SiriusXM Holdings Stock: Weighing The Risks And Rewards For Long-Term Investors.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SiriusXM Holdings Stock: Weighing the Risks and Rewards for Long-Term Investors

SiriusXM Holdings Inc. (SIRI) has carved a niche for itself in the entertainment industry, dominating satellite radio. But is its stock a worthwhile investment for the long haul? For potential investors, understanding the inherent risks and potential rewards is crucial before committing capital. This in-depth analysis explores the factors that make SiriusXM a compelling, yet complex, investment opportunity.

The Allure of SiriusXM: A Deep Dive into the Positives

SiriusXM boasts a powerful, nearly unmatched advantage: its subscriber base. The company's vast network of subscribers provides a stable revenue stream, less susceptible to the volatility seen in other entertainment sectors. This consistent cash flow is a significant draw for long-term investors seeking stability. Furthermore, the company's strategic acquisitions and expansion into new audio platforms, such as Pandora, broaden its reach and appeal to a wider demographic. This diversification strategy mitigates risk and enhances growth potential.

- Stable Subscriber Base: The core strength of SiriusXM lies in its loyal subscriber base, providing predictable revenue and reducing reliance on advertising fluctuations.

- Content Diversification: The inclusion of Pandora and other audio platforms diversifies content offerings, attracting a wider range of listeners and increasing revenue streams.

- Technological Advancements: SiriusXM is constantly innovating, integrating new technologies and features to enhance user experience and attract new subscribers. This commitment to improvement ensures it remains competitive in a rapidly evolving media landscape.

Navigating the Challenges: Potential Risks for Investors

While SiriusXM offers considerable advantages, potential investors must carefully consider several significant risks:

- Competition: The streaming audio market is fiercely competitive. Services like Spotify and Apple Music pose a considerable threat to SiriusXM's market share, especially among younger demographics.

- Subscription Dependence: SiriusXM's revenue is heavily reliant on subscription fees. A significant decline in subscribers could negatively impact profitability.

- Economic Sensitivity: Consumer spending habits directly impact subscription services. During economic downturns, consumers may be more likely to cut back on entertainment expenses, affecting subscriber retention.

- Regulatory Hurdles: The media landscape is subject to evolving regulations. Changes in regulations could affect SiriusXM's operations and profitability.

Long-Term Outlook: Is SiriusXM a Buy, Sell, or Hold?

The long-term outlook for SiriusXM is multifaceted. While the consistent subscriber base and strategic acquisitions present a compelling case for long-term growth, the competitive landscape and economic sensitivities remain significant concerns. Investors should carefully weigh these factors against their own risk tolerance and investment goals. A diversified portfolio is always recommended to mitigate potential losses.

For conservative investors, SiriusXM might be considered a "hold" or even a "sell," given the competitive pressures and reliance on subscriptions. However, for investors with a higher risk tolerance and a longer-term perspective, SiriusXM's steady revenue stream and potential for growth in new audio platforms could make it an attractive "buy."

Before making any investment decisions, it's crucial to conduct thorough due diligence, including reviewing financial statements, analyzing industry trends, and considering your own financial situation. Consult with a qualified financial advisor to determine if SiriusXM aligns with your investment strategy.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Always conduct thorough research and consider consulting a financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SiriusXM Holdings Stock: Weighing The Risks And Rewards For Long-Term Investors.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Hs 2 Contractors Staff Supply Practices Investigated In West Midlands

May 28, 2025

Hs 2 Contractors Staff Supply Practices Investigated In West Midlands

May 28, 2025 -

Planning Permission Fury Historic Villages Sewage System Overwhelmed By New Homes

May 28, 2025

Planning Permission Fury Historic Villages Sewage System Overwhelmed By New Homes

