SiriusXM Holdings Investment: Weighing The Risks And Rewards For Potential Millionaires

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SiriusXM Holdings Investment: Weighing the Risks and Rewards for Potential Millionaires

SiriusXM Holdings Inc. (SIRI), the satellite radio giant, has seen its stock price fluctuate significantly in recent years, presenting both enticing opportunities and considerable risks for potential millionaire investors. Is now the right time to invest in SiriusXM, and what factors should high-net-worth individuals consider before committing significant capital? Let's delve into the potential rewards and risks.

The Allure of SiriusXM: Potential for High Returns

SiriusXM's appeal lies in its unique position within the entertainment landscape. With a largely subscription-based revenue model, the company enjoys predictable cash flows, a significant advantage in an increasingly volatile market. This stability, coupled with potential growth avenues, makes it attractive to investors seeking long-term gains.

- Dominant Market Share: SiriusXM holds a near-monopoly in satellite radio, providing a strong foundation for revenue generation.

- Expanding Content Offerings: The company continues to invest in diverse programming, including music, sports, news, and talk radio, catering to a broad audience. This expansion aims to attract and retain subscribers.

- Potential for Technological Advancements: As the automotive industry embraces technological integration, SiriusXM's presence in connected cars presents significant growth opportunities. The integration of their services into newer vehicle models provides a steady stream of new subscribers.

Navigating the Risks: Understanding the Challenges

Despite its strengths, SiriusXM faces several challenges that potential investors must carefully consider:

- Competition from Streaming Services: The rise of streaming services like Spotify and Apple Music poses a significant threat to SiriusXM's subscriber base. The competition for listener attention is fierce.

- Economic Downturn Sensitivity: As a discretionary spending item, SiriusXM subscriptions might be vulnerable during economic downturns. Investors should consider the cyclical nature of the business.

- Debt Levels: SiriusXM carries a substantial amount of debt, which could impact its financial flexibility and profitability during challenging economic conditions.

Analyzing the Investment Landscape for High-Net-Worth Individuals

For high-net-worth individuals, a SiriusXM investment should be a component of a diversified portfolio, not a sole focus. Consider these factors:

- Risk Tolerance: High-net-worth investors with a higher risk tolerance might find SiriusXM's potential for growth appealing, even with the associated risks. However, careful due diligence is crucial.

- Long-Term Investment Strategy: SiriusXM is a long-term play. Investors should not expect quick, short-term gains. A long-term perspective is necessary to see significant returns.

- Diversification: Spreading investments across various asset classes is crucial to mitigate risk. SiriusXM shouldn't be the only stock in your portfolio.

Where to Learn More:

To conduct thorough due diligence, consult financial professionals and research reputable financial news sources. Websites like the provide crucial company filings and information.

Conclusion: A Calculated Risk for the Savvy Investor

SiriusXM presents a compelling investment opportunity for potential millionaires with a long-term perspective and a moderate to high-risk tolerance. However, a thorough understanding of the company's strengths, weaknesses, and the broader market landscape is critical before making any investment decisions. Remember to consult with a financial advisor to determine if SiriusXM aligns with your individual financial goals and risk profile. The potential for significant returns exists, but careful consideration of the risks is paramount.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SiriusXM Holdings Investment: Weighing The Risks And Rewards For Potential Millionaires. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Orthodox Christianitys Appeal To Young Men A Look At The Growing Us Following

May 27, 2025

Orthodox Christianitys Appeal To Young Men A Look At The Growing Us Following

May 27, 2025 -

Photos De Macron Et Brigitte Au Vietnam Dementi Formel De L Elysee

May 27, 2025

Photos De Macron Et Brigitte Au Vietnam Dementi Formel De L Elysee

May 27, 2025 -

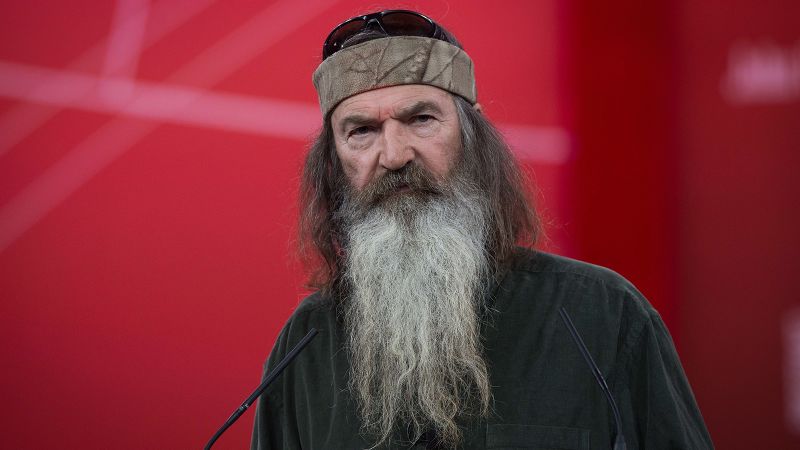

Farewell To Phil Robertson Duck Dynasty Star Dies At Age 79

May 27, 2025

Farewell To Phil Robertson Duck Dynasty Star Dies At Age 79

May 27, 2025 -

Ukraine Capital Targeted Russias Aerial Offensive Follows Prisoner Exchange

May 27, 2025

Ukraine Capital Targeted Russias Aerial Offensive Follows Prisoner Exchange

May 27, 2025 -

Benefit Cap Changes Rayner Remains Tight Lipped On Abolition

May 27, 2025

Benefit Cap Changes Rayner Remains Tight Lipped On Abolition

May 27, 2025

Latest Posts

-

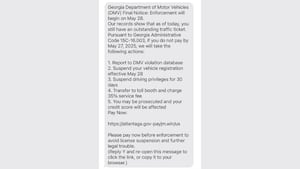

Beware Georgia Dmv Text Scam Targeting Drivers

May 28, 2025

Beware Georgia Dmv Text Scam Targeting Drivers

May 28, 2025 -

Major Blast Rocks Chinese Chemical Plant Authorities Battle To Contain Aftermath

May 28, 2025

Major Blast Rocks Chinese Chemical Plant Authorities Battle To Contain Aftermath

May 28, 2025 -

Chinese Chemical Plant Explosion Rescue Operation Underway After Major Blast

May 28, 2025

Chinese Chemical Plant Explosion Rescue Operation Underway After Major Blast

May 28, 2025 -

Protect Yourself How To Spot And Avoid The Georgia Dmv Imposter Scam

May 28, 2025

Protect Yourself How To Spot And Avoid The Georgia Dmv Imposter Scam

May 28, 2025 -

Us Backed Gaza Aid Group Begins Distribution A New Chapter In Relief Efforts

May 28, 2025

Us Backed Gaza Aid Group Begins Distribution A New Chapter In Relief Efforts

May 28, 2025