SiriusXM Holdings Stock: Assessing The Risk And Reward For Potential Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SiriusXM Holdings Stock: Assessing the Risk and Reward for Potential Investors

SiriusXM Holdings Inc. (SIRI) has captivated investors for years, offering a blend of potential rewards and inherent risks. This in-depth analysis explores the current state of SiriusXM stock, examining its strengths, weaknesses, opportunities, and threats (SWOT analysis) to help potential investors make informed decisions. Is now the right time to buy, sell, or hold SIRI stock? Let's delve into the details.

SiriusXM's Strengths: A Dominant Player in Satellite Radio

SiriusXM's primary strength lies in its dominance within the satellite radio market. With a substantial subscriber base and a vast library of programming, including exclusive content, the company enjoys significant brand recognition and market share. This established position provides a strong foundation for future growth and profitability. Their consistent revenue generation from subscriptions provides a relatively stable income stream, lessening the impact of economic downturns compared to more volatile industries.

Opportunities for Growth: Expansion and Innovation

Several opportunities exist for SiriusXM's future growth. The company's expansion into podcasting and other audio entertainment formats presents a significant avenue for attracting new subscribers and diversifying its revenue streams. The increasing popularity of podcasts, coupled with SiriusXM's established platform, presents a potent combination for market penetration. Furthermore, advancements in connected car technology offer substantial opportunities for integrating SiriusXM services directly into vehicles, boosting subscription numbers. Consider the potential for partnerships with major automakers – this synergistic approach could significantly drive growth.

Weaknesses: Competition and Dependence on Subscriptions

Despite its market leadership, SiriusXM faces significant competition from streaming music services like Spotify and Apple Music. These services offer broader musical selections and often come at a lower price point, posing a threat to SiriusXM's subscriber base. The company's reliance on subscription revenue presents another vulnerability. Any significant decline in subscriptions could dramatically impact the company's financial performance. This over-reliance on a single revenue stream is a key risk factor to consider.

Threats: Technological Disruptions and Economic Downturns

The ever-evolving technological landscape presents a significant threat. The rise of other audio entertainment platforms and potential technological disruptions could further erode SiriusXM's market share. Economic downturns also represent a considerable threat. During periods of economic instability, consumers are more likely to cut discretionary spending, including entertainment subscriptions like SiriusXM, impacting revenue and potentially stock price.

Financial Performance and Valuation: A Crucial Consideration

Before investing in SiriusXM stock, a thorough review of the company's financial performance and valuation is essential. Analyze key financial metrics such as revenue growth, profitability margins, debt levels, and cash flow. Compare these figures to industry averages and competitor performance to gauge the company's financial health and potential for future growth. Consider using tools and resources available online to properly assess the stock's valuation. Remember to consult with a financial advisor before making any investment decisions.

Conclusion: Weighing the Risks and Rewards

SiriusXM Holdings stock presents a compelling investment opportunity for those willing to accept a degree of risk. While the company's established market position and ongoing expansion efforts offer significant potential for growth, investors must carefully consider the competitive pressures, reliance on subscriptions, and vulnerability to economic fluctuations. A comprehensive understanding of the company's financial performance and a thorough risk assessment are critical before investing. Always conduct thorough due diligence and consider consulting a financial professional for personalized advice.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SiriusXM Holdings Stock: Assessing The Risk And Reward For Potential Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bbc Documents Impact Of Israeli Blockade Starving Infant In Gaza

