SiriusXM Holdings: Should You Invest? Weighing The Risks And Rewards

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SiriusXM Holdings: Should You Invest? Weighing the Risks and Rewards

SiriusXM Holdings (SIRI) has carved a niche for itself in the audio entertainment landscape, offering satellite radio and a growing on-demand streaming service. But is it a smart investment for your portfolio? This in-depth analysis explores the potential rewards and risks associated with investing in SiriusXM, helping you make an informed decision.

The Allure of SiriusXM: A Look at the Strengths

SiriusXM's success stems from its unique value proposition: commercial-free music, sports, talk, and entertainment, accessible across a wide range of devices. This has fostered a loyal subscriber base, a crucial factor in its financial stability. Several key strengths bolster its investment appeal:

- Strong Subscriber Base: SiriusXM boasts a substantial and relatively stable subscriber count, providing a predictable revenue stream. This recurring revenue model is a significant advantage in the volatile media industry.

- Diversification Strategy: The company's expansion into on-demand streaming services, like Pandora, has broadened its reach and target audience, mitigating reliance on its core satellite radio business. This diversification strategy is crucial in navigating the ever-evolving media consumption habits.

- Exclusive Content and Partnerships: Securing exclusive rights to sports programming and collaborations with popular personalities adds value and attracts new subscribers. This strategic content acquisition strengthens its competitive advantage.

- Cost Advantages: Its satellite infrastructure represents a considerable barrier to entry for competitors, creating a moat around its business. This significant infrastructure investment contributes to its competitive edge.

Navigating the Challenges: Potential Risks to Consider

Despite the apparent strengths, investing in SiriusXM isn't without its challenges:

- Competition from Streaming Services: The rise of free and paid streaming services like Spotify and Apple Music presents stiff competition, forcing SiriusXM to constantly innovate and adapt. This competitive landscape necessitates continuous investment in technology and content.

- Dependence on Automotive Sales: A significant portion of SiriusXM’s subscriber base comes from new car sales. Economic downturns or shifts in consumer preferences toward used vehicles can negatively impact subscriber growth. This correlation between automotive sales and subscription numbers poses a significant risk.

- Regulatory Scrutiny: The media industry is subject to ongoing regulatory scrutiny, and any significant changes in regulations could impact SiriusXM's operations. Keeping abreast of regulatory changes is critical for investors.

- Debt Levels: SiriusXM carries a considerable amount of debt. While manageable currently, a significant economic downturn could strain its financial position. Analyzing its debt-to-equity ratio is crucial before investing.

Should You Invest? A Balanced Perspective

The decision to invest in SiriusXM requires careful consideration of your risk tolerance and investment goals. While its strong subscriber base and diversification efforts are positive indicators, the competitive pressures and dependence on automotive sales present inherent risks.

Before making any investment decisions, thoroughly research SiriusXM’s financial statements, including its income statement, balance sheet, and cash flow statement. Consider consulting with a financial advisor to determine if SiriusXM aligns with your individual investment strategy.

Further Research:

For more detailed financial information, visit the official SiriusXM investor relations website: [Insert Link to SiriusXM Investor Relations]. You can also access their SEC filings through the SEC's EDGAR database: [Insert Link to SEC EDGAR].

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Conduct thorough research and seek professional guidance before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SiriusXM Holdings: Should You Invest? Weighing The Risks And Rewards. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Upcycle Your Coffee Grounds 3 Benefits For Your Garden

May 27, 2025

Upcycle Your Coffee Grounds 3 Benefits For Your Garden

May 27, 2025 -

Kyiv Under Attack Russias Aerial Assault And The Prisoner Exchange

May 27, 2025

Kyiv Under Attack Russias Aerial Assault And The Prisoner Exchange

May 27, 2025 -

The Most Uncomfortable Scene In Star Trek Strange New Worlds According To Anson Mount

May 27, 2025

The Most Uncomfortable Scene In Star Trek Strange New Worlds According To Anson Mount

May 27, 2025 -

Examining The Career Of Michelle Mone Triumphs And Tragedies

May 27, 2025

Examining The Career Of Michelle Mone Triumphs And Tragedies

May 27, 2025 -

Giancarlo Stantons Next Move Mariners Reportedly In Pursuit After Yankees Tenure Ends

May 27, 2025

Giancarlo Stantons Next Move Mariners Reportedly In Pursuit After Yankees Tenure Ends

