SiriusXM Holdings Stock Performance: A Look At Recent Gains And Future Potential

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SiriusXM Holdings Stock Performance: A Look at Recent Gains and Future Potential

SiriusXM Holdings Inc. (SIRI) has seen a surge in its stock performance recently, prompting investors to question the longevity of these gains and explore the potential for future growth. This in-depth analysis examines the factors driving SiriusXM's recent success and delves into the prospects for continued growth, considering both opportunities and challenges.

Recent Gains: A Closer Look

SiriusXM's stock price has experienced a notable upswing in the past [Insert Time Period, e.g., quarter, year], driven by a confluence of factors. These include:

-

Strong Subscriber Growth: The company has consistently added subscribers across its various platforms, demonstrating the enduring appeal of its satellite radio service and the growing popularity of its streaming options. This consistent growth in paid subscribers translates directly into increased revenue streams. [Link to SiriusXM's investor relations page showing subscriber numbers].

-

Strategic Partnerships and Acquisitions: SiriusXM's strategic partnerships and acquisitions have broadened its reach and content offerings, further fueling subscriber growth. These moves have allowed them to tap into new markets and diversify their revenue streams, reducing reliance on any single platform. [Insert example of a recent strategic partnership or acquisition here, with a link to a relevant news source].

-

Improved Operating Efficiency: The company has implemented cost-cutting measures and streamlined its operations, leading to improved margins and profitability. This focus on efficiency allows SiriusXM to reinvest in growth initiatives and return value to shareholders. [Link to SiriusXM's financial reports demonstrating improved efficiency].

-

Positive Market Sentiment: Overall positive sentiment within the broader market has also contributed to SiriusXM's stock price appreciation. Investor confidence, influenced by factors such as economic indicators and interest rate changes, often impacts individual stock performance.

Future Potential: Navigating the Challenges

While the recent performance is encouraging, several factors could influence SiriusXM's future stock trajectory:

-

Competition: The increasing competition from other streaming services, including Pandora and Spotify, presents a significant challenge. SiriusXM must continue to innovate and offer compelling content to retain its subscriber base and attract new users.

-

Economic Conditions: Macroeconomic factors, such as inflation and recessionary pressures, could impact consumer spending and potentially affect subscriber acquisition and retention. The affordability of entertainment services is a key consideration for many consumers.

-

Technological Advancements: The rapid pace of technological advancements requires SiriusXM to adapt and invest in new technologies to stay competitive. Failing to keep up with technological trends could hinder its ability to attract and retain subscribers.

Analyzing the Investment Landscape

Investors considering SiriusXM stock should carefully weigh the potential for continued growth against the challenges outlined above. Fundamental analysis, focusing on key financial metrics such as revenue growth, profitability, and debt levels, is crucial. Technical analysis can also provide insights into short-term price movements. [Link to a reputable financial news source discussing stock market analysis].

Conclusion:

SiriusXM's recent stock performance reflects positive momentum, driven by strong subscriber growth, strategic initiatives, and improved operational efficiency. However, investors should acknowledge the competitive landscape and potential economic headwinds. A thorough assessment of both opportunities and challenges is crucial for making informed investment decisions regarding SiriusXM Holdings Inc. (SIRI). Remember to conduct your own thorough research and consult with a financial advisor before making any investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SiriusXM Holdings Stock Performance: A Look At Recent Gains And Future Potential. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Sirius Xm Holdings Stock Performance Has Its Run Ended

