SiriusXM Stock Analysis: Weighing The Risks And Rewards For Potential Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SiriusXM Stock Analysis: Weighing the Risks and Rewards for Potential Investors

SiriusXM Holdings Inc. (SIRI) has carved a niche for itself in the satellite radio market, boasting millions of subscribers. But is now the right time to invest? This in-depth analysis explores the potential risks and rewards for prospective investors considering adding SIRI to their portfolios.

The Allure of SiriusXM: A Look at the Positives

SiriusXM's dominance in satellite radio is undeniable. This provides a strong foundation for consistent revenue streams, particularly appealing in a market increasingly dominated by streaming services. The company's subscriber base remains robust, indicating a loyal customer base. This inherent stickiness offers a degree of insulation against the competitive pressures faced by other media companies.

Furthermore, SiriusXM's diversification strategy, expanding beyond satellite radio into podcasting and other audio entertainment ventures, demonstrates a proactive approach to future market changes. This forward-thinking approach aims to capture a larger share of the evolving audio landscape. The company’s strategic acquisitions and partnerships also play a significant role in its growth trajectory.

- Strong Subscriber Base: A large and loyal subscriber base provides a reliable revenue stream.

- Diversification Efforts: Expansion into podcasting and other audio platforms mitigates risk.

- Strategic Acquisitions: Acquisitions fuel growth and expand market reach.

Navigating the Challenges: Potential Risks to Consider

Despite its strengths, SiriusXM isn't without its challenges. The rise of streaming services like Spotify and Apple Music presents significant competition, potentially eroding SiriusXM's market share. Furthermore, the increasing cost of programming and technology presents an ongoing operational hurdle.

The company's reliance on the automotive industry is also a factor to consider. Fluctuations in car sales directly impact the number of new SiriusXM subscriptions, creating a degree of cyclical vulnerability. Finally, the regulatory environment and potential future changes could also impact the company's profitability.

- Intense Competition: Streaming services pose a significant threat to market share.

- High Operational Costs: Programming and technology costs can strain profitability.

- Automotive Industry Dependence: Fluctuations in car sales impact subscription growth.

SiriusXM Stock: A Valuation Perspective

Analyzing SiriusXM's stock requires a careful consideration of its valuation metrics. Investors should examine key ratios such as the Price-to-Earnings (P/E) ratio, Price-to-Sales (P/S) ratio, and Debt-to-Equity ratio to gain a comprehensive understanding of the company's financial health and growth potential. Comparing these metrics to industry averages and competitors offers valuable context. Remember to consult financial news sources and expert analysts for the most up-to-date financial data. [Link to a reputable financial news source]

Conclusion: Is SiriusXM Right for Your Portfolio?

SiriusXM offers a compelling investment proposition for those comfortable with a degree of risk. Its established market position and diversification efforts are positive indicators. However, the competitive landscape and dependence on the automotive industry warrant careful consideration. Conduct thorough due diligence, including reviewing financial statements and industry analyses, before making any investment decisions. Consider seeking advice from a qualified financial advisor to determine if SiriusXM aligns with your individual risk tolerance and investment goals.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Always conduct your own research and consider seeking professional advice before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SiriusXM Stock Analysis: Weighing The Risks And Rewards For Potential Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Closure After Decades Four Wwii Airmen Identified From Non Recoverable Crash Site

May 28, 2025

Closure After Decades Four Wwii Airmen Identified From Non Recoverable Crash Site

May 28, 2025 -

Macron Denies Allegations After Viral Video Showing Interaction With Brigitte

May 28, 2025

Macron Denies Allegations After Viral Video Showing Interaction With Brigitte

May 28, 2025 -

Seaside Heights Boardwalk Curfew Fails To Deter Violence Multiple Injuries Reported

May 28, 2025

Seaside Heights Boardwalk Curfew Fails To Deter Violence Multiple Injuries Reported

