SiriusXM Holdings: Should You Invest Or Walk Away? Examining The Stock's Performance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SiriusXM Holdings: Should You Invest or Walk Away? Examining the Stock's Performance

SiriusXM Holdings (SIRI) has been a source of both excitement and concern for investors. This satellite radio giant boasts a massive subscriber base, but its stock performance has been a rollercoaster in recent years. So, is now the time to buy, sell, or hold? Let's delve into the current state of SiriusXM and explore whether it's a worthwhile investment.

Understanding SiriusXM's Business Model

SiriusXM's primary revenue stream comes from its subscription service, offering ad-free music, sports, news, talk radio, and entertainment across various platforms. This model provides a predictable revenue stream, but it's also susceptible to churn – the loss of subscribers. The company has successfully expanded its offerings beyond traditional satellite radio, incorporating streaming services and partnerships to broaden its reach and appeal to a younger demographic.

Recent Stock Performance and Financial Health:

Over the past year, SIRI has shown [insert recent stock performance data, e.g., a modest increase/decrease, citing percentage change and specific time frame]. While this might seem [positive/negative], a deeper dive into the financials reveals [insert key financial indicators like revenue growth, earnings per share (EPS), debt levels, etc. Include specific numbers and compare to previous periods]. This data suggests [state your interpretation – e.g., a healthy financial position, concerns about profitability, or a period of transition].

Factors Influencing SiriusXM's Future:

Several factors will significantly impact SiriusXM's future performance:

- Competition: The streaming music market is fiercely competitive. Services like Spotify and Apple Music pose a significant challenge, attracting subscribers with vast music libraries and lower price points. SiriusXM's ability to innovate and differentiate its offerings is crucial for maintaining its market share.

- Technological Advancements: The increasing popularity of connected cars and smart devices presents both opportunities and challenges. Integration with these platforms is essential for growth, but it also requires significant investment.

- Subscription Prices: Maintaining subscriber loyalty while balancing profitability necessitates careful management of subscription pricing. Increasing prices too aggressively could lead to churn, while keeping them too low might impact profitability.

- Content Acquisition Costs: Securing high-quality programming and securing exclusive rights to popular content is vital. These costs can significantly impact profitability and are subject to market fluctuations.

Should You Invest?

The decision of whether to invest in SiriusXM is ultimately a personal one, depending on your risk tolerance and investment goals. While the company possesses a strong subscriber base and a relatively stable revenue stream, the competitive landscape and the challenges of navigating the evolving media landscape present significant risks.

Potential Upsides:

- Established Brand Recognition: SiriusXM enjoys strong brand recognition and customer loyalty.

- Diverse Revenue Streams: The company's diversification beyond satellite radio reduces reliance on a single revenue source.

- Potential for Growth in Connected Cars: The integration of SiriusXM into connected car systems offers significant growth potential.

Potential Downsides:

- Fierce Competition: The streaming market is highly competitive, and SiriusXM faces significant challenges from established players.

- Dependence on Subscription Revenue: The company's reliance on subscription revenue makes it vulnerable to subscriber churn.

- High Debt Levels: [If applicable, mention high debt levels and their potential impact].

Before making any investment decisions, it is crucial to conduct thorough due diligence, consult with a financial advisor, and consider your own risk tolerance. This analysis provides a general overview and should not be considered financial advice.

Related Articles:

- [Link to an article about the streaming music market]

- [Link to an article about the automotive industry and connected cars]

- [Link to an article about investing in technology stocks]

Disclaimer: This article is for informational purposes only and does not constitute financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SiriusXM Holdings: Should You Invest Or Walk Away? Examining The Stock's Performance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

