SiriusXM Holdings Stock Performance: Analyzing Recent Gains And Future Potential.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SiriusXM Holdings Stock Performance: Analyzing Recent Gains and Future Potential

SiriusXM Holdings Inc. (SIRI) has seen a surge in its stock price recently, leaving investors wondering: is this a fleeting rally or the start of a sustained upward trend? This in-depth analysis explores the factors contributing to SiriusXM's recent gains and examines the potential for future growth.

Recent Gains: A Closer Look

SiriusXM's stock performance has been impressive lately, outperforming some market expectations. Several key factors have contributed to this positive trajectory:

-

Strong Subscriber Growth: The company has consistently reported robust subscriber growth across its various platforms, demonstrating the enduring appeal of satellite radio and its expanding digital offerings. This consistent addition of paying customers directly translates to increased revenue streams. More subscribers mean more advertising revenue and higher subscription fees, bolstering the company's bottom line.

-

Successful Content Strategy: SiriusXM's investment in exclusive programming and partnerships with high-profile personalities has proven successful in attracting and retaining subscribers. This focus on unique and engaging content is crucial in a competitive media landscape. The addition of new podcasts and expansion into different audio formats are key elements in this success.

-

Strategic Acquisitions and Partnerships: Strategic acquisitions and partnerships have broadened SiriusXM's reach and diversified its revenue streams. These moves showcase the company's proactive approach to adapting to the evolving media environment and capitalizing on new opportunities. This strategic expansion has been instrumental in driving further growth.

-

Improved Operating Efficiency: SiriusXM has demonstrated a commitment to improving its operational efficiency, resulting in stronger margins and profitability. Cost-cutting measures and streamlining processes have positively impacted the company's financial performance.

Future Potential: Looking Ahead

While the recent gains are encouraging, investors should consider the potential challenges and opportunities that lie ahead for SiriusXM:

-

Competition from Streaming Services: The rise of streaming services poses a significant challenge to traditional radio broadcasters. SiriusXM must continue to innovate and adapt to stay competitive in this crowded market. This ongoing competition requires constant evolution and adaptation.

-

Technological Advancements: The company needs to stay ahead of the curve in terms of technological advancements, including the integration of new audio formats and platforms. Investing in research and development will be crucial for maintaining its competitive edge.

-

Economic Conditions: Macroeconomic factors, such as inflation and recessionary fears, can impact consumer spending and subscription rates. SiriusXM's ability to navigate economic uncertainty will be a key determinant of its future performance.

H2: Analyst Opinions and Price Targets

Several analysts have weighed in on SiriusXM's stock performance and future potential, offering a range of price targets. While individual analyst opinions vary, many remain positive about the company's long-term prospects, citing its strong subscriber base and potential for further growth. It's crucial, however, to conduct your own thorough research before making any investment decisions.

H2: Investment Considerations

Investing in SiriusXM, like any stock, involves risk. Before investing, consider your personal risk tolerance, diversification strategy, and long-term financial goals. Consult with a qualified financial advisor for personalized advice.

Conclusion:

SiriusXM's recent stock performance reflects a combination of positive factors, including strong subscriber growth, a successful content strategy, and improved operational efficiency. While challenges remain, the company's potential for future growth, particularly in the expanding digital audio landscape, suggests a promising outlook for investors who are willing to accept the associated risks. However, continuous monitoring of market trends and company performance is essential for informed decision-making. Conduct thorough due diligence before making any investment choices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SiriusXM Holdings Stock Performance: Analyzing Recent Gains And Future Potential.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

