SiriusXM Holdings: Understanding The Risks And Rewards Of This High-Growth Stock

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SiriusXM Holdings: Navigating the Risks and Rewards of a High-Growth Stock

SiriusXM Holdings Inc. (SIRI) has captivated investors with its consistent growth and potential for future expansion. But is this satellite radio giant a sound investment? Understanding both the alluring rewards and the inherent risks is crucial before adding SIRI to your portfolio. This in-depth analysis will help you make an informed decision.

The Allure of SiriusXM: A Deep Dive into the Rewards

SiriusXM's success story rests on its unique value proposition: ad-free, high-quality audio entertainment. This resonates strongly with a large and loyal subscriber base, fueling consistent revenue growth. Several factors contribute to its attractiveness as a high-growth stock:

- Dominant Market Share: SiriusXM enjoys a near-monopoly in the satellite radio market, leaving little room for significant competition. This translates to pricing power and predictable revenue streams.

- Expanding Content Library: The company constantly expands its programming, adding diverse genres and celebrity-hosted shows to attract a broader audience and retain existing subscribers. This includes popular podcasts and exclusive content unavailable elsewhere.

- Technological Advancements: SiriusXM isn't resting on its laurels. It's actively investing in technological advancements, including integration with connected cars and smart devices, ensuring continued relevance in a rapidly evolving media landscape. This expansion into connected car services represents a significant growth opportunity.

- Strategic Partnerships: Collaborations with automakers ensure pre-installed SiriusXM radios in many new vehicles, creating a built-in customer acquisition channel. This strategic approach secures long-term subscriber growth.

- Potential for International Expansion: While primarily focused on the North American market, SiriusXM has the potential to expand internationally, unlocking substantial future growth opportunities.

The Cloudy Horizon: Understanding the Risks Associated with SiriusXM

Despite the compelling rewards, potential investors must acknowledge several risks:

- Competition from Streaming Services: The rise of streaming music services like Spotify and Apple Music presents a significant challenge. These platforms offer vast music libraries at competitive prices, potentially attracting subscribers away from satellite radio.

- Subscription Churn: Maintaining high subscriber retention is crucial. Any significant increase in churn rates could negatively impact revenue. Economic downturns can also influence subscriber decisions.

- Dependence on the Automotive Industry: SiriusXM's success is closely tied to the automotive industry. Economic slowdowns or changes in consumer preferences could significantly impact its growth.

- Regulatory Hurdles: The regulatory landscape can be unpredictable, potentially impacting the company's operations and expansion plans.

- Debt Levels: SiriusXM carries a substantial debt load. Managing this debt effectively is critical for long-term financial stability.

Conclusion: Weighing the Pros and Cons

SiriusXM Holdings presents a compelling investment opportunity, fueled by a dominant market position and a consistent growth trajectory. However, investors must carefully consider the risks associated with increasing competition from streaming services and economic downturns. Thorough due diligence, including analyzing financial statements and industry trends, is essential before making any investment decisions.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions. Always conduct your own research and assess your individual risk tolerance. For more information on investing in the stock market, consider resources like the .

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SiriusXM Holdings: Understanding The Risks And Rewards Of This High-Growth Stock. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

