SiriusXM Holdings Stock Analysis: Weighing The Risks And Rewards For Long-Term Investors.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SiriusXM Holdings Stock Analysis: Weighing the Risks and Rewards for Long-Term Investors

SiriusXM Holdings Inc. (SIRI) has carved a niche for itself in the entertainment landscape, dominating satellite radio. But for long-term investors, the question remains: is SiriusXM a worthwhile addition to a diversified portfolio? This in-depth analysis weighs the potential rewards against the inherent risks, providing crucial insights for informed decision-making.

The Allure of SiriusXM: A Deep Dive into Potential Rewards

SiriusXM's robust subscriber base and diverse content offerings are key attractions for investors. Its dominance in satellite radio provides a stable revenue stream, relatively insulated from the volatility affecting other media sectors. The company's strategic moves, such as expanding into podcasting and online streaming via Pandora, demonstrate a proactive approach to adapting to the evolving media consumption landscape. This diversification mitigates reliance on a single platform, a critical factor for long-term growth.

-

Consistent Subscriber Growth: SiriusXM consistently reports growth in its subscriber numbers, indicating strong demand for its services. This steady growth translates to predictable revenue streams, making it an attractive option for investors seeking stability. Further analysis of their quarterly earnings reports reveals a strong trend in this area. [Link to SiriusXM Investor Relations]

-

Content Diversification: The integration of Pandora and expansion into podcasts diversify content offerings, appealing to a broader audience and mitigating risk associated with relying solely on satellite radio. This strategic approach increases the company's potential for future growth and profitability.

-

Strong Brand Recognition: SiriusXM enjoys high brand recognition and loyalty among its subscribers, establishing a strong foundation for continued growth and market dominance. This established brand equity reduces marketing costs and facilitates subscriber acquisition.

Navigating the Challenges: Potential Risks for SiriusXM Investors

While the potential rewards are significant, investors must also acknowledge the inherent risks associated with investing in SiriusXM.

-

Competition from Streaming Services: The rise of streaming services like Spotify and Apple Music poses a significant competitive challenge. These platforms offer a vast library of music at a potentially lower cost, directly competing with SiriusXM's core offering. Understanding this competitive pressure is crucial for any long-term investment strategy.

-

Dependence on the Automotive Industry: A significant portion of SiriusXM's subscribers are acquired through partnerships with auto manufacturers. Economic downturns or shifts in consumer preferences toward electric vehicles (EVs) – many of which offer alternative in-car entertainment systems – could negatively impact subscription growth.

-

Regulatory Scrutiny and Technological Advancements: The regulatory landscape can be unpredictable, and technological advancements could disrupt SiriusXM's business model. Staying informed about potential regulatory changes and technological disruptions is vital for mitigating risk.

Conclusion: A Long-Term Perspective on SiriusXM Stock

SiriusXM's position in the entertainment industry is undeniably strong. However, long-term investors should adopt a cautious, well-informed approach. The company's diversification strategies demonstrate a commitment to adapting to the changing media landscape, but the competitive pressures and economic factors mentioned above cannot be ignored. Thorough due diligence, including analyzing financial statements, understanding industry trends, and assessing your personal risk tolerance, is paramount before investing.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Investing in the stock market carries inherent risks, and past performance is not indicative of future results. Always consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SiriusXM Holdings Stock Analysis: Weighing The Risks And Rewards For Long-Term Investors.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Beware New Text Message Scam Targeting Georgia Drivers License Holders

