SiriusXM Holdings' Stock Performance: A Deep Dive For Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SiriusXM Holdings' Stock Performance: A Deep Dive for Investors

SiriusXM Holdings Inc. (SIRI), a leading provider of satellite radio and entertainment, has seen its stock performance fluctuate significantly in recent years. Understanding the factors driving these fluctuations is crucial for investors considering adding SIRI to their portfolios. This deep dive explores SiriusXM's recent performance, examines key influencing factors, and offers insights for potential investors.

SiriusXM's Recent Stock Performance: A Rollercoaster Ride?

The stock price of SiriusXM has experienced periods of both substantial growth and decline. While the company has consistently demonstrated revenue growth fueled by subscriber additions and expansion into new audio entertainment platforms, macroeconomic factors and investor sentiment have played a significant role in shaping its stock price trajectory. For example, [link to a reputable financial news source showing SIRI's stock chart]. Analyzing these trends reveals a complex picture that requires a nuanced understanding of the company's fundamentals and external market conditions.

Key Factors Influencing SiriusXM's Stock:

Several key factors contribute to the volatility of SiriusXM's stock price:

-

Subscriber Growth: The consistent addition of new subscribers remains a crucial driver of revenue growth. However, the rate of subscriber acquisition and the average revenue per user (ARPU) are closely monitored by investors. Slowdowns in subscriber growth can negatively impact the stock price.

-

Competition: The increasing competition from streaming services like Spotify and Pandora, offering similar audio entertainment, presents a challenge to SiriusXM's market dominance. The company's ability to innovate and differentiate its offerings is crucial for maintaining its competitive edge.

-

Economic Conditions: Macroeconomic factors like inflation and recessionary fears can influence investor sentiment towards SiriusXM, impacting its stock price. During periods of economic uncertainty, investors may be less inclined to invest in discretionary spending categories like entertainment.

-

Debt Levels: SiriusXM carries a substantial debt load. While manageable currently, significant increases in interest rates could negatively impact the company's profitability and investor confidence.

-

Content Acquisition and Programming: The quality and diversity of SiriusXM's programming are essential for attracting and retaining subscribers. Strategic acquisitions of content and talent can positively influence subscriber growth and investor sentiment.

-

Technological Advancements: SiriusXM's ability to adapt to technological advancements and incorporate new platforms (like its expansion into podcasts and online streaming) is crucial for future growth and maintaining relevance in the evolving media landscape.

Analyzing the Future of SIRI:

Predicting future stock performance is always challenging. However, by closely monitoring the factors outlined above – subscriber growth, competition, economic conditions, debt levels, content strategy, and technological adaptability – investors can form a more informed opinion about the potential for future growth. Consider analyzing the company's quarterly earnings reports and investor presentations for a deeper understanding of its financial health and strategic direction. [Link to SiriusXM's Investor Relations page].

Is SiriusXM a Good Investment for You?

Whether SiriusXM is a suitable investment depends on your individual investment goals and risk tolerance. While the company demonstrates consistent revenue growth and holds a strong market position, its stock price remains subject to volatility. Thorough due diligence and a diversified investment strategy are recommended for any investor considering adding SIRI to their portfolio. Consult with a qualified financial advisor before making any investment decisions.

Call to Action: Stay informed about SiriusXM's performance by regularly reviewing financial news sources and the company's investor relations materials. Understanding the key drivers of its stock price will help you make more informed investment choices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SiriusXM Holdings' Stock Performance: A Deep Dive For Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