May 27, 2025

Sirius Xm Holdings Stock Performance Has Its Run Ended

May 27, 2025 -

Expect Large Crowds Hillsboroughs Memorial Day Parade Returns

May 27, 2025

Expect Large Crowds Hillsboroughs Memorial Day Parade Returns

May 27, 2025 -

Sirius Xm Dark Wave Playlist 5 25 25 Track Listing And Slicing Up Eyeballs Picks

May 27, 2025

Sirius Xm Dark Wave Playlist 5 25 25 Track Listing And Slicing Up Eyeballs Picks

May 27, 2025 -

I Os 18 4 1 Apples Signing Closure Prevents Older I Os Version Restores

May 27, 2025

I Os 18 4 1 Apples Signing Closure Prevents Older I Os Version Restores

May 27, 2025 -

21 Children Among 73 Arrested In Jersey Shore Boardwalk Memorial Day Weekend Disturbances

May 27, 2025

21 Children Among 73 Arrested In Jersey Shore Boardwalk Memorial Day Weekend Disturbances

May 27, 2025

Latest Posts

-

Israeli Ultra Nationalists March In Jerusalem Heightened Tensions And Clashes

May 28, 2025

Israeli Ultra Nationalists March In Jerusalem Heightened Tensions And Clashes

May 28, 2025 -

From Lumber To Likes Shepmates Journey To Social Media Domination

May 28, 2025

From Lumber To Likes Shepmates Journey To Social Media Domination

May 28, 2025 -

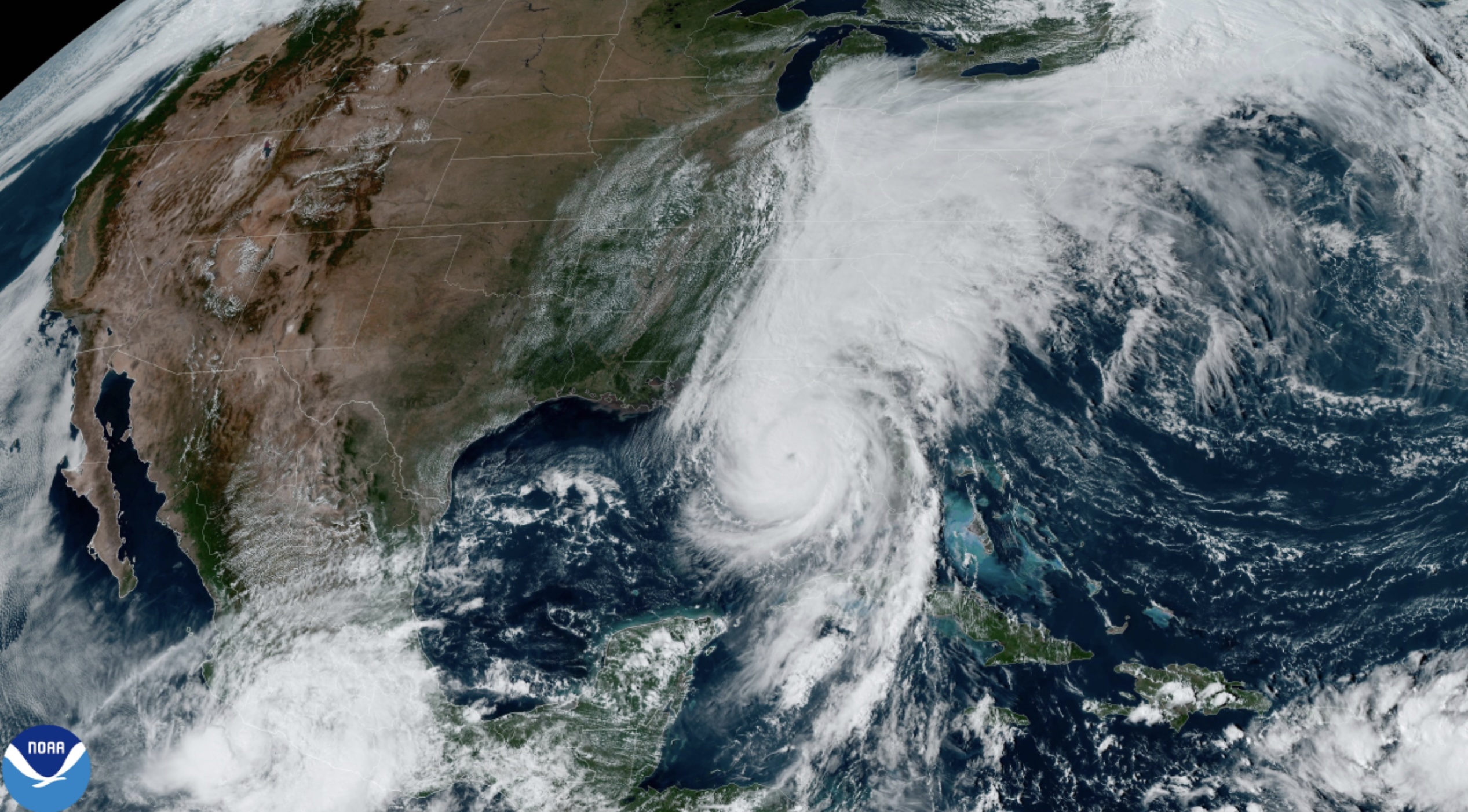

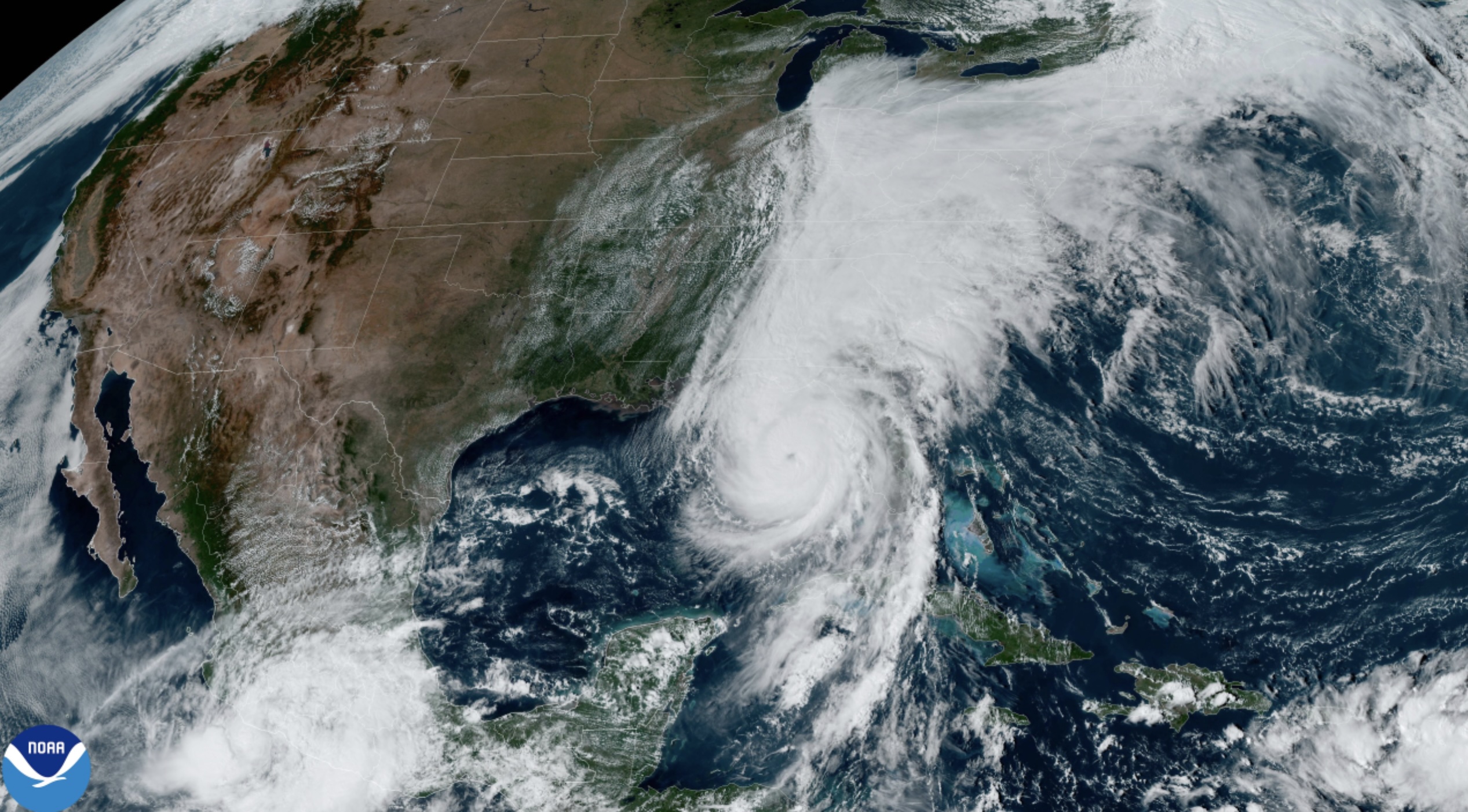

Increased Hurricane Threat Above Normal Conditions Could Mean 10 Us Hurricanes This Summer

May 28, 2025

Increased Hurricane Threat Above Normal Conditions Could Mean 10 Us Hurricanes This Summer

May 28, 2025 -

Above Normal Hurricane Season Forecast 10 Storms Possible For The Us

May 28, 2025

Above Normal Hurricane Season Forecast 10 Storms Possible For The Us

May 28, 2025 -

Royal Visit And Political Controversy King Charles In Canada As Trump Eyes 51st State

May 28, 2025

Royal Visit And Political Controversy King Charles In Canada As Trump Eyes 51st State

May 28, 2025