SiriusXM Holdings Stock Performance: Has Its Winning Streak Ended?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SiriusXM Holdings Stock Performance: Has Its Winning Streak Ended?

SiriusXM Holdings Inc. (SIRI), the satellite radio giant, has enjoyed a period of considerable growth and investor enthusiasm. But recent market fluctuations have some questioning whether the company's winning streak has finally come to an end. This article delves into SiriusXM's recent stock performance, analyzing the factors contributing to its ups and downs and exploring the outlook for investors.

A Look Back at SiriusXM's Success:

For years, SiriusXM steadily increased its subscriber base and revenue, fueled by its dominant position in the satellite radio market and successful expansion into podcasting and other audio entertainment platforms. This consistent growth translated into a strong stock performance, attracting significant investor interest. The company's strategic acquisitions and technological advancements further solidified its market leadership. Key to its success has been its ability to retain subscribers and attract new ones through compelling programming and bundled services.

The Recent Dip: What Happened?

However, recent months have seen a noticeable dip in SiriusXM's stock price. Several factors may be contributing to this downturn:

-

Increased Competition: The rise of streaming services like Spotify and Apple Music, offering vast music libraries and podcasts, presents a formidable challenge to SiriusXM's traditional satellite radio model. This increased competition is impacting subscriber growth and potentially affecting investor confidence.

-

Economic Headwinds: The broader economic slowdown and concerns about inflation have impacted investor sentiment across various sectors, including entertainment and media. This general market volatility has undoubtedly played a role in SiriusXM's stock price decline.

-

Changing Consumer Habits: The shift towards on-demand streaming services has altered consumer media consumption habits. While SiriusXM has attempted to adapt by investing in its streaming platform, the transition isn't without its challenges.

-

Concerns about Future Growth: Analysts are closely scrutinizing SiriusXM's future growth prospects, particularly in light of the increased competition and potential saturation of the satellite radio market. This uncertainty has led to some cautiousness among investors.

Analyzing the Future: Is This a Buying Opportunity?

The recent dip in SiriusXM's stock price presents a complex scenario for potential investors. While the challenges outlined above are significant, several factors suggest potential for future growth:

-

Strong Brand Recognition: SiriusXM boasts strong brand recognition and a loyal subscriber base. This established market position provides a solid foundation for future growth initiatives.

-

Content Diversification: The company's continued investment in podcasting and other audio content formats diversifies its revenue streams and mitigates its reliance solely on satellite radio.

-

Technological Advancements: SiriusXM's ongoing investments in technology could lead to innovative products and services, further strengthening its competitive edge.

What to Watch For:

Investors should carefully monitor the following key indicators to better assess SiriusXM's future performance:

- Subscriber growth and churn rates: These metrics will offer insights into the company's ability to retain existing subscribers and attract new ones.

- Revenue diversification: Tracking the success of SiriusXM's expansion into podcasting and other audio formats is crucial.

- Competitive landscape: Monitoring the actions of competitors and evaluating the overall market dynamics is essential.

Conclusion:

Whether SiriusXM's winning streak has truly ended remains to be seen. The company faces significant challenges in a rapidly evolving media landscape. However, its strong brand recognition, ongoing diversification efforts, and technological investments offer potential for future growth. Investors should conduct thorough due diligence and carefully consider the risks and rewards before making any investment decisions. Staying informed about industry trends and carefully monitoring SiriusXM's financial performance is paramount.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SiriusXM Holdings Stock Performance: Has Its Winning Streak Ended?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nadals Tearful Farewell A French Open Legend Bids Adieu

