SiriusXM Holdings' Performance: Should You Invest Now?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SiriusXM Holdings' Performance: Should You Invest Now?

SiriusXM Holdings Inc. (SIRI), a leading provider of satellite radio and streaming audio services, has seen its stock performance fluctuate in recent years. While the company boasts a loyal subscriber base and a strong brand, potential investors are grappling with questions about its future growth and the viability of its business model in a rapidly evolving entertainment landscape. This article delves into SiriusXM's recent performance, analyzing its strengths and weaknesses to help you determine if it's the right investment for you.

SiriusXM's Recent Financial Highlights:

SiriusXM's financial performance has been a mixed bag. While subscriber numbers have generally grown, the company faces challenges in maintaining consistent revenue growth and profitability. Recent quarterly reports should be carefully examined for key metrics such as:

- Subscriber Growth: Analyze the net addition of subscribers, both paid and trial, to gauge the strength of the company's customer acquisition strategy. A consistently growing subscriber base is a positive indicator.

- Average Revenue Per User (ARPU): This metric indicates the average revenue generated per subscriber. Increases in ARPU suggest successful pricing strategies or the uptake of premium services.

- Operating Income and Margins: Tracking these figures helps understand the profitability and efficiency of the company's operations. Consistent growth in operating income is a favorable sign.

- Debt Levels: High debt levels can pose a risk to the company's financial stability. Examining SiriusXM's debt-to-equity ratio is crucial.

Strengths of SiriusXM:

- Established Brand and Subscriber Base: SiriusXM enjoys brand recognition and a large, loyal subscriber base, providing a solid foundation for future growth.

- Diversification Efforts: The company is expanding its offerings beyond satellite radio, including streaming services and partnerships with other entertainment companies, which helps mitigate reliance on a single revenue stream. This diversification is crucial in a competitive market.

- Exclusive Content: SiriusXM offers exclusive programming and personalities, providing a unique value proposition to subscribers. This differentiation from other streaming services is key.

Weaknesses of SiriusXM:

- Competition from Streaming Services: The rise of streaming services like Spotify and Apple Music presents significant competition, forcing SiriusXM to innovate and adapt to maintain its market share.

- Dependence on the Automotive Industry: A significant portion of SiriusXM's revenue is derived from partnerships with automakers. Economic downturns affecting the automotive sector could negatively impact SiriusXM's performance.

- High Debt Levels: As mentioned earlier, high debt levels can pose a financial risk, especially during economic uncertainty.

Should You Invest in SiriusXM?

The decision to invest in SiriusXM requires careful consideration of its strengths, weaknesses, and the broader market conditions. While the company has a strong subscriber base and is attempting diversification, the competitive landscape and high debt levels present significant challenges.

Before making any investment decisions, it's crucial to:

- Conduct thorough due diligence: Independently research SiriusXM's financial statements, industry analyses, and future growth prospects.

- Consult with a financial advisor: A financial advisor can offer personalized advice based on your individual financial situation and risk tolerance.

- Monitor market trends: Stay informed about industry developments and competitive pressures affecting SiriusXM.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in the stock market involves risk, and you could lose money.

Further Reading: For more in-depth financial analysis, you can consult resources like the Securities and Exchange Commission (SEC) filings and reputable financial news websites. (replace with a working link if possible).

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SiriusXM Holdings' Performance: Should You Invest Now?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Alabama Based Firm Divests Bank Of America Holdings Birmingham Capital Managements Recent Activity

May 28, 2025

Alabama Based Firm Divests Bank Of America Holdings Birmingham Capital Managements Recent Activity

May 28, 2025 -

Wwii Bomber Crash 11 Dead 4 Finally Identified And Returned Home

May 28, 2025

Wwii Bomber Crash 11 Dead 4 Finally Identified And Returned Home

May 28, 2025 -

Pdd Holdings Q1 2025 Earnings Release Analysis And Predictions

May 28, 2025

Pdd Holdings Q1 2025 Earnings Release Analysis And Predictions

May 28, 2025 -

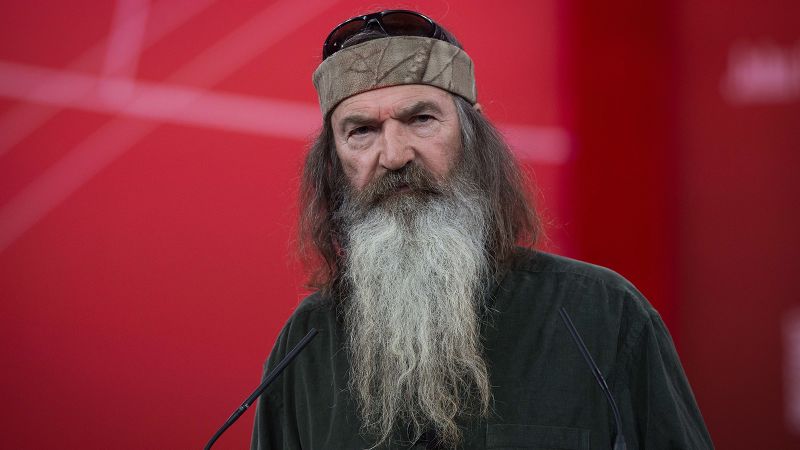

Duck Dynastys Phil Robertson Passes Away Fans Mourn The Loss Of A Legend

May 28, 2025

Duck Dynastys Phil Robertson Passes Away Fans Mourn The Loss Of A Legend

May 28, 2025 -

Latest Nba Trade Buzz Dallas Mavericks Target Holiday And Ball Bucks Keep Antetokounmpo

May 28, 2025

Latest Nba Trade Buzz Dallas Mavericks Target Holiday And Ball Bucks Keep Antetokounmpo

May 28, 2025

Latest Posts

-

Heart Attack Deaths Under 50 Understanding The Risks Among Partners

May 29, 2025

Heart Attack Deaths Under 50 Understanding The Risks Among Partners

May 29, 2025 -

Livestock At Risk How Climate Change Denial Could Lead To Pest Resurgence

May 29, 2025

Livestock At Risk How Climate Change Denial Could Lead To Pest Resurgence

May 29, 2025 -

Trumps 51st State Push A Counterpoint To King Charles Canadian Tour

May 29, 2025

Trumps 51st State Push A Counterpoint To King Charles Canadian Tour

May 29, 2025 -

Kfcs Investment In Uk And Ireland 7 000 Jobs Created

May 29, 2025

Kfcs Investment In Uk And Ireland 7 000 Jobs Created

May 29, 2025 -

Giannis Antetokounmpo Trade Unexpected Contenders And Potential Deals

May 29, 2025

Giannis Antetokounmpo Trade Unexpected Contenders And Potential Deals

May 29, 2025