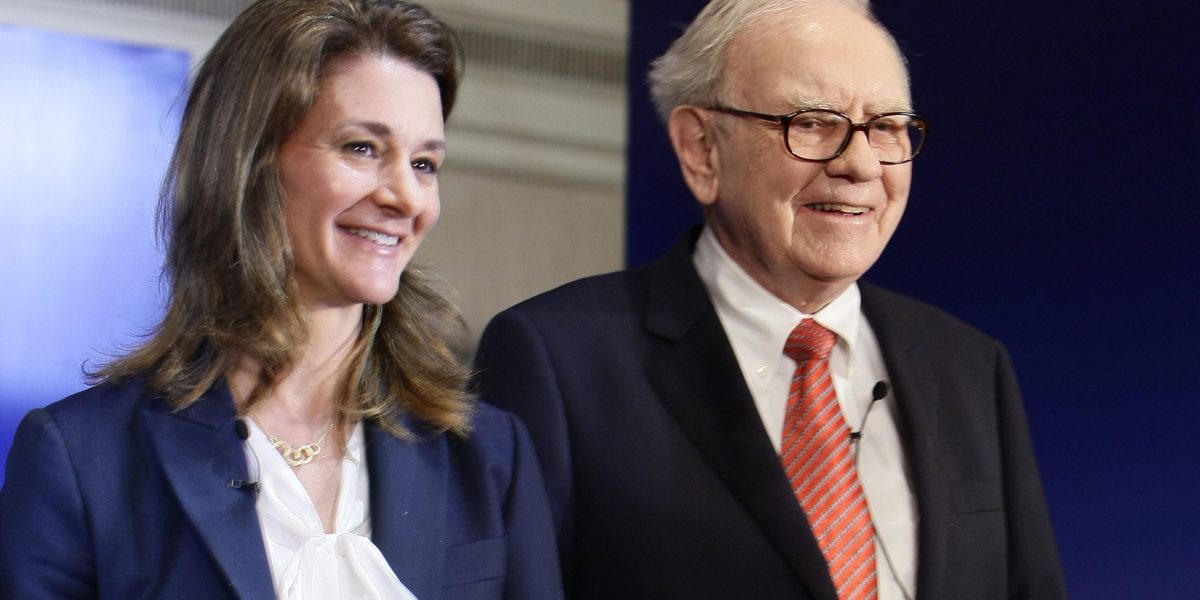

Hundreds Of Billionaires Pledge 600 Billion A New Era Of Giving

May 29, 2025

Hundreds Of Billionaires Pledge 600 Billion A New Era Of Giving

May 29, 2025 -

Rising Beef Prices Key Driver Of Years Highest Food Inflation

May 29, 2025

Rising Beef Prices Key Driver Of Years Highest Food Inflation

May 29, 2025 -

Alexandra Daddarios Bold Choice A Sheer Gown At The Dior Cruise Collection

May 29, 2025

Alexandra Daddarios Bold Choice A Sheer Gown At The Dior Cruise Collection

May 29, 2025