SiriusXM Stock Performance: Has The Millionaire-Maker Run Its Course?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SiriusXM Stock Performance: Has the Millionaire-Maker Run Its Course?

SiriusXM Holdings Inc. (SIRI) has had a rollercoaster ride, captivating investors and creating millionaires along the way. But with recent performance fluctuating, many are asking: has the golden age of SiriusXM stock passed its peak? This in-depth analysis explores the current state of SIRI, examining its strengths, weaknesses, and future prospects. We'll delve into the factors driving its performance and consider whether it still holds the potential for significant growth, or if investors should consider other opportunities.

The Rise and Rise (and Potential Fall?) of SiriusXM

SiriusXM's success story is undeniably compelling. The satellite radio giant, formed from the merger of Sirius and XM in 2008, has consistently delivered compelling content, attracting a loyal subscriber base. This subscriber growth has historically translated into strong revenue, fueling impressive stock performance for early investors. For years, SiriusXM was considered a "millionaire-maker" stock, rewarding those who held onto their shares through periods of market volatility.

However, recent performance has been less spectacular. While the company continues to add subscribers, the rate of growth has slowed, and the stock price has experienced periods of stagnation and even decline. This has led many to question the long-term viability of SIRI as a high-growth investment.

Analyzing the Current Landscape: Strengths and Weaknesses

To understand SiriusXM's current trajectory, we need to examine both its strengths and weaknesses:

Strengths:

- Strong Brand Recognition and Loyal Subscriber Base: SiriusXM benefits from extensive brand recognition and a highly engaged subscriber base, providing a stable revenue stream.

- Exclusive Content and Programming: The company offers exclusive content and programming not available on other platforms, creating a strong competitive advantage. This includes ad-free music channels, sports talk, and comedy shows.

- Expanding into New Markets: SiriusXM is actively exploring new avenues for growth, including podcasting and connected car services, broadening its revenue streams beyond traditional satellite radio.

Weaknesses:

- Slower Subscriber Growth: The rate of subscriber growth has slowed in recent years, raising concerns about future revenue growth potential. Increased competition from streaming services is a contributing factor.

- High Debt Levels: SiriusXM carries a significant debt load, which can impact profitability and financial flexibility.

- Dependence on the Automotive Industry: A significant portion of SiriusXM's revenue comes from automotive partnerships. Changes in the automotive industry, such as the rise of electric vehicles, could impact future growth.

Looking Ahead: Is There Still Potential?

While the "millionaire-maker" days might be behind it for now, SiriusXM is far from being a failed investment. The company's strategic moves into podcasting and connected car services show a commitment to innovation and diversification. The strong brand recognition and loyal subscriber base provide a solid foundation for future growth.

However, investors should carefully consider the risks, including slower subscriber growth and high debt levels. Diversification within your portfolio remains crucial. Analyzing upcoming financial reports and keeping an eye on industry trends is paramount for any investor considering SIRI.

Call to Action: Stay informed about SiriusXM's performance by regularly checking financial news sources and the company's investor relations website. Conduct your own thorough research before making any investment decisions. Remember that past performance is not indicative of future results.

Related Articles:

- [Link to an article about the podcasting industry]

- [Link to an article about the connected car market]

- [Link to SiriusXM's investor relations page]

This article provides general information and should not be considered financial advice. Always consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SiriusXM Stock Performance: Has The Millionaire-Maker Run Its Course?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