May 28, 2025

Bbc Documents Impact Of Israeli Blockade Starving Infant In Gaza

May 28, 2025 -

Antonio Filosa Appointed Stellantis Ceo Key Facts And Future Implications

May 28, 2025

Antonio Filosa Appointed Stellantis Ceo Key Facts And Future Implications

May 28, 2025 -

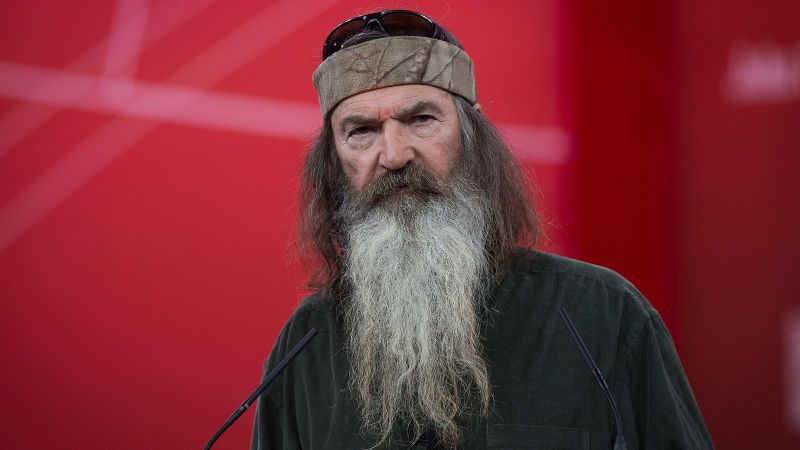

Family Mourns Phil Robertson Of Duck Dynasty Dies At Age 79

May 28, 2025

Family Mourns Phil Robertson Of Duck Dynasty Dies At Age 79

May 28, 2025 -

Alleged Assistance To Escaped New Orleans Inmates The Seven Suspects

May 28, 2025

Alleged Assistance To Escaped New Orleans Inmates The Seven Suspects

May 28, 2025 -

June 2025 Social Security What The 15 Cut Proposal Means For You

May 28, 2025

June 2025 Social Security What The 15 Cut Proposal Means For You

May 28, 2025

Latest Posts

-

Transportation Secretary Offers Plan To Address Newark Airports Air Traffic Delays

May 31, 2025

Transportation Secretary Offers Plan To Address Newark Airports Air Traffic Delays

May 31, 2025 -

Housing Market Shift Sellers Dominate As Buyer Numbers Dip To 12 Year Low

May 31, 2025

Housing Market Shift Sellers Dominate As Buyer Numbers Dip To 12 Year Low

May 31, 2025 -

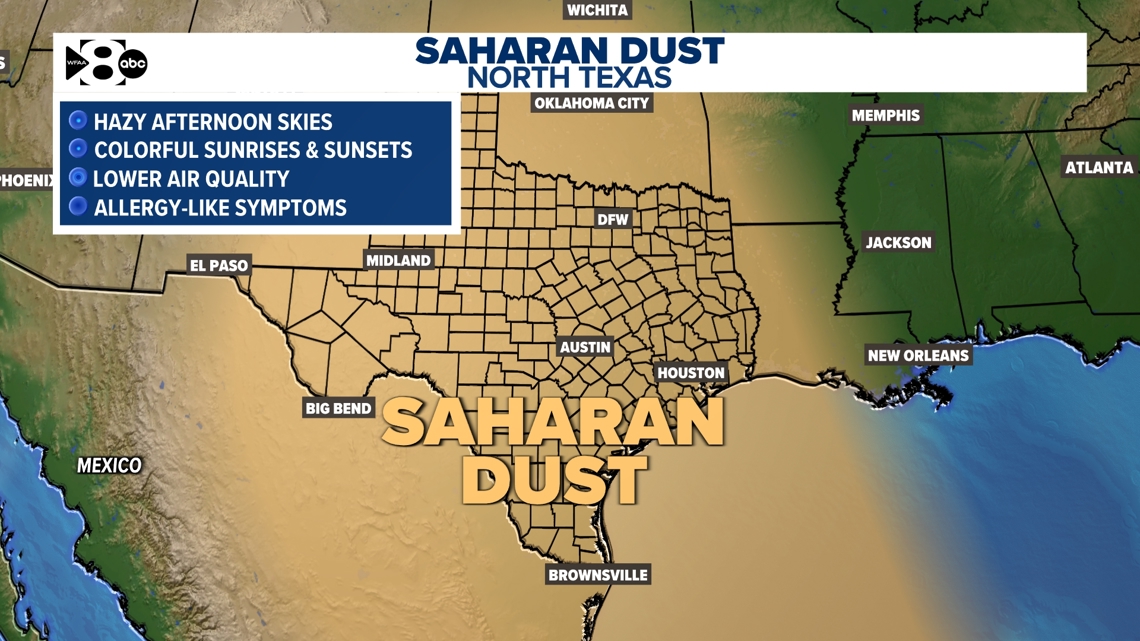

North Texas Weather Alert Saharan Dust Impacts And Health Concerns

May 31, 2025

North Texas Weather Alert Saharan Dust Impacts And Health Concerns

May 31, 2025 -

Longer Delays Anticipated For Newark Airport Air Traffic Control Modernization

May 31, 2025

Longer Delays Anticipated For Newark Airport Air Traffic Control Modernization

May 31, 2025 -

Aep Rate Hike Explained Years Of Factors Leading To Higher Costs

May 31, 2025

Aep Rate Hike Explained Years Of Factors Leading To Higher Costs

May 31, 2025