SiriusXM Holdings Stock: A Deep Dive Into Its Millionaire-Making History And Future Prospects

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SiriusXM Holdings Stock: A Deep Dive into its Millionaire-Making History and Future Prospects

SiriusXM Holdings Inc. (SIRI) has a captivating history, transforming from a niche satellite radio service to a multimedia entertainment giant. Its journey has created millionaires, and its future prospects continue to spark investor interest. But is it still a worthwhile investment? This deep dive explores SiriusXM's past successes, current standing, and future potential, offering insights for both seasoned investors and newcomers considering adding SIRI to their portfolios.

A Look Back: From Humble Beginnings to Satellite Radio Dominance

SiriusXM's story is one of innovation and strategic acquisitions. Initially two separate companies, Sirius and XM Satellite Radio, battled for market share before merging in 2008. This merger, a pivotal moment in the company's history, created the dominant force in satellite radio we know today. The combined entity leveraged economies of scale, expanding its programming offerings and subscriber base significantly. Early investors who held on through the turbulent merger period were handsomely rewarded as the stock price steadily climbed.

Key Factors Driving SiriusXM's Success:

- Exclusive Content: SiriusXM boasts a roster of exclusive programming, including live sports, talk radio, and music channels unavailable elsewhere. This unique content offering creates a strong barrier to entry for competitors.

- Premium Audio Experience: Unlike terrestrial radio, SiriusXM offers a commercial-free listening experience, appealing to a segment of consumers willing to pay for ad-free entertainment.

- Strategic Partnerships: Collaborations with major automakers for factory-installed receivers have been instrumental in driving subscriber growth. This integrated approach ensures consistent access to the SiriusXM platform for millions of drivers.

- Consistent Subscriber Growth: Despite the rise of streaming services, SiriusXM has consistently added subscribers, demonstrating the enduring appeal of its ad-free, curated content.

Current Market Position and Challenges:

While SiriusXM enjoys a dominant position in satellite radio, it faces challenges in the ever-evolving media landscape. The rise of streaming services like Spotify and Apple Music presents competition for listener attention and advertising revenue. Furthermore, technological advancements and changing consumer preferences necessitate continuous adaptation and innovation.

Future Prospects and Investment Considerations:

SiriusXM is actively diversifying its offerings to remain competitive. This includes expanding its podcast portfolio, exploring new audio technologies, and leveraging its vast data resources for targeted advertising. The company's strong cash flow and potential for further subscriber growth remain attractive to investors. However, potential risks include increasing competition, regulatory changes, and the ongoing evolution of consumer media habits.

Analyzing the Stock:

Before investing in SiriusXM, potential investors should carefully consider factors like:

- Valuation: Analyze the company's price-to-earnings ratio (P/E) and other key financial metrics to determine if the stock is currently overvalued or undervalued.

- Financial Performance: Review the company's financial statements to assess its profitability, debt levels, and cash flow.

- Growth Potential: Consider the company's future growth prospects, taking into account factors like subscriber growth, revenue diversification, and competitive pressures.

- Risk Tolerance: Assess your own risk tolerance before making any investment decisions.

Conclusion:

SiriusXM's journey from a fledgling satellite radio provider to a major entertainment player showcases its resilience and adaptability. While its future trajectory isn't without challenges, the company's strategic initiatives and consistent subscriber growth suggest continued potential. However, thorough due diligence and a clear understanding of the risks involved are crucial before incorporating SIRI into your investment portfolio. Conduct your own research and consult with a financial advisor before making any investment decisions. This article provides information for educational purposes only and should not be considered financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SiriusXM Holdings Stock: A Deep Dive Into Its Millionaire-Making History And Future Prospects. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jersey Shore Chaos Fights And Stabbings Erupt Despite Curfew