73 Arrested Boardwalk Closed Memorial Day Weekend Brings Chaos To The Jersey Shore

May 27, 2025

73 Arrested Boardwalk Closed Memorial Day Weekend Brings Chaos To The Jersey Shore

May 27, 2025 -

Yankees Issue Update On Stantons Injury Disappointing News For Fans

May 27, 2025

Yankees Issue Update On Stantons Injury Disappointing News For Fans

May 27, 2025 -

Rumeurs D Agresssion De Macron Par Brigitte La Reponse De L Elysee

May 27, 2025

Rumeurs D Agresssion De Macron Par Brigitte La Reponse De L Elysee

May 27, 2025 -

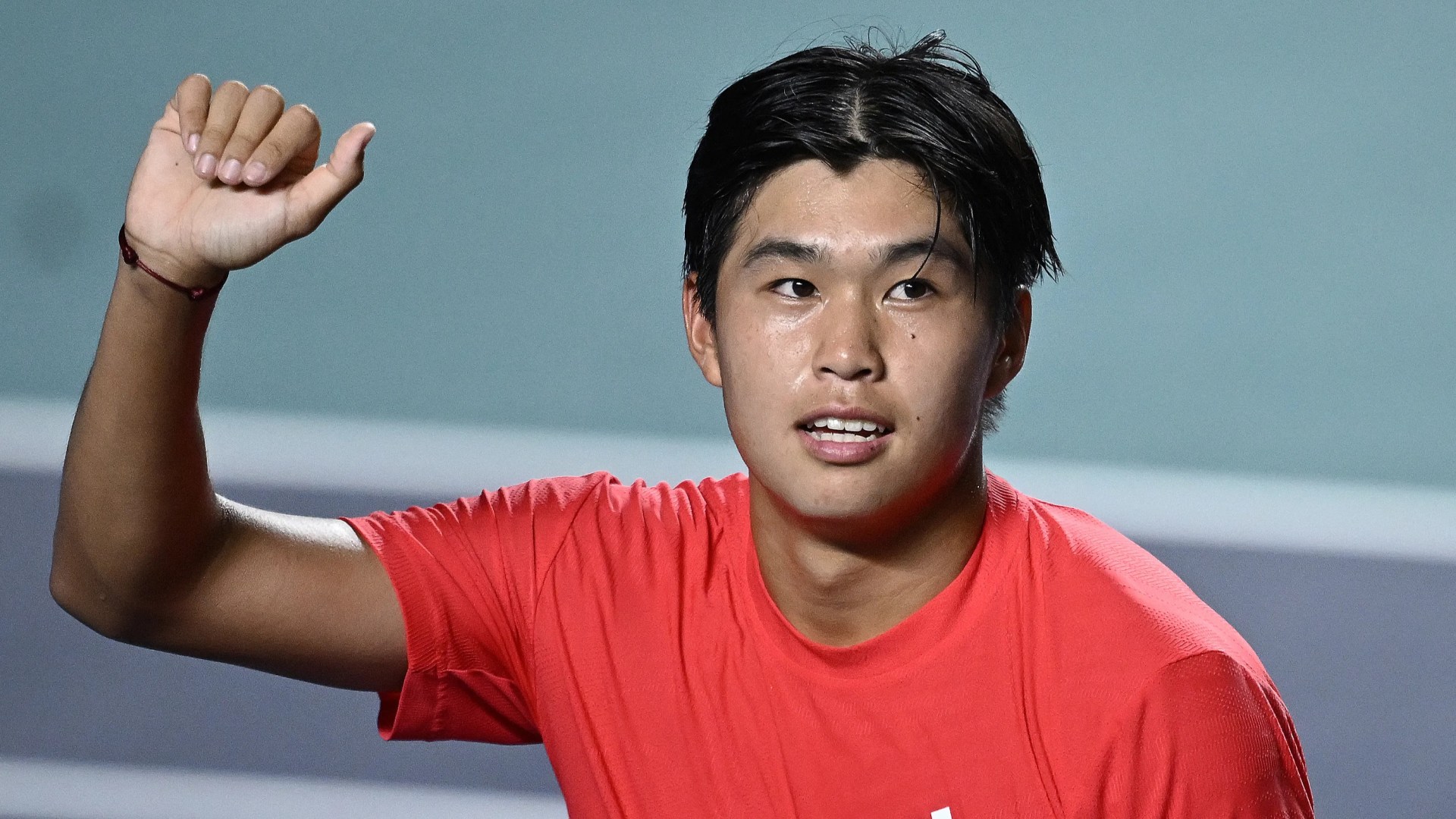

The Rise Of A Us Tennis Prodigy A Name Inspired By Moms Work A Goal To Beat World No 3

May 27, 2025

The Rise Of A Us Tennis Prodigy A Name Inspired By Moms Work A Goal To Beat World No 3