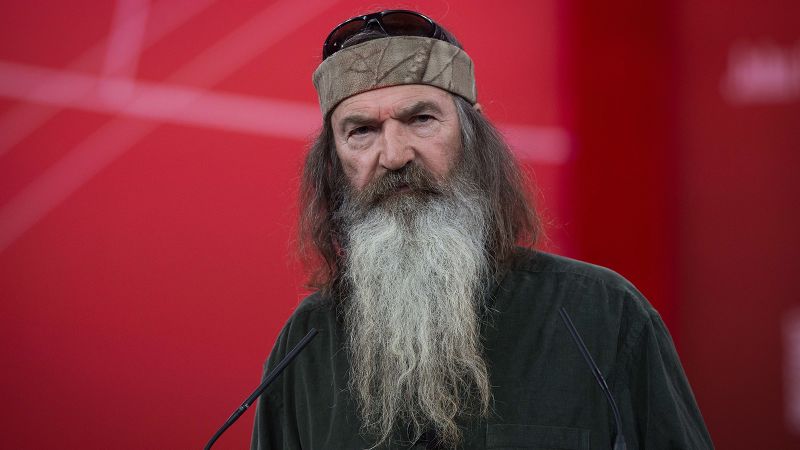

Duck Dynastys Phil Robertson Passes Away Fans Mourn The Loss Of A Legend

May 28, 2025

Duck Dynastys Phil Robertson Passes Away Fans Mourn The Loss Of A Legend

May 28, 2025 -

Financial Avengers Portfolio Deep Dive Bank Of Americas Significant Position

May 28, 2025

Financial Avengers Portfolio Deep Dive Bank Of Americas Significant Position

May 28, 2025 -

King Charles Canadian Visit A Success Amidst Trumps Statehood Bid

May 28, 2025

King Charles Canadian Visit A Success Amidst Trumps Statehood Bid

May 28, 2025 -

Research Funding Cuts Spark Nih Staff Walkout And Growing Controversy

May 28, 2025

Research Funding Cuts Spark Nih Staff Walkout And Growing Controversy

May 28, 2025 -

Urgent Rescue Operation Following Devastating Chemical Plant Blast In China

May 28, 2025

Urgent Rescue Operation Following Devastating Chemical Plant Blast In China

May 28, 2025

Latest Posts

-

Trade Court Decision Trumps Global Tariff Actions Declared Illegal

May 31, 2025

Trade Court Decision Trumps Global Tariff Actions Declared Illegal

May 31, 2025 -

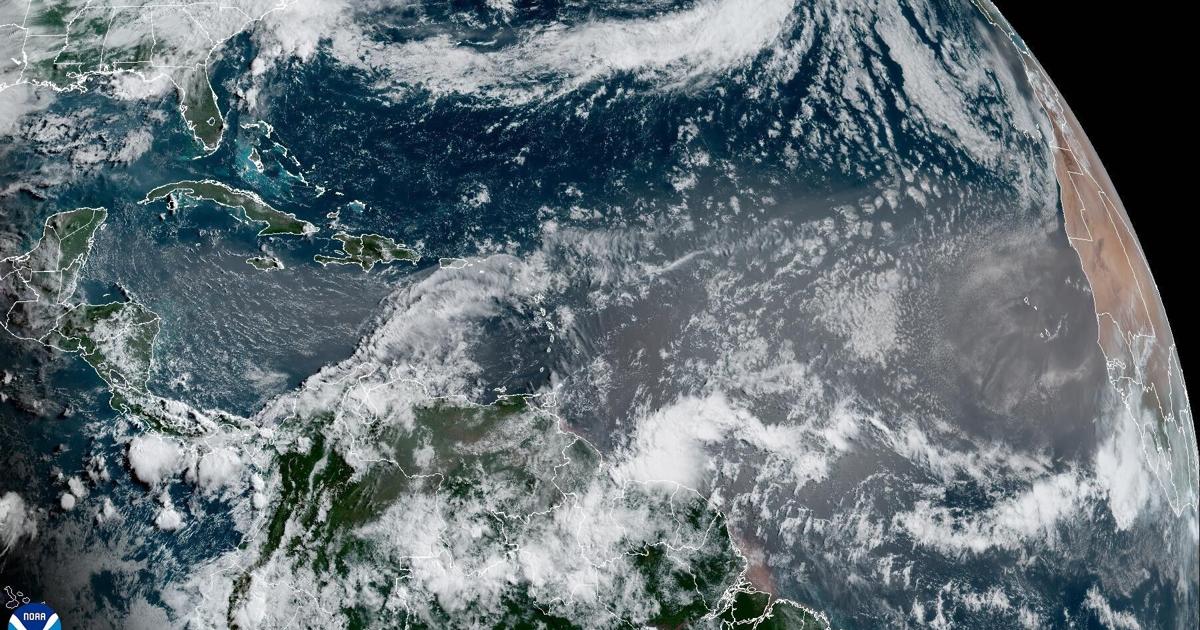

Saharan Dust Dramatic Louisiana Sunsets Predicted See The Forecast

May 31, 2025

Saharan Dust Dramatic Louisiana Sunsets Predicted See The Forecast

May 31, 2025 -

Louisiana Sunsets Saharan Dust Plumes Impact And Predicted Arrival

May 31, 2025

Louisiana Sunsets Saharan Dust Plumes Impact And Predicted Arrival

May 31, 2025 -

Urgent Search Missing Teen Reward For Information

May 31, 2025

Urgent Search Missing Teen Reward For Information

May 31, 2025 -

Holger Runes Smooth Sailing Continues At French Open

May 31, 2025

Holger Runes Smooth Sailing Continues At French Open

May 31, 2025