May 28, 2025

Beware New Text Message Scam Targeting Georgia Drivers License Holders

May 28, 2025 -

French President Macron Responds To Video Of Interaction With Brigitte Macron

May 28, 2025

French President Macron Responds To Video Of Interaction With Brigitte Macron

May 28, 2025 -

Amazon Amzn Momentum Analyzing The Factors Driving Growth

May 28, 2025

Amazon Amzn Momentum Analyzing The Factors Driving Growth

May 28, 2025 -

From Lumber To Likes Shepmates Journey To Social Media Domination

May 28, 2025

From Lumber To Likes Shepmates Journey To Social Media Domination

May 28, 2025 -

Bruneis Sultan Undergoes Medical Assessment In Kl For Fatigue

May 28, 2025

Bruneis Sultan Undergoes Medical Assessment In Kl For Fatigue

May 28, 2025

Latest Posts

-

Glacier Collapse Disaster Significant Portion Of Blatten Buried

May 31, 2025

Glacier Collapse Disaster Significant Portion Of Blatten Buried

May 31, 2025 -

Aep Rate Hike Tracing The Roots Of The Looming Increase

May 31, 2025

Aep Rate Hike Tracing The Roots Of The Looming Increase

May 31, 2025 -

Uche Ojeh Husband Of Today Shows Sheinelle Jones Dies After Cancer Battle

May 31, 2025

Uche Ojeh Husband Of Today Shows Sheinelle Jones Dies After Cancer Battle

May 31, 2025 -

Flight Delays In Newark The Impact Of Secretary Duffys Air Traffic Control Reform

May 31, 2025

Flight Delays In Newark The Impact Of Secretary Duffys Air Traffic Control Reform

May 31, 2025 -

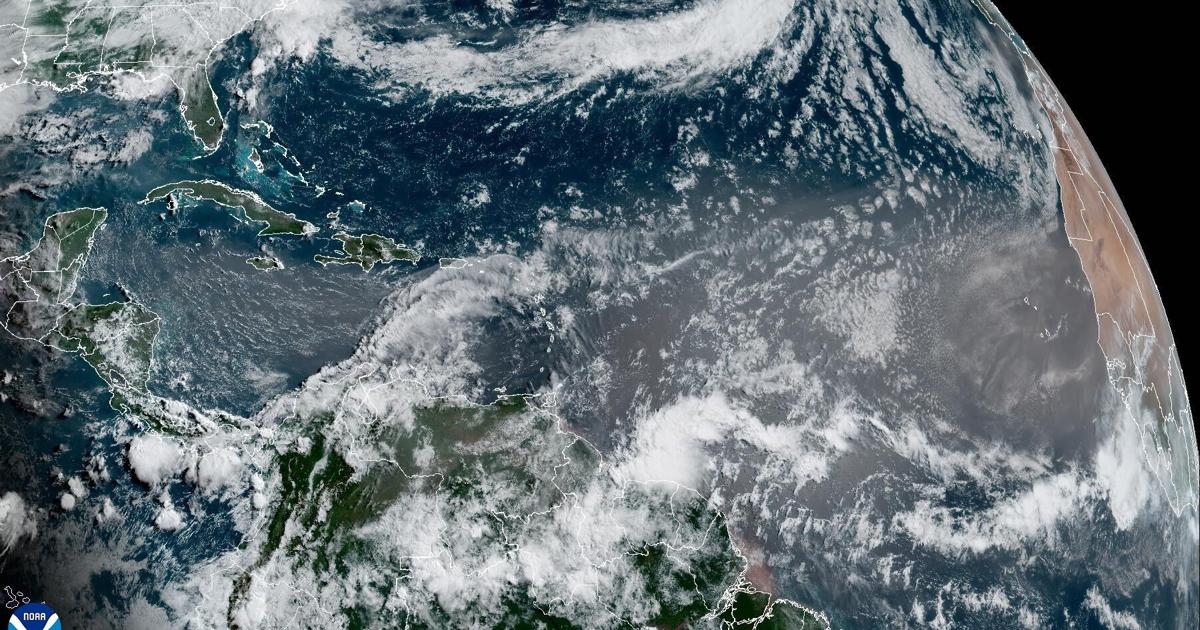

Louisiana Sunsets Saharan Dusts Impact And Forecast

May 31, 2025

Louisiana Sunsets Saharan Dusts Impact And Forecast

May 31, 2025