SiriusXM Holdings Stock: Is It Time To Sell?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SiriusXM Holdings Stock: Is It Time to Sell? Navigating the Satellite Radio Giant's Future

SiriusXM Holdings Inc. (SIRI) has enjoyed a relatively comfortable ride as a dominant player in satellite radio. But with the rise of streaming services and changing consumer habits, investors are increasingly asking: is it time to sell SiriusXM stock? The answer, as with most investments, isn't simple and requires a careful examination of the company's current performance and future prospects.

This article will delve into the key factors influencing SiriusXM's stock price, exploring both the bullish and bearish arguments to help you make an informed decision.

The Case for Holding (or Buying) SiriusXM Stock:

-

Strong Subscriber Base: SiriusXM boasts a substantial and loyal subscriber base, providing a stable revenue stream. This recurring revenue model is a major strength, offering a degree of predictability in challenging economic times. The company continues to add subscribers, albeit at a slower pace than in previous years.

-

Content Exclusivity: SiriusXM's investment in exclusive content, including sports programming, Howard Stern's show, and various music channels, creates a significant barrier to entry for competitors. This differentiates it from free, ad-supported streaming services.

-

Potential for Growth in Connected Vehicles: The integration of SiriusXM into new vehicles remains a key growth driver. As more cars become connected, the potential for subscriber acquisition expands significantly. This presents a long-term opportunity for consistent growth.

-

Diversification Efforts: SiriusXM is actively diversifying its offerings beyond satellite radio, exploring opportunities in digital audio and other related areas. These efforts are crucial in mitigating the risk associated with reliance on a single revenue source.

-

Reasonable Valuation: Compared to some tech stocks, SiriusXM's valuation might appear relatively attractive to some investors, depending on their investment strategy and risk tolerance. However, it's crucial to conduct thorough due diligence and compare it to industry peers.

The Case Against SiriusXM Stock:

-

Competition from Streaming Services: The rise of popular streaming services like Spotify and Apple Music presents a formidable challenge. These services offer a vast library of music and podcasts at a lower price point, potentially attracting subscribers away from SiriusXM.

-

Slower Subscriber Growth: While SiriusXM continues to add subscribers, the growth rate has slowed in recent years, raising concerns about future expansion. This slowing growth warrants close attention from potential investors.

-

Dependence on the Automotive Industry: SiriusXM's significant reliance on the automotive industry exposes it to cyclical downturns and fluctuations in vehicle sales. Economic slowdowns could negatively impact subscriber acquisition.

-

High Debt Levels: The company carries a substantial debt load, which can be a concern for investors during periods of economic uncertainty or rising interest rates. Understanding the company's debt management strategy is vital.

Conclusion: Making Your Decision

Ultimately, whether or not to sell SiriusXM stock depends on your individual investment goals, risk tolerance, and market outlook. While the company enjoys a strong subscriber base and recurring revenue, the competitive landscape and dependence on the automotive industry present significant challenges.

Before making any decisions, conduct thorough research, consider consulting a financial advisor, and carefully analyze the company's financial statements and future projections. Remember that the stock market is inherently volatile, and past performance is not indicative of future results. This article provides information for educational purposes only and is not financial advice.

Further Reading:

- – For official company information and financial reports.

- – For up-to-date market analysis.

This information is for general knowledge and informational purposes only, and does not constitute investment advice. Always consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SiriusXM Holdings Stock: Is It Time To Sell?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Unpaid Jackpot Texas Resident Takes State Lottery To Court Over 83 5 Million