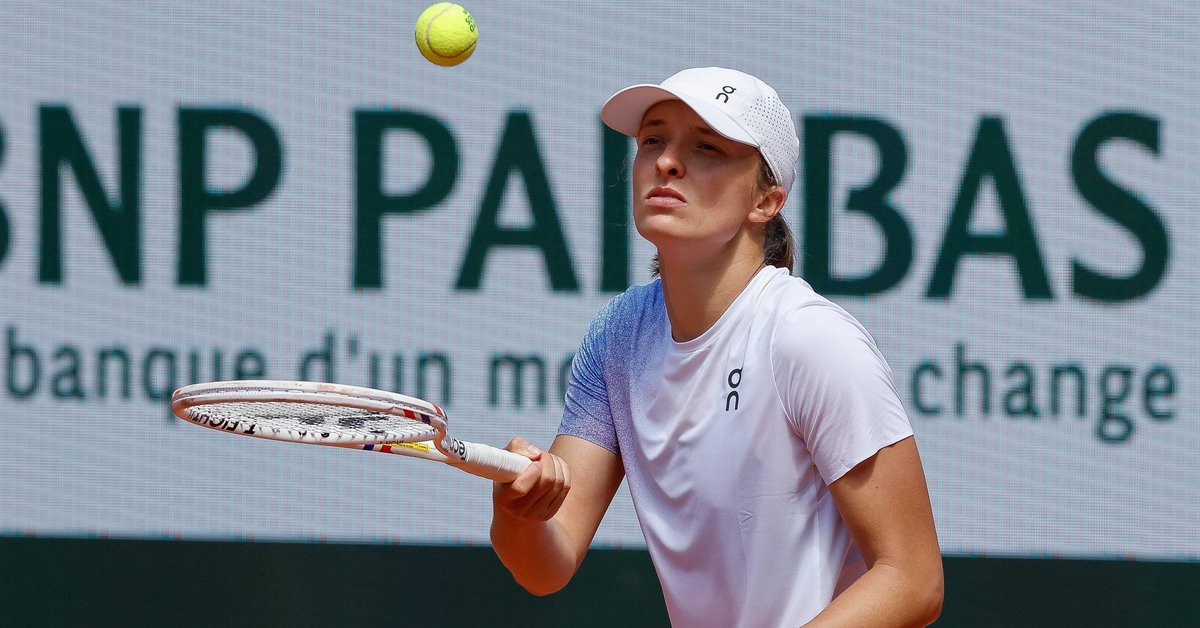

Swiatek W Roland Garros Walka O Obrone Tytulu Relacja Na Zywo

May 27, 2025

Swiatek W Roland Garros Walka O Obrone Tytulu Relacja Na Zywo

May 27, 2025 -

American Dream Or German Comfort A Personal Account Of Relocation

May 27, 2025

American Dream Or German Comfort A Personal Account Of Relocation

May 27, 2025 -

Swiatek W Roland Garros Szansa Na Obrone Tytulu Relacja Na Zywo

May 27, 2025

Swiatek W Roland Garros Szansa Na Obrone Tytulu Relacja Na Zywo

May 27, 2025 -

Memorial Day Weekend Violence Popular Jersey Shore Boardwalk Closed Following 73 Arrests

May 27, 2025

Memorial Day Weekend Violence Popular Jersey Shore Boardwalk Closed Following 73 Arrests

May 27, 2025 -

Iga Swiatek Roland Garros Pelny Terminarz I Godzina Pierwszego Meczu

May 27, 2025

Iga Swiatek Roland Garros Pelny Terminarz I Godzina Pierwszego Meczu

May 27, 2025

Latest Posts

-

Major Blast Devastates Chinese Chemical Plant Authorities Launch Urgent Rescue Effort

May 29, 2025

Major Blast Devastates Chinese Chemical Plant Authorities Launch Urgent Rescue Effort

May 29, 2025 -

Alexandra Daddarios Sheer Lace Dior Cruise Look Photos

May 29, 2025

Alexandra Daddarios Sheer Lace Dior Cruise Look Photos

May 29, 2025 -

The Milwaukee Bucks Risky Bet Banking On Doc Rivers To Keep Giannis

May 29, 2025

The Milwaukee Bucks Risky Bet Banking On Doc Rivers To Keep Giannis

May 29, 2025 -

China Chemical Plant Blast Scale Of Disaster Still Unfolding Rescue Efforts Intensify

May 29, 2025

China Chemical Plant Blast Scale Of Disaster Still Unfolding Rescue Efforts Intensify

May 29, 2025 -

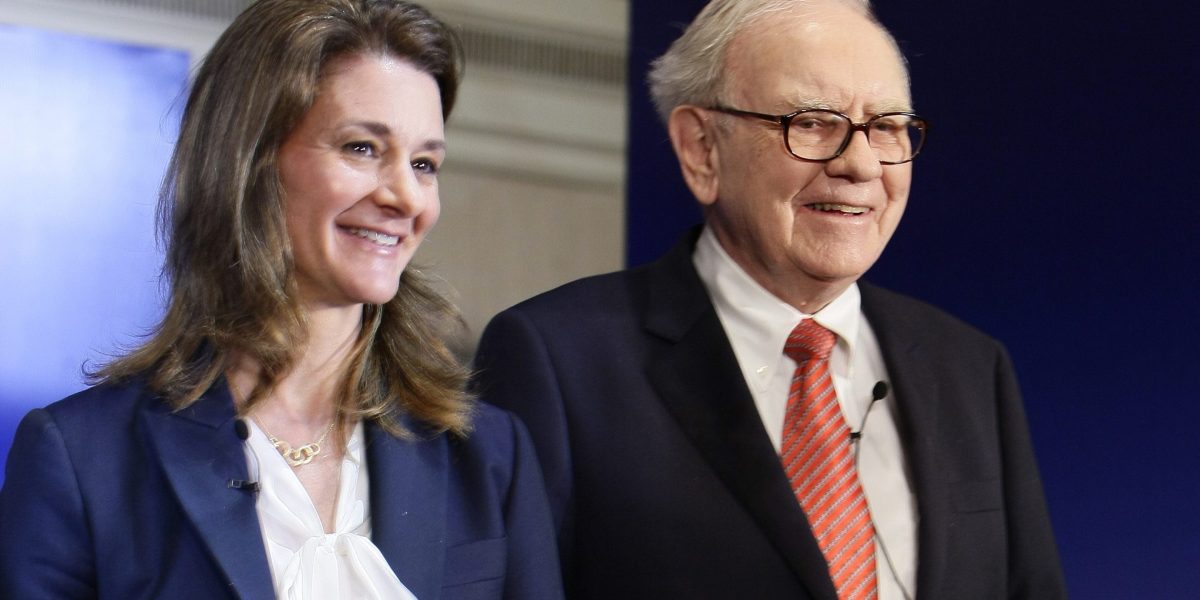

Examining The 600 Billion Pledge The Evolution Of Billionaire Giving

May 29, 2025

Examining The 600 Billion Pledge The Evolution Of Billionaire Giving

May 29, 2025