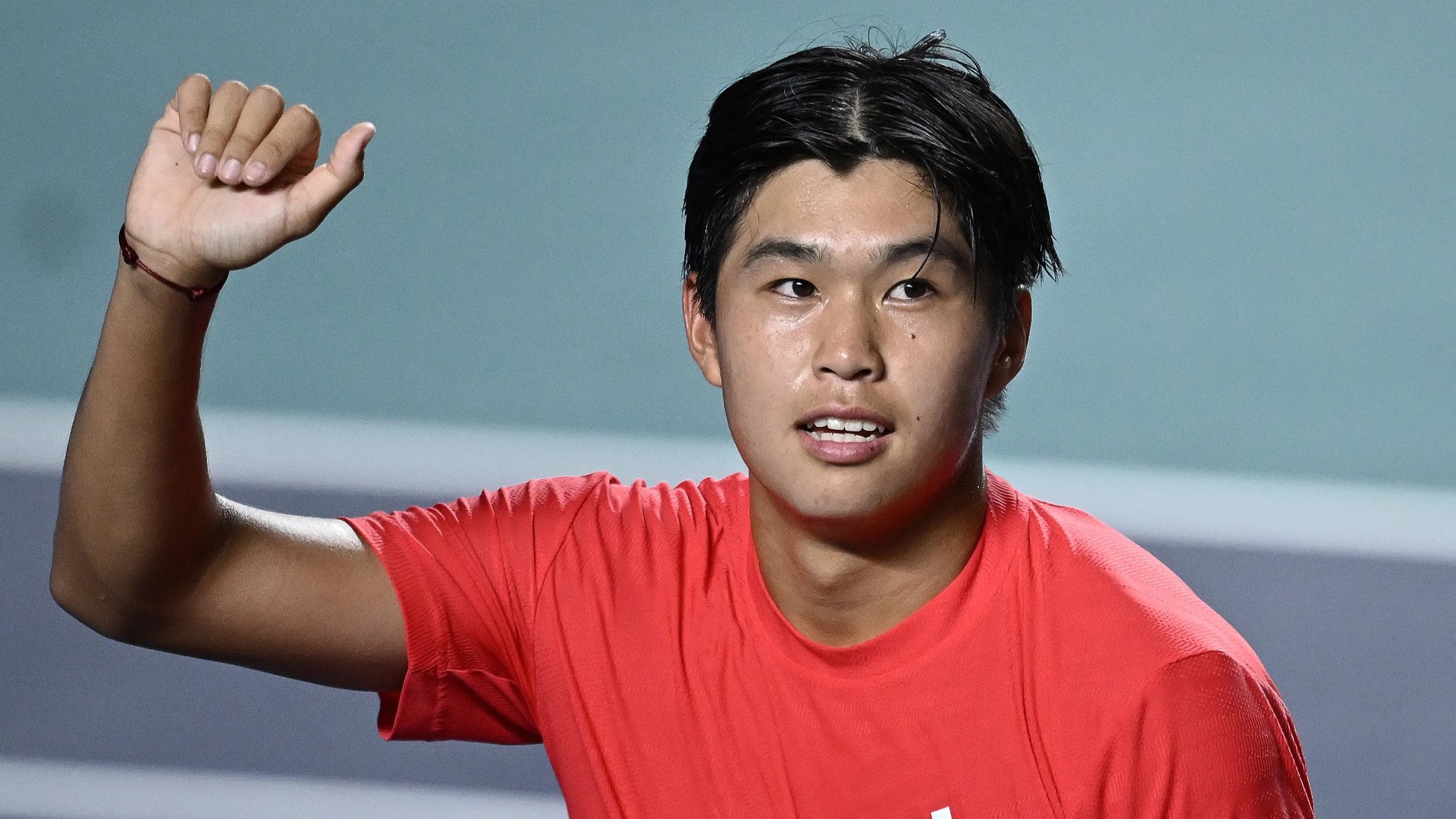

Facing The World No 3 The Story Of The Us Tennis Prodigy With A Unique Name

May 27, 2025

Facing The World No 3 The Story Of The Us Tennis Prodigy With A Unique Name

May 27, 2025 -

Less Than A Week On Everest The Risks Of Accelerated Ascents With Anesthetic Gas

May 27, 2025

Less Than A Week On Everest The Risks Of Accelerated Ascents With Anesthetic Gas

May 27, 2025 -

Giancarlo Stanton From Bronx Bombers To Seattle Mariners A New Chapter Begins

May 27, 2025

Giancarlo Stanton From Bronx Bombers To Seattle Mariners A New Chapter Begins

May 27, 2025 -

Memorial Day Weekend 73 Arrests Highlight Beach Towns Lawlessness

May 27, 2025

Memorial Day Weekend 73 Arrests Highlight Beach Towns Lawlessness

May 27, 2025 -

How Family And Friends Remember George Floyds Life

May 27, 2025

How Family And Friends Remember George Floyds Life

May 27, 2025

Latest Posts

-

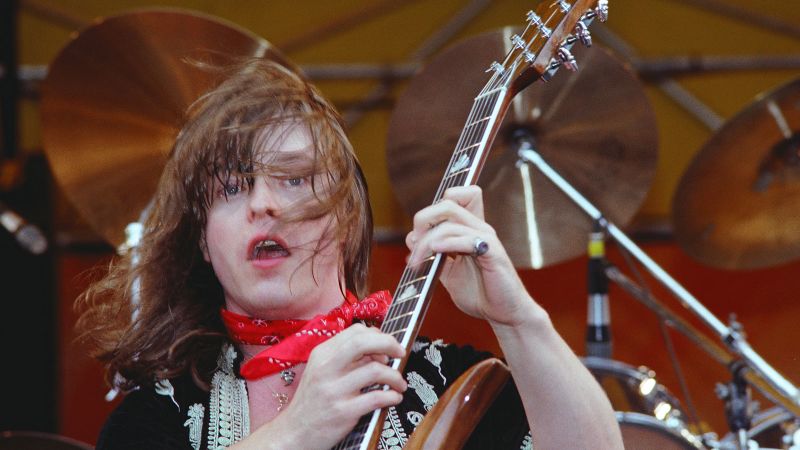

Rick Derringer 77 A Talented Guitarists Life And Death

May 30, 2025

Rick Derringer 77 A Talented Guitarists Life And Death

May 30, 2025 -

73 Year Old Country Icon George Straits Emotional Farewell A Moving Eulogy

May 30, 2025

73 Year Old Country Icon George Straits Emotional Farewell A Moving Eulogy

May 30, 2025 -

Roland Garros Djokovic Gauff Sinner And Draper In Action Day 5

May 30, 2025

Roland Garros Djokovic Gauff Sinner And Draper In Action Day 5

May 30, 2025 -

England Cricket News Smith Gets Odi Nod Against West Indies

May 30, 2025

England Cricket News Smith Gets Odi Nod Against West Indies

May 30, 2025 -

Investigation Launched Following Meter Fitting Scandal Thousands Seek Redress

May 30, 2025

Investigation Launched Following Meter Fitting Scandal Thousands Seek Redress

May 30, 2025