SiriusXM Stock: Weighing The Risks And Rewards For Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SiriusXM Stock: Weighing the Risks and Rewards for Investors

SiriusXM Holdings Inc. (SIRI) has been a fascinating case study for investors, offering a blend of growth potential and inherent risks. This satellite radio giant boasts a loyal subscriber base and a diversified revenue stream, but faces challenges from evolving listening habits and increasing competition. Understanding both sides of the coin is crucial before making any investment decisions.

The Allure of SiriusXM: A Look at the Rewards

SiriusXM's primary advantage lies in its exclusive content and ad-free listening experience. This resonates strongly with a significant portion of the population, creating a loyal subscriber base that provides predictable revenue streams. The company's diverse programming, including sports, music, talk radio, and comedy, caters to a wide range of preferences.

- Strong Subscriber Base: Consistent subscriber growth historically signals a healthy business model and strong brand loyalty. This provides a level of stability not often seen in the volatile entertainment industry.

- Recurring Revenue: The subscription-based model ensures a predictable revenue stream, reducing the reliance on volatile advertising revenue.

- Content Diversification: The range of programming minimizes the risk of relying solely on one genre or demographic.

- Potential for Expansion: Opportunities exist for growth through expansion into new markets and the integration of new technologies, such as integrating with smart cars and other connected devices.

Navigating the Risks: Challenges Facing SiriusXM

Despite its strengths, SiriusXM faces several headwinds that investors need to carefully consider.

- Competition from Streaming Services: The rise of streaming services like Spotify and Apple Music presents a significant challenge. These platforms offer vast music libraries at competitive price points, potentially drawing subscribers away from satellite radio.

- Technological Disruption: The automotive industry's shift towards digital dashboards and in-car entertainment systems could impact the demand for satellite radio. This potential disruption requires SiriusXM to adapt and innovate.

- Economic Sensitivity: Subscriptions can be considered a discretionary expense, making them susceptible to economic downturns. A weakened economy could lead to subscriber churn.

- Dependence on the Automotive Industry: A significant portion of SiriusXM's subscriptions come through new car sales. Slowdowns in the automotive sector could directly impact subscriber acquisition.

Analyzing the Current Market Position and Future Outlook

Currently, SiriusXM is actively working to mitigate these risks. They are investing in digital platforms, expanding their podcast offerings, and integrating their services into connected cars. These strategic moves are designed to address the changing landscape of the audio entertainment industry and maintain their competitive edge. However, the success of these initiatives remains to be seen.

Making an Informed Investment Decision

Investing in SiriusXM requires careful consideration of both the potential rewards and the inherent risks. While the company's loyal subscriber base and recurring revenue provide a degree of stability, the competitive pressure from streaming services and potential technological disruptions cannot be ignored. Thorough due diligence, including analyzing financial statements and industry trends, is crucial before making any investment decisions. Consulting with a financial advisor is also highly recommended.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market carries inherent risks, and past performance is not indicative of future results. Always conduct your own thorough research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SiriusXM Stock: Weighing The Risks And Rewards For Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Alexandra Daddarios Bold Fashion Choice At The Dior Cruise Collection

May 28, 2025

Alexandra Daddarios Bold Fashion Choice At The Dior Cruise Collection

May 28, 2025 -

Against The Algorithmic Age A Physicians Advocacy For Human Connection At Harvards Commencement

May 28, 2025

Against The Algorithmic Age A Physicians Advocacy For Human Connection At Harvards Commencement