May 27, 2025 -

Stricter Regulations Unfinished Housing Sites Could Be Taken From Developers

May 27, 2025

Stricter Regulations Unfinished Housing Sites Could Be Taken From Developers

May 27, 2025

Latest Posts

-

Fake Text Message From Ga Department Of Driver Services Is It A Scam

May 28, 2025

Fake Text Message From Ga Department Of Driver Services Is It A Scam

May 28, 2025 -

Thames Valley Police Man Charged In Crash That Injured Officer

May 28, 2025

Thames Valley Police Man Charged In Crash That Injured Officer

May 28, 2025 -

See Through Style Alexandra Daddarios Daring Dress Choice

May 28, 2025

See Through Style Alexandra Daddarios Daring Dress Choice

May 28, 2025 -

Are Americans Still Welcome In Canada Canadians Weigh In

May 28, 2025

Are Americans Still Welcome In Canada Canadians Weigh In

May 28, 2025 -

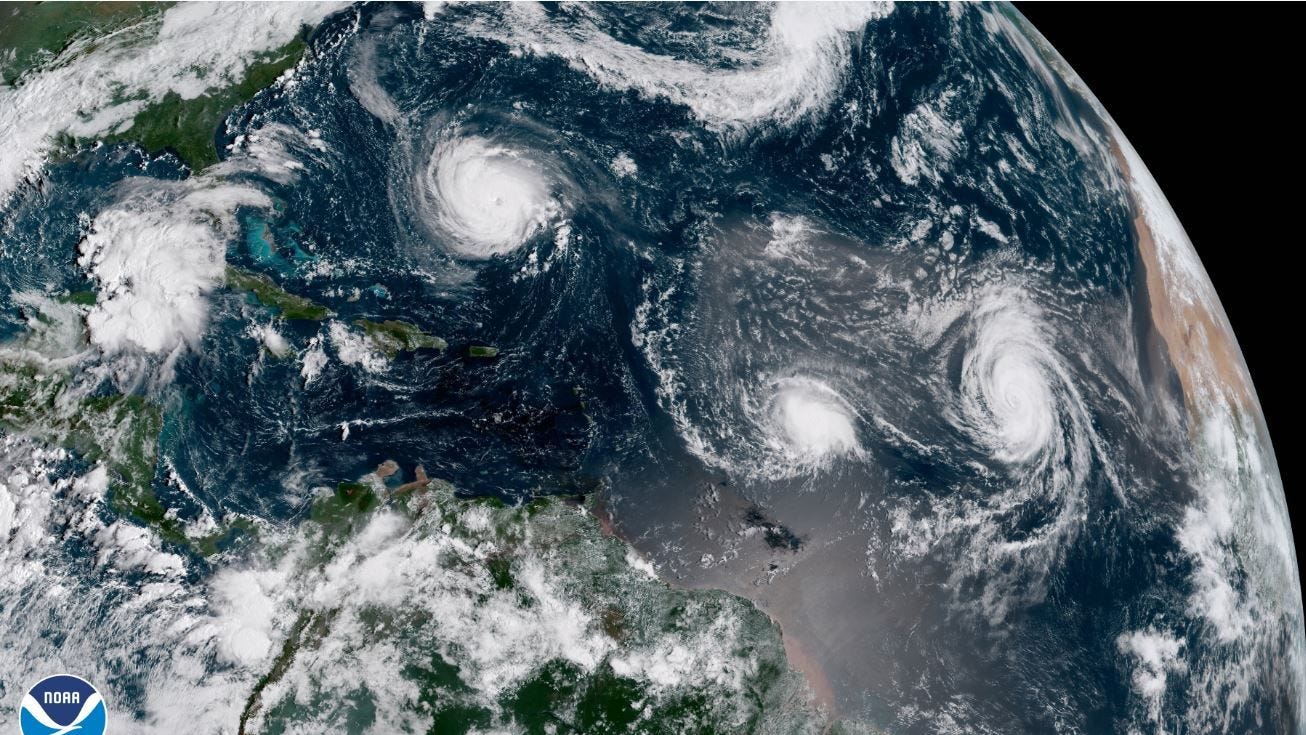

Preparing For The 2025 Hurricane Season Answers To Key Questions

May 28, 2025

Preparing For The 2025 Hurricane Season Answers To Key Questions

May 28, 2025