SiriusXM Holdings Stock: Is It Time To Sell Or Hold?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SiriusXM Holdings Stock: Is It Time to Sell or Hold?

SiriusXM Holdings Inc. (SIRI) has been a rollercoaster ride for investors in recent years. While the company boasts a dominant position in satellite radio, questions remain about its long-term growth potential and the impact of changing consumer listening habits. So, is now the time to sell your SiriusXM stock, or should you hold on for the long haul? This in-depth analysis will explore the key factors to consider before making your investment decision.

Understanding SiriusXM's Current Market Position

SiriusXM enjoys a near-monopoly in the satellite radio market, providing a consistent revenue stream. However, the rise of streaming services like Spotify and Apple Music presents a significant challenge. The company is actively diversifying, investing heavily in its streaming platform, Pandora, and expanding into connected car services. This strategic shift aims to capture a larger share of the evolving audio entertainment market.

Key Factors Influencing SiriusXM Stock Price:

- Subscription Growth: The rate at which SiriusXM adds new subscribers is a crucial indicator of its financial health. Consistent subscriber growth signals a strong, healthy business model, while stagnation or decline could trigger a sell-off. Analyzing recent subscriber acquisition data is vital for informed decision-making.

- Competition from Streaming Services: The competitive landscape is fierce. The continued growth of on-demand music streaming services poses a significant threat. SiriusXM's ability to differentiate itself and offer unique value propositions will be crucial for future success.

- Connected Car Partnerships: The integration of SiriusXM into new vehicles is a key driver of growth. Securing partnerships with major auto manufacturers is essential for maintaining market share and reaching new subscribers. Any news regarding significant new partnerships or losses should be closely monitored.

- Financial Performance: Analyzing SiriusXM's financial reports, including revenue, earnings, and cash flow, provides valuable insights into the company's overall performance and financial stability. Look for consistent profitability and strong revenue growth.

- Debt Levels: High levels of debt can negatively impact a company's financial flexibility and potentially hinder its ability to invest in future growth initiatives. Evaluating the company's debt-to-equity ratio is essential.

Arguments for Holding SiriusXM Stock:

- Strong Brand Recognition: SiriusXM is a well-established brand with high recognition among consumers. This brand loyalty offers a strong foundation for continued growth.

- Diversification Efforts: The company's investments in Pandora and connected car services demonstrate a commitment to adapting to the changing media landscape. This proactive approach mitigates some of the risks associated with competition from streaming services.

- Potential for Long-Term Growth: While facing challenges, SiriusXM still has significant potential for long-term growth, particularly in the connected car market. This potential makes it an interesting prospect for long-term investors with a higher risk tolerance.

Arguments for Selling SiriusXM Stock:

- Competition from Streaming: The intense competition from established streaming giants poses a considerable threat to SiriusXM's market share.

- Slower than Expected Growth: If subscriber growth fails to meet expectations, it could lead to downward pressure on the stock price.

- High Debt Levels: Substantial debt levels could limit the company's ability to invest in future growth opportunities and respond effectively to competitive pressures.

Conclusion: A Calculated Risk

Whether to sell or hold SiriusXM stock ultimately depends on your individual investment strategy, risk tolerance, and long-term outlook. Thoroughly researching the company's financial performance, competitive landscape, and future growth prospects is crucial. Consult with a financial advisor for personalized guidance before making any investment decisions. Remember, investing in the stock market always involves risk, and past performance is not indicative of future results. Stay informed about industry news and company announcements to make the most informed decisions regarding your SiriusXM holdings. This information is for educational purposes only and should not be considered financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SiriusXM Holdings Stock: Is It Time To Sell Or Hold?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