May 27, 2025

Unpaid Jackpot Texas Resident Takes State Lottery To Court Over 83 5 Million

May 27, 2025 -

Big Reds Final Showdown Ncaa Championship Game Preview

May 27, 2025

Big Reds Final Showdown Ncaa Championship Game Preview

May 27, 2025 -

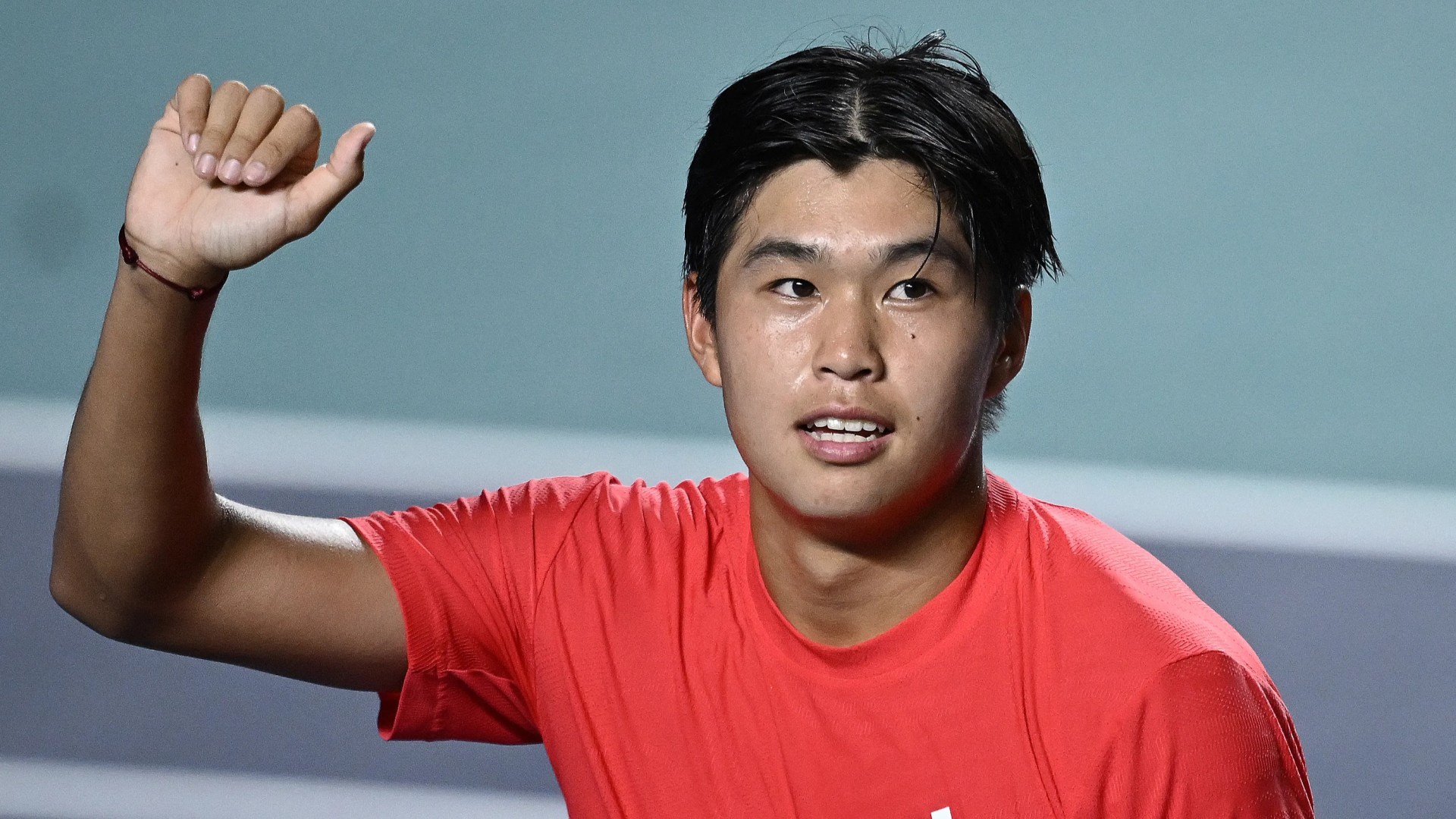

The Unlikely Path A Us Tennis Prodigys Rise From A Job Inspired Name To Facing World No 3

May 27, 2025

The Unlikely Path A Us Tennis Prodigys Rise From A Job Inspired Name To Facing World No 3