May 28, 2025

Jersey Shore Chaos Fights And Stabbings Erupt Despite Curfew

May 28, 2025 -

Leaked Audio Police Doubts Emerge In High Profile Abortion Case Arrest

May 28, 2025

Leaked Audio Police Doubts Emerge In High Profile Abortion Case Arrest

May 28, 2025 -

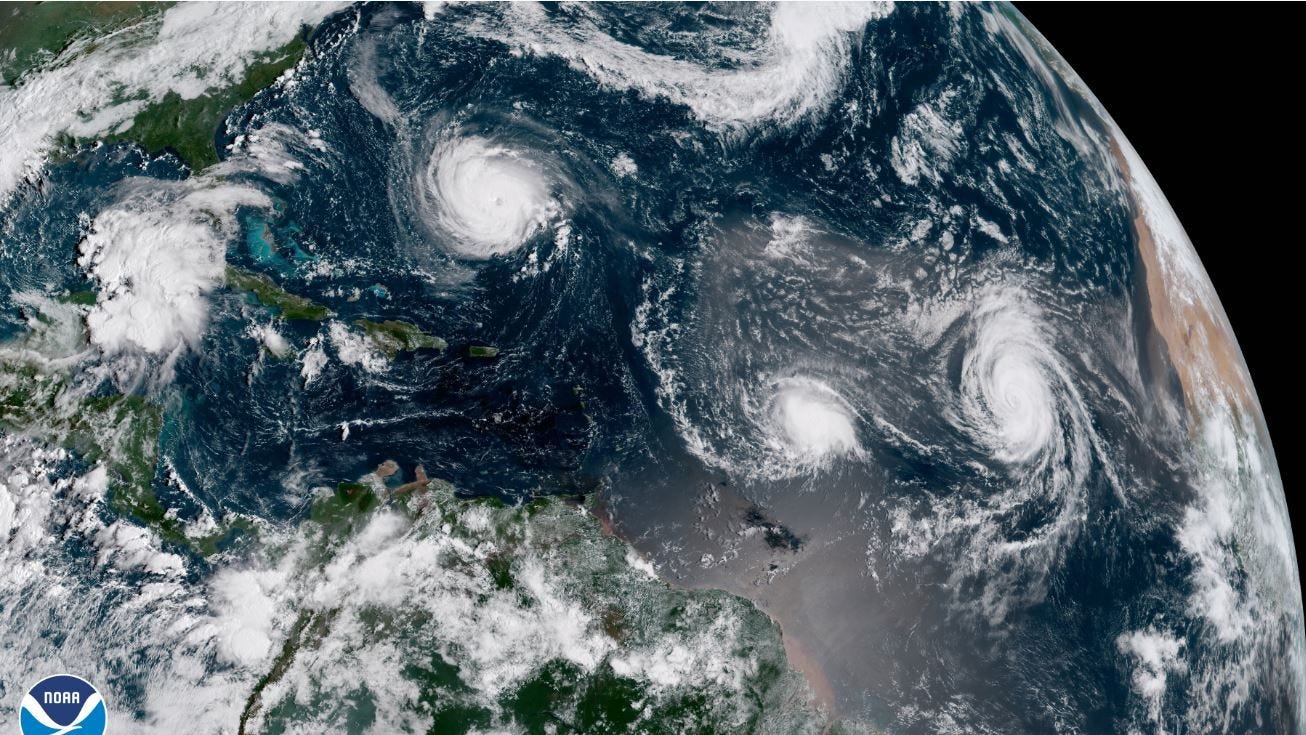

Predicting The 2025 Hurricane Season A Comprehensive Guide

May 28, 2025

Predicting The 2025 Hurricane Season A Comprehensive Guide

May 28, 2025 -

Controversial Everest Ascent Accelerated Climb Achieved With Anesthetic Gas Assistance

May 28, 2025

Controversial Everest Ascent Accelerated Climb Achieved With Anesthetic Gas Assistance

