SiriusXM Holdings Stock Analysis: Weighing The Risks And Rewards

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SiriusXM Holdings Stock Analysis: Weighing the Risks and Rewards

SiriusXM Holdings Inc. (SIRI) has carved a niche for itself in the satellite radio market, but its stock performance presents a complex picture for investors. Is now the time to buy, sell, or hold? This in-depth analysis weighs the potential risks and rewards of investing in SiriusXM, providing you with the information you need to make an informed decision.

The Allure of SiriusXM: A Deep Dive into the Positives

SiriusXM boasts a substantial subscriber base, a key strength driving its revenue. Its exclusive content, including ad-free music channels, sports programming, and talk radio, fosters a loyal customer base. This strong subscriber retention contributes significantly to the company's predictable revenue streams, making it relatively resilient compared to some other media companies. Furthermore, SiriusXM's strategic partnerships, such as its relationship with Pandora, expand its reach and diversify its revenue sources. The ongoing integration of Pandora into its platform presents an exciting opportunity for growth.

- Strong Subscriber Base: A consistently growing subscriber base provides a stable revenue foundation.

- Exclusive Content: Ad-free listening and unique programming create a high value proposition for subscribers.

- Pandora Integration: Synergies between SiriusXM and Pandora offer potential for future expansion and revenue diversification.

- Recurring Revenue Model: The subscription-based model provides predictable and consistent cash flow.

Navigating the Challenges: Understanding the Risks

Despite its advantages, SiriusXM isn't without its challenges. Increased competition from streaming services like Spotify and Apple Music poses a significant threat. The company's reliance on the automotive industry – a key distribution channel for its service – exposes it to fluctuations in car sales. Moreover, the high cost of satellite technology and maintaining its infrastructure presents ongoing operational expenses. Finally, potential regulatory changes within the media landscape could impact the company's operations and profitability.

- Intense Competition: Streaming music services are aggressively vying for market share.

- Automotive Industry Dependence: Fluctuations in car sales directly impact SiriusXM's subscriber acquisition.

- High Operational Costs: Maintaining satellite infrastructure and technology requires substantial investment.

- Regulatory Uncertainty: Changes in media regulations could pose unforeseen challenges.

SiriusXM Stock: A Valuation Perspective

Analyzing SiriusXM's stock requires a careful evaluation of its financial performance, growth prospects, and competitive landscape. Consider reviewing recent financial reports to understand its revenue growth, profitability, and debt levels. Compare its valuation metrics (like the Price-to-Earnings ratio – P/E ratio) to those of its competitors to gauge its relative attractiveness. Remember to factor in the long-term growth potential, considering the evolution of the audio entertainment market. Professional financial advice is always recommended before making any investment decisions. Tools like those offered by [link to reputable financial analysis website] can aid in this process.

Conclusion: A Calculated Investment

Investing in SiriusXM presents both opportunities and risks. While its strong subscriber base and exclusive content offer significant advantages, the competitive landscape and operational challenges must be carefully considered. Thorough due diligence, including analyzing its financial performance and comparing it to industry peers, is crucial. Ultimately, the decision to invest in SiriusXM should align with your individual risk tolerance and investment goals. Remember to consult a financial advisor for personalized advice tailored to your specific circumstances. This analysis provides a framework, but not financial guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SiriusXM Holdings Stock Analysis: Weighing The Risks And Rewards. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Russias Largest Aerial Offensive Yet Devastates Ukrainian Cities