May 28, 2025 -

King Charles Canadian Itinerary Political Undercurrents And Royal Engagements

May 28, 2025

King Charles Canadian Itinerary Political Undercurrents And Royal Engagements

May 28, 2025 -

Wwii Bomber Crash 11 Dead 4 Finally Coming Home After 79 Years

May 28, 2025

Wwii Bomber Crash 11 Dead 4 Finally Coming Home After 79 Years

May 28, 2025

Latest Posts

-

Controversy At Met Police Call Handler Resignation After Reinstatement Decision

May 30, 2025

Controversy At Met Police Call Handler Resignation After Reinstatement Decision

May 30, 2025 -

Henrique Rocha Choca O Mundo Do Tenis Com Vitoria Em Roland Garros

May 30, 2025

Henrique Rocha Choca O Mundo Do Tenis Com Vitoria Em Roland Garros

May 30, 2025 -

The Path Ahead Analyzing Senate Republicans Tactics On Trumps Legislation

May 30, 2025

The Path Ahead Analyzing Senate Republicans Tactics On Trumps Legislation

May 30, 2025 -

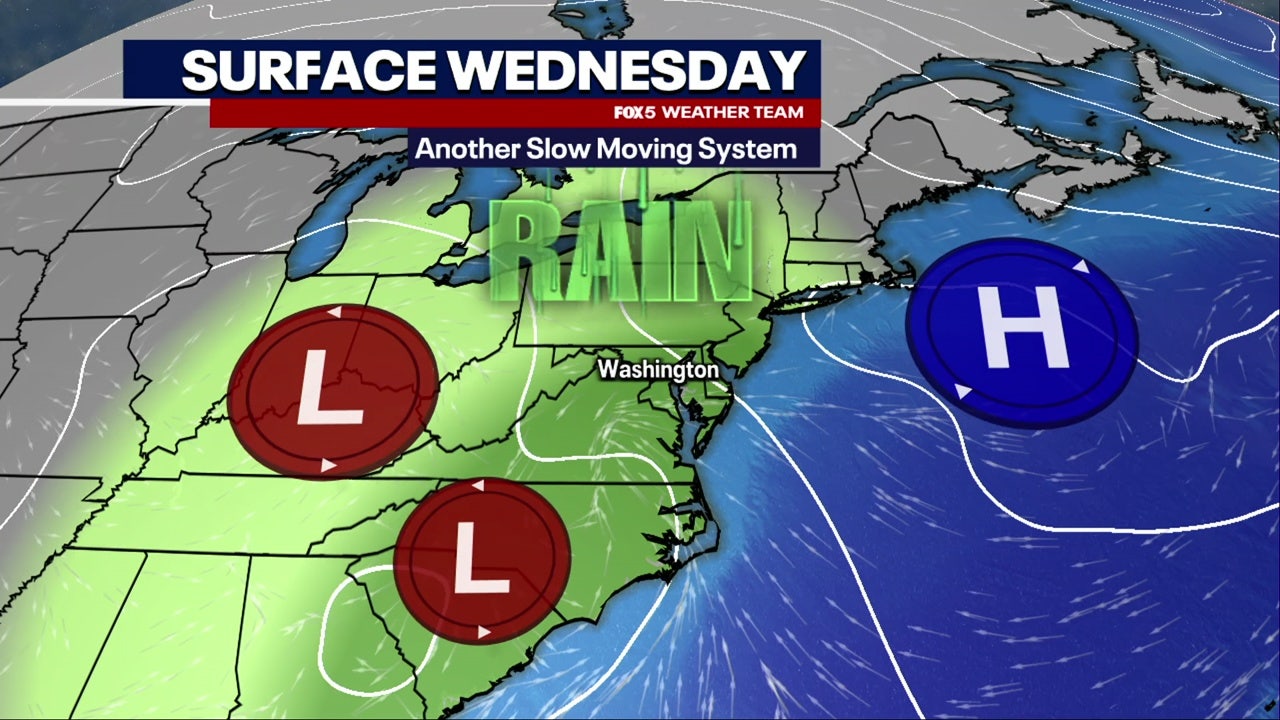

Dc Maryland Virginia Thunderstorm And Heavy Rain Warning For Wednesday

May 30, 2025

Dc Maryland Virginia Thunderstorm And Heavy Rain Warning For Wednesday

May 30, 2025 -

Sean Diddy Combs Faces Accusation Of Threatening Kid Cudi Trial Recap

May 30, 2025

Sean Diddy Combs Faces Accusation Of Threatening Kid Cudi Trial Recap

May 30, 2025