73 Arrests Multiple Stabbings Mark Chaotic Memorial Day In Beach Town

May 28, 2025

73 Arrests Multiple Stabbings Mark Chaotic Memorial Day In Beach Town

May 28, 2025 -

Alexandra Daddarios Naked Lace Dress Sparks Conversation

May 28, 2025

Alexandra Daddarios Naked Lace Dress Sparks Conversation

May 28, 2025 -

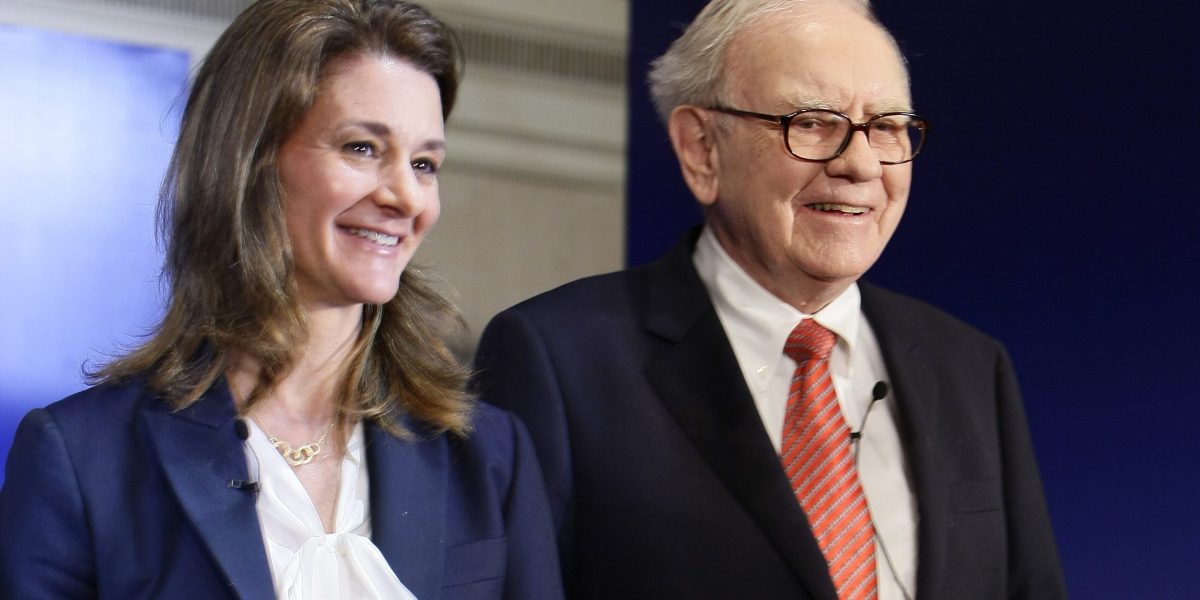

Has The Gates Buffett Era Of Giving Ended Hundreds Of Billionaires Pledge 600 Billion

May 28, 2025

Has The Gates Buffett Era Of Giving Ended Hundreds Of Billionaires Pledge 600 Billion

May 28, 2025 -

Alcohol Consumption And Brain Damage The Extent Of The Problem

May 28, 2025

Alcohol Consumption And Brain Damage The Extent Of The Problem

May 28, 2025 -

Pdd Holdings Q1 2025 Earnings Report Analyzing The E Commerce Leaders Financial Performance

May 28, 2025

Pdd Holdings Q1 2025 Earnings Report Analyzing The E Commerce Leaders Financial Performance

May 28, 2025

Latest Posts

-

Life Sentence For Indian Teacher In Odishas Deadly Wedding Bomb Case

May 29, 2025

Life Sentence For Indian Teacher In Odishas Deadly Wedding Bomb Case

May 29, 2025 -

Investigation Into Forced Meter Fittings Leads To Thousands Seeking Payouts

May 29, 2025

Investigation Into Forced Meter Fittings Leads To Thousands Seeking Payouts

May 29, 2025 -

French Open Schedule Novak Djokovics Matches And Daily Order Of Play

May 29, 2025

French Open Schedule Novak Djokovics Matches And Daily Order Of Play

May 29, 2025 -

2025 French Open Jaume Munar And Arthur Fils Clash In Second Round

May 29, 2025

2025 French Open Jaume Munar And Arthur Fils Clash In Second Round

May 29, 2025 -

Trumps Anger At Putin Fuels Consideration Of Fresh Russia Sanctions

May 29, 2025

Trumps Anger At Putin Fuels Consideration Of Fresh Russia Sanctions

May 29, 2025