May 27, 2025 -

Orthodox Christianitys Appeal To Young Men A Look At The Growing Us Following

May 27, 2025

Orthodox Christianitys Appeal To Young Men A Look At The Growing Us Following

May 27, 2025 -

Trading The Golden State For Germany A Story Of Regret And Re Evaluation

May 27, 2025

Trading The Golden State For Germany A Story Of Regret And Re Evaluation

May 27, 2025

Latest Posts

-

Kfc Announces 7 000 Job Creation In Uk And Ireland Expansion

May 28, 2025

Kfc Announces 7 000 Job Creation In Uk And Ireland Expansion

May 28, 2025 -

Alexandra Daddarios Bold Fashion Choice At Dior Cruise Collection

May 28, 2025

Alexandra Daddarios Bold Fashion Choice At Dior Cruise Collection

May 28, 2025 -

American Music Awards 2025 Winners Your Ultimate Guide

May 28, 2025

American Music Awards 2025 Winners Your Ultimate Guide

May 28, 2025 -

Harvards Flaws A Former Students Perspective And Choice In The 2024 Election

May 28, 2025

Harvards Flaws A Former Students Perspective And Choice In The 2024 Election

May 28, 2025 -

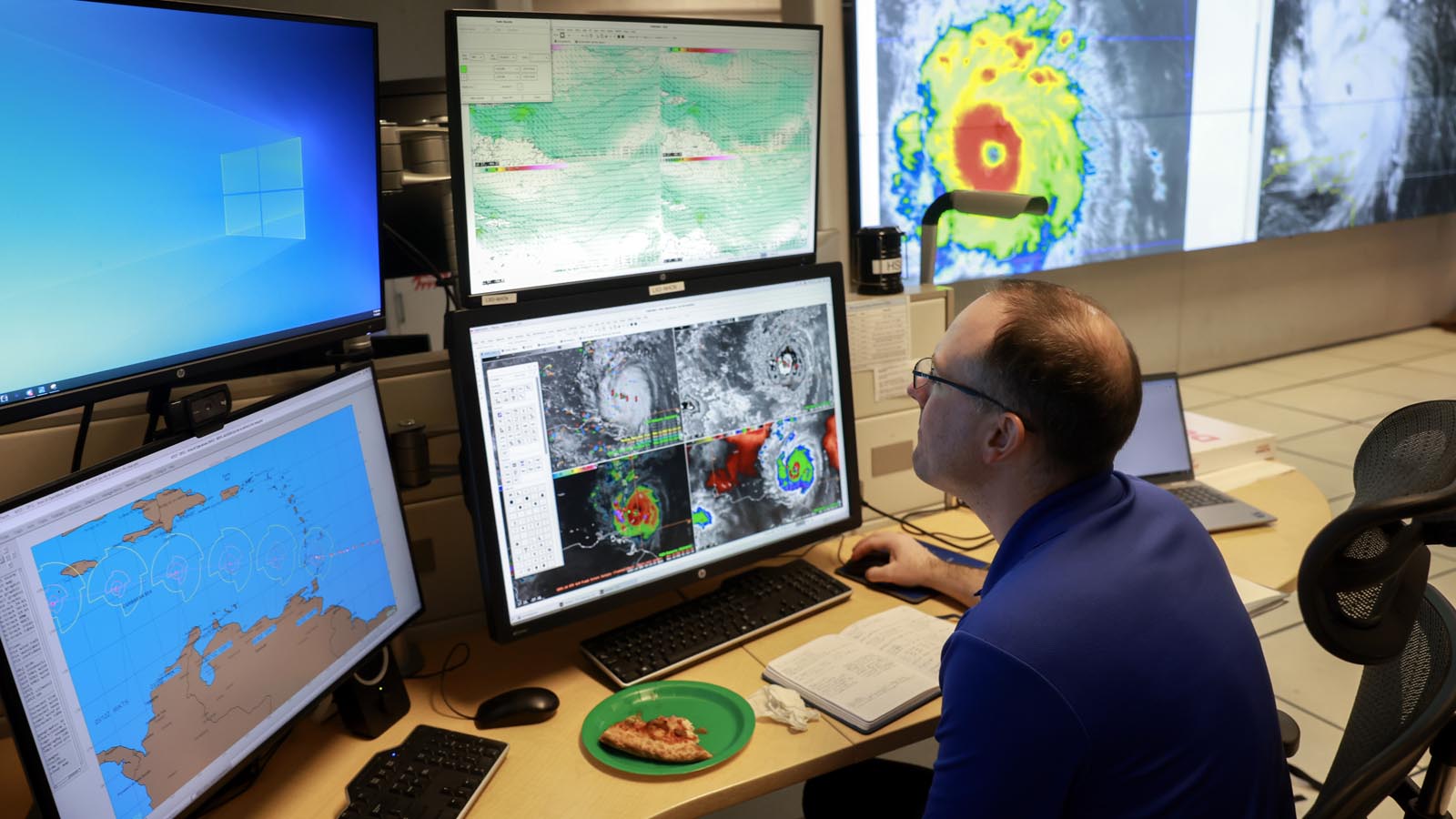

2025 Hurricane Season Selecting The Most Trustworthy Forecasting Models

May 28, 2025

2025 Hurricane Season Selecting The Most Trustworthy Forecasting Models

May 28, 2025