May 28, 2025 -

Investigation Launched Following Minke Whale Death On Portstewart Coastline

May 28, 2025

Investigation Launched Following Minke Whale Death On Portstewart Coastline

May 28, 2025 -

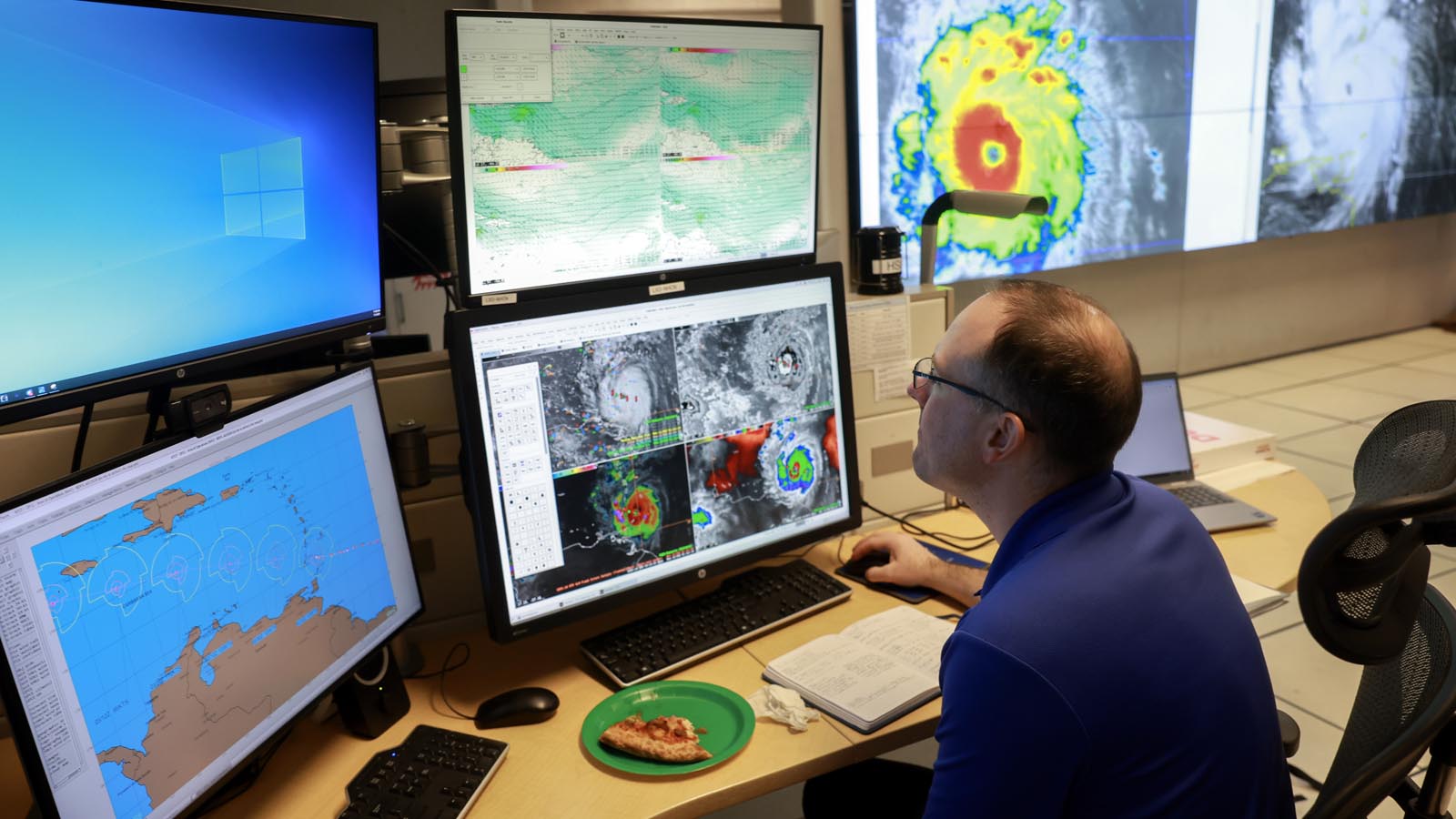

2025 Hurricane Season Choosing The Best Forecasting Models

May 28, 2025

2025 Hurricane Season Choosing The Best Forecasting Models

May 28, 2025 -

Large Scale Chemical Plant Explosion In China Investigation Begins

May 28, 2025

Large Scale Chemical Plant Explosion In China Investigation Begins

May 28, 2025

Latest Posts

-

Giannis Antetokounmpo Trade Unexpected Contenders And Potential Deals

May 29, 2025

Giannis Antetokounmpo Trade Unexpected Contenders And Potential Deals

May 29, 2025 -

Analysis Macrons Response To Viral Video Of Incident With Brigitte Macron

May 29, 2025

Analysis Macrons Response To Viral Video Of Incident With Brigitte Macron

May 29, 2025 -

Fraud Alert Local Governments Warn Of Georgia Dmv Imposter Scam

May 29, 2025

Fraud Alert Local Governments Warn Of Georgia Dmv Imposter Scam

May 29, 2025 -

King Charles Canadian Tour And Trumps 51st State Bid A Clash Of Headlines

May 29, 2025

King Charles Canadian Tour And Trumps 51st State Bid A Clash Of Headlines

May 29, 2025 -

The Trump Harvard Incident A Deeper Look Into Maga Fundraising

May 29, 2025

The Trump Harvard Incident A Deeper Look Into Maga Fundraising

May 29, 2025