May 27, 2025

Russias Largest Aerial Offensive Yet Devastates Ukrainian Cities

May 27, 2025 -

Senior North Korean Official Arrested After Warship Launch Malfunction

May 27, 2025

Senior North Korean Official Arrested After Warship Launch Malfunction

May 27, 2025 -

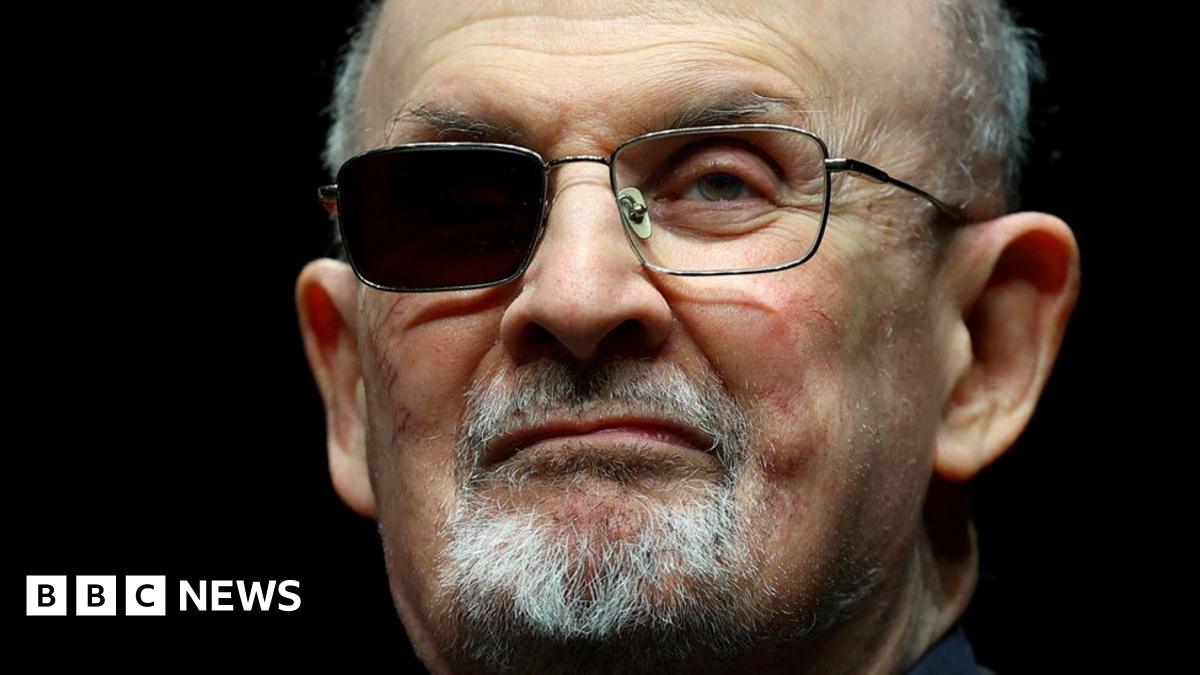

Rushdie Pleased With Attackers Sentencing A New Chapter

May 27, 2025

Rushdie Pleased With Attackers Sentencing A New Chapter

May 27, 2025 -

Pdd Holdings Q1 2025 Earnings A Deep Dive Into The E Commerce Leaders Performance

May 27, 2025

Pdd Holdings Q1 2025 Earnings A Deep Dive Into The E Commerce Leaders Performance

May 27, 2025 -

236 55 Million Investment Two Sigmas Confidence In Bank Of America Bac

May 27, 2025

236 55 Million Investment Two Sigmas Confidence In Bank Of America Bac

May 27, 2025

Latest Posts

-

1300 Palestinian Children Dead Ambassadors Heartbreaking Testimony

May 30, 2025

1300 Palestinian Children Dead Ambassadors Heartbreaking Testimony

May 30, 2025 -

Understanding The Nitrous Oxide Crisis A Public Health Emergency

May 30, 2025

Understanding The Nitrous Oxide Crisis A Public Health Emergency

May 30, 2025 -

Diddy Faces Accusation Former Employee Testifies About Threat To Kill Kid Cudi

May 30, 2025

Diddy Faces Accusation Former Employee Testifies About Threat To Kill Kid Cudi

May 30, 2025 -

Protect Giants Causeway Dont Insert Coins Into Rocks

May 30, 2025

Protect Giants Causeway Dont Insert Coins Into Rocks

May 30, 2025 -

Washington D C Weather Wet Wednesday And A Rainy Outlook Ahead

May 30, 2025

Washington D C Weather Wet Wednesday And A Rainy Outlook Ahead

May 30, 2025