May 28, 2025 -

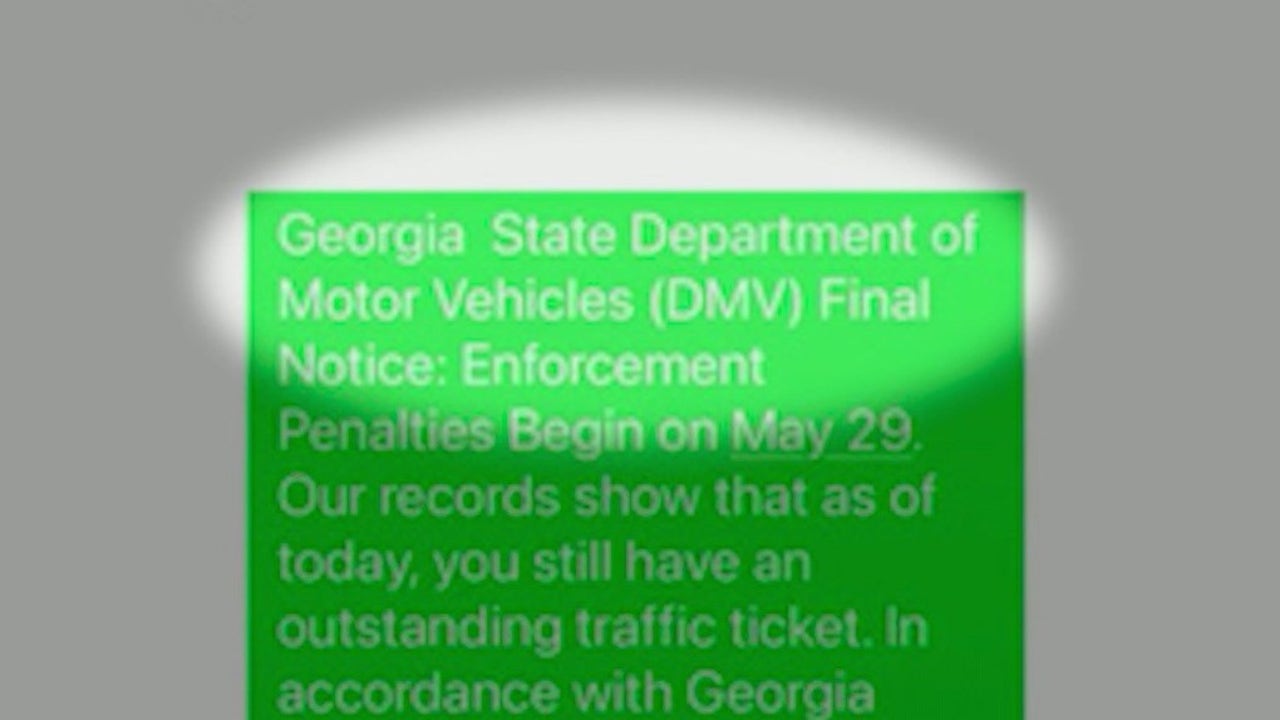

Rising Number Of Text Message Scams Targeting Georgia Drivers

May 28, 2025

Rising Number Of Text Message Scams Targeting Georgia Drivers

May 28, 2025 -

Israeli Ultra Nationalist March Fuels Jerusalem Tensions Cnn Report

May 28, 2025

Israeli Ultra Nationalist March Fuels Jerusalem Tensions Cnn Report

May 28, 2025 -

Financial Avengers Portfolio Bank Of America Ranks Among Top 8 Positions

May 28, 2025

Financial Avengers Portfolio Bank Of America Ranks Among Top 8 Positions

May 28, 2025

Latest Posts

-

Report Urges Cannabis Decriminalisation London Mayor Gives Backing

May 30, 2025

Report Urges Cannabis Decriminalisation London Mayor Gives Backing

May 30, 2025 -

Giants Causeways Rock Formations Under Threat From Coin Damage

May 30, 2025

Giants Causeways Rock Formations Under Threat From Coin Damage

May 30, 2025 -

West Indies Tour Smith To Open For England In Edgbaston Odi

May 30, 2025

West Indies Tour Smith To Open For England In Edgbaston Odi

May 30, 2025 -

High Profile Escapes A Look At The Recent Us Jailbreaks And Their Aftermath

May 30, 2025

High Profile Escapes A Look At The Recent Us Jailbreaks And Their Aftermath

May 30, 2025 -

Receitas E Animacao Tudo O Que Precisa Para Uma Festa Portuguesa Genuina

May 30, 2025

Receitas E Animacao Tudo O Que Precisa Para Uma Festa Portuguesa Genuina

May 30, 2025