SiriusXM Stock Performance: Has Its Run Ended?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SiriusXM Stock Performance: Has Its Run Ended?

SiriusXM Holdings Inc. (SIRI) has enjoyed a significant run-up in its stock price over the past few years, captivating investors with its seemingly unstoppable growth in subscribers and revenue. But as the market shifts and competition intensifies, the question on many investors' minds is: has SiriusXM's growth story reached its peak? This article delves into the current performance of SiriusXM stock, analyzing its strengths, weaknesses, and future prospects to help you determine if it's still a worthwhile investment.

SiriusXM's Recent Performance: A Mixed Bag

SiriusXM's stock price has experienced considerable volatility in recent months. While the company continues to report strong subscriber growth, driven by its diverse content offerings and expanding reach, several factors are casting doubt on its future trajectory. Recent financial reports show healthy revenue growth, but profit margins have been under pressure, raising concerns among analysts. This fluctuation makes evaluating the stock's long-term potential a complex endeavor.

Factors Contributing to the Uncertainty:

Several key factors contribute to the uncertainty surrounding SiriusXM's future performance:

-

Increased Competition: The rise of streaming services like Spotify and Apple Music, offering comparable audio content, presents a significant challenge. These platforms often boast larger music libraries and more flexible pricing models, directly impacting SiriusXM's market share.

-

Economic Headwinds: Inflation and a potential recession could impact consumer spending, potentially leading to subscriber churn as individuals look to cut back on discretionary spending. This economic sensitivity is a key risk factor for SiriusXM's future growth.

-

Content Costs: Securing and maintaining high-quality programming is expensive. Rising content costs could squeeze profit margins, impacting the company's overall profitability and potentially affecting investor sentiment.

-

Technological Advancements: The ongoing evolution of audio technology and the increasing popularity of podcasts pose a threat to SiriusXM's traditional satellite radio model. Adapting to these technological shifts will be crucial for the company's long-term survival.

Strengths Still Present:

Despite the challenges, SiriusXM retains several key strengths:

-

Strong Subscriber Base: SiriusXM boasts a loyal and substantial subscriber base, providing a solid foundation for future revenue generation.

-

Exclusive Content: The company continues to invest in exclusive content, attracting and retaining subscribers. This exclusive content acts as a significant moat against competitors.

-

Bundling Opportunities: SiriusXM has explored successful bundling opportunities, partnering with other entertainment providers to offer comprehensive packages. This strategy can drive subscriber acquisition and increase Average Revenue Per User (ARPU).

The Verdict: Is It Time to Sell?

Determining whether to hold or sell SiriusXM stock depends entirely on individual investment goals and risk tolerance. While the company faces substantial challenges, its substantial subscriber base and efforts to diversify its offerings offer a degree of resilience. However, investors should carefully consider the economic climate and the competitive landscape before making any investment decisions. Conducting thorough due diligence and potentially consulting a financial advisor is highly recommended.

What to Watch For:

Investors should closely monitor the following key indicators to better assess SiriusXM's future performance:

- Subscriber growth rates: A slowing or declining subscriber base would be a significant negative signal.

- Average revenue per user (ARPU): Sustained ARPU growth indicates pricing power and strong customer engagement.

- Profit margins: Improving or stable profit margins suggest effective cost management and strong profitability.

The future of SiriusXM remains uncertain. While its current subscriber base and exclusive content provide a solid foundation, navigating the competitive landscape and adapting to changing consumer preferences will be crucial for its long-term success. The decision of whether to hold or sell is ultimately a personal one, requiring careful analysis and consideration of the broader economic and technological context. Remember to always conduct your own research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SiriusXM Stock Performance: Has Its Run Ended?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Baroness Mone A Case Study In Entrepreneurial Success And Failure

May 28, 2025

Baroness Mone A Case Study In Entrepreneurial Success And Failure

May 28, 2025 -

Livestock At Risk How Climate Change Denial Under Trump Might Unleash A Pest Invasion

May 28, 2025

Livestock At Risk How Climate Change Denial Under Trump Might Unleash A Pest Invasion

May 28, 2025 -

Emotional French Open Goodbye Rafael Nadal Honored

May 28, 2025

Emotional French Open Goodbye Rafael Nadal Honored

May 28, 2025 -

Liverpool Fc Parade Incident A Comprehensive Overview

May 28, 2025

Liverpool Fc Parade Incident A Comprehensive Overview

May 28, 2025 -

The Trump Administrations Impact On Climate Change And The Rise Of Livestock Killing Pests

May 28, 2025

The Trump Administrations Impact On Climate Change And The Rise Of Livestock Killing Pests

May 28, 2025

Latest Posts

-

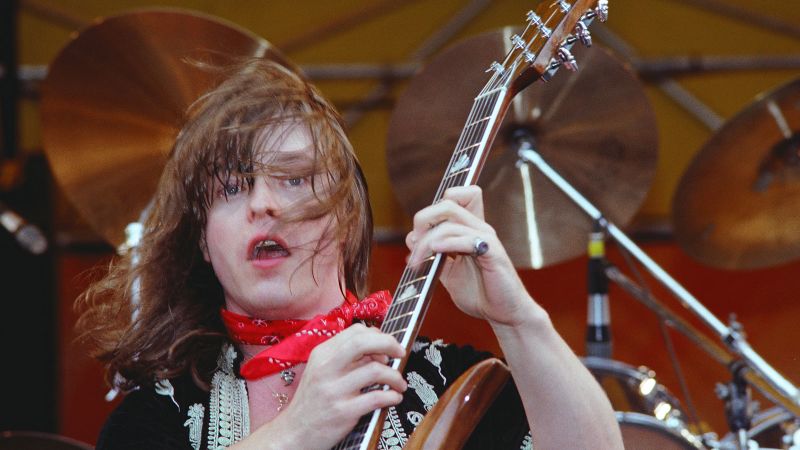

Rick Derringer Guitarist For Weird Al Yankovic Dies At 77

May 29, 2025

Rick Derringer Guitarist For Weird Al Yankovic Dies At 77

May 29, 2025 -

Met Police Faces Backlash Call Handlers Resignation Over Reinstatement Decision

May 29, 2025

Met Police Faces Backlash Call Handlers Resignation Over Reinstatement Decision

May 29, 2025 -

Significant Report On Cannabis London Mayors Call For Decriminalisation

May 29, 2025

Significant Report On Cannabis London Mayors Call For Decriminalisation

May 29, 2025 -

Explosive Testimony In Diddy Trial Ex Employee Claims Death Threat Against Kid Cudi

May 29, 2025

Explosive Testimony In Diddy Trial Ex Employee Claims Death Threat Against Kid Cudi

May 29, 2025 -

Henrique Rocha Estreia Vitoriosa Em Roland Garros

May 29, 2025

Henrique Rocha Estreia Vitoriosa Em Roland Garros

May 29, 2025