May 27, 2025

Nadals Tearful Farewell A French Open Legend Bids Adieu

May 27, 2025 -

Incident Macron Macron L Elysee Precise Le Contexte De La Video

May 27, 2025

Incident Macron Macron L Elysee Precise Le Contexte De La Video

May 27, 2025 -

Discover 5 Key I Os 18 5 Improvements And 3 More

May 27, 2025

Discover 5 Key I Os 18 5 Improvements And 3 More

May 27, 2025 -

Confirmation Of Remains Missing Kerry Farmer Michael Gaine Found

May 27, 2025

Confirmation Of Remains Missing Kerry Farmer Michael Gaine Found

May 27, 2025 -

Kings Solidarity Visit Navigating The Canada Us Trade Conflict

May 27, 2025

Kings Solidarity Visit Navigating The Canada Us Trade Conflict

May 27, 2025

Latest Posts

-

Diors Cruise 2026 Design Details And Roman History

May 29, 2025

Diors Cruise 2026 Design Details And Roman History

May 29, 2025 -

Stellantis New Ceo Antonio Filosas Leadership Role Begins

May 29, 2025

Stellantis New Ceo Antonio Filosas Leadership Role Begins

May 29, 2025 -

Nih Research Cuts Spark Staff Rebellion Walkout Highlights Growing Tensions

May 29, 2025

Nih Research Cuts Spark Staff Rebellion Walkout Highlights Growing Tensions

May 29, 2025 -

Milwaukee Bucks Desperate Play Banking On Doc Rivers To Retain Giannis Antetokounmpo

May 29, 2025

Milwaukee Bucks Desperate Play Banking On Doc Rivers To Retain Giannis Antetokounmpo

May 29, 2025 -

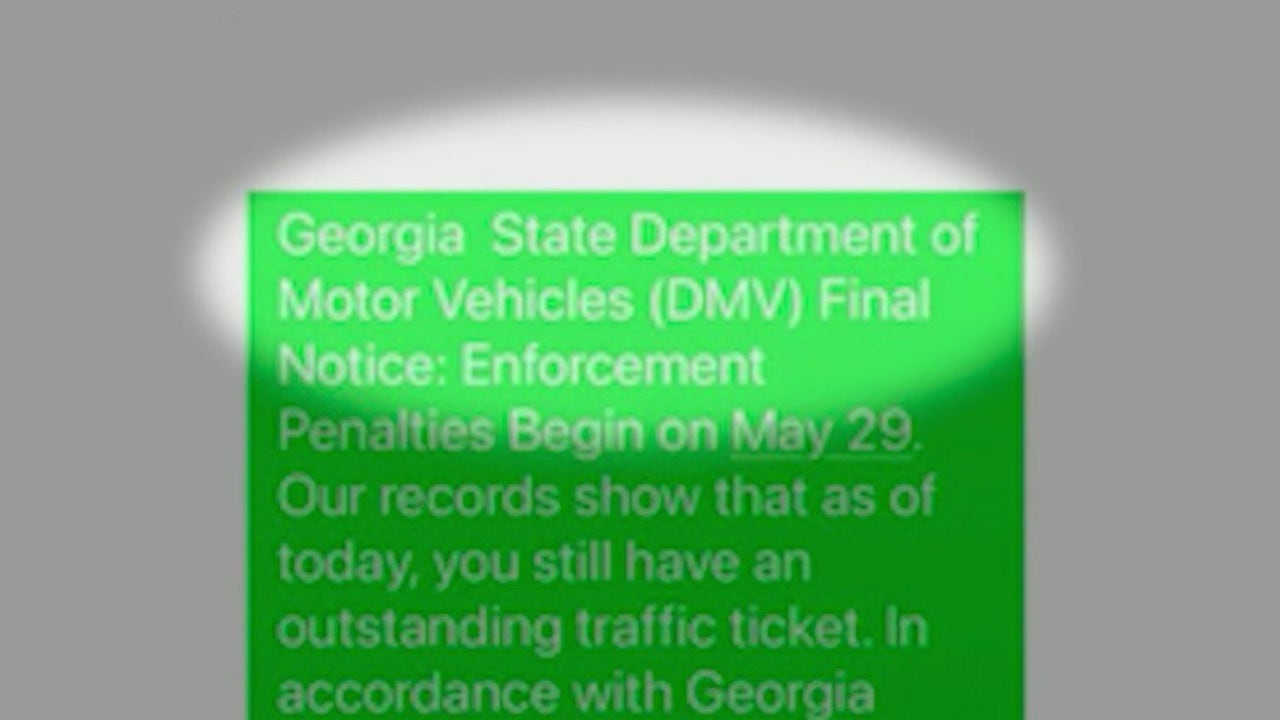

Urgent Warning Fake Traffic Ticket Texts Targeting Georgians

May 29, 2025

Urgent Warning Fake Traffic Ticket Texts Targeting Georgians

May 29, 2025