French Open Round 1 Zverev Vs Tien And Mensik Vs Muller Predictions

May 27, 2025

French Open Round 1 Zverev Vs Tien And Mensik Vs Muller Predictions

May 27, 2025 -

Terps And Big Red Clash Maryland Cornell Lacrosse Championship Game Preview

May 27, 2025

Terps And Big Red Clash Maryland Cornell Lacrosse Championship Game Preview

May 27, 2025 -

Analysis Jeanine Pirros Comments On The Tragic Israeli Embassy Deaths

May 27, 2025

Analysis Jeanine Pirros Comments On The Tragic Israeli Embassy Deaths

May 27, 2025 -

Bank Of America Bac A Major Holding For Financial Avengers Inc

May 27, 2025

Bank Of America Bac A Major Holding For Financial Avengers Inc

May 27, 2025 -

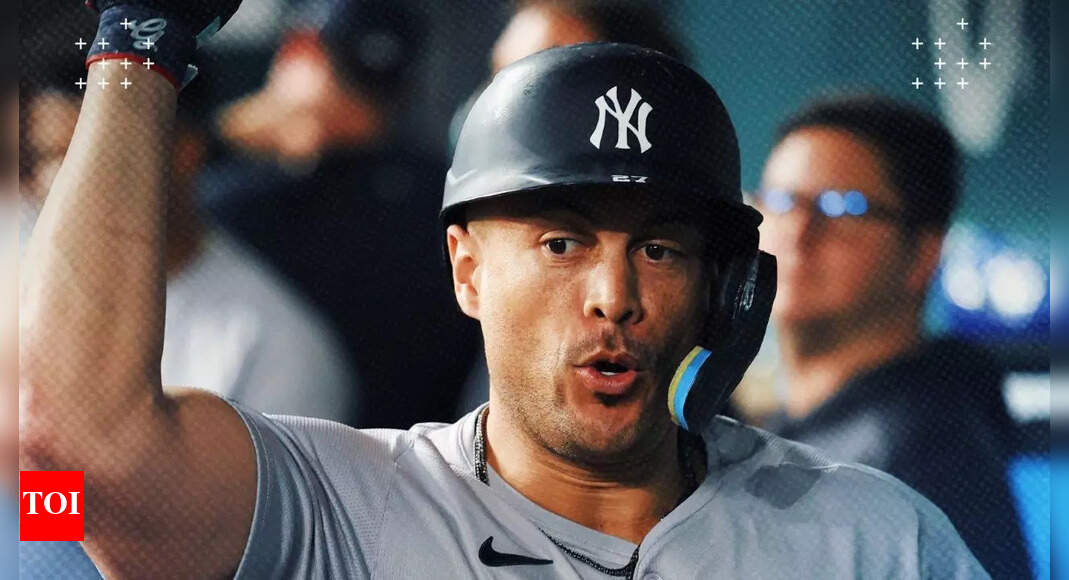

Report Giancarlo Stanton Finds New Home Leaving Yankees For Mariners

May 27, 2025

Report Giancarlo Stanton Finds New Home Leaving Yankees For Mariners

May 27, 2025

Latest Posts

-

D C Area Faces Wet Wednesday Extended Rainy Forecast Predicted

May 30, 2025

D C Area Faces Wet Wednesday Extended Rainy Forecast Predicted

May 30, 2025 -

French Open Mens Day 5 Key Matches And Potential Upsets

May 30, 2025

French Open Mens Day 5 Key Matches And Potential Upsets

May 30, 2025 -

1300 Palestinian Children Dead Ambassadors Heartbreaking Testimony

May 30, 2025

1300 Palestinian Children Dead Ambassadors Heartbreaking Testimony

May 30, 2025 -

Understanding The Nitrous Oxide Crisis A Public Health Emergency

May 30, 2025

Understanding The Nitrous Oxide Crisis A Public Health Emergency

May 30, 2025 -

Diddy Faces Accusation Former Employee Testifies About Threat To Kill Kid Cudi

May 30, 2025

Diddy Faces Accusation Former Employee Testifies About Threat To Kill Kid Cudi

May 30, 2025