SiriusXM Holdings Stock Performance: Weighing The Risks And Rewards For Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SiriusXM Holdings Stock Performance: Weighing the Risks and Rewards for Investors

SiriusXM Holdings Inc. (SIRI), a leading provider of satellite radio and streaming audio services, has seen its stock performance fluctuate significantly in recent years. For potential investors, understanding the current market landscape and weighing the inherent risks and rewards is crucial before making any investment decisions. This article delves into SiriusXM's recent performance, exploring the factors driving its stock price and offering insights into whether it's a worthwhile addition to your portfolio.

SiriusXM's Recent Stock Performance: A Rollercoaster Ride?

SiriusXM's stock price has experienced periods of both growth and decline, influenced by a complex interplay of factors. While the company boasts a substantial subscriber base and dominant market share in satellite radio, its growth trajectory isn't without its challenges. Recent financial reports have shown mixed results, impacting investor sentiment. Analyzing these reports, coupled with broader economic conditions and industry trends, is vital for gauging the future potential of SIRI stock.

Factors Influencing SiriusXM's Stock Price:

Several key factors contribute to the volatility of SiriusXM's stock price:

-

Competition: The streaming audio landscape is fiercely competitive. Services like Spotify, Apple Music, and Pandora pose significant challenges, particularly in attracting younger demographics. SiriusXM's ability to innovate and adapt to this competitive environment is crucial for its long-term success.

-

Subscription Growth: The rate of subscriber acquisition and retention directly impacts SiriusXM's revenue and profitability. Slowing growth or a significant increase in churn could negatively affect the stock price. Investors closely monitor these metrics in quarterly earnings reports.

-

Economic Conditions: Like many consumer discretionary stocks, SiriusXM's performance is sensitive to broader economic trends. During economic downturns, consumers may be more likely to cut back on subscription services, impacting the company's revenue.

-

Technological Advancements: The constant evolution of audio technology presents both opportunities and challenges. SiriusXM's ability to integrate new technologies and maintain a compelling user experience is key to staying ahead of the curve.

The Risks Associated with Investing in SiriusXM:

Investing in any stock involves inherent risks. Specific risks associated with SiriusXM include:

-

Increased Competition: The ongoing pressure from streaming services poses a persistent threat to SiriusXM's market share and future growth.

-

Dependence on Subscriptions: The company's business model heavily relies on subscription revenue. A decline in subscriber numbers could significantly impact profitability.

-

Technological Disruption: Rapid technological advancements could render current services obsolete, requiring substantial investments in research and development to stay competitive.

The Potential Rewards of Investing in SiriusXM:

Despite the risks, there are several potential rewards for investors:

-

Strong Brand Recognition: SiriusXM benefits from strong brand recognition and a loyal customer base, providing a solid foundation for future growth.

-

Diversification Opportunities: SiriusXM's expansion into podcasts and other audio content diversifies its revenue streams and reduces reliance on satellite radio alone. This strategic diversification mitigates risk and provides growth potential.

-

Potential for Increased Market Penetration: While facing competition, SiriusXM still holds significant market share. Opportunities for increased penetration within existing and new markets exist.

Conclusion: A Calculated Investment?

Investing in SiriusXM Holdings requires careful consideration of the risks and rewards. The company's future performance hinges on its ability to navigate the competitive streaming landscape, maintain subscriber growth, and adapt to technological advancements. Conduct thorough due diligence, consult with a financial advisor, and understand your own risk tolerance before investing in SIRI stock. While the potential for growth exists, the inherent risks should not be underestimated. Stay informed about the company's financial performance and industry trends to make informed investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SiriusXM Holdings Stock Performance: Weighing The Risks And Rewards For Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bbcs Match Of The Day Gary Linekers Legacy After 26 Years Concludes