May 28, 2025 -

Ideology And Funding Nih Faces Staff Backlash Over Policy Changes

May 28, 2025

Ideology And Funding Nih Faces Staff Backlash Over Policy Changes

May 28, 2025

Latest Posts

-

Duke Energys June 1 Rate Hike How Much Will Ohioans Pay

May 31, 2025

Duke Energys June 1 Rate Hike How Much Will Ohioans Pay

May 31, 2025 -

Israels West Bank Settlement Policy New Expansion Details

May 31, 2025

Israels West Bank Settlement Policy New Expansion Details

May 31, 2025 -

Community Searches For Missing Teen Reward For Safe Return

May 31, 2025

Community Searches For Missing Teen Reward For Safe Return

May 31, 2025 -

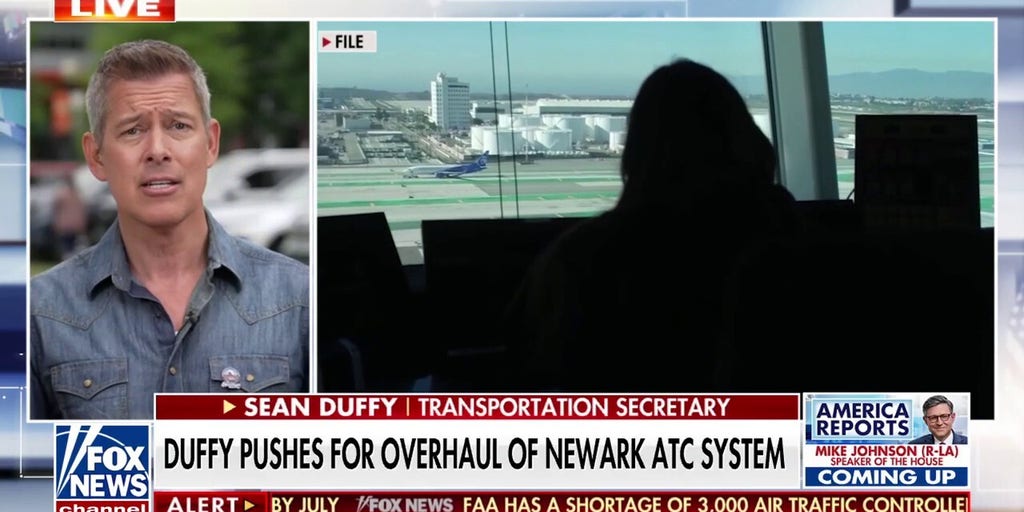

Air Traffic Control Overhaul The Impact On Newark Airport Departures

May 31, 2025

Air Traffic Control Overhaul The Impact On Newark Airport Departures

May 31, 2025 -

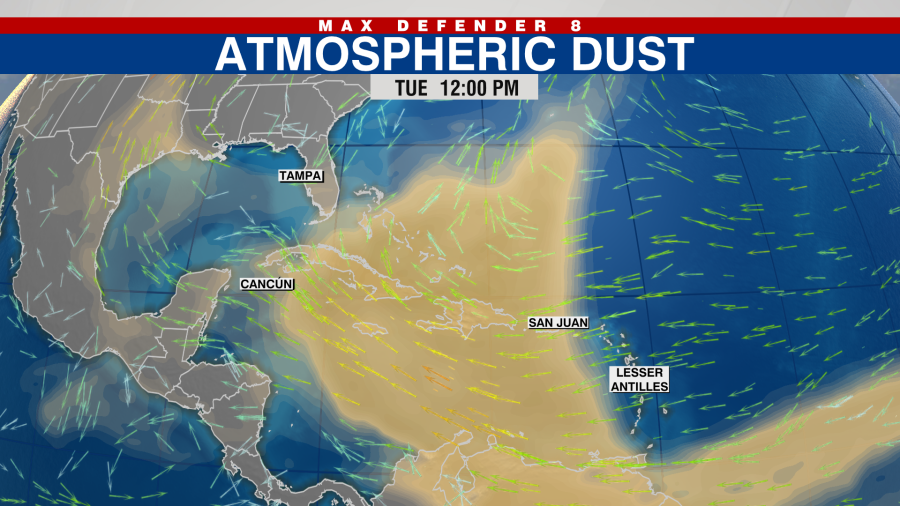

Preparing For The Saharan Dust Guidance For Florida Residents

May 31, 2025

Preparing For The Saharan Dust Guidance For Florida Residents

May 31, 2025