SiriusXM: Is This Stock Right For Your Portfolio?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SiriusXM: Is This Stock Right for Your Portfolio?

SiriusXM Holdings Inc. (SIRI) is a name familiar to millions of satellite radio subscribers. But for investors, the question remains: is SiriusXM stock the right fit for your portfolio? This in-depth analysis explores the company's strengths, weaknesses, and future prospects to help you make an informed decision.

SiriusXM's Strengths: A Dominant Player in Satellite Radio

SiriusXM holds a near-monopoly in the satellite radio market in North America, giving it a significant competitive advantage. This dominance translates to consistent revenue streams and strong cash flow, making it an attractive option for income-seeking investors. Their subscriber base remains robust, fueled by the convenience and curated content offering. This consistent growth is a key indicator of the company's financial stability.

- High Subscriber Retention: SiriusXM boasts impressive subscriber retention rates, suggesting strong customer loyalty and satisfaction with their service. This translates into predictable revenue streams and minimizes the need for constant acquisition efforts.

- Strong Brand Recognition: The SiriusXM brand is well-established and widely recognized, providing a significant marketing advantage. This brand recognition allows for efficient marketing campaigns and reduced marketing costs compared to emerging competitors.

- Expanding Content Offerings: Beyond traditional radio, SiriusXM is expanding its content library, incorporating podcasts, original programming, and on-demand content to attract a broader audience and improve user engagement. This diversification is crucial for long-term growth.

SiriusXM's Weaknesses: Competition and Technological Shifts

While SiriusXM enjoys a dominant position, the company faces challenges. The rise of streaming services and the increasing popularity of podcasts represent significant competitive threats. Additionally, reliance on a subscription model makes the company vulnerable to economic downturns.

- Competition from Streaming Services: Services like Spotify and Apple Music offer vast music libraries at competitive prices, posing a challenge to SiriusXM's core offering. This competition necessitates continuous innovation and adaptation to maintain market share.

- Economic Sensitivity: As a subscription-based service, SiriusXM's performance is directly linked to consumer spending habits. During economic downturns, consumers may be more likely to cut discretionary spending, impacting subscription rates.

- Technological Dependence: SiriusXM relies heavily on satellite technology, making it potentially vulnerable to technological advancements and disruptions. The company needs to adapt and integrate new technologies to maintain its competitiveness.

Future Prospects and Investment Considerations:

The future of SiriusXM hinges on its ability to adapt to evolving consumer preferences and technological advancements. Strategic acquisitions, expansion into new content areas, and leveraging its strong brand recognition will be key factors in determining its long-term success. Investors should consider:

- Diversification Strategy: Analyze SiriusXM's efforts to diversify its content offerings and explore new revenue streams. This diversification is critical for mitigating risks associated with reliance on a single revenue model.

- Debt Levels: Assess SiriusXM's debt levels and its ability to manage its financial obligations. High debt can pose significant risks to long-term sustainability.

- Industry Trends: Stay updated on the broader media and entertainment landscape. Understanding emerging trends and competitive pressures is crucial for making informed investment decisions.

Conclusion: Is SiriusXM Right for You?

SiriusXM offers a compelling investment case due to its market dominance and strong cash flow. However, investors need to carefully consider the competitive landscape and potential risks associated with its subscription model and technological dependence. Thorough due diligence, including researching financial statements and industry trends, is essential before incorporating SiriusXM into your portfolio. Remember to consult with a financial advisor before making any investment decisions. This analysis provides information for consideration, but it's not financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SiriusXM: Is This Stock Right For Your Portfolio?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bbc Documents Impact Of Israeli Blockade Hungry Baby In Gaza

May 28, 2025

Bbc Documents Impact Of Israeli Blockade Hungry Baby In Gaza

May 28, 2025 -

From Harvard Student To Critic My Perspective On Harvard Vs Trump

May 28, 2025

From Harvard Student To Critic My Perspective On Harvard Vs Trump

May 28, 2025 -

Ultra Nationalist March In Jerusalem Ignites Fresh Wave Of Violence

May 28, 2025

Ultra Nationalist March In Jerusalem Ignites Fresh Wave Of Violence

May 28, 2025 -

Hs 2 Staffing Investigation Launched Into West Midlands Contractors

May 28, 2025

Hs 2 Staffing Investigation Launched Into West Midlands Contractors

May 28, 2025 -

Facing Social Security Cuts What To Expect In June 2025

May 28, 2025

Facing Social Security Cuts What To Expect In June 2025

May 28, 2025

Latest Posts

-

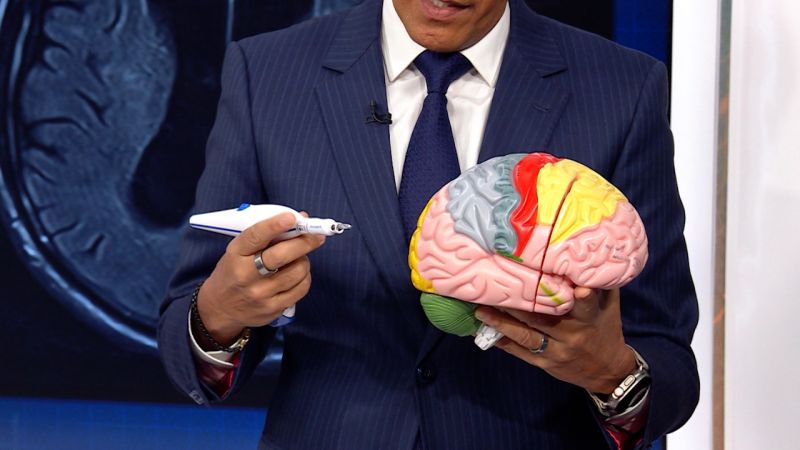

Dr Sanjay Gupta On The Medical Approach To Billy Joels Neurological Problem

May 30, 2025

Dr Sanjay Gupta On The Medical Approach To Billy Joels Neurological Problem

May 30, 2025 -

Badenochs Controversial Decisions A Tory Crisis Brewing

May 30, 2025

Badenochs Controversial Decisions A Tory Crisis Brewing

May 30, 2025 -

New York Knicks Ending Years Of Disappointment

May 30, 2025

New York Knicks Ending Years Of Disappointment

May 30, 2025 -

Day 4 Recap Ex Juniors Dominate Evening Events

May 30, 2025

Day 4 Recap Ex Juniors Dominate Evening Events

May 30, 2025 -

Cnns Dr Sanjay Gupta Discusses Treatment Options For Billy Joels Neurological Issue

May 30, 2025

Cnns Dr Sanjay Gupta Discusses Treatment Options For Billy Joels Neurological Issue

May 30, 2025