May 28, 2025

Bbcs Match Of The Day Gary Linekers Legacy After 26 Years Concludes

May 28, 2025 -

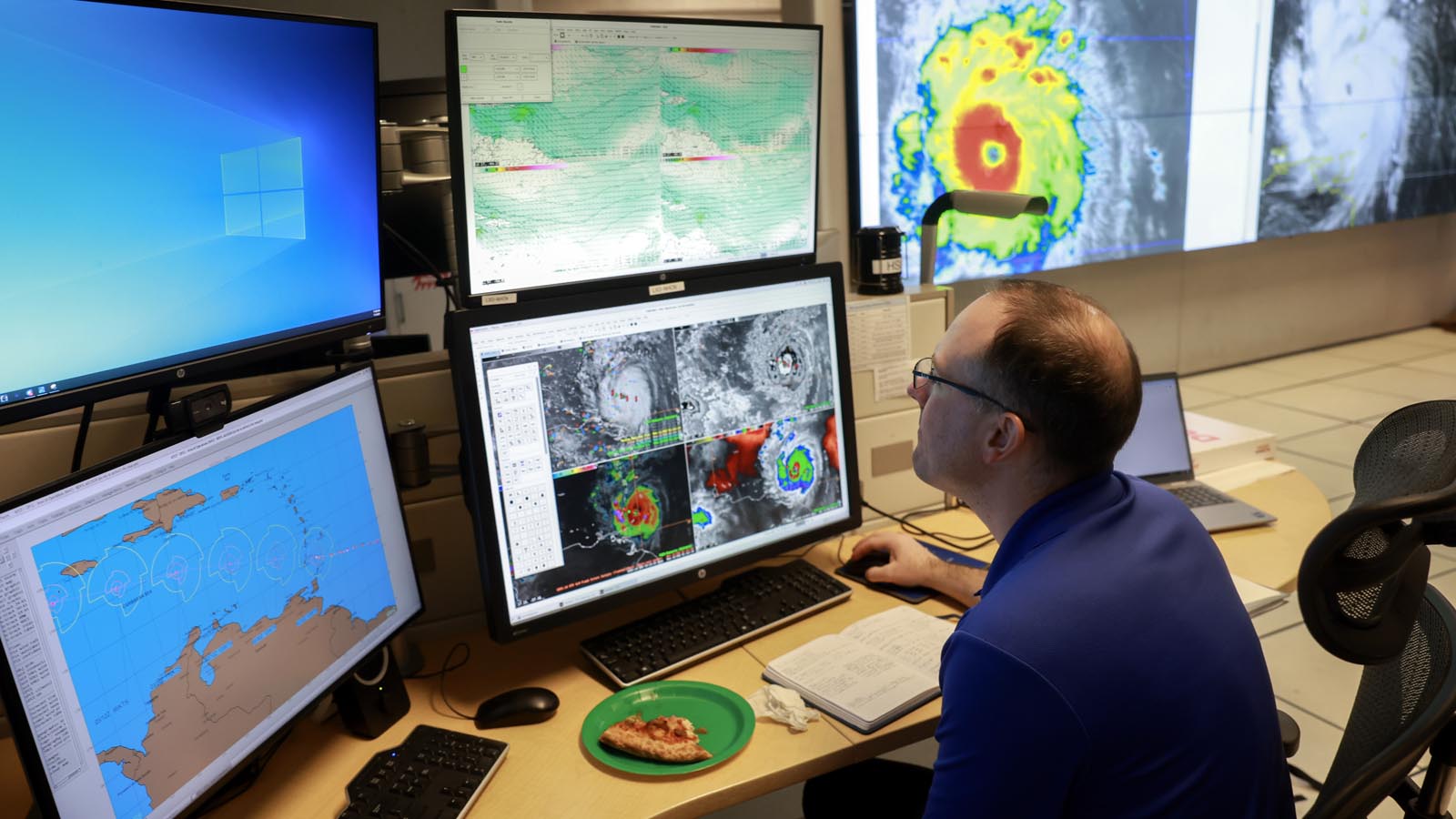

Reliable Hurricane Models For The 2025 Season A Guide

May 28, 2025

Reliable Hurricane Models For The 2025 Season A Guide

May 28, 2025 -

Update Human Remains Identified As Belonging To Michael Gaine

May 28, 2025

Update Human Remains Identified As Belonging To Michael Gaine

May 28, 2025 -

Complete 2025 Social Security Payment Schedule United States

May 28, 2025

Complete 2025 Social Security Payment Schedule United States

May 28, 2025 -

Social Security Recipients To Receive Payments Up To 5 108

May 28, 2025

Social Security Recipients To Receive Payments Up To 5 108

May 28, 2025

Latest Posts

-

Baby Critically Hurt In Severe Dog Attack In Greater Manchester

Jun 01, 2025

Baby Critically Hurt In Severe Dog Attack In Greater Manchester

Jun 01, 2025 -

Is The West Accidentally Bankrolling Putins War In Ukraine

Jun 01, 2025

Is The West Accidentally Bankrolling Putins War In Ukraine

Jun 01, 2025 -

New Discovery Extensive Mayan City With Pyramids And Canals Dates Back 3 000 Years

Jun 01, 2025

New Discovery Extensive Mayan City With Pyramids And Canals Dates Back 3 000 Years

Jun 01, 2025 -

Today Shows Sheinelle Jones Receives Support At Husband Uche Ojehs Funeral

Jun 01, 2025

Today Shows Sheinelle Jones Receives Support At Husband Uche Ojehs Funeral

Jun 01, 2025 -

Match Day 7 Popcorn Film And Football

Jun 01, 2025

Match Day 7 Popcorn Film And Football

Jun 01, 2025