May 27, 2025

Latest Posts

-

Under 50 And Gone Examining Heart Attack Risk In Partners

May 29, 2025

Under 50 And Gone Examining Heart Attack Risk In Partners

May 29, 2025 -

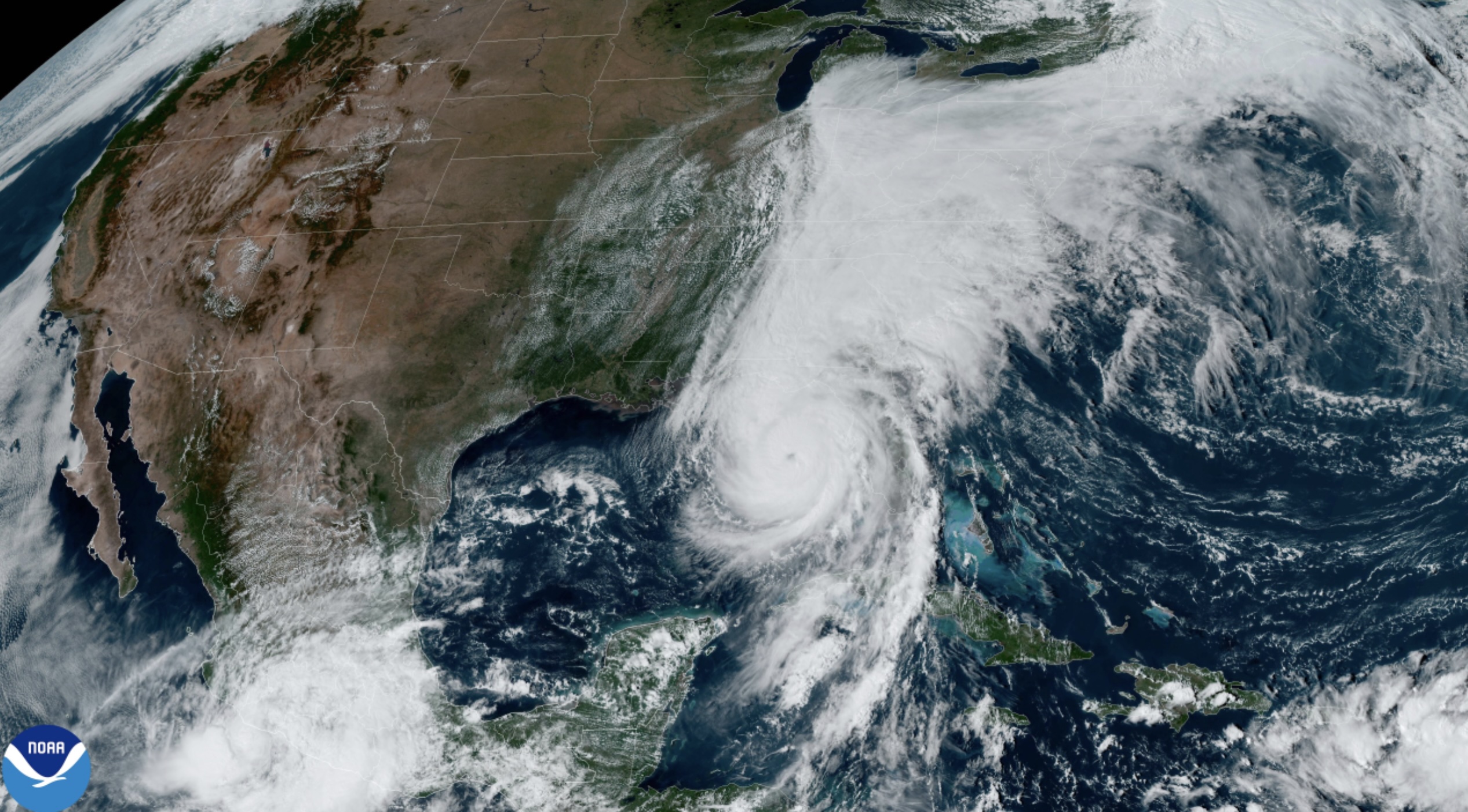

Summer Hurricane Outlook Above Normal Conditions Suggest Potential For 10 Hurricanes

May 29, 2025

Summer Hurricane Outlook Above Normal Conditions Suggest Potential For 10 Hurricanes

May 29, 2025 -

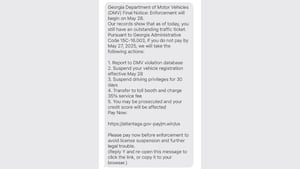

Is That Text From The Ga Department Of Driver Services Real Learn How To Spot The Scam

May 29, 2025

Is That Text From The Ga Department Of Driver Services Real Learn How To Spot The Scam

May 29, 2025 -

Partners Early Death From Heart Attack Understanding The Statistics

May 29, 2025

Partners Early Death From Heart Attack Understanding The Statistics

May 29, 2025 -

Food Inflation Hits Year High Peak The Impact Of Beef Prices

May 29, 2025

Food Inflation Hits Year High Peak The Impact Of Beef Prices

May 29, 2025